What Is FINRA Rule 2111 Suitability?

FINRA Rule 2111 Suitability is a regulation established by the Financial Industry Regulatory Authority (FINRA), which governs the suitability of recommendations made by broker-dealers to their clients. FINRA Rule 2111 requires brokers and firms to have a reasonable basis to believe that a recommended transaction or investment strategy is suitable for the customer based on facts obtained through reasonable diligence.

Rule 2111 requires that any recommendations made by a broker-dealer must be suitable for the client based on the client’s investment profile, which includes their investment objectives, risk tolerance, financial situation, and other relevant factors.

In other words, your broker-dealer must ensure their investment recommendations suit your needs and circumstances. As you’re about to learn from the FINRA attorneys for securities disputes at The White Law Group, that’s just the tip of the iceberg regarding FINRA Rule 2111 suitability.

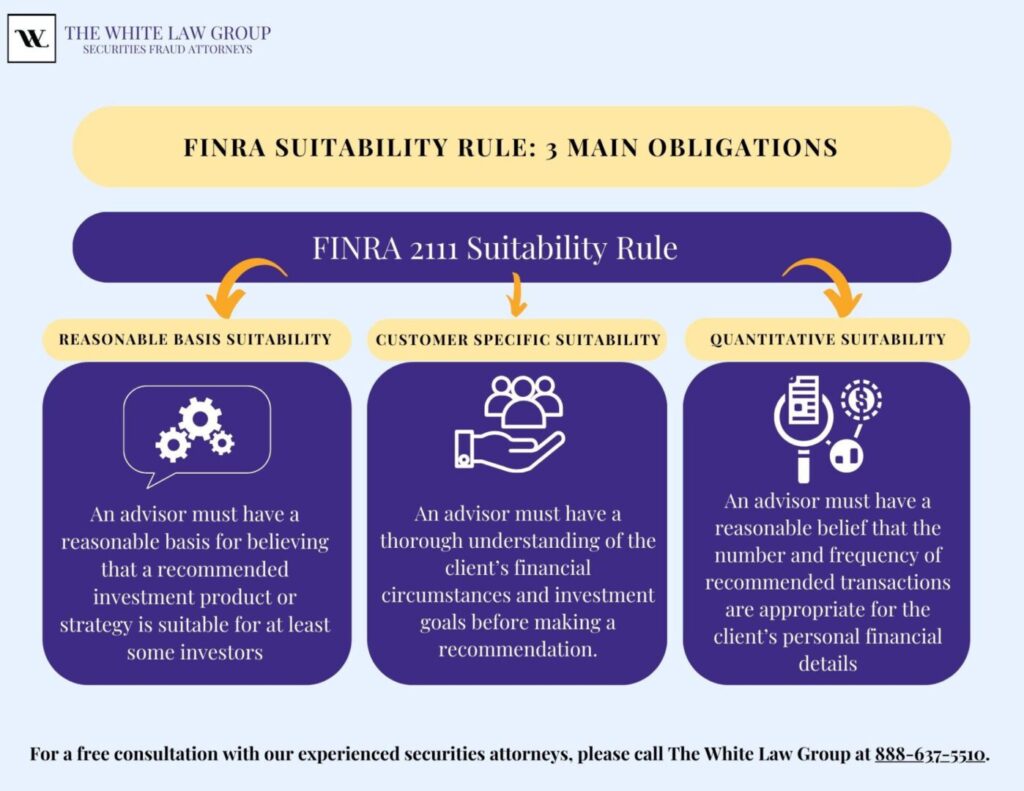

The Three Main Suitability Obligations FINRA Rule 2111 Identifies

Three suitability obligations refer to financial advisors’ and brokers’ duties towards their clients when recommending investment products or services. FINRA Rule 2111 identifies which three main suitability obligations exist. We’ll also cover them here. The obligations are as follows:

Reasonable Basis Suitability

The advisor must have a reasonable basis for believing that a recommended investment product or strategy is suitable for at least some investors. This means that the advisor must have conducted appropriate due diligence to understand the product’s features and risks and reasonably believe that the product is suitable for the intended client base.

This obligation emphasizes that their advice should be based on a thorough and reasonable analysis of relevant factors such as the client’s financial situation, investment goals, risk tolerance, and other pertinent factors. All financial professionals are expected to have a solid rationale or basis for recommending a particular investment product or strategy. If not, they risk violating FINRA’s Rule 2111 (Suitability Rule).

Customer-Specific Suitability

Without mentioning customer-specific suitability, we can’t discuss the three main obligations that FINRA Rule 2111 identifies. In other words, an advisor must have a reasonable basis for believing that a recommended investment product or strategy is suitable for a particular client, based on their financial situation, investment objectives, risk tolerance, and other relevant factors.

Before making recommendations, an advisor must thoroughly understand the client’s financial circumstances and investment goals. If not, they risk violating FINRA Rule 2111 (Suitability). This information is crucial in determining the suitability of a particular investment strategy for that specific customer.

Some key aspects of customer-specific suitability include:

- Know Your Customer (KYC): Financial professionals are typically required to conduct a thorough “Know Your Customer” process to collect relevant information about the customer. This process helps in understanding the customer’s financial profile and needs.

- Customization of Recommendations: Adhering to suitability under FINRA Rule 2111 means that recommendations should be tailored to the individual customer, considering financial goals, risk appetite, investment knowledge, and specific constraints or preferences.

- Risk Tolerance Matching: Investment recommendations should align with the customer’s risk tolerance. For example, if a customer has a low tolerance for risk, recommending highly volatile investments may not be suitable and could be considered broker misconduct under FINRA Rule 2111.

- Regular Review and Communication: Financial professionals should periodically review the customer’s situation and adjust recommendations as needed. Communication with the customer is essential to consider their evolving needs and circumstances.

Quantitative Suitability

Learning about the three main suitability obligations identified under FINRA Rule 2111 also means discovering quantitative suitability. This obligation requires the advisor to have a reasonable basis for believing that a series of recommended transactions, when taken together, are not excessive or unsuitable for the client.

This means that the advisor must reasonably believe that the number and frequency of recommended transactions are appropriate for the client, considering the client’s financial situation. Quantitative suitability also serves as a regulatory measure crafted to shield investors from trading activities that are either excessive or unsuitable, potentially jeopardizing their best interests and violating FINRA Rule 2111 suitability.

For example, a treasury bond may suit you, but investing all of your capital in one security would not be great. This requirement guarantees that financial advisors prioritize the well-being of their clients and avoid committing broker misconduct.

Your Investment Profile and Why It’s Important

When you sign up with your brokerage firm, you must answer some questions regarding your investment profile. This is so your broker can better understand your investment goals, financial situation, and risk tolerance. According to FINRA Rule 2111, which identifies three main suitability obligations, this information helps the broker provide investment recommendations suitable for your unique circumstances.

For example, suppose you are a younger investor with a higher risk tolerance. In that case, the broker may recommend investments with a higher potential for returns and a higher risk level. On the other hand, if you are an older investor with a lower risk tolerance, the broker may recommend more conservative investments with a lower potential for returns and risk.

Here are some common elements that may be included in an investment profile that adheres to FINRA Rule 2111 (Suitability Rule):

- Investment Objectives: Your overall investment goals, such as maximizing returns, generating income, preserving wealth, or achieving a specific financial milestone like retirement.

- Time Horizon: The length of time you plan to hold your investments, such as short-term (less than 1 year), medium-term (1-5 years), or long-term (5 years or more).

- Risk Tolerance is your willingness and ability to tolerate investment risk. This element includes factors such as your investment experience, financial situation, and overall comfort level with market volatility.

- Investment Experience: Your investment experience, including the types of investments you have made and your level of knowledge and expertise in financial markets.

- Financial Situation: Your income, net worth, and current financial obligations, such as debts and expenses.

- Liquidity Needs: Your short-term cash needs, such as emergency savings or upcoming expenses, may affect your investment strategy.

- Tax Situation: Your tax bracket, tax liabilities, and tax planning strategies, which may affect your investment decisions.

Broker Misconduct and FINRA Rule 2111

There are several ways that your broker can make a misstep in connection with FINRA Rule 2111 (Suitability Rule). For example, recommending a high-risk investment to a client with a low-risk tolerance or a complex investment to a client with little investment experience would be considered unsuitable.

Other ways a broker can violate FINRA Rule 2111 suitability include:

- If your broker-dealer concentrates your investments in one particular security or asset class, this could expose you to higher risks and may be unsuitable.

- Excessive trading, also known as churning, is unsuitable for most investors and can result in unnecessary fees and losses.

- Misrepresenting investment risks can lead to unsuitable client investments and significant losses.

- If a broker-dealer fails to consider a client’s investment profile, including their investment objectives, risk tolerance, and financial situation, before making a recommendation, this would violate FINRA Rule 2111 (Suitability).

Complicating matters, what constitutes misconduct from a broker or dealer isn’t always evident immediately. Sometimes, unsuitable investments can initially appear profitable but lead to significant financial harm over a long period.

Frequently Asked Questions (FAQs)

What Does FINRA Rule 2111 Suitability Mean for Investors?

This regulatory standard requires that broker-dealers only recommend investment-related strategies suitable for each investor’s unique requirements and preferences. Brokers and dealers can violate this rule in many ways. One example is not informing an investor about key investment-related details, which could constitute a lack of communication.

When Did FINRA Rule 2111 (Suitability Rule) Become Effective?

This rule went into effect in July 2012. Under this rule, dealers and brokers must consider investor-specific factors before making any recommendations to investors. This rule helps protect those who invest, especially those with a lower risk level or limited funds.

What Are the Three Main Suitability Obligations Identified in FINRA Rule 2111?

These three crucial obligations include reasonable basis, customer-specific, and quantitative suitability. A broker-dealer can violate these regulations by making investments too concentrated for an investor’s objectives.

Reputable and Reliable FINRA Attorneys for Securities Disputes

When disputes arise between investors and securities firms or brokers, they may be required to resolve their differences through FINRA arbitration. FINRA arbitration is a process in which an impartial arbitrator or panel of arbitrators is appointed to hear the dispute and render a decision.

A FINRA arbitration attorney can help clients navigate the arbitration process and represent their interests. Some of the many things an attorney can help you with may include:

- Conducting discovery

- Preparing and filing your claim

- Presenting evidence at a hearing

- Negotiating on your behalf

- Appealing the decision if necessary

In addition to their knowledge of FINRA rules and procedures, the attorneys at the White Law Group also have experience in securities law and litigation. They can provide valuable guidance to clients on the strengths and weaknesses of their broker misconduct case, the likelihood of success, and the potential risks and rewards of pursuing arbitration in matters involving FINRA Rule 2111 suitability.

If you have a securities-related dispute, the FINRA attorneys for securities disputes at the White Law Group may be able to help you. The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm dedicated to helping investors in claims in all 50 states against their financial professional or brokerage firm. Since the firm launched in 2010, it has handled over 700 FINRA arbitration cases.

For a free consultation with a FINRA attorney, please call our offices at 888-637-5510 for a free consultation.

The White Law Group is a national securities fraud, securities arbitration, and investor protection law firm with offices in Chicago, Illinois, and Seattle, Washington. For more information on The White Law Group and its representation of investors, please visit White Law Group.

Tags: Financial Industry Regulatory Authority, finra arbitration attorneys, FINRA oversight, FINRA Rule 2111, FINRA Rules, Securities Attorney, suitabiity Last modified: June 17, 2025