Securities Fraud Attorneys for Unsuitable, Complex Investments

Investors have plenty of choices for investing their money today, including complex investment products. Unfortunately, sometimes alternative investment products created for wealthy, experienced investors are also sold to elderly or unsophisticated investors. These investments are typically highly complex and difficult to understand. They may have significant commissions and sales charges or fees that benefit the broker, but not the investor.

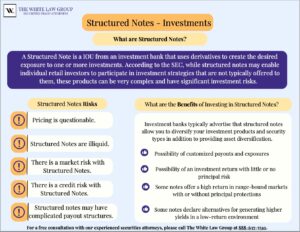

Complex investment products have intricate structures and features, often designed to provide exposure to specific markets, strategies, or risk profiles. These products typically go beyond traditional investments like stocks and bonds and may involve variable annuities, non-traded investments or structured products. While they can offer unique opportunities, it’s important to understand their complexities and risks before investing.

Suitability is critical when it comes to complex investment products. It refers to whether a particular investment is appropriate for an individual investor based on their financial goals, risk tolerance, investment knowledge, and overall financial situation.

Are these Complex Investments Suitable for you?

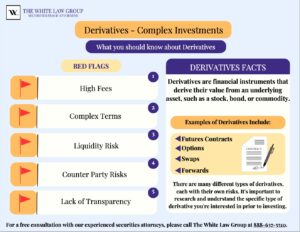

Investors may have limited access to information or face challenges in understanding the product’s intricacies and true value. This limited transparency can make it difficult to evaluate the risks and make informed investment decisions.

Alternative Investments with Limited Liquidity

Private Placement Investments: Private placement investments are considered complex, high-risk investments due to several factors. They are typically exempt from the same level of regulatory scrutiny as publicly traded securities. This reduced regulatory oversight can result in fewer investor protections and disclosure requirements. As a result, investors may have limited information about the investment, the underlying assets, and the financial condition of the issuing company. See: The Trouble with Private Placements Under Regulation D.

Private placements are typically illiquid, meaning they have limited opportunities for investors to sell their holdings or access their invested capital. Unlike publicly traded securities that can be easily bought or sold on a stock exchange, private placements often involve long holding periods, lock-up periods, or restrictions on transferring ownership. Investors may face challenges in converting their investment into cash, which can result in limited flexibility and potential financial constraints.

Since non-traded REITs are not traded on public exchanges, investors may face challenges in obtaining current pricing information. This lack of price transparency can make it harder to assess the investment’s performance and potential returns accurately. ? For more information, please see: Are Non-Traded REITs a Safe Bet?

Business Development Companies (BDCs): A Business Development Company (BDC) is also considered a complex investment product. BDCs are a type of investment company that primarily invests in small and mid-sized private businesses. Unlike traditional BDCs that are publicly traded, non-traded BDCs do not trade on a public exchange. Similar to non-traded REITs, non-traded BDCs are illiquid investments, meaning they don’t have a market for buying or selling shares. Investors typically commit their capital for an extended period, often seven to ten years or longer, and may have limited options to access their investment before the maturity of the investment. For more information please see: Business Development Companies BDCs – the good, the bad, and the UGLY.

BDCs typically invest in a diversified portfolio of private companies, including debt and equity securities. The underlying investment strategies and risk profiles can vary between different BDCs. Some BDCs invest in securities that are rated below investment grade by rating agencies. Below investment grade securities, which are often referred to as “junk,” have speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may also be illiquid and difficult to value.

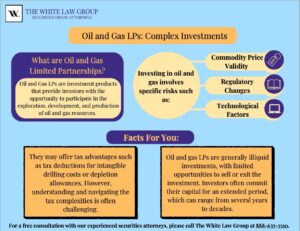

They may offer tax advantages such as tax deductions for intangible drilling costs or depletion allowances. However, understanding and navigating the tax complexities associated with these investments can be challenging, requiring specialized knowledge or consultation with tax professionals. Oil and gas LPs are generally illiquid investments, with limited opportunities to sell or exit the investment. Investors often commit their capital for an extended period, which can range from several years to decades, depending on the life cycle of the oil and gas project. The lack of liquidity can restrict investors’ ability to access their capital before the project’s completion.

Other High- Risk, Complex Investments

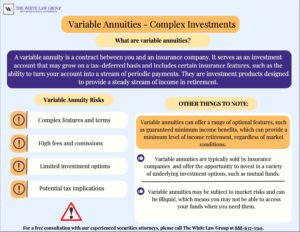

Variable annuities also come with a complex fee structure. These fees can include mortality and expense charges, administrative fees, investment management fees, and surrender charges. These numerous fees can impact the overall return of the annuity and can be challenging for investors to fully understand and compare with other investment options.

Some unscrupulous financial advisors or brokers may encourage investors to switch from one variable annuity to another, primarily for the purpose of generating additional commissions or fees for themselves. When variable annuity switching involves misrepresentation, unauthorized trading, or other fraudulent activities, it can harm investors.

Hedge funds: Hedge funds are investment products that pool capital from accredited investors to pursue higher returns using various strategies. These strategies can include long-short equity, arbitrage, distressed debt, or global macro investing. Hedge funds often have minimum investment requirements, limited liquidity, and charge performance-based fees. They are subject to less regulatory oversight compared to traditional investment funds.

Are Complex Investments Suitable for you?

Suitability is an assessment of whether a particular investment is appropriate for an investor based on their financial goals, risk tolerance, investment knowledge, and overall financial situation.

The suitability analysis becomes even more crucial when considering complex investment products, such as variable annuities, structured products, or non-traded investments.

When you start working with a broker or financial advisor, you’ll fill out a suitability profile that includes information about your financial goals. Your broker should base his investment recommendations on this profile, but often that is not the case. Complex investment products often require a higher level of understanding and expertise to assess their risks, benefits, and potential returns. It is important to evaluate whether the investor has the necessary knowledge and experience to comprehend the complexities of the investment and make informed decisions. If an investor lacks the required understanding, the investment may not be suitable for them.

The suitability analysis considers whether the investor’s risk tolerance aligns with the risks associated with the complex investment. If an investor has a low-risk tolerance or cannot afford to take on substantial risk, complex investments may not be suitable for them.

Different complex products have different objectives, such as capital appreciation, income generation, or hedging strategies. It is crucial to determine whether the investment can help the investor achieve their specific financial objectives. Many complex investment products, such as private placements or non-traded REITs and BDCs have limited liquidity. Suitability analysis considers whether the investor has sufficient liquidity or the ability to hold the investment for the required time frame. If an investor needs access to their funds in the short term, an illiquid complex investment may not be suitable.

Finally, a suitability analysis takes into account the investor’s overall financial situation, including their income, assets, liabilities, and investment portfolio. Complex investments often require a substantial commitment of capital or have high minimum investment requirements. The analysis assesses whether the investor can afford to allocate funds to a complex investment without jeopardizing their financial well-being.

FINRA Suitability Rules

Financial Industry Regulatory Authority (FINRA), the self-regulator who oversees brokers and brokerage firms, has suitability rules and guidelines for recommending complex investment products. FINRA Rule 2111 requires that a firm or its representative have a reasonable basis to believe a recommended transaction or investment strategy involving a security is suitable for the customer. This is based on the information obtained through reasonable diligence of the firm or broker to understand the customer’s investment profile.

It is important for brokers and advisors to assess the suitability of these investments for each individual investor and provide appropriate advice regarding the risks and complexities involved.

If you believe that your broker has recommended a complex investment product that is unsuitable, and you have lost money, you may have recovery options. The securities attorneys at the White Law Group can assess your situation, review the relevant documentation, and determine if you have grounds for a complaint or potential legal recourse. You may be able to recover your losses through FINRA Arbitration.

FINRA Arbitration Attorneys

FINRA arbitration provides an easy and efficient forum for resolving securities disputes. It offers a streamlined process that often leads to faster resolutions compared to traditional court litigation. However, it’s important to consult with a firm experienced in securities law, such as The White Law Group, to guide you through the arbitration process and ensure that your rights are protected.

For a free consultation with our experienced securities attorneys, please call The White Law Group at 888-637-5510.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm with offices in Chicago, Illinois and Seattle, Washington. The firm has extensive experience representing investors in unsuitable investment claims against brokerage firms and financial advisors.

For more information on The White Law Group, visit https://whitesecuritieslaw.com.

Last modified: September 28, 2023