Are Private Placement Investments Suitable for you?

Did your financial advisor recommend investing in Reg D private placements? If you are not an accredited investor this type of investment may not be suitable for you. If you suffered investment losses in a Reg D private placement, the securities fraud attorneys at The White Law Group may be able to help you.

What is a Regulation D Private Placement Investment?

Private placements under Regulation D are a type of investment that is not publicly traded and is offered to accredited investors.

Regulation D (Reg D) is a set of rules established by the U.S. Securities and Exchange Commission (SEC) under the Securities Act of 1933. It provides exemptions from the registration requirements for certain private securities offerings. The purpose of Reg D is to raise capital for small businesses and startups by providing them with the ability to raise funds from accredited investors without having to go through the rigorous and costly process of a full public offering. Reg D provides three main exemptions from registration requirements:

Rule 504: This exemption allows companies to offer and sell up to $5 million of securities within a 12-month period. It is often used by small businesses and startups to raise funds locally or in a single state.

Rule 505: This exemption allows companies to offer and sell up to $5 million of securities within a 12-month period, but it imposes certain restrictions on the type of investors who can participate. Companies can sell securities to an unlimited number of accredited investors (wealthy individuals or institutions meeting certain criteria), as well as up to 35 non-accredited investors who meet certain sophistication requirements.

Rule 506: This exemption is the most common and offers two distinct options:

- Rule 506(b): Under this option, a company can raise an unlimited amount of funds without general advertising or solicitation. It can sell securities to an unlimited number of accredited investors and up to 35 non-accredited investors who meet certain sophistication requirements.

- Rule 506(c): This option allows companies to engage in general advertising or solicitation to attract investors, but it restricts the offering to accredited investors only. Companies must take reasonable steps to verify the accredited status of the investors.

While Reg D provides exemptions from registration, it doesn’t mean that the offerings are exempt from all securities laws. Companies must still comply with anti-fraud provisions and provide accurate and complete information to investors.

How Does a Private Placement Investment Work?

Companies choose a specific Reg D exemption that aligns with their needs and investor criteria. They prepare legal documentation, including a private placement memorandum (PPM) that outlines the investment opportunity and risks.

Depending on the exemption chosen, companies may verify the accredited investor status of potential investors and, if permitted, market the investment opportunity through general solicitation. Interested investors review the PPM, commit funds through a subscription agreement, and upon reaching a target, the company closes the offering. Raised funds are used for stated business purposes, and ongoing communication with investors is maintained.

Examples of Private Placements

- Limited Liability Companies (LLC)

- Non-Traded Real Estate Investment Trust (REIT)

- Hedge Funds

- Equipment Leasing Agreements

- Tenants-in-Common

- 1031 DST (Delware Statutory Trust)

- Oil and Gas Limited Partnerships

- Non-traded Business Development Company (BDC)

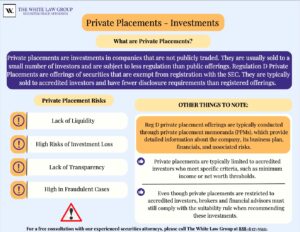

The Risks of Investing in Private Placements under Reg D

While they can offer potentially high returns, there are several risks associated with investing in Reg D private placements, including:

- Limited liquidity: Reg D private placements are not publicly traded, so there is limited liquidity for investors. This means that it can be difficult to sell your investment if you need to access your funds quickly.

- Lack of transparency: Private companies are not required to disclose the same level of information as publicly traded companies, so investors may not have access to all the information they need to make informed decisions.

- High risk: Private placements are generally considered to be high-risk investments because they are often offered by startup companies or companies with a limited operating history. These companies may have a higher risk of failure or may be more susceptible to market fluctuations.

- Limited regulatory oversight: Reg D private placements are exempt from many of the regulations that govern publicly traded securities, so investors may have limited legal recourse if something goes wrong.

- Potential for fraud: Because private placements are not subject to the same level of regulatory oversight as publicly traded securities, there is a greater risk of fraud or misrepresentation.

Suitability Rule and Reg D Private Placements

The suitability rule is commonly referred to as FINRA Rule 2111, or simply the Suitability Rule. FINRA stands for the Financial Industry Regulatory Authority, which is a self-regulatory organization that oversees brokerage firms and brokers in the United States. FINRA Rule 2111 sets forth the obligations and standards that your broker must follow when recommending investments.

Private placements are typically limited to accredited investors who meet specific criteria, such as minimum income or net worth thresholds. The suitability rule acknowledges that accredited investors may have a certain level of financial sophistication and risk tolerance that may make private placements suitable for them.

Even though private placements are restricted to accredited investors, brokers and financial advisors must still comply with the suitability rule when recommending these investments. They must assess whether a private placement is suitable for the individual accredited investor based on their specific financial circumstances and investment objectives.

Complex, High-Risk Investments

Reg D Private placements can be inherently risky due to their illiquid nature, limited transparency, and concentrated exposure. Brokers and financial advisors have a responsibility to evaluate the risks involved with private placements and determine if the investment aligns with the client’s risk tolerance. They must ensure that the investor understands the risks involved and can withstand potential losses.

Private placements often require extensive disclosure documents, such as private placement memoranda (PPMs), offering circulars, or prospectuses. Brokers and financial advisors must review these documents. They need to ensure that the investor receives all necessary information to make an informed investment decision. They should disclose key facts about the investment, such as the issuer’s business, financial condition, risk factors, and any conflicts of interest.

The White Law Group has represented numerous investors in claims involving Reg D private placement investments.

Reg D Private Placement Investors may have Claims

When brokers violate securities laws, such as making unsuitable investments in private placement investments, the brokerage firm they are working with may be liable for investment losses through FINRA Arbitration.

FINRA Dispute Resolution is an arbitration venue for investors with claims against their brokerage firm or financial professional. It provides investors with an opportunity to attempt to recoup their investment losses and is an alternative to filing such claims in court. For more information, please visit: FINRA Arbitration Attorney.

Free Consultation

If you invested in a Reg D private placement investment and have suffered significant losses, please contact the securities attorneys of The White Law Group at 888-637-5510 for a free consultation.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm with offices in Chicago, Illinois and Seattle, Washington.

Our firm has handled over 700 FINRA arbitration claims involving unauthorized trading, unsuitable investments, fraud, negligence, churning/excessive trading, and improper use of margin.

For more information on The White Law Group, visit https://whitesecuritieslaw.com.

Tags: FINRA suitability rule, private placements Reg D, Regulation D Last modified: March 7, 2024