Unsuitable Investment Lawyer

The Financial Industry Regulatory Authority (FINRA) is the self–regulator who oversees brokers and brokerage firms. FINRA has rules regarding unsuitable investments. If your broker fails to follow FINRA rules, you may want to seek legal advice from an experienced unsuitable investment lawyer.

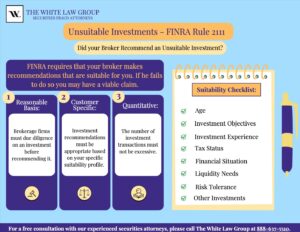

FINRA Rule 2111 requires that a firm or its representative have a reasonable basis to believe a recommended transaction or investment strategy involving a security is suitable for the customer. This is based on the information obtained through reasonable diligence of the firm or associated person to understand the customer’s investment profile.

The rule states that the customer’s investment profile “includes, but is not limited to, the customer’s age, other investments, financial situation and needs, tax status, investment objectives, investment experience, investment time horizon, liquidity needs and risk tolerance,” among other information.

Brokers must have a firm understanding of both the product and the customer, according to Rule 2111. The lack of such an understanding itself violates the suitability rule.

Firms that fail to perform adequate due diligence, or that make unsuitable recommendations, can be held responsible for losses in a Financial Industry Regulatory Authority (FINRA) arbitration claim.

FINRA rule 2111 describes three separate suitability obligations:

(1) Reasonable Basis – firms must have a reasonable basis to believe, based on adequate due diligence, that a recommendation is suitable at least for some investors; The broker must have knowledge of the risks associated with the security or investment strategy. Since most investment opportunities are suitable for at least some investors, firms need to understand the potential risks of the investment.

(2) Customer Specific – firms must have reasonable grounds to believe a recommendation is suitable for the specific investor; including investment experience, retirement goals, investment time horizon, liquidity needs, risk tolerance and financial situation.

(3) Quantitative – firms must have a reasonable basis to believe the number of recommended transactions within a certain period is not excessive (i.e., that the investor’s account is not being churned).

Do I need an Unsuitable Investment Lawyer?

The following are examples of situations involving unsuitable investment recommendations by a broker or financial advisor.

High-risk investments for conservative investors: If you have a low-risk tolerance and are looking for stable and secure investments, your broker should not recommend high-risk investments such as speculative stocks, options trading, or highly leveraged products. These investments carry a significant risk of loss and may not align with your investment objectives.

Lack of diversification: You must diversify to decrease your risk. If your broker sold you a large position in a single stock or a few closely related securities without considering diversification, it could be considered unsuitable. Concentrated positions can expose you to volatility and potential losses if the value of your investment declines.

Illiquid investments with limited access to funds: Illiquid investments, such as private placements or non-traded REITs, lack readily available markets to sell or exit the investment. If your broker recommended investments with extended lock-up periods or limited liquidity without explaining the risks and impact on your cash flow, it may be unsuitable, especially if you require access to your funds in the near future.

Complex investment products with unclear risks: Some financial products, such as derivatives, structured products, or certain alternative investments, can be complex and difficult to understand. If your broker recommended these products without providing explanation of the risks involved, it could be considered unsuitable. It’s important for brokers to explain the risks and potential returns associated with any investment.

Account churning or excessive trading: If your broker excessively trades in your account to generate commissions without regard to your investment goals, it may be a case of account churning. Churning is illegal when a broker engages in excessive trading to generate commissions for themselves, which may result in unnecessary costs and a negative impact on your investment performance.

If you suspect that you have been sold unsuitable investments, you may want to consult with an experienced investment fraud lawyer who can help you assess whether you have legal recourse.

What is my Suitability Profile?

The following must be considered by the broker before making investment recommendations:

Age of the Investor – An investor’s age may be an important part of the profile – what may be a suitable investment for a 25-year-old may not be appropriate for someone nearing retirement age.

Investment Objectives – When an investor begins their relationship with a new broker, they will be asked to choose one of the following: Preservation of Capital; Current Income; Growth and Income; Capital Appreciation; and Aggressive Growth. According to FINRA rules, the investment recommendations must follow the investor’s objective. For example, if an investor’s objective was preservation of capital, a portfolio of high-risk stocks may be considered unsuitable investments.

Other Investments – It is important for a broker to understand what other investments are in the mix prior to making an investment recommendation. Diversification could protect the investor from fluctuations in the market. As the adage says, don’t put all of your eggs in one basket.

Tax Status – Financial advisors must consider tax implications of any investment before recommending the investment. For example, some financial professionals may improperly recommend that a customer switch or trade variable annuities in order to generate a commission. While variable annuity switching is not illegal, and is often not in the client’s best interest, and it could have negative tax consequences as well and could be considered unsuitable.

Financial Situation and Needs – This refers to the investor’s current and future financial situation including account assets, such as wealth and income, set off against liabilities, such as debt and dependents.

Investment Experience – Certain investments may only be suitable for experienced or sophisticated investors, such as high-risk, high-reward investments in unregistered securities.

Liquidity Needs – Liquidity is the degree to which an asset or security can be quickly bought or sold in the market at a fair price. Highly illiquid Investments such as non-traded REITs, or private placement investments may be considered unsuitable for an investor if they are planning to retire soon.

Risk Tolerance – Possibly the most important factor in making investment recommendations, risk tolerance describes how much an investor can afford to lose.

Unsuitable Investment Lawyer for FINRA Arbitration

FINRA Arbitration is a process that allows investors to seek resolution and recover financial losses for claims related to securities fraud, including unsuitable investments.

It offers a simple process that often leads to faster resolutions compared to traditional court litigation. However, it’s important to consult with an experienced FINRA lawyer to guide you through the process and ensure that your rights are protected.

When you open an account with a brokerage firm, you typically sign an agreement that includes a mandatory arbitration clause. This means that any disputes between you and the brokerage firm must be resolved through arbitration rather than going to court.

To start the process, you must file a Statement of Claim with FINRA, outlining the details of your case, including the alleged unsuitable investments and the losses you have suffered as a result. The claim will specify the amount of compensation you are seeking.

FINRA will appoint a panel of arbitrators to hear your case. The panel typically consists of three arbitrators, including both public and industry arbitrators with experience and expertise in securities matters.

The arbitration hearing is similar to a trial, but less formal. Both parties present their evidence, including documents, testimonies from witnesses, and expert opinions. The arbitrators review the evidence and make a decision based on the facts and laws. The decision is known as an award. The award may include money that compensates you for your unsuitable investment losses, including any associated costs, fees, and interest. The decision of the arbitration panel is binding and enforceable.

Hiring an Unsuitable Investment Lawyer

The unsuitable investment lawyers at the White Law Group can help you with the FINRA arbitration process including evaluating the merits of your claim and determining whether you have a strong case for arbitration.

If you believe you have suffered losses due to unsuitable investments, please contact the White Law Group for a free consultation at (888) 637-5510.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm dedicated to helping investors in claims in all 50 states against their financial professional or brokerage firm. Since the firm launched in 2010, it has handled over 700 FINRA arbitration cases.

Our firm represents investors in all types of securities related claims, including claims involving stock fraud, broker misrepresentation, churning, unsuitable investments, selling away, and unauthorized trading, among many others.

With over 30 years of securities law experience, The White Law Group has the expertise to help investors defrauded in securities, investment and financial business transactions attempt to recover their investment losses. For more information, please visit our website, www.whitesecuritieslaw.com.

Tags: broker suitability obligations, financial advisor suitability obligations, FINRA arbitration attorney, FINRA know your customer rule, FINRA Rule 2090, FINRA Rule 2111, FINRA suitability rules, securities fraud attorney, securities fraud lawyer, securities fraud suitability claims, securities fraud unsuitability claims, unsuitable investment fraud lawyer Last modified: August 10, 2023