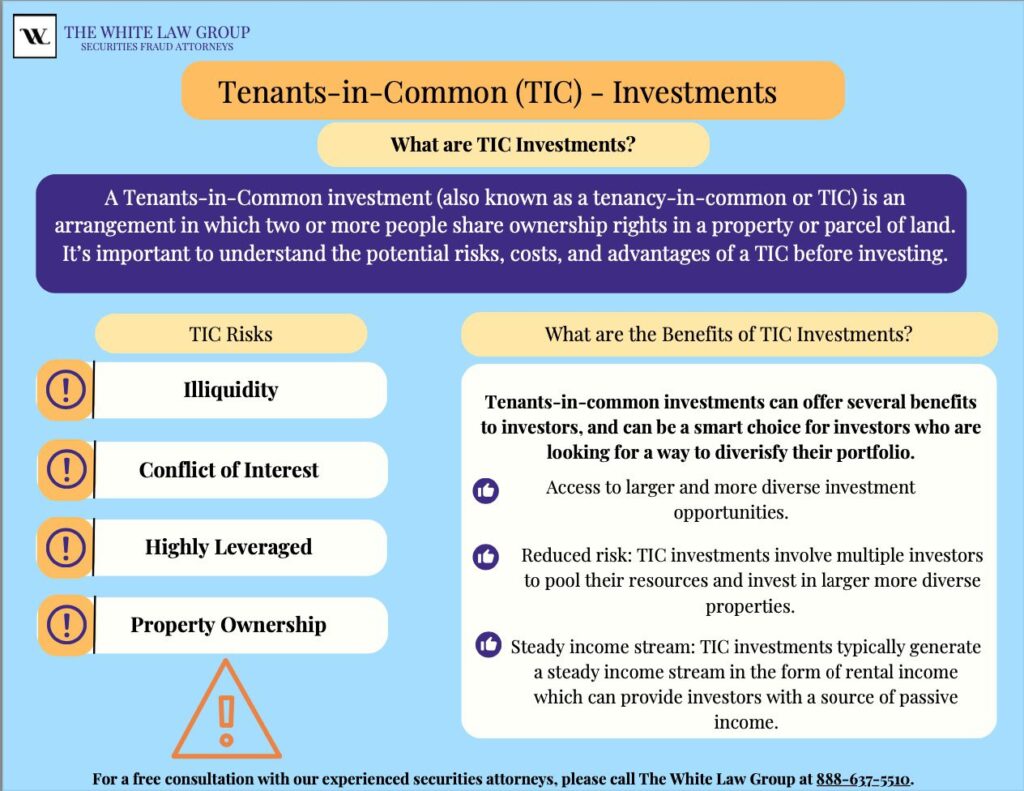

A tenants-in-common investment (also known as a tenancy-in-common or TIC) is an arrangement in which two or more people share ownership rights in a property or parcel of land. At first, it can sound appealing. Shared ownership. Passive income. Potential tax deferral through a 1031 exchange. That combination feels reassuring, and the perceived benefits of tenants-in-common investments are often emphasized early in the sales process.

But what looks straightforward on the surface often becomes far more complicated in practice. TIC structures involve multiple owners, layered entities, and long-term commitments that can be difficult to unwind. Understanding how these investments actually function is critical before deciding whether they align with your financial goals, especially when weighing the benefits against the risks of tenants-in-common investments.

It’s essential to understand the potential risks, costs, and advantages of a TIC before investing. Generally offered as a 1031 exchange tax deferral, tenants-in-common investments are often misrepresented by financial professionals as having risks and benefits that do not exist. Moreover, the investments – due to the attractiveness of the income they offer – are often marketed to conservative and retired investors.

How Does a Tenants-in-Common Investment Work?

Tenants-in-Common (TIC) refers to an investment by the taxpayer in real estate that is co-owned with other investors. Since the taxpayer holds a deed to real estate as a tenant in common, the investment qualifies under the like-kind rules of § 1031. This structure is frequently compared in TIC vs. DST discussions.

Essentially, the way that a TIC investment works is as follows: After acquiring a property, the TIC sponsor markets and sells interests in the property to investors (at a markup), with the sponsor then reducing its own interest in the property to a small fraction or zero as its interests are sold off to the investors.

The sponsor then forms a second entity to enter into a lease agreement with the investors, pursuant to which the investors become the landlord of the subject property and the second entity becomes the property manager. The lessee would then sub-lease the property to tenants and, in theory, pay the promised income to the owners. This reliance on the TIC sponsor is one of the core risks of tenants-in-common investments.

Various broker-dealers have been used by TIC sponsors to market and sell interests in these investments to the unsuspecting public and were compensated (handsomely) by these sponsors through commissions.

A Delaware Statutory Trust (also known as a DST) goes hand-in-hand with Tenants-in-Common investments, though there are slight differences. A DST is a separate legal entity formed as a trust under the law of Delaware in which each owner has a “beneficial interest” in the DST for income tax purposes and is treated as owning an undivided fractional interest in the property. Recently, DSTs have been gaining popularity for several reasons, including their ability to secure financing more readily and attract more investors with lower minimum investment amounts.

What Is the Difference between a TIC and DST?

The TIC vs. DST comparison often comes down to complexity and control. While both structures are commonly used for 1031 exchanges, they operate very differently behind the scenes.

Tenants-in-common investments require coordination among multiple owners, each with their own financial circumstances and priorities. DSTs, by contrast, consolidate decision-making under a trust structure, which may reduce administrative friction, though it does not eliminate investment risk. For investors evaluating TIC vs. DST, the difference in governance can significantly affect risk exposure.

The main difference between tenants-in-common and a Delaware statutory trust is that a tenancy-in-common is a form of ownership in which multiple people own a property together. In contrast, a Delaware Statutory Trust is a trust set up to invest in real estate or other assets.

Another difference between TICs and DSTs is that a TIC provides each owner with a separate share of the property. In contrast, a Delaware statutory trust provides beneficiaries with an interest in the trust itself. Additionally, a tenancy in common does not provide limited liability protection to its owners, while a Delaware statutory trust does provide limited liability protection to its beneficiaries.

Understanding the practical differences among TIC, DST, and other ownership structures can significantly impact long-term outcomes.

What Are the Benefits of Tenants-in-Common Investments?

The primary reason someone would want to invest in a TIC is the tax benefits, known as the 1031 exchange, that they would receive. Under the Like-Kind Exchange IRC Code § 1031: “Whenever you sell business or investment property, and you have a gain, you generally have to pay tax on the gain at the time of sale.

IRC Section 1031 provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar property as part of a qualifying like-kind exchange. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free.”

Eventually, you do have to pay the taxes, but a 1031 exchange allows you to defer those taxes until later. For some investors, the benefits of tenants-in-common investments include access to larger commercial properties and the ability to hold passive ownership.

What Are the Risks of Tenants-in-Common Investments?

TIC investments come with several risk factors that you should be aware of. The risks of tenants-in-common investments are substantial and often understated during the sales process. These risks include:

- While the investor is often focused on avoiding the Capital Gains Tax, they do not consider that up to 35 people may own TIC properties (and there is no limit with a DST). This is an inherent problem because unanimous consent from all tenants is necessary to make decisions such as selling, leasing, and refinancing.

- Another significant risk of tenants-in-common investments is that they’re almost always illiquid. This can create several problems. For example, if one of the TIC owners experiences a life-altering event, they can’t simply liquidate their interests. They have to wait until the decision to sell is made by all or the majority (depending on the TIC structure), and they are ready to sell.

- Your broker may be recommending a TIC for his own interests. Financial advisors should prioritize their clients’ best interests. Unfortunately, that is not always the case, as TIC investments pay unusually high sales commissions to the advisors. This may lead to a conflict of interest. The question becomes, did my advisor recommend this TIC because they thought it was a significant investment and fit my needs, or were they more interested in the 5-10 percent commission they are making on this sale?

- Another risk of tenants-in-common investments is that they’re also highly leveraged, borrowing enormously to acquire the properties. This means that these investments risk default even with the most minor market fluctuations.

Tenants-in-Common Investment Sponsors

A TIC sponsor is an individual or entity that locates properties to buy ‘wholesale,’ then packages them, and sells them to multiple investors at a ‘retail’ price. The various investors hold a title as ‘Tenants in Common’. The difference between the wholesale and retail price is what the TIC sponsor earns for their services. Typically, this is between 5-7% percent of the total value of the investment, according to TM 1031 Exchange.

The sponsors often make the investments sound too good to be true – income-producing, no hassles, excellent properties. The sponsors usually even provide glossy marketing materials showing the properties and forecasting excellent prospects. Notwithstanding these representations, TIC investments remain extremely high-risk, in large part due to the enormous commissions paid to sponsors, brokerage firms, and financial advisors, which can eat into any profitability the investments may have.

Common Tenants-in-Common (TIC) Sponsors

Several companies sponsor TIC and DST investments, including:

- 1031 Exchange Properties

- Capital Real Estate

- Cornerstone Real Estate Investment Services

- Irexa Financial Services Wealth Strategies

- Kay Properties & Investments, LLC

Other companies that are DST and TIC sponsors include:

Madison Capital Group:

- MCG – Charleston Apartments, LLC 2020

- MCG – Hendersonville TIC, LLC 2021

Nelson Brothers

Cottonwood Residential:

- Cottonwood Residential – CW Investor on Highland, LLC 2019

- Cottonwood Residential – Melrose II S TIC, LLC 2021

Avistone Commercial Real Estate Investing:

- Avistone – Citygate, LLC

- Avistone – Cramer Creek, LLC

- Avistone – Cramer Creek S, LLC

- Avistone – Dearborn, LLC

- Avistone – Gateway, LLC

- Avistone – Gateway Oaks, LLC

- Avistone – Gateway Oaks S, LLC

- Avistone – Northgate, LLC

- Avistone – Northgate III, LLC

- Avistone – Northwoods, LLC

- Avistone – Northwest, LLC

- Avistone – Northwest S, LLC

- Avistone – Pleasantdale, LLC

- Avistone – Presidents, LLC

- Avistone – Tampa Flex S, LLC

- Avistone – Tuller, LLC

- Avistone – Tuller S, LLC

- Avistone – West Tech, LLC

American Capital Group:

- ACG – Addison Greens Apartment Associates, LLC

- ACG – The Dakota Apartments Associates, LLC

- ACG – Highlands at Spectrum Apartments, LLC

- ACG – Monticello Apartments Associates, LLC

- ACG – Sterling Pointe Apartment Associates, LLC

Cabot Investment Properties:

- Cabot -Ashtabula Acquisition, LLC

- Cabot -Creekside Acquisition, LLC

- Cabot – East Town Acquisition, LLC

- Cabot – Golf CL-PP Acquisition, LLC

- Cabot – Northpark Southland Acquisition, LLC

- Cabot – Oak Grove Acquisition, LLC

- Cabot – Turfway Ridge Acquisition, LLC

Cottonwood Capital, LLC:

- Cottonwood -Arbors S, LLC

- Cottonwood – Blue Swan S, LLC

- Cottonwood – Copperfield S, LLC

- Cottonwood – Gables S, LLC

- Cottonwood – Oakridge S, LLC

- Cottonwood – Regatta S, LLC

- Cottonwood – West Town S, LP

Covington Realty Partners:

- Covington Dardenne Acquisition, LLC

- Covington First Colony Commons

- Covington Gateway Station Shopping Center Phase II

- Covington Lansing Acquisition, LLC

Desanto Realty Group:

- DRG – Cason Estates, LLC

- DRG – Clearview, LLC

- DRG – Cypress Medical, LLC

- DRG – Fox Chase, LLC

- DRG – Hendersonville, LLC

- DRG – Hunter’s Chase, LLC

- DRG – Northwoods Crossing, LLC

- DRG – Pennbrook, LLC

- DRG – Perry’s Crossing

Direct Invest, LLC:

- Direct Invest – 116 Invest Highway, LLC

- Direct Invest – 246 Omini Way, LLC

- Direct Invest – 2810 North Parnham Road, LLC

- Direct Invest – 500 East Main, LLC

- Direct Invest – Braintree Park, LLC

- Direct Invest – Delmar, LLC

- Direct Invest – Heron Cover, LLC

- Direct Invest – Riverbend Executive Park, LLC

- Direct Invest – Winding Brook Drive, LLC

Gemini Real Estate Advisors, LLC:

- Gemini – 442 West 36th Street S, LLC TIC Comfort Inn (NYNY)

- Gemini – Brandon S TIC – Brandon LA Fitness Shopping Center

- Gemini – Diamond Run S, LLC – TIC Diamond Run Mall

- Gemini – Johnstown Galleria S, LLC – TIC Johnstown Galleria

- Gemini – Rio Norte S LLC – TIC Rio Norte Shopping Center

- Gemini – Rowlette Crossing S LLC – TIC Rowlette Crossing Shopping Center

- Gemini – Tinley Park S, LLC – TIC Tinley Park LA Fitness

Griffin Capital Corporation:

- Griffin Capital – Bolingbrook Investors, LLC

- Griffin Capital – Independence Investors, LLC

- Griffin Capital – Palomar Investors, LLC

- Griffin Capital – Redwood Investors, LLC

- Griffin Capital – Westmont Investors, LLC

Inland Real Estate:

- Inland Real Estate – Charlotte 1031, LLC

- Inland Real Estate – Olivet Church 1031, LLC

- Inland Real Estate – Glenview 1031, LLC

- Inland Real Estate – Dublin 1031, LLC

- Inland Real Estate – Houston 1031, LLC

- Inland Real Estate – Plano 1031, LLC

- Inland Real Estate – Eden Prairie 1031, LLC

- Inland Real Estate – Waukesha 1031, LLC

- Inland Real Estate – Tampa Coconut Palms Office Building 1031, LLC

- Inland Real Estate – Geneva 1031, LLC

- Inland Real Estate – Memorial Square 1031, LLC

- Inland Real Estate – Countrywood 1031, LLC

- Inland Real Estate – Carmel Office 1031, LLC

Frequently Asked Questions

Is a tenants-in-common investment suitable for you?

Your financial advisor should recommend only investments suitable for their clients. The financial advisor should conduct a holistic suitability analysis. Liquidity needs, time horizon, risk tolerance, age, and income are just a few categories an advisor should consider before recommending any investment. Once that is completed, the brokerage firm must ensure that due diligence has been conducted at every level of each investment.

In many cases, advisors emphasize the perceived benefits of tenants-in-common investments without giving equal weight to how these benefits may change over time or under different market conditions.

FINRA issued multiple notices reminding brokerage firms that they cannot recommend TICs based solely on information received from the sponsoring company. In fact, the firm is legally required to conduct a “reasonable investigation” on its own to confirm that there is no misrepresentation on the sponsor’s end. These safeguards are in place to protect the investor, but unfortunately, sometimes they are overlooked.

When firms fail to perform this investigation, investors may be left with an incomplete understanding of both the benefits of tenants-in-common investments and the risks involved.

What is FINRA arbitration?

FINRA is responsible for overseeing the activities of brokerage firms and for enforcing rules and regulations related to the trading of securities. Seeking restitution through FINRA arbitration can be a helpful process if you feel as though you’ve been defrauded. Once you’ve retained a securities fraud attorney, the process of filing a claim through FINRA could take place.

This claim should include a description of the fraud, the amount of money lost, and any supporting documentation. Once the claim is filed, FINRA will appoint an arbitrator to hear the case.

The arbitrator is responsible for reviewing the evidence and deciding whether the investor is entitled to restitution. If the arbitrator rules in favor of the investor, they will issue an award for damages, and this can be used to seek restitution from the person or company that defrauded the investor.

FINRA arbitration is often used when inventors allege that the benefits of tenants-in-common investments were overstated or presented without adequate disclosure.

What is the difference between TIC vs. joint tenancy?

While both involve shared ownership, TIC vs. joint tenancy differ significantly in structure and rights. Tenants-in-common investors hold distinct ownership interests that can be transferred or inherited, while joint tenancy typically includes rights of survivorship. These distinctions can have significant legal and financial implications.

What should TIC investors know before participating in a 1031 exchange?

TIC investors should understand that while this type of exchange can defer taxes, it does not eliminate risk. Property performance, leverage, sponsor management, and liquidity constraints still apply. Proper due diligence is essential before committing proceeds from a sale.

What role does the 1031 exchange play in tenants-in-common investments?

This type of exchange is often the primary reason tenants-in-common investments are recommended. However, tax deferral should be evaluated alongside investment fundamentals. Investors should consider whether the structure aligns with long-term financial needs, not just short-term tax goals.

Focusing solely on the benefits of tenants-in-common investments tied to tax deferral can cause investors to overlook long-term limitations and exit challenges.

Filing a FINRA Claim Against Your Brokerage Firm

The foregoing information, which is all publicly available, is being provided by The White Law Group. If you have suffered losses as a result of a financial advisor’s misleading representations of a Tenants-in-Common (TIC) or DST investment, we may be able to help. The securities attorneys of The White Law Group can file a FINRA arbitration claim to recover your losses.

For a free consultation with a securities attorney, please call 888-637-5510.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm with offices in Chicago, Illinois, and Seattle, Washington. For more information on the firm and its representation of investors in FINRA arbitration claims, visit https://whitesecuritieslaw.com.

Tags: tenants-in-common, TIC investment Last modified: January 12, 2026