1031 Delaware Statutory Trust (DST) Investments

If you are concerned about investment losses in a 1031 Delaware Statutory Trust (DST) investment, the securities attorneys at the White Law Group may be able to help you by filing a claim against your brokerage firm.

A Delaware Statutory Trust (DST) is a legally recognized trust that is set up for the purpose of business, but not necessarily in the U.S. state of Delaware.

Investors seeking to defer paying capital gains taxes on property often do so using §1031 of the Internal Revenue Code. Under §1031, an investor may defer paying capital gain taxes on property when they purchase “like kind” property within 45 days of selling the original property.

Traditionally, investors have taken this route by way of tenant in common investments (or TICs). However, recently a similar structured investment called a Delaware Statutory Trust (or DST) has become popular with investors and while there are a lot of similarities between TICs and DSTs in form and structure, there are some important differences.

What is a Delaware Statutory Trust (DST)?

What is a Delaware Statutory Trust (DST)?

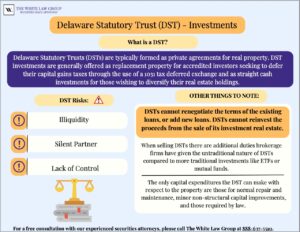

Delaware Statutory Trusts (DSTs) are typically formed as private agreements for real property. DST Investments are generally offered as replacement property for accredited investors seeking to defer their capital gains taxes through the use of a 1031 tax deferred exchange and as straight cash investments for those wishing to diversify their real estate holdings.

DSTs are similar to tenants-in-common (TIC) investments when it comes to benefits, risks, and structure.

The idea behind the TIC and DST property ownership structure is that it allows the smaller investor to own a fractional interest in large, institutional quality and professionally managed commercial properties along with other investors, not as limited partners, but as individual owners within a Trust.

Each owner receives their percentage share of the cash flow income, tax benefits, and appreciation, if any, of the entire property. The DST ownership option essentially offers the same benefits and risks that an investor would receive as a single large-scale investment property owner, but without the management responsibility.

DST vs TIC: What’s the difference?

A tenancy-in-common is a type of property ownership where multiple people share ownership of a certain property, while a Delaware Statutory Trust is a type of trust that is established for the purpose of investing in real estate or other assets.

A key difference between the two is that a tenancy-in-common provides each owner with a distinct share of the property, whereas a Delaware Statutory Trust provides the beneficiaries with an interest in the trust itself. Another notable difference is that a tenancy-in-common does not offer limited liability protection to its owners, while a Delaware Statutory Trust provides limited liability protection to its beneficiaries.

Delaware Statutory Trust (DST) Tax Advantages

DSTs give you the same tax benefits you’d get from direct real property ownership or a TIC, including mortgage interest deduction. Also, most people purchase a DST by performing a 1031 like kind exchange, allowing the purchaser to defer capital gains on a previous investment.

This can make DST investments attractive to older real estate investors who still want the benefits of real estate ownership but without the hassle. Brokerage firms that sell DSTs often focus on the tax deferral, income potential and lack of day-to-day management as the basis of recommending DSTs. There are downside risks though.

Downside Risks of Investing in Delaware Statutory Trusts (DSTs)

Liquidity – Like other real estate, a DST is considered an illiquid asset. Though you may be receiving cash flow, you won’t have access to any proceeds until the asset is sold, and the program concludes, which could involve a span of 7-10 years or more.

Rights – In a DST, you are basically a silent partner. Investors in a DST do not have a formal vote regarding property operations or dispositions. As such, you don’t have a say in who leases the property, what capital improvements should be made, when the asset should be sold, or anything else concerning the property.

Selling – The biggest risk for investors may be lack of control in when the investment will be sold. In this regard, DST owners have even fewer rights than TIC owners (whose rights are also limited by the nature and structure of TICs).

Additionally, once the trust is formalized, no future equity contributions can be made to the DST. DSTs cannot renegotiate the terms of the existing loans, or add new loans. DSTs cannot reinvest the proceeds from the sale of its investment real estate.

The only capital expenditures the DST can make with respect to the property are those for normal repair and maintenance, minor non-structural capital improvements, and those required by law. These limitations can be catastrophic in volatile market climates (i.e. when the market declines and tenants fail to renew or pay their rent).

FINRA Brokerage Firm Responsibilities involving a 1031Delaware Statutory Trust (DST)

When selling any investment, broker dealers are required to perform adequate due diligence on all investment recommendations. They must ensure that each investment recommendation that is made is suitable for the investor in light of the investor’s age, risk tolerance, net worth, financial needs, and investment experience.

When selling DSTs there are additional duties brokerage firms have given the untraditional nature of DSTs compared to more traditional investments like ETFs or mutual funds.

Specifically, DSTs are considered by FINRA to be “non-conventional investments.” Notice to Member 03-71 (“NTM 03-71”) reminded brokers and broker-dealers of their requirements as they pertained to the sale of non-conventional investments (NCIs).

The notice to member specifically requires broker-dealers that sell NCIs to, among other things, conduct (1) appropriate due diligence, (2) perform a reasonable-basis suitability analysis, (3) perform customer specific suitability analysis for recommended transactions, (4) provide a balanced disclosure of the risks and rewards associated with a particular product, especially when selling to retail investors; (5) implement appropriate internal controls; and (6) train registered persons regarding the features, risks, and suitability of these products.

Appropriate Due Diligence

NTM 05-18 also reinforced these same basic obligations and directed the message to Members with regard specifically to TIC sales (as stated above, TICs and DSTs are structured very similarly). This notice also reminded brokers that sell TICs to, among other things, conduct (1) appropriate due diligence, (2) perform a reasonable-basis suitability analysis, (3) perform customer specific suitability analysis for recommended transactions, and (4) ensure that promotional materials are accurate.

NTM 05-18 also reminds firms of their requirement to balance the potential tax savings provided by performing a 1031 exchange with the costs of purchasing a particular TIC property. This can be a very important consideration when deciding whether to purchase a DST. While a 1031 exchange may allow an investor to defer capital gains on the sale of an investment, if the cost of the replacement investment is the same or more than the tax benefits, then the risk and other downsides of DSTs must be a greater consideration.

As stated above, brokerage firms often focus on the tax advantages and income potential of DSTs and downplay the risks, illiquidity, and costs. However, they are required by FINRA rules to balance these considerations before making any DST recommendations and brokerage firms’ failure to properly disclose and account for these risks is often where they get in trouble when selling these products.

FINRA Arbitration to Recover Investment Losses in Delaware Statutory Trust (DST)

The Financial Industry Regulatory Authority (FINRA) regulates the securities industry in the United States. It is responsible for overseeing the activities of brokerage firms, and for enforcing rules and regulations related securities.

You may be able to recover investment losses through FINRA arbitration if you’ve been defrauded. Once you’ve retained a securities fraud attorney, the process of filing a claim through FINRA could take place. This claim should include a description of the fraud, the amount of money lost, and any supporting documentation.

Once the claim is filed, FINRA will appoint an arbitrator to hear the case. The arbitrator is responsible for reviewing the evidence and making a decision about whether the investor is entitled to restitution. If the arbitrator rules in favor of the investor, they will issue an award for damages, and this can be used to seek restitution from the person or company that defrauded the investor.

Is a Delaware Statutory Trust (DST) Investment Suitable for You?

Your financial advisor should only recommend investments that are suitable for their clients. The financial advisor should conduct a suitability analysis on a holistic level. Liquidity needs, time horizon, risk tolerance, age, income, are just a few categories an advisor should consider prior to recommending any investment. Once that is completed the brokerage firm must ensure that due diligence was completed at every level of each investment.

Fortunately for investors who purchase a DST through a brokerage firm, you may be able to recover investment losses through FINRA arbitration.

The White Law Group exclusively represents investors in claims against brokerage firms through the FINRA arbitration process. If you suffered losses investing in a Delaware Statutory Trust (DST), please call The White Law Group at 1-888-637-5510 for a free consultation.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm with offices in Chicago, Illinois and Seattle, Washington.

For more information on The White Law Group, and its representation of investors, please visit: whitesecuritieslaw.com.

Delaware Statutory Trust (DST) Sponsors

Like TICs, DSTs are generally put together by investment sponsors that find the property and then sells the DST interests to individuals. Often brokerage firms are used by the DST sponsor companies for finding the individuals to invest.

For this service, brokerage firms are generally paid a high commission, often 7% or higher (a 7% up front commission is well in excess of the commissions offered financial advisors selling annuities or mutual funds, which creates an inherent conflict of interest for advisors recommending DST investments).

The following is a list of DST sponsors that create Delaware Statutory Trust investment deals and their offerings:

AEI

AEI Net Lease Portfolio DST

AEI Healthcare Portfolio DST

AEI Net Lease PORTFOLIO 19 DST

ARCTRUST

ARCTRUST Phoenix DST

ARCTRUST Vestal Home Improvement DST

ARCTRUST Essential Property, DST

ARCTRUST Industrial DST

ARCTRUST Somerset Pharmacy DST

Ares Diversified Real Estate Exchange LLC

ADREX Clearwater DST

ADREX Diversified 3 DST

ADREX Diversified 4 DST

ADREX Diversified 5 DST

ADREX Diversified I DST

ADREX Diversified II DST

ADREX Multifamily I DST

Ares Industrial Real Estate Exchange LLC

AIREX Portfolio 7 DST

AIREX Portfolio IV DST

AIREX Portfolio V DST

AIREX Portfolio VI DST

American Capital Group

Palms at Morada DST

Arrimus Capital

ACA Illinois Tier 1 Student Housing DST

ACA Stadium View Student Housing DST

BDP Holdings

Baker Tilly/BT REI Manager LLC

BT Bloomington Student Housing DST

BT Mankato Student Housing DST

BT Ames Student Housing DST

BT Mankato Student Housing DST

Black Creek Industrial Exchange

BC Industrial Exchange Portfolio III DST

BC Industrial Exchange Portfolio I DST

BC Industrial Exchange Portfolio III DST

BC Industrial Exchange Portfolio II DST

BC Exchange Clayton Commerce Center DST

BC Exchange Reno Logistics Center DST

BC Exchange Logistics Portfolio DST

Bluerock Value Exchange

BR Diversified Industrial Portfolio I, DST

BR 79 West, DST

BR Harrison Trace, DST

BR Lake Linganore DST

Cantor Fitzgerald

CF ON3 Lifesciences Parent DST

CF ON3 Lifesciences Parent DST

CF Weston Multifamily DST

CF Legacy at Fox Valley Multifamily DST

CF Livonia DST

CF Net Lease Portfolio V DST

CF Net Lease Portfolio IV DST

CF Retail Properties VI DST

CF Westchester Multifamily DST

CF Pearland Multifamily DST

CF Archer Multifamily DST

CF Pillar Partners, LP

CF Palms Multifamily DST

CF Arrabella Multifamily DST

CF West End Multifamily DST

CF Glenmuir Multifamily DST

CF Industry Multifamily DST

CF Valencia Life Sciences DST

CF Texas Multifamily Portfolio DST

CF Bala Woods Multifamily DST

CF Chisholm Multifamily DST

CF Kacey Multifamily DST

CF Riverview Multifamily DST

CF Mount Comfort DST

CF Tribeca Multifamily DST

Capital Square 1031

CS1031 Holiday MHC, DST

CS1031 Asheville NC Apartments Portfolio, DST

CS1031 Lyric at Norton Commons Apartments, DST

CS 1031 Tapestry West Apartments DST

CS1031 FarmHaus Apartments DST

CS1031 Zero Coupon LV Training Facility DST

CS1031 Parkland Apartments DST

CS1031 Lakeside at Riverwatch, DST

CS1031 Country Lakes Village MHC, DST

CS1031 The Trails at Short Pump Apartments DST

CS1031 Hunter’s Chase Apartments, DST

CS1031 Village at Westland Cove Apartments, DST

CS1031 Twin Palms MHC, DST

CS1031 Coach House MHC, DST

CS1031 17 Broad Apartments, DST

CS1031 Midway Estates MHC, DST

CS1031 Livingston Apartment Flats, DST

CS1031 MOB AZ I, DST

CS1031 Lullwater at Big Ridge Apartments, DST

CS1031 MOB TX VII, DST

CS1031 Integra Vistas Apartments, DST

CS1031 Sun Key Village MHC, DST

CS1031 SouthLawn Lawrenceville Apartments, DST

CS1031 Foxwood Village MHC, DST

CS1031 Streets of Greenbrier Apartments, DST

CS1031 SomerHill Farms Apartments, DST

CS1031 Colorado Power, DST

CS1031 Canopy at Ginter Park Apartments DST

CS1031 California Data Center, DST

CS1031 Whispering Pines MHC, DST

CS1031 The Falls at Ormond Beach MHC, DST

CS1031 Marina Pointe Apartments, DST

CS1031 Maplewood Estates MHC, DST

CS1031 Harbor View MHC, LLC

CS1031 Residence at Riverwatch Apartments, DST

CS1031 SE MOB Portfolio, DST

CS1031 Fairlane Harbor MHC, DST

CS1031 Abbington Place Apartments, DST

CS1031 MOB TX VI, DST

CS1031 Midwest Industrial, DST

CS1031 Augusta MOB, DST

CS1031 SE Apartment Portfolio, DST

CS1031 So Cal MOB, DST

CS1031 Houston Memory Care II, DST

CS1031 Midwest Dialysis, DST

CS1031 Carolina Tech HQ, DST

CS1031 Carolina Industrial, DST

CS1031 Houston Memory Care, DST

CS1031 Old Towne Loft Apartments, DST

CS1031 Jacksonville FL HQ, DST

CS1031 Ashland MOB, DST

CS1031 Diversified Dialysis Portfolio, DST

CS1031 Tampa Pharma, DST

CS1031 High Ridge Apartments, DST

CS1031 California MOB I, DST

CS1031 Louisburg MOB, DST

CS1031/Kay Alexander Pointe Apartments, DST

CS1031/Kay Maple Springs Apartments, DST

CS1031 Kinston MOB, DST

CS1031 Morganton MOB, DST

CAI Investments

CAI INVESTMENTS RENO-TAHOE, DST

CAI INVESTMENTS KANSAS CITY, DST

CAI Investments Lake Forest Global HQ, DST

CAI Investments Coatesville DST

CAI Investments Daytona, DST

CAI Investments Healthcare Products I, DST

CAI Investments Healthcare Products II, DST

CAI Investments Medical Products I, DST

Carter Exchange

CX Texas Industrial, DST CX Partners Fund 2 Ltd CX Evergreens at Mahan, DST CX Mode at Hyattsville, DST CX Heritage, DST CX Station at Savannah Quarters, DST CX Owings Mills Multifamily, DST CX Station at Clift Farm, DST CX Palo Verde Holdings Ltd. CX Retreat at the Park, DST CX Lullwater at Blair Stone, DST CX Multifamily Portfolio, DST CX EOS Orlando, DST CX Foundry Yards, DST CX Residences at Congressional Village, DST CX Station at Clift Farm, DST CX Lively Indigo Run, DST CX Midwest Industrial Logistics, DST CX Station at Poplar Tent, DST CX Station at Savannah Quarters, DST CX Alexandria, DST CX Courts of Avalon, DST CX Highland, DST CX Riverstone, DST CX Liberty Mill, DST CX Evergreens at Mahan, DST CX Residences at Congressional Village, DST CX Mode at Hyattsville, DST CX Highland, DST CX Reagan Crossing, DST

CX Cypress McKinney Falls, DST

Cameron

CAMERON WAL MART DST

CAMERON CHARLOTTE INDUSTRIAL DST

Core Pacific Advisors

CPA Arbour Commons DST

Core Pacific Crosslakes DST

CPA Franklin Industrial DST

Collective Apartments DST

CPA Cue Luxury Apartments DST

Cove Capital

Cove Net Lease Distribution 57 DST

Cove Net Lease Medical 52 DST

Cove Pharmacy Net Lease 45

Cove Net Lease Income Fund 18, LLCCove San Antonio Multifamily 33 DSTCove Airport Medical DST

Cove Debt Free Charlotte Pharmacy DSTCove Debt Free Maplewood Industrial DSTCove Debt Free Maryland Medical DST

Cove Debt Free Tacoma Data Center DST

Cove Debt Free Washington Pharmacy DST

Cove Debt Free Winston-Salem Distribution DST

Cove Net Lease Distribution 44 DST

Cove LaPlace Dialysis 26 DST

Cove Tractor Net Lease 45 DST

Cove Shreveport Pharmacy DST

Cove Essential Net Lease 30 DST

Croatan Investments

Croatan Luna Pointe DST

Croatan Addicks Stone Village DST

Croatan North Oaks DST

Cunat Exchange

Cunat Exchange DST I

Cunat Exchange DST II

Cunat Exchange DST III

Cunat Exchange DST IV

DPM Self Storage

DPM SELF STORAGE ST CHARLES DST

DPM SELF STORAGE SAGINAW DST

DPM SELF STORAGE COLUMBUS DST

Essex Realty Investments (ERI)

ERI (Fayetteville) DST

ExchangeRight

Lakeside at Arbor Place DST

ExchangeRight Net Leased Portfolio 34 DST

ExchangeRight Value Added Portfolio 1 DST

ExchangeRight Net Leased Portfolio 28 DST

Four Springs TEN31 Xchange

FSC Healthcare 7 DST

FSC Industrial III DST

FSC Automotive I DST

FSC Healthcare II DST

FSC Industrial 7 DST

FSC Industrial 6 DST

FSC Industrial 8 DST

FSC Industrial 9 DST

FSC Healthcare II DST

FSC Healthcare III DST

FSC Industrial IV DST

FSC Diversified 2 DST

FSC HEALTHCARE IV DST

FSC AS Jonesboro AR, DST

FSC AS Mt. Juliet TN DST

FSC MRC Odessa TX, DST

FSC GM Lebanon IN, DST

FSC AS Jonesboro AR DST

FSC BJ Tilton NH, DST

Go Store It

GO STORE IT ASHEVILLE II, DST NC

Go Store It Asheville Storage DST NC

GO STORE IT ATLANTA DST NC

Go Store It Bluffton Storage DST

Go Store It Charleston Gregorie DST

GO STORE IT CHARLESTON II DST

Go Store It Charleston III DST

Go Store It Charleston Storage DST

GO STORE IT CHARLOTTE DST

GO STORE IT CHARLOTTE II DST

GO STORE IT CONCORD STORAGE DST

GO STORE IT CROSSVILLE DST

Go Store It Fletcher Storage DST

Go Store It Greenville Storage DST

Go Store It Hampton DST

GO STORE IT HILTON HEAD II DST

Go Store It Kennesaw, LLC

Go Store It Louisville LLC

Go Store It Louisville Storage DST

Go Store It Mt. Pleasant, LLC

GO STORE IT NANTUCKET STORAGE DST

Go Store It Naples Storage, DST

GO STORE IT NASHVILLE STORAGE DST

Go Store It Nashville, LLC

Go Store It North Carolina, DST

Go Store It Orlando DST NC

Go Store It Raleigh Storage DST NC

Go Store It Richmond Storage, DST NC

Go Store It Wilmington II, DST NC

GO STORE IT WILMINGTON III DST NC

Go Store It Wilmington Storage DST

Griffin Capital Guardians of Wealth

Hamilton Zanze (HZ)

HZ Crestone DST

HZ Deer Valley DST

HZ Greens DST

HZ Bellevue DST

HZ Cantare DST

HZ Rivertop DST

HZ DST Credit Fund I, LLC

HZ Kirkwood DST

HZ Signature Point DST

HZ Echelon DST

HZ Jefferson Square DST

HZ Foothills DST

HZ Steelyard DST

Hasta DST Ventures

Hasta Multifamily DST

IDEAL Capital Group Holdings, LLC

ICG1031 Hudson, DST

ICG1031 Tempe DST

Inland Private Capital Corporation

VA Coastal Logistics DST

IPC Student Housing Portfolio DST

Essential Net Lease Portfolio DST

IPC Industrial Portfolio DST

Franklin WI Multifamily DST

Kansas City MSA Senior Living DST

Huntsville SFR DST

Diversified Residential Portfolio II DST

Grand Rapids Multifamily DST

Rochester MN Senior Living DST

Ft. Collins Multifamily III DST

National Multifamily Portfolio III DST

Rancho Cordova Retail Center, L.L.C.

Riverdale Multifamily DST

Sun Belt Multifamily Portfolio DST

FL-NY Multifamily Portfolio DST

Milwaukee MSA Multifamily Portfolio DST

Texas Healthcare Portfolio DST

Midwest Senior Living Portfolio DST

Dallas Multifamily DST

Denver MSA Multifamily II DST

Brighton Multifamily DST

NC Student Housing Portfolio DST

Florida Multifamily Portfolio DST

Self-Storage Portfolio III DST

Colorado Multifamily Portfolio IV DST

San Marcos Student Living DST

Park Creek Steeple Multifamily DST

Orlando Student Housing DST

Phoenix MSA Multifamily DST

Gulf Coast Industrial DST

East Coast Wholesale Portfolio DST

Zero Coupon Ann Arbor Lab DST

Zero Coupon AZ Fulfillment DST

Zero Coupon Chicagoland Office DST

Zero Coupon Essential Portfolio DST

Zero Coupon Essential Portfolio II DST

Zero Coupon MI Office DST

Zero Coupon OH Fulfillment DST

Zero Coupon Pharmacy DST

Zero Coupon Pharmacy II DST

Zero Coupon Pharmacy III DST

Zero Coupon Pharmacy IV DST

Zero Coupon Pharmacy V DST

Zero Coupon Pharmacy VI DST

Zero Coupon Pharmacy VII DST

Zero Coupon Pharmacy VIII DST

Zero Coupon UT Office DST

InCommerical

InCommercial Net Lease DST 1

InCommercial Net Lease DST 2

InCommercial Net Lease DST 3

InCommercial Net Lease DST 4

InCommercial Net Lease DST 5

InCommercial Net Lease DST 6

Inspired Healthcare Capital LLC

Inspired Senior Living of Athens DST

Inspired Senior Living of Las Vegas DST

Inspired Senior Living of Fort Myers DST

Inspired Senior Living of Appleton DST

Inspired Senior Living of Dartmouth DST

Inspired Senior Living of Chesterfield DST

Inspired Senior Living of North Haven DST

Inspired Senior Living of Grapevine DST

Inspired Senior Living of Pinellas Park DST

Inspired Senior Living of Eugene DST

Inspired Senior Living of Reno DST

Inspired Senior Living of Lake Orion DST

Inspired Senior Living of Arlington Heights DST

Inspired Senior Living of Mequon DST

Inspired Senior Living of Delray Beach DST

Inspired Senior Living of Brookhaven DST

Inspired Senior Living of Carson Valley DST

Inspired Senior Living of Augusta DST

Inspired Senior Living of St. Petersburg DST

Inspired Senior Living of Largo DST

Inspired Senior Living of Dunedin DST

Inspired Senior Living of Melbourne DST

Inspired Senior Living of Round Rock DST

Inspired Senior Living of Naperville DST

Inspired Senior Living of San Marcos DST

Inspired Senior Living of Hamilton DST

IHC – Ashbrook DST

IHC – Candle Light Cove DST

IHC – Peachtree DST

JLL Exchange

JLLX Ardenwood I, DST

JLLX Ardenwood II, DST

JLLX Diversified II, DST

JLLX Diversified III, DST

JLLX Friendship Distribution, DST

JLLX Johns Creek, DST

JLLX LOUISVILLE AIRPORT DISTRIBUTION CENTER DST

JLLX Louisville Logistics Center, DST

JLLX Mason Mill, DST

JLLX Milford Crossing, DST

JLLX Montecito Marketplace, DST

JLLX Penfield, DST

JLLX Reserve at Venice, DST

JLLX Rockwell Apartments, DST

JLLX San Marcos, DST

JLLX SJC Medical Office, DST

JLLX Stony Point, DST

JLLX Taunton Distribution Center, DST

JLLX The Preserve at the Meadows, DST

JLLX Townlake of Coppell, DST

JLLX Villas at Legacy, DST

JLLX West Phoenix Distribution Center DST

JLLX Whitestown, DST

Landmark Dividend, LLC

Landmark Dividend Solar Land 1 DST

Livingston St. Capital

LSC-3 Office, DST

LSC-AM MC2, DST

LSC-BIO HC1, DST

LSC-Carrollton 55 Plus, DST

LSC-DD MC1, DST

LSC-FAUR MC3, DST

LSC-GLENMONT ABBEY 55 PLUS MULTIFAMILY, DST

LSC-Hanover Place 55 Plus Multi3, DST

LSC-King City, DST

LSC-Lewisville 55 Plus, DST

LSC-Ponte Vedra, DST

LSC-Regency Crest, DST

LSC-Reno NV, DST

LSC-SCH MULTI1, DST

LSC-Texas 55 Plus, DST

LSC-Towson MD, DST

LSC-UKHS HC2, DST

LSC-Valley Forge 55 Plus, DST

LSC-Vancouver WA, DST

Madison Capital Group

MCG Charleston James Island DST

MCG CHARLESTON EAST BAY DST

MCG ASHEVILLE DST

MCG CHARLOTTE MILL HOUSE DST

Madison Realty Companies

Madison Realty Senior Care I-UT, DST

Madison Realty Senior Care II-AZ, DST

Madison Realty Senior Care Alta Ridge, DST

Moody National Companies

Moody CY Waterbury DST

Moody ELM AL North Austin DST

Moody Mosaic DST

Moody Village 1 DST

Moody DFW DST

Moody National Academy DST

Moody Rainey DWTN Austin DST

Moody RI SW Austin DST

Moody Village Towers DST

Nelson Brothers

NP Skyloft DST

NB Loft Vue DST

NB Vue Mac DST

NB Gathering

NB Auraria

NB The Mark

NB Downs

NB Taylor Bend II DST

NB Mountain Valley DST

NB Auraria DST

NB Stadium View DST

NB Crest Investor

NB Private Equity Credit Opportunities Fund

NP Sol Y Luna DST

Net Lease Capital Advisors

Government Lease Holdings DST

GSA Birmingham Government Lease Investors DST

295 BR Holdco, DST

4851 JS Industrial, DST

AZ Randall OH, DST

AZ Romulus MI, DST

Commerce 94 Industrial, DST

Emerald Pass 12101 Holdings DST

FC Euclid OH Investors, DST

FC Grand Rapids MI Investors, DST

FC Oklahoma City OK Investors, DST

FC Tulsa OK Investors DST

NLCA VA BIRMINGHAM REALTY DST

NLCA GSA BALTIMORE DST

NLCA DG Investment Grade Portfolio 1 DST

Two VA Properties Investors DST

New Star Exchange 1

NE1 BTR Villages, DST

NE1 UC, DST

Nexpoint

NexPoint Hughes DST

NexPoint Buffalo DST

NexPoint Life Sciences DST

NexPoint Storage II DST

NexPoint Hickory DST

NexPoint Storage I DST

NexPoint Gamma DST

NexPoint Polo Glen DST

NexPoint Flamingo DST

NexPoint Texas Multifamily Portfolio DST

NREA Southeast Portfolio One, DST

NREA Southeast Portfolio Three, DST

NREA Retreat, DST

NREA Estates, DST

NREA Meritage, DST

NREA Adair, DST

RK Riverstone DST

RK Dawson Park DST

RK Pointe at East Shore DST

RK Trailside Verdae DST

RK AVLI at Crosstown Center DST

RK Pointe at Research Park DST

RK Pointe at Greenville DST

RK Haven Pointe at Carolina Forest DST

RK CODA DST

RK Pointe at Prosperity Village DST

RK Pointe at Lake Crabtree DST

RK Berewick Pointe DST

RK One White Oak DST

RK Montecito Pointe DST

RK Manchester Place DST

RK Edwards Mill DST

RK Sonata Apartments, LLC

REVA Kay (Real Estate Value Advisors)

REVA Kay Health Solutions DST

REVA Kay Tampa UBC, DST

REVA Kay Fort Stockton DST

REVA Kay Universal DST

REVA Kay Sabal 6, DST

REVA Kay Tampa IBC 2, DST

REVA Kay Tampa IBC 1, DST

REVA Kay Brookings, DST

REVA Kay 150 Corporate, DST

REVA Kay Interchange, DST

REVA Kay Seacoast DST

REVA Kay Innsbrook DST

REVA Kay Battlefield Technology Center DST

REVA Kay Shannon Oaks, DST

REVA Kay Ashley Corporate Center, DST

REVA Kay Brandywine, DST

Starboard Realty Advisors

Starboard Silver Oaks DST

Starboard Arden DST

Starboard Dylan DST

Starboard Jade DST

Starboard Harpers DST

Starboard Mesa Ridge DST

Starboard Premier DST

Starboard WA Multifamily III DST

Starboard Madison View DST

Starboard Diagonal DST

Starboard Metro DST

Starboard Mountain Ranch DST

Starboard Lemon Grove DST

Trilogy Real Estate Group

Trilogy Riverset Multifamily DST

Park 205 Multifamily DST

Franklin WI Multifamily DST

Lansing MI Multifamily DST

Valeo Groupe Americas

Vineyard Austin DST

Vineyard Braselton DST

Epoch Fort Collins DST

Vineyard Pearland DST

Epoch Huntsville DST

Tags: 1031 DST, alternative investments, Delaware Statutory Trust, illiquid investments Last modified: June 24, 2024