Today’s opinion piece in Investment News raises questions about Blackstone Real Estate Income Trust Inc.’s (BREIT) valuation practices. Nontraded REITs often rely on internally determined valuations, leading to opacity and potential discrepancies in value. Despite concerns about the broader commercial real estate market, BREIT’s net asset value (NAV) has remained high, raising eyebrows in the industry.

Media outlets like The New York Times and Business Insider have published articles about BREIT’s questionable valuations and long-term sustainability. Skepticism stems from the discrepancy between BREIT’s seemingly resilient valuation and the challenges faced by other real estate funds in the post-pandemic economic landscape.

Questions have been raised about Blackstone REIT’s ability to maintain such high stock valuations, especially given the market conditions and the timing of its property acquisitions.

BREIT Tender Offer Price is 38% Below NAV

Before discussing BREIT’s questionable valuations, it is essential to understand the company’s background and mission. Blackstone Real Estate Income Trust (Blackstone REIT) is a public, non-listed REIT associated with the prominent private equity firm The Blackstone Group (NYSE: BX). According to its website, it is “designed to provide individual investors access to Blackstone’s leading institutional real estate investment platform. ”

Last October, MacKenzie Capital Management LP extended a minimum tender offer to Blackstone REIT (BREIT) shareholders to purchase Class S common stock shares for $9.27 per share. This event led to accusations of questionable valuations by BREIT.

In a letter addressed to owners of Blackstone REIT stock, “The share repurchase program is oversubscribed. If you submitted each and every month over the past 6 months, you would have redeemed about 90% of your shares, and about 97% over the past year, which leaves thousands of investors like you trapped in an investment they cannot liquidate completely or quickly.”

As previously reported, Blackstone Real Estate Income Trust began imposing restrictions on fulfilling redemption requests in November 2022 for the first time in its six-year history. This decision led some to speculate that BREIT’s valuations were questionable. An influx of redemption requests from investors surpassed the 5% quarterly limit based on the company’s net asset value. Although redemption requests for BREIT continued to exceed this limit in subsequent months, they have gradually decreased in recent times.

MacKenzie offers to acquire up to 1.5 million shares of Blackstone REIT stock, amounting to $13.9 million, and is set to expire on December 11, 2023.

Tender Offer Price May Indicate Losses for BREIT Shareholders and Questionable Valuations

The offered purchase price represents a substantial 38% discount compared to Blackstone Real Estate Income Trust’s estimated net asset value of $14.88 per Class S Share as of August 31, 2023. Notably, BREIT shares have recently traded at a 4% discount to NAV on LODAS Markets, an online secondary market specializing in non-traded alternative investments.

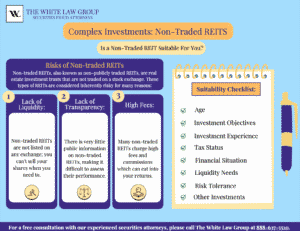

The Risks of Investing in Non-traded REITs

Suppose you invest in non-traded Real Estate Investment Trusts (REITs), such as BREIT. In that case, you must be aware of the potential risks, including questionable valuations, especially when certain economic and market factors are involved.

Suppose you invest in non-traded Real Estate Investment Trusts (REITs), such as BREIT. In that case, you must be aware of the potential risks, including questionable valuations, especially when certain economic and market factors are involved.

Consider the impact of high interest rates on stocks issued by REITs like Blackstone REIT. As an investor, you should know that non-traded REITs often rely on borrowing to finance property acquisitions and improvements. When interest rates rise, borrowing costs increase, potentially squeezing the REIT’s profitability and ability to distribute dividends to investors. This situation might make the investment less appealing, especially in a rising interest rate environment.

Furthermore, non-traded REITs like BREIT often focus on specific geographic regions or property types, such as suburban office buildings or particular markets, which can lead to questionable valuations. This limited diversification can make these REITs more vulnerable to local economic conditions and trends. If a particular market or property type experiences a downturn, the overall performance of a REIT like BREIT might suffer.

Also, keep in mind the issue of liquidity. Non-traded REITs like Blackstone Real Estate Income Trust typically have less liquidity than publicly traded REITs. If you invest in non-traded REITs, you might find it challenging to sell your shares quickly, and you could face restrictions on when and how you can exit your investment, which is a risk in addition to questionable valuations by REITs like BREIT. In uncertain market conditions or when the investment outlook is less favorable, this lack of liquidity can become a risk, as you may be unable to access your capital quickly.

Non-traded REITs are known for their opaque valuation practices. Unlike publicly traded REITs with readily available market prices, non-traded REITs typically provide periodic valuations that may not accurately reflect current market conditions. As an investor in REITs like BREIT, you may find the valuation of your investment questionable, particularly during turbulent times.

Class Action vs. Individual FINRA Arbitration Lawsuit

People often wonder whether a large class action lawsuit is a better litigation option for them than an individual FINRA arbitration case. The answer depends on many factors, but an individual arbitration claim is likely better if the loss sustained is significant (say larger than $100,000). Class actions as a recovery option are more appropriate for grouping large numbers of individuals who have small claims – such as claims of questionable valuations by firms like BREIT–that are too small to generally pursue individually.

Recovery of Investment Losses – Blackstone REIT

The White Law Group is investigating potential claims against brokerage firms who may have unsuitably recommended BREIT and other non-traded REITs to investors.

These claims result when broker-dealers fail to perform adequate due diligence on investments before selling them to their clients. This includes firms such as BREIT failing to assess questionable valuations. Additionally, brokerage firms often fail to determine whether the investments are appropriate considering their client’s age, investment experience, net worth, and risk tolerance.

If you are concerned about your investment losses in Blackstone REIT (BREIT), please call The White Law Group’s securities attorneys at (888) 637-5510 for a free consultation.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm with offices in Chicago, Illinois, and Seattle, Washington. We have significant experience leading cases involving questionable valuations by REIT firms like BREIT.

FAQs

Does BREIT usually fulfill redemption requests?

In February 2024, BREIT reported that it was able to fulfill 100 percent of redemption requests for the first time since 2022. Requests totaled $961 million that month, a significantly lower figure than the previous year. For example, in January 2023, redemptions peaked at $5.3 billion. In its March 2024 prospectus, BREIT expressed optimism in the real estate market for both the short and medium term. Although concerns around questionable valuations remain, BREIT appears to have improved its performance in recent years.

How do interest rates impact returns on REIT investments?

REITs typically perform better when interest rates rise during periods of economic growth. As the economy grows, the value of real estate owned by the REIT also tends to increase. This makes REITs a popular investment vehicle during times of higher inflation, as the Federal Reserve often responds to rising prices by raising interest rates, thus making borrowing money more expensive. However, REITs can also become less profitable during periods of high inflation, as the cost of borrowing is higher.

Are non-traded REITs a wise investment for investors in need of liquidity?

While non-traded REITs are more liquid than real estate investments, they are less liquid than publicly traded REITs. Some non-traded REITs do, however, allow investors to redeem their shares after a specific minimum holding period. Before investing in a non-traded REIT, consider how much liquidity you will need in the short term.

Tags: Blackstone Real Estate Income Trust class action lawsuit, Blackstone Real Estate Income Trust complaints, Blackstone Real Estate Income Trust lawsuit, Blackstone Real Estate Income Trust liquidation, Blackstone Real Estate Income Trust losses, Blackstone Real Estate Income Trust recovery, Blackstone Real Estate Income Trust redemption, Blackstone Real Estate Income Trust REIT, Blackstone Real Estate Income Trust secondary sales, Blackstone Real Estate Income Trust shareholders, BREIT complaints, BREIT lawsuit, BREIT losses, BREIT NAV Last modified: February 25, 2025