Unsuitable investments refer to financial products unsuitable for your investment goals, risk tolerance, or financial situation. Brokers or financial advisors typically recommend or sell these investments, and they may not have adequately assessed your individual needs or provided appropriate advice.

Table of Contents

Toggle

The Financial Industry Regulatory Authority (FINRA) is the self–regulator that oversees brokers and brokerage firms. FINRA has rules regarding inappropriate investments. If your broker fails to follow FINRA rules, you may want to seek legal advice from an experienced, unsuitable investment lawyer.

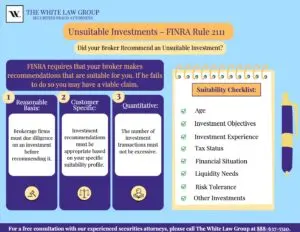

FINRA Rule 2111 requires a firm or its representative to have a reasonable basis for believing that a recommended transaction or investment strategy involving a security is suitable for the customer. This basis is based on the information obtained through the firm’s or associated person’s reasonable diligence in understanding the customer’s investment profile.

The rule states that the customer’s investment profile “includes, but is not limited to, the customer’s age, other investments, financial situation and needs, tax status, investment objectives, investment experience, investment time horizon, liquidity needs and risk tolerance,” among other information. Unsuitable investment lawyers examine each factor when assessing the strength of an unsuitable investment case.

According to FINRA Rule 2111, brokers must have a firm understanding of both the product and the customer. A lack of such understanding violates the suitability rule.

Firms that fail to perform adequate due diligence or make unsuitable recommendations can be held responsible for losses in a Financial Industry Regulatory Authority (FINRA) arbitration claim.

Rule 2111 describes three separate suitability obligations that unsuitable investment lawyers typically investigate when building a case:

- (1) Reasonable Basis – firms must have a reasonable basis to believe, based on adequate due diligence, that a recommendation is suitable, at least for some investors. The broker must know the risks associated with the security or investment strategy. Since most investment opportunities are suitable for at least some investors, firms need to understand the potential risks of the investment.

- (2) Customer-specific: Firms must have reasonable grounds to believe a recommendation suits the investor, including investment experience, retirement goals, investment time horizon, liquidity needs, risk tolerance, and financial situation. Unsuitable investment lawyers often focus on this obligation when attempting to prove a broker pushed an unsuitable investment on their client.

- (3) Quantitative: Firms must have a reasonable basis for believing that the number of recommended transactions within a certain period is not excessive (i.e., that the investor’s account is not being churned).

Do I need an Unsuitable Investment Lawyer?

The following are situations involving unsuitable investment recommendations by a broker or financial advisor. If you feel any of them apply to you, you should contact an unsuitable investment lawyer.

- High-risk investments for conservative investors: If you have a low-risk tolerance and are looking for stable and secure investments, your broker should not recommend high-risk investments such as speculative stocks, options trading, or highly leveraged products. These investments carry a significant risk of loss and may not align with your investment objectives.

- Lack of diversification: You must diversify to decrease your risk. If your broker sold you a prominent position in a single stock or a few closely related securities without considering diversification, it could be regarded as an unsuitable investment and potentially grounds for you to contact an unsuitable investment lawyer. Concentrated positions can expose you to volatility and potential losses if the value of your investment declines.

- Illiquid investments with limited access to funds: Illiquid investments, such as private placements or non-traded REITs, lack readily available markets to sell or exit the investment. Suppose your broker recommended investments with extended lock-up periods or limited liquidity without explaining the risks and impact on your cash flow. In that case, it may be unsuitable, especially if you require access to your funds shortly. Given your investor profile, an unsuitable investment lawyer can evaluate whether the illiquid investment was appropriate for you.

- Complex investment products with unclear risks: Some financial products, such as derivatives, structured products, or certain alternative investments, can be complex and challenging to understand. If your broker recommended these products without explaining the risks involved, it could be considered an unsuitable investment. Brokers need to define the risks and potential returns associated with any investment. Unsuitable investment lawyers can advise whether your broker provided you with adequate notice of the risk associated with an investment.

- Account churning or excessive trading: If your broker excessively trades in your account to generate commissions without regard to your investment goals, it may be a case of account churning. Churning is illegal when a broker engages in excessive trading to generate commissions for themselves, which may result in unnecessary costs and negatively impact your investment performance.

Suppose you suspect that you have been sold unsuitable investments. In that case, you should consult an experienced, unsuitable investment lawyer who can help you assess your legal recourse.

What is my Suitability Profile?

The broker must consider the following before making investment recommendations:

- Age of the Investor—An investor’s age may be an important part of the profile. What may be a suitable investment for a 25-year-old may not be appropriate for someone nearing retirement age. Those approaching retirement may want to contact an unsuitable investment lawyer if their broker recommends an overly aggressive set of investments.

- Investment Objectives – When an investor begins their relationship with a new broker, they will be asked to choose one of the following: Preservation of Capital, Current Income, Growth and Income; Capital Appreciation, and Aggressive Growth. According to FINRA rules, the investment recommendations must follow the investor’s objective. For example, if an investor’s objective was capital preservation, a portfolio of high-risk stocks may be considered unsuitable investments. Any client unsure whether their broker failed to build a portfolio reflecting their investment objectives should contact an unsuitable investment lawyer.

- Other Investments—A broker must understand other investments before recommending an investment. Diversification could protect the investor from market fluctuations. As the adage says, don’t put all of your eggs in one basket.

- Tax Status—Financial advisors must consider the tax implications of any investment before recommending it. For example, some financial professionals may improperly recommend a switch or trade variable annuities to generate a commission. Any investor in such a situation should consider contacting an unsuitable investment lawyer. While variable annuity switching is not illegal, it is often not in the client’s best interest, and it could also have adverse tax consequences. Thus, it could be considered an unsuitable investment.

- Financial Situation and Needs – This refers to the investor’s current and future financial situation, including account assets, such as wealth and income, set off against liabilities, such as debt and dependents.

- Investment Experience—Certain investments, such as high-risk, high-reward investments in unregistered securities, may only suit experienced or sophisticated investors. Unsuitable investment lawyers can investigate a client’s history as an investor to determine whether they have the experience and knowledge to add complex investment products to their portfolio.

- Liquidity Needs—Liquidity is the degree to which an asset or security can be quickly bought or sold fairly. Highly illiquid Investments, such as non-traded REITs or private placement investments, may be unsuitable for investors who plan to retire soon.

- Risk Tolerance—The most critical factor in making investment recommendations, risk tolerance, describes how much an investor can afford to lose. It is a key component of an unsuitable investment lawyer’s case.

FINRA Arbitration for Suitability Cases

FINRA Arbitration allows investors to seek resolution and recover financial losses for claims related to securities fraud, including inappropriate investments. It is simple and often leads to faster resolutions than traditional court litigation.

When you open an account with a brokerage firm, you typically sign an agreement with a mandatory arbitration clause. This means that any disputes between you and the brokerage firm must be resolved through arbitration rather than going to court. It’s essential to consult with an experienced FINRA unsuitable investment lawyer to guide you through the process and protect your rights.

To start the process, you must file a Statement of Claim with FINRA, outlining the details of your case, including the alleged unsuitable investments and the losses you have suffered. The claim will specify the amount of compensation you are seeking.

FINRA will appoint a panel of arbitrators to hear your case. The panel typically consists of three arbitrators, including both public and industry arbitrators with experience and expertise in securities matters. An unsuitable investment lawyer can accompany and advise you during these hearings.

The arbitration hearing is similar to a trial but less formal. Both parties present their evidence, including documents, testimonies from witnesses, and expert opinions. The arbitrators review the evidence and decide based on the facts and laws. The decision is known as an award. The award may include money compensating you for your unsuitable investment losses, including any associated costs, fees, and interest. The decision of the arbitration panel is binding and enforceable.

Hiring an Unsuitable Investment Lawyer

The securities fraud attorneys at the White Law Group can help you with the FINRA arbitration process, which includes evaluating the merits of your claim and determining whether you have a strong case for arbitration.

If you believe you have suffered losses due to unsuitable investments, please call the White Law Group at (888) 637-5510 for a free consultation.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm dedicated to helping investors file claims against their financial professional or brokerage firm in all 50 states. Since its launch in 2010, the firm has handled over 700 FINRA arbitration cases.

Our firm represents investors in all types of securities-related claims, including claims involving stock fraud, broker misrepresentation, churning, unsuitable investments, selling away, and unauthorized trading.

With over 30 years of securities law experience, The White Law Group has the expertise to help investors defrauded in securities, investment, and financial business transactions attempt to recover their investment losses. For more information, please visit our website, White Law Group.

Frequently Asked Questions

Brokers have a fiduciary duty to act in their clients’ best interest and must adhere to FINRA’s “suitability rule” (Rule 2111). This rule requires brokers to:

- Understand the client’s financial profile.

- Recommend investments that match the client’s goals and risk tolerance.

- Avoid high-risk investments for clients seeking conservative growth or income.

An investment may be unsuitable if:

- It involves risks the client was unaware of or did not consent to.

- The investment does not match the client’s financial needs, such as liquidity requirements or time horizon.

- It results in excessive losses or costs due to high fees or frequent trading.

Common examples include:

- High-risk investments like penny stocks or leveraged ETFs for conservative investors.

- Illiquid investments, such as private placements or non-traded REITs, for investors needing quick access to funds.

- Over-concentration in a single security, sector, or asset class.

- Recommendations of complex or high-risk securities you do not understand.

- High-pressure sales tactics or frequent trading in your account (churning).

- Losses that are inconsistent with your risk tolerance or financial goals.