Innovation X Holdings LLC – Private Placement Investment Offering

Are you concerned about your investment in Innovation X Holdings? If so, the securities fraud attorneys at The White Law Group may be able to help you by filing a FINRA Dispute Resolution claim.

According to filings with the SEC, Innovation X Holdings filed a form D to raise capital from investors in 2017. The total offering amount sold to investors was purportedly $11,388,288.

The White Law Group has represented hundreds of investors in claims involving Regulation D private placement investments sold by independent broker-dealers. Often these investments are touted for their income potential and for being “non-correlated” to the stock market. Too often the financial advisor or broker ignores and/or fails to disclose the risks involved in these investments. Private placements can carry significant risk, and you may lose all of your investment.

The Risks of Reg D Private Placement Investments

The Risks of Reg D Private Placement Investments

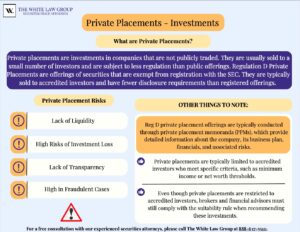

Investing in private placement investments under Regulation D (Reg D) such as Innovation X Holdings LLC involves various risks. Here are some risks to consider:

- Private placements bypass certain regulatory requirements, such as registration with the Securities and Exchange Commission (SEC). This exemption means that the investments receive limited oversight and have fewer disclosure requirements compared to publicly traded securities.

- Companies offering private placements may provide limited information about their operations, financials, and business plans. This lack of transparency makes it challenging for investors to conduct thorough due diligence and assess the potential risks and rewards of the investment.

- Private placement investments often carry higher risk and greater volatility compared to publicly traded securities. Start-up companies, for example, may have uncertain prospects and higher failure rates, which can result in a complete loss of investment.

- These offerings typically lack liquidity, meaning there may be limited or no secondary market for selling the securities. Investors may encounter difficulties in selling their holdings and may need to hold the investments for an extended period, potentially impacting their ability to access funds.

- Private placements often involve investing in a specific company or a limited number of companies. This concentration of investment increases the risk, as the performance of the entire investment portfolio may heavily rely on the success or failure of a few companies.

- Reg D offerings often require investors to meet certain criteria, such as being accredited investors or having a high net worth. These requirements ensure that investors possess the necessary knowledge and financial capacity to understand and bear the risks associated with private placements.

Hiring a FINRA Attorney

The White Law Group is investigating potential securities claims involving Innovation X Holdings LLC and the liability broker dealers may have for improperly recommending it to investors.

Brokers and financial advisors are required to do due diligence before recommending any investment to their clients. If they don’t, you may be able to seek recourse to pursue broker negligence or breach of fiduciary duty claims against the broker and/or the brokerage firm.

If you are concerned about your investment in Innovation X Holdings LLC, the securities attorneys at The White Law Group may be able to help you. For a free consultation, please call 888-637-5510 or visit our website at https://whitesecuritieslaw.com.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm with offices in Chicago, Illinois and Seattle, Washington. We help investors across the country to recover investment losses through FINRA Arbitration.

Tags: Innovation X Holdings LLC, private placement investment Last modified: July 13, 2023