iCap Files Chapter 11, Allegations of Ponzi Scheme

The White Law Group continues to investigate securities fraud claims involving iCap Equity, LLC and other iCap Enterprises offerings. Our firm is currently representing investors in claims against their brokerage firms for allegations of unsuitable recommendations in iCap Equity offerings. See: FINRA Claim Filed against Ages Financial Services LTD and Somerset Securities Inc.: FINRA Claim.

iCap Equity, LLC, a real estate investment firm based in Bellevue, Washington, reportedly focuses on developing apartments and other real estate projects.

Update on iCap Enterprises Bankruptcy Case – Allegations of Ponzi Scheme

On February 23, 2024, the debtors reportedly filed motions regarding obtaining supplemental secured financing and entering into a cooperation agreement. The DIP Motion allegedly seeks authorization for the debtors to secure up to $5,000,000 in postpetition financing and grant liens to secure the loan facility. It also reportedly seeks super priority claims and related relief under various sections of the Bankruptcy Code.

Additionally, the debtors are purportedly requesting findings that iCap Enterprises operated as a Ponzi Scheme during the prepetition period. If granted, these findings would impact litigation claims and recovery efforts against third parties who conducted business with the debtors.

The “Ponzi Presumption” would also reportedly aid in recovery and litigation efforts by presuming that transfers and transactions were made with intent to hinder, delay, or defraud investors. This presumption could assist in avoidance and recovery actions against third parties.

Negative Cash Flows since Inception

The bankruptcy filings further allegedly reveal that the company’s initial expectations were overly optimistic. By November 2016, shortly before the maturity of Fund 1 and a year before Fund 2 matured, the company had allegedly exited 22 of its original investments, but only 9 were alleged exited within one year of the initial investment date. Additionally, 20 original investments were purportedly still pending, with an average hold period of 661 days.

Despite the company’s consistent statements in quarterly newsletters and investor calls indicating that both funds were performing well, the reality was allegedly quite different. According to the company’s records, Fund 1’s real estate investments purportedly incurred losses of approximately $38 million through 2021, while Fund 2’s investments lost $18.5 million through the same period.

Years later, in May 2021, the company reportedly disclosed in another Offering Memorandum that its entities had been operating with negative cash flows since their inception. These revelations underscore the significant discrepancies between the company’s optimistic projections and the actual performance of its investment funds.

What does Chapter 11 Bankruptcy mean for iCap Equity Investors?

On September 29, 2023, iCap Equity, LLC, and its affiliated companies filed for Chapter 11 bankruptcy in the Eastern District of Washington. This follows the CEO’s departure in March and the suspension of investor interest payments. The filing reveals iCap had assets ranging from $50 million to $100 million and liabilities between $100 million and $500 million and involves twenty-six related companies. For investors in iCap, this skewed asset-to-liability ratio spells trouble, indicating that when liquidated, substantial debts might go unpaid, affecting investors negatively.

Chapter 11 bankruptcy involves restructuring debts while the company continues to operate. Individuals who provided funds through bonds or investment notes will likely lose out in the restructuring as unsecured creditors. Bankruptcy isn’t designed to aid investors but rather to assist the company, often aiming to eliminate unsecured debts entirely.

Investors shouldn’t anticipate recovering their investments from the bankruptcy proceedings. iCap openly states in its bankruptcy petition that it owes more than it owns. Even if all the company’s assets are sold at their stated values, it won’t cover the debts. Additionally, Chapter 11 restructuring is costly, with millions of dollars likely paid to professionals handling the process. Lastly, such complex bankruptcies can drag on for many years, often a decade or longer.

Multiple Lawsuit Pending against iCap Equity

According to the Seattle Times on October 25, 2023, iCap Equity has found itself entangled in at least six civil lawsuits in King County, Washington. The litigants in some of these cases have also named the former CEO and his brother, the company’s Chief Operating Officer. During August and September, a King County judge reportedly issued an order to freeze iCap accounts, preventing property sales and the use of investor funds. Not long after, the company filed for Chapter 11 bankruptcy, and the CEO resigned from his position. The company is currently under the management of a third-party group, Paladin.

The exact number of investors who purchased promissory notes from iCap and the total debt owed by the company remain unclear, according to the Seattle Times article. However, bankruptcy filings have listed more than 2,700 individuals and entities as creditors, with total financial liabilities falling within the range of $100 million to $500 million.

Unpaid Payroll Taxes

Additionally, iCap reportedly has unpaid payroll taxes of nearly $196,000 to the IRS and property taxes of $11,000 to Snohomish County for a property in Lynnwood. The largest debts are owed to investors, with amounts ranging from over $3 million to as much as $10.5 million per creditor, as stated in court documents. iCap’s creditors span multiple states and countries, including Washington state and China.

Notably, lawsuits in King County allege that iCap executives enticed investors by making “very safe” claims about their investment opportunities, promising to acquire and develop land across Washington.

Chinese Investors File a Lawsuit against iCap

One specific lawsuit filed in King County Superior Court illustrates iCap’s promise to develop a site in Kenmore into five senior-care homes. However, as of October 5, the project reportedly remains unfinished, highlighting the investors’ dissatisfaction.

The situation has also drawn the attention of Chinese investors, who have reportedly filed a lawsuit during the summer. They allege that iCap specifically targeted Chinese immigrants and Chinese nationals in their marketing efforts. According to this case, a group of 28 investors, many of whom do not speak English, invested more than $17.5 million and have yet to receive full repayment.

iCap CEO Steps Down

According to a letter to investors on September 12, 2023, iCap Equity, after “facing the hard reality of increasing challenges” is making a strategic shift. The company notes that its plan to expand its real estate portfolio fell through and market conditions continue to decline. This follows the company’s disturbing news in March that it would not be able to make interest payments to investors.

The company has brought in Paladin Management Group, an advisory and consulting firm experienced with restructuring, and the current CEO will be stepping down, according to the letter.

iCap Equity Halts Payments to Shareholders

According to a letter to investors on March 20, 2023, iCap Equity LLC halted monthly interest payments to its shareholders blaming the “monumental challenges” for the real estate capital markets due to rising interest rates and inflation.

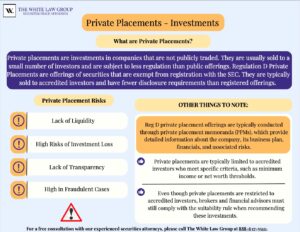

The Risks of Reg D Private Placements

The problem with private placement investments such as Icap Equity is that they typically involve a high degree of risk. They are often sold as unregistered securities which lack the same regulatory oversight as more traditional investment products like stocks or bonds. They also tend to be illiquid and when ready to sell, it is often difficult to find a buyer. Although you may be able to sell these investments through a secondary market, it may be at a financial loss.

The White Law Group is investigating potential claims involving brokerage firms who may have for improperly recommended iCap Equity offerings to investors, including the following, among others:

iCap Equity LLC

iCap Pacific Northwest Opportunity and Income Fund

iCap Pacific Income V LLC

iCap Vault I LLC

ICAP Equity Income Fund (ETF)

FINRA Claims to Recover iCap Equity Losses

Numerous FINRA-registered broker dealers purportedly sold iCap offerings to their clients. According to iCap Form D filings with the SEC, the following firms were listed as sales compensation recipients, among others:

Cambridge Investment Research, Inc.,

Ausdal Financial Partners,

Financial Goal Securities, Inc.,

Cobalt Capital, Inc.,

Center Street Securities, Inc.,

Chauner Securities,

IBN Financial,

Pariter Securities,

Advisory Group Equity Services,

Titan Securities,

Green Vista Capital, LLC,

Somerset Securities, Inc.,

Skyway Advisors, LLC, 124630,

Bradley Wealth Management, LLC,

Claraphi Advisory Network, LLC,

Wall Street Strategies, Inc.,

Merrimac Corporate Securities, Inc

Broker Dealers are required to perform adequate due diligence on any investment they recommend. They must ensure that all recommendations are suitable for the investor. Firms that fail to do so, may be held responsible for any losses in a FINRA arbitration claim.

FINRA Dispute Resolution is an arbitration venue for investors with claims against their brokerage firm or financial professional. It provides investors with an opportunity to attempt to recoup their investment losses and is an alternative to filing such claims in court. To learn more, please see: Regulation D Private Placement Fraud Attorneys

How to Recover iCap Investment Losses

To speak with a securities attorney about your recovery options regarding iCap Equity, please call The White Law Group at 888-637-5510 for a free consultation.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm with offices in Chicago, Illinois and Seattle, Washington.

For more information on The White Law Group and its representation of investors in FINRA arbitration claims, visit https://www.whitesecuritieslaw.com.

Tags: ICap Equity, icap pacific northwest opportunity and income fund, private placement investments Last modified: February 27, 2024