Broker Misconduct vs. Broker Fraud – What’s the Difference?

Broker misconduct refers to improper or unethical behavior by a stockbroker or financial advisor while handling a client’s investment accounts. While not all instances of misconduct are necessarily fraudulent, misconduct can encompass a wide range of actions that harm investors or violate industry regulations.

If you have suffered losses due to your broker or financial advisor’s wrongdoing, you may need to hire an experienced broker fraud lawyer, like the attorneys at The White Law Group.

The White Law Group – National Broker Fraud Lawyers

If you’ve experienced losses in your investments due to broker misconduct or negligence, the lawyers at The White Law Group may offer assistance. Our two-attorney securities law firm has handled over 700 FINRA arbitration claims since 2010.

The Financial Industry Regulatory Authority (FINRA), which serves as the primary regulator of the securities industry, operates the largest dispute resolution platform for securities-related disputes. Almost all investors, brokerage firms, and individual brokers handle conflicts through FINRA Dispute Resolution. This is primarily because most brokerage firms include mandatory arbitration clauses in their account agreements, requiring investors to address their disputes through FINRA.

Suppose you’re seeking to recover damages resulting from the actions of an unscrupulous or negligent broker. In that case, The White Law Group’s broker fraud lawyers can initiate an arbitration claim or request mediation through FINRA. It’s important to note that you generally have six years from the alleged act to file your claim, although there may be exceptions to this rule.

Broker misconduct may include any of the following:

- Unauthorized Trading: Making trades in clients’ accounts without their consent or approval.

- Churning:Excessively trading securities in a client’s account to generate commissions for the broker without regard for the client’s investment goals.

- Misrepresentation: Providing false or misleading information about an investment to entice a client to buy or sell is unethical behavior.

- Failure to Supervise: Firms and brokers must supervise their employees and ensure compliance with industry rules and regulations. Failure to do so can constitute misconduct.

- Broker Negligence: A stockbroker’s failure to exercise reasonable care and diligence in managing a client’s investments is a notable example of unethical behavior.

- Breach of Fiduciary Duty: Brokers are held to a fiduciary standard, which means they must act in the best interests of their clients. A violation of this duty can be considered misconduct.

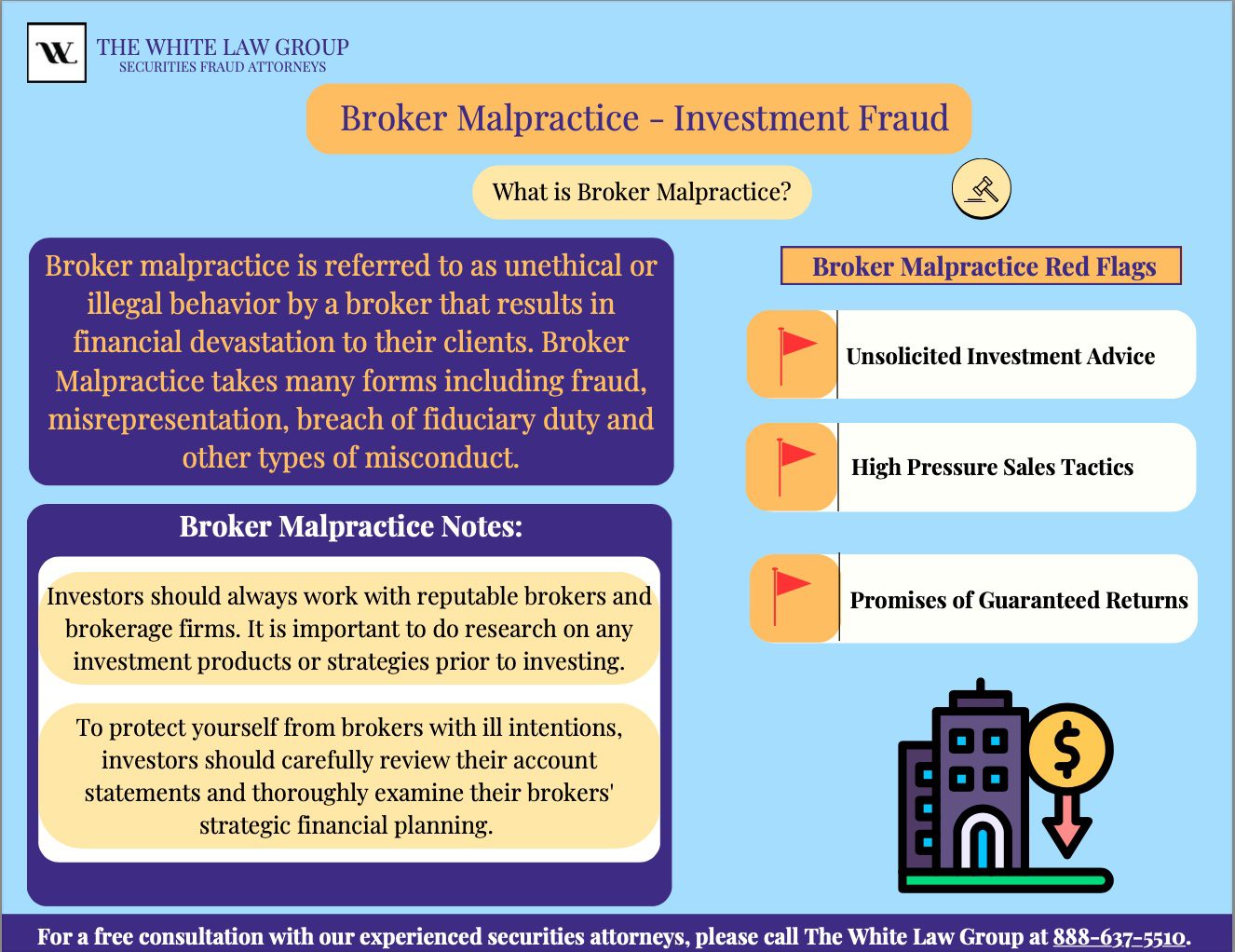

- High-Pressure Sales Tactics: Using aggressive or coercive tactics to persuade clients to make investments that may not suit their financial situation or goals.

- Selling Away: Engaging in private securities transactions (selling away) without the proper disclosure and approval from the brokerage firm.

- Excessive Fees: Charging clients excessively high fees or commissions that are not in line with industry standards.

- Unsuitable Recommendations: Recommending investments that are not suitable for a client’s risk tolerance, financial situation, or investment objectives.

- Insider Trading: Trading securities based on non-public, material information is illegal.

- Forgery: Signing documents or authorizations on behalf of a client without their knowledge or consent is a notable example of unethical behavior by a stockbroker.

While some instances of broker misconduct may involve fraudulent activities, not all misconduct rises to the level of fraud. Fraud typically involves intentional deception or misrepresentation for financial gain. However, misconduct can still result in significant economic harm to investors and can lead to disciplinary actions by regulatory authorities such as FINRA (Financial Industry Regulatory Authority). If you have suffered losses due to broker misconduct, you may need the services of an experienced fraud lawyer.

How Do I Know If I’m a Victim of Broker Misconduct or Broker Fraud?

Detecting whether you’ve been a victim of fraud or broker misconduct can be challenging, as some forms of misconduct may not be immediately apparent. However, there are several signs and red flags to watch for that may indicate you’ve been a victim of unethical behavior by a stockbroker:

- Unexplained Losses: Sudden, significant losses in your investment portfolio that you can’t attribute to market fluctuations or economic conditions may raise suspicions of misconduct.

- Unauthorized Transactions: If you notice trades or transactions in your account that you did not authorize or were not aware of, this could indicate unauthorized trading, a form of broker misconduct.

- Excessive Trading (Churning): Frequent and excessive trading in your account, driven by the broker’s desire to generate more commissions, is a form of misconduct known as churning.

- Unsuitable Recommendations: If your broker recommended unsuitable investments for your risk tolerance, financial goals, or investment horizon, this may be a sign of wrongdoing.

- Lack of Transparency: If your broker fails to provide clear and complete information about your investments, fees, risks, or performance, this may indicate a lack of transparency and broker misconduct.

- Failure to Follow Instructions: If your broker consistently disregards your instructions or preferences regarding your investments, this could be a sign of wrongdoing.

- Conflicts of Interest: Be wary of situations where your broker has undisclosed conflicts of interest, such as recommending products or services from which they stand to gain personally.

- False Statements or Misrepresentations: If your broker provided false or misleading information about an investment to entice you to buy or sell, this may constitute fraud.

- Neglecting Your Risk Tolerance: If your broker consistently recommends high-risk investments, despite your stated preference for low-risk options, they could be engaging in unethical behavior.

- Missing Documentation: Not receiving proper documentation of your investment transactions or account statements may indicate a lack of transparency or potential broker misconduct.

- Lack of Communication: If your broker fails to communicate with you regularly or respond to your inquiries and concerns, this could be a sign of wrongdoing.

- Inconsistent Investment Strategy: If your broker frequently changes your investment strategy without clear justification or communication, this may be a red flag.

What About Broker Negligence?

Broker negligence occurs when a broker fails to exercise the appropriate level of care, diligence, and competence when handling a client’s investments or providing financial advice. It involves breaching the duty of care that brokers owe their clients. Broker negligence can take various forms.

Brokers must understand their clients’ financial situation, investment objectives, risk tolerance, and other factors. Negligence can occur when a broker fails to gather and consider this essential information when making investment recommendations. For example, it would be negligent for someone in an advisory role to suggest high-risk investments to a risk-averse client.

Brokers must conduct thorough research and due diligence on investment products they recommend. Negligence can occur if a broker fails to adequately research an investment or provide accurate information to the client. Once investments are made, brokers are obligated to monitor and manage those investments. Negligence may arise if a broker fails to provide proper oversight or neglects to adjust the investment strategy as needed.

Brokers must disclose any conflicts of interest that affect their ability to provide impartial advice. Failure to disclose such conflicts can result in negligence, potentially leading to biased recommendations.

Broker negligence may also occur if a broker fails to keep the client informed about their investments or changes in the market that may affect their portfolio. If a client provides specific instructions or restrictions on their investments, a broker must follow them. Negligence can occur if the broker disregards or fails to adhere to the client’s directives.

When broker negligence leads to financial losses or harm to a client, the client may have legal recourse to seek compensation. Consulting with a fraud lawyer can be essential for clients seeking help for broker negligence.

Negligence vs. Recklessness

Negligence stems from carelessness. Recklessness indicates a blatant disregard for an investor’s well-being. A negligent broker may rush through the due diligence or forget to mention a vital investment-related detail.

A reckless broker intentionally leaves out information or lies to an investor, downplaying an investment’s risk. As you can imagine, legal consequences are typically more severe for those guilty of recklessness than negligence.

If You Suspect Broker Fraud or Broker Misconduct

If you suspect fraud or broker misconduct, take the following steps:

- Carefully examine your account statements to check for unauthorized transactions or discrepancies.

- Consider freezing or moving any affected accounts to prevent further losses.

- Keep records of all communication with your broker, including emails, account statements, and notes from phone calls or meetings.

- Consult with a broker fraud lawyer: Consider seeking legal advice from a securities attorney specializing in broker misconduct cases, such as those at The White Law Group. They can help you assess your situation and guide you through the necessary steps.

If you believe you’ve been a victim of broker misconduct, you can file a complaint with regulatory bodies like FINRA (Financial Industry Regulatory Authority). Acting quickly is key. Waiting too long may limit your options for financial recovery.

FINRA Rules Protecting Investors from Broker MisconductFINRA Rules Protecting Investors from Broker Misconduct

FINRA has established a set of rules and regulations to address misconduct. They include procedures for investigations and sanctions when violations occur. Here are some of the key FINRA rules related to misconduct and the potential sanctions:

FINRA Rule 2010 – Standards of Commercial Honor and Principles of Trade:

FINRA Rule 2010 requires members and associated persons to observe high standards of commercial honor and just and equitable trade principles. Sanctions for violations can include fines, suspension, or expulsion from FINRA membership.

FINRA Rule 4111 – Restricted Firm Obligations:

FINRA Rule 4111 requires brokerage firm members with a history of broker misconduct to put aside reserve funds to pay for future and unpaid investor claims. The rule requires member firms identified as “Restricted Firms” to deposit cash or qualified securities in a segregated, restricted account, adhere to specified conditions or restrictions, or comply with a combination of such obligations.

FINRA Rule 3110 – Supervision Rule:

- FINRA Rule 3110 requires brokerage firms to diligently supervise the activities of their representatives to ensure compliance with FINRA and SEC rules and regulations, as well as federal and state laws.

When FINRA identifies broker misconduct and broker fraud through investigations, it has the authority to impose a range of sanctions depending on the severity of the violation. Sanctions can include fines, suspension, expulsion from FINRA membership, cease and desist orders, and restitution to affected customers. In some instances of particularly egregious misconduct or repeated violations, regulatory authorities or law enforcement agencies may pursue criminal or civil actions.

Frequently Asked Questions (FAQs)

What Is the Difference Between a Negligent Broker and a Fraudulent Broker?

It is understandable that brokers need help with misconduct. Sometimes, this help requires spotting the difference between a negligent and fraudulent broker. Someone acting negligently typically doesn’t do their due diligence due to a lack of experience or other unintentional factors. A fraudulent broker knowingly misleads clients, typically for the broker’s financial gain. Contact an attorney immediately for help with broker fraud speculation.

Can I Sue a Brokerage Firm If the Individual Broker No Longer Works There?

Yes. Pursuing legal action against a brokerage firm is possible, even when the person you suspect of misconduct no longer works there. FINRA has ruled that advisory firms have a supervisory duty over those they hire as financial advisors. We recommend consulting a regulatory body, such as FINRA, to explain your situation.

Will Broker Misconduct Negatively Impact My Credit Score?

Unfortunately, it’s hard to say. While misconduct from a broker won’t directly impact your credit score, the financial fallout of their devious behavior or actions can have indirect results.

For instance, imagine that Sarah is a 62-year-old nurse planning to retire. She trusted her financial advisor to help Sarah with her retirement goal. Instead, this person engaged in excessive trading to earn more commissions while Sarah’s account performance tanked. In this situation, Sarah, unable to depend on retirement savings, may have to take out personal loans to stay afloat, negatively impacting her credit score.

FINRA Arbitration to Recover Losses

The broker fraud lawyers at The White Law Group can help you file a FINRA arbitration claim to recover losses from misconduct and/or fraud. If your brokerage firm failed to supervise your broker or financial advisor, they may be liable for your losses. Our firm will begin by assessing the case’s viability, offering guidance on legal options, and helping you file arbitration claims correctly and on time.

We will build strong cases by gathering evidence, identifying witnesses, and preparing compelling legal arguments. During arbitration proceedings, we serve as advocates, presenting the case, cross-examining witnesses, and safeguarding your rights. If negotiations are possible, we may engage in settlement discussions to secure fair compensation without a full hearing.

The White Law Group is a national securities fraud, securities arbitration, and investor protection law firm with offices in Chicago, Illinois, and Seattle, Washington. We represent investors in all 50 states in claims against their brokerage firms, and our broker fraud lawyers have recovered millions of dollars from many brokerage firms.

If you are concerned about your investments, please call The White Law Group lawyers at 888-637-5510 for a free consultation.

For more information on The White Law Group and its representation of investors, please visit WhiteSecuritiesLaw.com.

Last modified: September 3, 2025