Concerned about your investment losses in a Valeo Groupe 1031 DST investment?

Valeo Groupe Americas is an affiliate of Valeo Groupe, which offers multinational interests in both senior and student niche housing markets, according to its website. The company reportedly sponsors 1031 DST properties.

The White Law Group is investigating the liability that FINRA registered brokerage firms may have for improperly recommending Valeo Groupe 1031 DST investments to investors.

According to SEC filings, the Valeo Groupe Americas filed a Form D to raise capital from investors for the following 1031 DST Delaware Statutory Trust investments, among others:

Epoch Fort Collins DST Epoch Huntsville DST Vineyard Austin DST Vineyard Braselton DST Vineyard Pearland DST

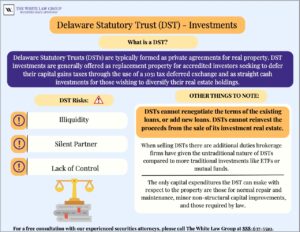

The Risks of Investing in 1031 DST Investments

The White Law Group has represented dozens of investors over the last few years in DSTs. Unfortunately, unscrupulous financial advisors will push these products to maximize their own commissions. The firm is investigating the liability that FINRA registered brokerage firms may have for improperly recommending Valeo Groupe America’s high-risk DSTs to investors.

The White Law Group has represented dozens of investors over the last few years in DSTs. Unfortunately, unscrupulous financial advisors will push these products to maximize their own commissions. The firm is investigating the liability that FINRA registered brokerage firms may have for improperly recommending Valeo Groupe America’s high-risk DSTs to investors.1031 DSTs are complex investment products. Like other real estate, a DST 1031 is considered an illiquid asset. Selling your investment in a DST might not be easy or quick, unlike stocks that trade publicly. When you invest in a DST, you won’t have control over the property’s management or decisions. Someone else, like a trustee or sponsor, makes these choices.

Further, real estate values can change due to market fluctuations or local factors, impacting your investment’s value. The income or distributions you receive from a DST can vary or might not be guaranteed, affected by economic changes or property occupancy. Changes in interest rates can influence property values and borrowing costs, affecting returns. Tax implications of 1031 exchanges are complex and subject to changes in tax laws or interpretations. Compared to publicly traded investments, DSTs might provide limited information for investors to evaluate their performance or prospects.

It’s essential to thoroughly research and understand these risks before investing in a 1031 DST. Consulting with financial advisors or experts who specialize in real estate investments can help in making informed decisions.

Broker Due Diligence and Regulation Best Interest

The SEC’s Regulation Best Interest (Reg BI) is a rule under the Securities Exchange Act of 1934. It sets a higher standard of conduct called the “best interest” standard for broker-dealers and their representatives.

This standard applies when they suggest any securities transaction or investment strategy involving securities, including recommending different types of accounts, to retail customers. Essentially, it requires these professionals to prioritize the customer’s best interests when making such recommendations.

Under the “best interest” standard, broker-dealers are obligated to perform comprehensive due diligence when evaluating any investment. This comprehensive evaluation aims to empower investors to make well-informed decisions aligned with their best interests.

If your financial advisor fails to perform due diligence on an investment before recommending it to you, they could be held liable for investment losses.

If your advisor unsuitably recommended a 1031 DST offering and you lost money, the securities attorneys at The White Law Group may be able to help you. You may be able to recover losses by filing a FINRA Arbitration claim against the brokerage firm that sold you the investment.

Class Action vs. Individual FINRA Arbitration Lawsuit

People often wonder whether a large class action lawsuit is a better litigation option for them than an individual FINRA arbitration case. The answer depends on many factors, but typically if the loss sustained is large (say larger than $100,000), an individual arbitration claim is likely a better option. Class actions as a recovery option are more appropriate for grouping large numbers of individuals who have small claims – too small to generally pursue individually.

Free Consultation with a Securities Attorney

If you have suffered losses investing in Valeo Groupe Americas 1031 DST offerings, please contact the offices of The White Law Group at 1-888-637-5510.

The White Law Group is a national securities fraud, securities arbitration, and investor protection law firm with offices in Chicago, Illinois and Seattle, Washington.

FINRA provides an arbitration forum for investors to resolve disputes. The White Law Group represents investors in FINRA arbitration claims throughout the country. Visit the firm’s homepage to learn more about the firm’s representation of investors.