Epoch Huntsville DST, Valeo Groupe Americas, Securities Investigation

The White Law Group is investigating potential securities claims involving broker dealers who may have improperly recommended Valeo Groupe offerings to investors, including Epoch Huntsville, DST.

Valeo Groupe Americas offers multinational interests in both senior and student niche housing markets through Vineyard Communities and Epoch Student Living, according to its website. The company raises capital through 1031 DST private placement investments such as Epoch Huntsville DST.

Epoch Huntsville DST, sponsored by Valeo Groupe Americas reportedly filed a form D to raise capital from investors in 2019, according to a filing with the SEC. The total offering amount was purportedly $23,700,000.

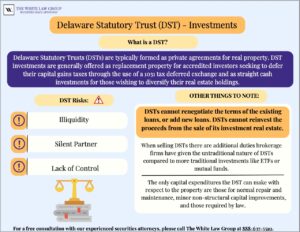

1031 DST Investment Risks

One significant risk factor to consider is the possibility of property value loss. Like any real estate investment, there is always the potential for the value of the property to decline over time, impacting your investment’s overall worth.

Additionally, DSTs are considered illiquid investments. They are typically offered through private placement offerings and lack a secondary market, meaning that you might encounter difficulties selling or trading your investment if the need arises.

Another risk is the reduction or elimination of monthly distributions. Just like any real estate investment, if the property experiences unexpected vacancies or substantial damage, it may lead to a suspension of cash flow distributions, affecting your expected returns.

Tax status changes are also critical to consider. The income stream and depreciation schedule of your investment property can influence your income bracket and tax status. An unfavorable tax ruling could eliminate the deferral of capital gains, resulting in immediate tax liabilities.

Fees and expenses associated with DSTs can eat into your returns, potentially outweighing the tax benefits you were hoping to gain from this investment.

Is a 1031 DST Investment Suitable for you?

Brokerage firms often push 1031 DST investments due to the high commissions associated with their sale and creation, despite the risks involved. If you believe your broker recommended a high-risk investment unsuitably or didn’t adequately inform you about the risks, you can resolve disputes through FINRA arbitration.

The Financial Industry Regulatory Authority (FINRA) provides an arbitration forum for investors to seek recourse when brokerage firms fail to disclose the risks associated with an investment properly. In such cases, the broker or brokerage firm may be held liable for any investment losses you incur.

If you are concerned about your investment in Epoch Huntsville DST or another Valeo Groupe offering, please contact The White Law Group for a free consultation at 888-637-5510. Our national securities fraud, securities arbitration, and investor protection attorneys are ready to assist you in understanding your rights and potential courses of action.

Remember, at The White Law Group, we are dedicated to protecting investors’ interests and seeking justice for those who may have suffered investment losses.

Visit our website at https://www.whitesecuritieslaw.com to learn more about our firm and the representation we provide for investors in FINRA arbitration claims.

Tags: DSTs, Epoch Huntsville DST, Valeo groupe americas Last modified: February 7, 2024