Ponzi Schemes on the Rise

According to Ponzitracker, there was a huge increase in Ponzi schemes in 2022 from the previous year. The site, which tracks the data of these fraudulent schemes, speculates that the numbers were down nearly 50 % in 2021 compared to 2019, seemingly due to the Covid-19 global pandemic. However, fraudsters appear to be jumping back into the game.

What is a Ponzi Scheme?

What is a Ponzi Scheme?

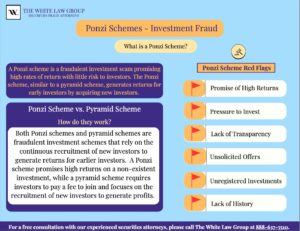

A Ponzi scheme is a fraudulent investing scam promising high rates of return with little risk to investors. The Ponzi scheme, similar to a pyramid scheme, generates returns for early investors by acquiring new investors.

Historically, three of the largest Ponzi schemes were uncovered during the 2008 financial crisis, including Bernie Madoff, who swindled $65 billion from unsuspecting investors, Thomas Petters with $3.7 billion and Allen Stanford with $8 billion.

Authorities reportedly discovered 59 alleged Ponzi schemes in 2022 with close to $5.3 billion in investor losses.

Ponzi scheme vs Pyramid scheme

Both Ponzi schemes and pyramid schemes are fraudulent investment schemes that rely on the continuous recruitment of new investors to generate returns for earlier investors. However, there are some key differences between the two.

A Ponzi scheme is named after Charles Ponzi, who became notorious for using this method in the early 20th century. In a Ponzi scheme, the fraudster promises investors high returns on their investment and pays those returns using the money invested by subsequent investors. There is no actual investment or business generating returns, and the scheme relies solely on the continuous recruitment of new investors to keep it going. Eventually, when there are no more new investors to recruit, the scheme collapses, and investors lose their money.

On the other hand, a pyramid scheme is a similar fraudulent investment scheme, but the structure is slightly different. In a pyramid scheme, investors are required to pay a fee to join, and they are promised the opportunity to earn money by recruiting new investors themselves. The more people they recruit, the more money they can make. However, the pyramid scheme often does not offer any actual product or service to sell, and the primary focus is on the recruitment of new investors. As with a Ponzi scheme, when there are no more new investors to recruit, the scheme collapses, and most investors lose their money.

While both Ponzi and pyramid schemes rely on the recruitment of new investors to generate returns for earlier investors, a Ponzi scheme promises high returns on a non-existent investment, while a pyramid scheme requires investors to pay a fee to join and focuses on the recruitment of new investors to generate profits.

Ponzi Schemes – Examples

The White Law Group has represented numerous investors through the years who have been defrauded by their brokers through various Ponzi schemes. The following are a few examples of schemes the firm has investigated.

Future Income Payments $310 Million Ponzi Scheme

The White Law Group handled numerous claims for investors who lost their retirements after investing in Future Income Payments, a structured cash flow investment that turned out to be a $310 million dollar Ponzi-scheme.

The CEO and mastermind of Future Income Payments LLC (FIP), formerly known as Pensions, Annuities, and Settlements LLC received a 10 year sentence in August 2022 after pleading guilty to fraud conspiracy.

FIP’s CEO and his co-conspirators allegedly solicited pensioners experiencing financial distress, most of whom were military veterans, by offering an upfront lump-sum payment in exchange for an assignment of the rights to their monthly pensions and disability payments. Even though the assignment transactions were characterized as “sales,” they were, in fact, usurious loans with annual interest rates of as much as 240%.

Using a network of hundreds of financial advisors and insurance agents nationwide, the CEO and others solicited thousands of seniors to purchase FIP’s “structured cash flows,” which were the pensioners’ monthly pension payments. After 7 years of living a lavish lifestyle, the CEO’s scheme collapsed leaving $310 million in losses to more than 2,500 retirees and had placed more than 13,000 veterans into exploitative loans.

Matthew Eckstein $12 Million Ponzi Scheme

Former Financial Advisor Matthew Eckstein was sentenced in July 2022 to up to ten-and-a-half years in prison for his role in a $12 million Ponzi scheme that targeted nearly 50 victims—many of them seniors—between 2015 and 2017. Nearly $5.6 Million has been returned to investors.

Eckstein originally pleaded guilty to the charges on Sept. 26, 2019, but later withdrew his plea. A new indictment was secured in August 2020, but court closures related to the COVID-19 pandemic further delayed the case.

While working as a financial advisor in Syosset, NY, Eckstein reportedly encouraged most of his clients to invest thousands of dollars in an insurance company known as Conmac Funding, allegedly claiming that after two years they would get their money back plus an additional 4 percent in interest, according to court records.

Instead of investing the money into Conmac Funding, prosecutors said Eckstein purportedly used it to pay for personal expenses and pay other victims of the scheme.

Shawn Goode $4.8 Million Ponzi Scheme

On April 18, 2022, the SEC filed an emergency action and charged financial advisor, Shawn Good with defrauding clients and misappropriating millions of dollars of investor funds.

Good, of Wilmington, NC, allegedly raised at least $4.8 million from five of his clients at Morgan Stanley to make supposedly low-risk investments in tax-free bonds and land-development projects. The clients included retirees and a single mother of young children. Rather than invest the money, however, the SEC alleges that Good used the funds to repay other victims and to pay for his own personal expenses, including luxury cars, international travel, and approximately $800,000 in credit card bills.

Brenda Smith $100 Million Ponzi Scheme

Former investment fund manager, Brenda Smith, 61, of Philadelphia, was reportedly sentenced on May 4, 2022, to 109 months in prison for orchestrating a $100 million Ponzi scheme.

Smith managed and controlled Broad Reach Capital LP, a pooled investment fund/hedge fund that was established in February 2016 and was open to accredited investors.

As reported, from February 2016 through August 2019, Smith reportedly promised investors a 30% yearly return through sophisticated trading strategies involving highly liquid securities.

Smith purportedly used the money to buy her own investments and pay back other investors, instead of investing the funds as promised and allegedly distributed a false document in July through Broad River, reportedly valuing its assets at $180 million.

To learn more see:

Update on Alleged Ponzi Scheme Involving Horizon Private Equity III

Ex-CEO Gets 25 Years For $1.3B Woodbridge Ponzi Scheme

SEC Bars Brokers over Belize Fund, an Alleged Ponzi-scheme

Financial Advisor Dawn Bennett gets 20 Years for $20 Million Ponzi Scheme

Cryptocurrency Ponzi Schemes

Regulators are focusing on cryptocurrency and digital assets, which have come under significant pressure as the total cryptocurrency market cap has reportedly taken a dive from over $2 trillion in January 2022 to roughly $800 billion in November.

According to Ponzitracker, a number of allegedly fraudulent schemes caught in 2022 involved cryptocurrency assets. At least five different alleged schemes were related to or based on cryptocurrency assets, including actions involving allegedly fraudulent exchanges, mining platforms, trading, and investment funds.

In May 2022, the Department of Justice charged the leader of a purported cryptocurrency and forex trading platform called EminiFX, with commodities fraud and wire fraud offenses. The CEO purportedly solicited more than $59 million in investments from hundreds of individual investors after making false representations in connection with the EminiFX trading platform.

In March of 2022, US Attorney’s office in Brooklyn charged the owners and operators of the web-based virtual currency companies EmpowerCoin, ECoinPlus and Jet-Coin, with conspiracy to commit wire fraud and money laundering, in connection with a sophisticated scheme to steal assets from investors. In total, EmpowerCoin, ECoinPlus and Jet-Coin received more than $40 million from investors.

As alleged, the websites for EmpowerCoin, ECoinPlus and Jet-Coin fraudulently promised investors and potential investors guaranteed fix returns on virtual currency investments. They falsely promised investors and potential investors that these returns were made possible through overseas virtual currency trading operations. Investors and potential investors were encouraged to invest in the companies with either cash or Bitcoin. The assets were used to repay other investors or simply stolen, including by the three owners, according to the complaint. The companies collapsed shortly after receiving the investors’ assets, without having engaged in trading activity.

Protecting yourself against a Ponzi Scheme – Common Red Flags

- Promise of High Returns: Ponzi schemes often promise very high returns, significantly higher than market rates. These returns are usually guaranteed, and the scheme promoters may claim that the returns are generated through innovative trading strategies or unique investment opportunities.

- Lack of Clarity about Investment Strategy: The promoters of a Ponzi scheme may be vague about how they plan to generate the promised returns. They may use technical jargon or claim that their investment strategy is proprietary, making it difficult for investors to understand how their money is being used.

- Pressure to Invest: Ponzi scheme operators often use high-pressure tactics to persuade potential investors to put their money into the scheme. They may create a sense of urgency by claiming that the investment opportunity is only available for a limited time or that there is a waiting list of investors.

- Lack of Transparency: Ponzi schemes often lack transparency. Promoters may provide investors with little or no information about the company’s financial condition, assets, liabilities, or performance. They may also refuse to provide audited financial statements or other documents that would enable investors to make an informed decision.

- Unsolicited Offers: Ponzi scheme operators may contact potential investors directly, often through unsolicited phone calls or emails. They may offer incentives, such as a high commission or referral fee, to persuade individuals to recruit other investors.

- Unregistered Investments: Ponzi schemes are often unregistered, meaning they are not regulated by any government agency. Promoters may claim that the investment is exempt from registration or that they are operating under a foreign jurisdiction that does not require registration.

- Lack of History: Ponzi schemes are often operated by individuals or companies with no track record or history of successful investments. Investors should always conduct thorough due diligence and research the promoters’ backgrounds and investment histories.

It’s important to note that just because one or more of these red flags is present doesn’t necessarily mean that the investment opportunity is a Ponzi scheme. However, investors should be cautious and do their research before investing their money.

Hiring a Securities Attorney

When brokers violate securities laws, such as making unsuitable investments, the brokerage firm they are working with may be liable for investment losses through FINRA Arbitration.

If your broker has defrauded you, you may be able to file a claim with FINRA to seek resolution through arbitration. FINRA arbitration can be a complex and technical process, and having an experienced attorney who is knowledgeable about securities law can greatly increase your chances of success.

A securities attorney, such as those at the White Law Group, can help you with many aspects of the arbitration process including evaluating the merits of your claim and determining whether you have a strong case for arbitration.

Your attorney can assist you in drafting a statement of claim that accurately reflects the allegations of fraud and the damages you are seeking. They will also represent you at the arbitration hearing, present evidence and make arguments on your behalf.

They can also negotiate a settlement on your behalf, which may be an option to consider before going to arbitration.

Working with a securities attorney can help ensure that your interests are protected throughout the FINRA arbitration process, and that you have the best possible chance of achieving a favorable outcome.

Keep in mind, FINRA arbitration is generally a faster and less expensive alternative to a traditional court proceeding.

Free Consultation

If you suspect you have been a victim of a Ponzi scheme and would like to speak with a securities attorney about your options, please call The White Law Group at 888-637-5510.

The White Law Group is a national securities fraud, securities arbitration, and investor protection law firm with offices in Chicago, Illinois and Seattle, Washington. For more information on The White Law Group and its representation of investors in FINRA arbitration claims, visit https://www.whitesecuritieslaw.com.

Tags: Brenda Smith, Crypto ponzi, FIP, Matthew Eckstein, Ponzi Scheme, ponzi scheme attorney, ponzi scheme red flag, securities fraud attorney, Shawn Good Last modified: March 6, 2024