What is Option Trading?

The following is a detailed guide on option trading. Option trading involves contracts that grant the buyer the choice, rather than the obligation, to purchase (via a call) or sell (through a put) an underlying asset at a set price on or before a specific date.

The seller of the option commits to buying or selling if the buyer exercises their right. Options have an expiry date; once expired, they lose value and cease to exist. Like other investments, options can be traded through brokerage accounts.

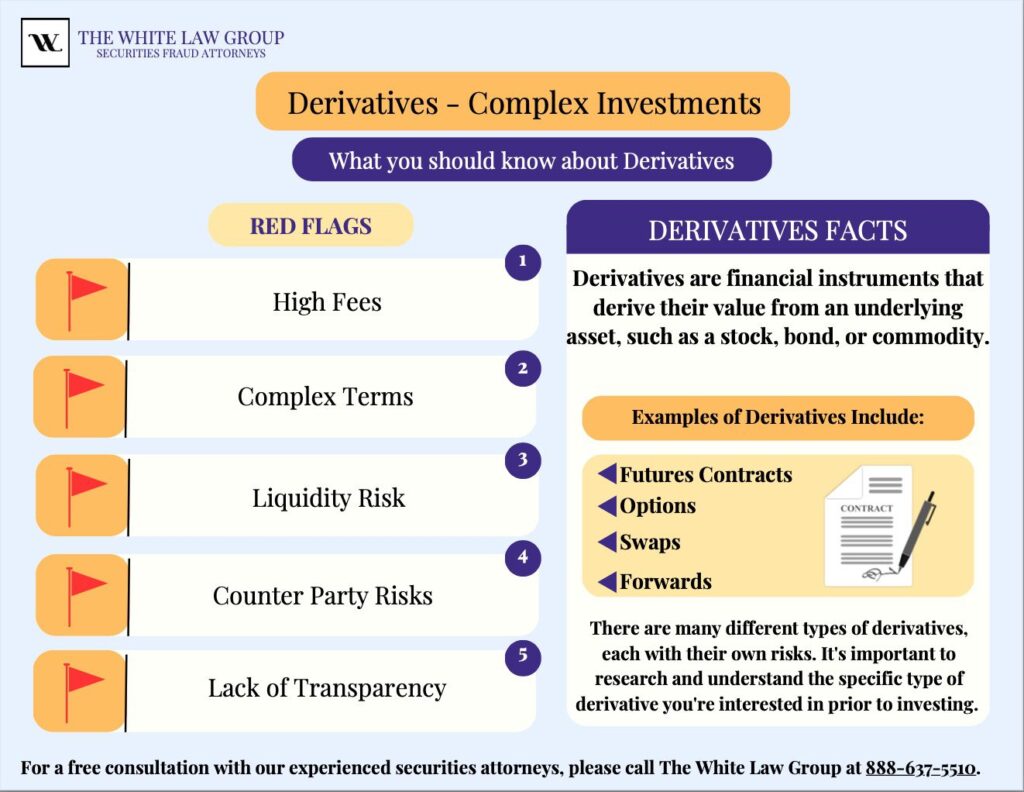

Options, considered derivatives, derive their worth from an underlying asset. In this option trading guide, we’ll explain how those underlying assets impact value and trading outcomes.

The primary factor impacting an option’s value is the asset it’s tied to, such as a stock or an index. Traders and professionals use options to manage risk by seeking income, speculating, or hedging against potential losses.

For instance, a stockholder might buy a put option to protect against a potential drop in the stock price.

You can buy and sell put and call options. Initiating a trade involves an opening purchase or sale. An opening purchase means buying a call or put to start a position. To exit a trade, an investor does the opposite: closing a purchased option involves selling the same contract series, while closing a sold option entails buying the same contract series.

Options by Underlying Asset

Options available to U.S. investors include stocks, indexes, debt, and foreign currencies. As this option trading guide explains, U.S. investors can access a wide range of contracts tied to stocks, indexes, debt, and foreign currencies.

A stock option contract typically signifies 100 shares of the underlying stock, but options can relate to diverse assets, from bonds to currencies to commodities. This option trading guide highlights how both instruments can shape a trader’s overall risk exposure.

Equity options are tied to stocks or similar products and specify a strike price at which the contract can be exercised.

Index options derive their value from an index like the S&P 500 or the Chicago Board Options Exchange’s Volatility Index (VIX). They are cash-settled, resulting in cash payments rather than the exchange of securities, such as index futures. These options often follow a European-style trading pattern, settling at expiration based on the index value at market open or close.

An option’s price, called the premium, fluctuates based on various factors, typically increasing as the option moves further “in-the-money” and decreasing as it moves further “out-of-the-money.”

Before delving into options trading, define your objectives clearly. As our options trading guide covers, options can serve different purposes in portfolios. Having a specific goal helps narrow down suitable strategies—be it seeking more income from stocks, protecting portfolio value during market declines, or achieving other objectives. The effectiveness of an options strategy depends on aligning it with your goals.

As this option trading guide demonstrates, understanding how options and other derivatives work is essential before investing. These instruments can diversify portfolios and manage risk when used appropriately, but they also carry the potential for rapid losses if misused or misunderstood.

Investors should evaluate their experience level, review risk disclosures, and confirm that any options strategy recommended by a broker aligns with their financial goals and risk tolerance. The White Law Group’s securities attorneys encourage all investors to remain informed, ask questions, and seek professional advice before investing.

Before diving into specific types of puts and calls, our option trading guide highlights how both instruments can shape a trader’s overall risk exposure.

Puts Calls: Definition and Explanation

Put Option – This contract grants the owner the right to sell the underlying stock at a specified price (the strike price) within a fixed period of time until it expires. For the writer, it involves an obligation to purchase the stock from the option holder if the option is exercised.

Call Option – A financial agreement that gives the buyer the right (but not the obligation) to purchase a stock, bond, commodity, or other asset at a predetermined price within a specific timeframe. The seller of a call option is obligated to sell the asset if the buyer exercises the call.

A call buyer benefits when the underlying asset’s value rises, which, as our option trading guide explains, can occur due to factors such as positive company news or acquisitions. The seller profits from the premium if the price remains below the strike price at expiration, as the buyer typically won’t exercise the option.

Put on a Call (PoC) – This compound option involves writing a put option on a call option. It involves two strike prices and exercise dates. If the put option is exercised, the holder will short a call option, granting the right to buy a specific asset at a set price within a defined period.

The value of a put on a call moves in an inverse relation to the stock price. It decreases as the stock price rises and increases as the stock price falls. Sometimes referred to as a split-fee option, a put on a call offers this unique characteristic of changing value concerning the stock’s price movements.

Different Strategies – Covered Call vs. Naked Puts

Covered Call (Buy/Write) – This strategy consists of writing a call that is covered by an equivalent long stock position, while owning the underlying stock. Our option trading guide compares this with naked put strategies to show how investors manage potential returns and losses.

This generates income (the premium) for the investor with the risk of potentially losing the upside appreciation of the shares if the option is exercised and the investor must sell their shares. The premium received adds to the investor’s bottom line regardless of the outcome.

In this option trading guide, investors learn that the covered call strategy provides a modest downside “cushion” if a stock’s price slides and the potential to enhance returns when it climbs. This balance of risk and reward is one reason equity options remain popular among investors seeking steady income while maintaining exposure to market gains.

Predictably, this benefit comes at a cost. If the stock price rallies above the call’s strike price, the stock is increasingly likely to be called away.

Because covered call writers can set their own exit price (typically the strike price plus the premium received), assignment often represents a successful outcome. This option trading guide explains how this approach serves as a practical tool in equity options management, helping traders plan around desired profit levels.

Investors don’t always need to sell an at-the-money call; index options can offer similar flexibility. Selecting strike prices ultimately reflects each investor’s priorities and the mix of puts and calls that best align with their strategy.

Uncovered Call – An uncovered call is a situation in which an investor sells a call option without owning the underlying stock and, if the contract is exercised, must purchase the shares at market price, regardless of how high the price has risen, and then sell them at the strike price.

The maximum loss for the writer of an uncovered call, also known as a naked call, is theoretically unlimited.

An option’s value is formed by the difference between the fixed strike price and the market price of the underlying security, known as the option’s “moneyness”.

Intrinsic Value – In relation to options, intrinsic value is the value of an option if it were to expire immediately with the underlying stock at its current price.

Intrinsic Value (Calls) – A call option is in-the-money when the underlying security’s price is higher than the strike price. As this option trading guide explains, understanding moneyness is crucial before entering any new position.

Intrinsic Value (Puts) – A put option is in-the-money if the underlying security’s price is less than the strike price. Only in-the-money options have inherent value. It represents the difference between the current price of the underlying security and the option’s exercise, or strike price.

Maximum Gain – In this option trading guide, the maximum gain for a covered call or equity options position equals the strike price minus the premium. Index options can behave similarly in this respect, offering both opportunity and risk.

Puts calls strategies like these require careful planning to manage exposure while pursuing steady returns.

Naked Puts – A naked put is when a put option is sold by itself (uncovered) without any offsetting positions. As explained in this option trading guide, this strategy involves an investor selling or writing put contracts without holding a short position in the underlying security.

This equity options approach aims to collect the premium on an asset expected to rise, yet still attractive to own even if it dips. Some investors also employ index options or blended puts and calls to balance income potential.

A naked put has limited upside profit potential and, in theory, unlimited downside loss potential, from the current price of the underlying security down to zero.

As outlined in this option trading guide, investors decide whether to buy or sell based on their individual goals and market outlook. Choosing between a call and a put depends on risk tolerance and strategy.

Beyond puts and calls, options contracts differ in their underlying assets and durations, offering flexibility across equity and index options for diversified portfolio management.

Try to review a well-thought-out set of “what if” scenarios before putting any money at risk.

What is FINRA?

FINRA (Financial Industry Regulatory Authority) plays a critical role in ensuring the integrity of America’s financial system – all at no cost to taxpayers. This option trading guide also references how FINRA rules protect investors engaging in derivatives and complex products.

Working under the supervision of the Securities and Exchange Commission, FINRA:

- Writes and enforces rules governing the ethical activities of all registered broker-dealer firms and registered brokers in the U.S.

- Examines firms for compliance with those rules;

- Fosters market transparency; and

- Educates investors.

What Does FINRA Do?

FINRA undertakes these efforts to protect the investing public against fraud and bad practices. If your broker has given unsuitable investment advice and you have suffered losses, you may be able to recoup your losses through FINRA Arbitration.

Five Steps to Protecting Market Integrity:

- Deter misconduct by enforcing the rules.

- Detect and prevent wrongdoing in the U.S. markets.

- Discipline those who break the rules.

- Educate and inform investors.

- Resolve securities disputes.

FINRA Regulations Regarding Option Trading

FINRA Rule 2360 governs option trading. This option trading guide notes that this rule established the approval process members must follow when opening brokerage accounts for equity options or index options.

In part, it covers the following:

- Flex Equity Options

- Position Limits

- Exercise Limits

- Reporting of Options Positions

- Liquidation of Positions and Restrictions on Access

- Limit on Uncovered Short Positions

- Restrictions on Option Transactions and Exercises

- Rights and Obligations of Holders and Writers

- Open Order “Ex-Date”

- Delivery of Current Disclosure Documents

- Confirmations

- Transactions with Issuers

- Restricted Stock

FINRA Rule 4512 outlines what information must be maintained for each customer.

FINRA Rule 2090 requires reasonable diligence in knowing the essential facts about every account.

FINRA Rule 3310(b) mandates broker-dealers implement written identification programs to verify customer identities.

FINRA Rule 4210 governs margin requirements for equity options and index options transactions.

FINRA also reminds firms to provide clients with the official disclosure document available through the Options Clearing Corporation. It’s key reading for anyone using put-call strategies.

The notice also reiterated to their members the obligations under Regulation Best Interest when making recommendations of options transactions to retail customers.

Options Trading – What Are the Risks?

Trading options can come with significant risks. This part of our option trading guide outlines potential losses and the regulations designed to minimize them. Risks vary greatly depending on whether you buy or sell options. Trading can also include taking on losses beyond your initial instrument.

That’s in part because options can provide leverage. As explained in this option trading guide, a relatively small premium can grant exposure to a significant contract value.

On the upside, investors can achieve considerable percentage gains from modest price improvements, though that same leverage amplifies losses. This principle applies equally to equity and index options, underscoring why puts and calls require careful approval and oversight by brokerage firms.

For information about the inherent risks and characteristics of the options market, refer to the Characteristics and Risks of Standardized Options—a disclosure document that brokerage firms are required to distribute to options customers.

Risks to Purchasers

Expiration Risk: In-the-money options contracts are generally automatically exercised at expiration. But to exercise a call option, the contract owner must have the funds available.

Because one options contract is tied to 100 shares of stock, exercising a call can require substantial funds. For a contract with a strike price of $100, the owner of a call would need $10,000 to exercise.

Risks to Sellers

Assignment* Risk: The seller of an options contract may be assigned and required to fulfill the contract by either buying or selling the underlying security at the strike price. For the sellers of equity options, assignments can happen at any time.

Like other securities, including stocks, bonds, and mutual funds, options carry no guarantees. Be aware that it’s possible to lose the entire principal invested, and sometimes more. As this option trading guide explains, an options holder risks the full amount of the premium paid for each contract.

However, an options writer assumes greater exposure. Writing an uncovered call, for instance, carries theoretically unlimited loss potential since there’s no ceiling on how high a stock’s price can rise.

Initial positions in equity or index options often require less capital than comparable stock trades, yet the leverage involved can amplify even modest moves. Puts-and-calls strategies should therefore be approached with care and a clear understanding of the risks. The exception to this general rule occurs when you use options to provide leverage.

Option Trading Guide: What Happens When Things Go Wrong?

When things go wrong, as they often do, you need the proper tools and techniques to get your strategy back on the profit track. Example: A long call position that has experienced a quick unrealized loss (can also be applied to a long put).

The option trading guide discusses repair strategies investors can consider when faced with unrealized losses.

According to an Investopedia article, one way to address an unrealized loss is to average down* by purchasing more options, but this only increases the risk if [company name/fund name] keeps falling or never returns to the strike price.

Averaging down by purchasing a second option with a lower strike price lowers the breakeven point. Still, it adds considerable additional risk, especially if the price has broken below a key support level.

Another repair attempt (can be combined with the one above) is to roll down into a butterfly spread. The term butterfly spread refers to an options strategy that combines bull* and bear spreads* with a fixed risk and capped profit.

These spreads are intended as market-neutral strategies and pay off the most if the underlying asset does not move before option expiration.

In advanced strategies like butterfly spreads, traders combine multiple contracts, either four calls, four puts, or a mix of puts and calls, using three distinct strike prices. The upper and lower strikes remain equidistant from the middle, or at-the-money, level.

This option trading guide highlights how both equity options and index options structures like these help investors pursue controlled profit targets while managing defined levels of risk.

We have considered some ways to adjust a long call position gone awry; it could involve averaging down, another strategy involves rolling down into a bull call spread, or a bear spread, which is an options strategy used when one is mildly bearish and wants to maximize profit while minimizing losses; and lastly, is to roll into a butterfly spread (combining both bull and bear spreads) by keeping the original call, selling two at-the-money call options, and buying an in-the-money call option.

Whether used alone or in tandem, these repair strategies covered in this option trading guide offer some flexibility in your trading plans. There will always be losses in options trading, so each trade must be evaluated in light of changing market conditions, risk tolerance, and desired objectives.

By properly managing the potential losers with innovative repair strategies, you stand a better chance of winning at the options game in the long run.

Broker Due Diligence and Regulation Best Interest

The SEC’s Regulation Best Interest (Reg BI) is a rule under the Securities Exchange Act of 1934. It sets a higher standard of conduct called the “best interest” standard for broker-dealers and their representatives.

This standard, mentioned in this option trading guide, applies when they suggest any securities transaction or investment strategy, including recommending different types of accounts to retail customers. Essentially, it requires these professionals to prioritize the customer’s best interests when making such recommendations.

Under the “best interest” standard, broker-dealers are obligated to perform comprehensive due diligence when evaluating any investment. This thorough evaluation aims to empower investors to make well-informed decisions aligned with their best interests.

Our option trading guide underscores the importance of that process for protecting investors from negligence or misconduct.

If your financial advisor fails to perform due diligence on an investment before recommending it to you, they could be held liable for investment losses. If your advisor unsuitably recommended Options, and you lost money, the securities attorneys at The White Law Group may be able to help you.

You may be able to recover losses by filing a FINRA Arbitration claim against the brokerage firm that sold you the investment.

Free Consultation with a Securities Attorney

Do you need assistance that goes beyond what our option trading guide covers?

If you have suffered losses trading options and would like to speak to a securities attorney about the potential to recover your investment losses, please call The White Law Group at 1-888-637-5510 for a free consultation.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm with offices in Chicago, Illinois, and Seattle, Washington. To learn more about The White Law Group, visit: whitesecuritieslaw.com.

Glossary:

Assignment – the fulfillment of the requirements of an options contract. An option assignment represents the seller’s obligation to fulfill the contract’s terms by either selling or buying the underlying security at the exercise price.

At-the-money/at-the-money option – describes an option with a strike price that is equal to the current market price of the underlying stock.

Averaging Down – As described in this option trading guide, this strategy involves purchasing additional shares or contracts after a price decline to lower the overall cost basis of an investment. The same principle can apply to equity options when investors anticipate recovery.

Bear Spread – This is another put-call strategy that seeks profit from moderate market declines while minimizing potential losses. This technique, often executed with index options, pairs simultaneous buys and sells at different strike prices and expiration dates to balance reward and risk. A bear spread may be contrasted with a bull spread, which is utilized by investors expecting moderate increases in the underlying security.

Bull Spread – As detailed in this option trading guide, a bull spread is an optimistic strategy aimed at profiting from a moderate rise in the price of a security or asset. This vertical spread involves simultaneously buying and selling put and call options at different strike prices, with the same expiration date and underlying asset.

In the case of equity options or index options, the lower strike option is purchased while the higher strike is sold. A bull call spread, also known as a debit call spread, creates a small net debit when opened since the option bought costs more than the one sold.

Call – the term “call” means an option contract under which the holder of the option has the right, in accordance with the terms of the option, to purchase the number of units of the underlying security or to receive a dollar equivalent of the underlying index covered by the option contract.

Compound Option – An option whose underlying security is another option. As this option trading guide explains, compound options include two strike prices and two exercise dates. These complex equity or index option structures combine multiple layers of contracts, allowing investors to manage timing and pricing flexibility across related put-call positions.

Exercise – In options trading, to exercise an option means that the purchaser or seller of an options contract buys (in the case of a call) or sells (in the case of a put) the option’s underlying security at a specified price on or before a specified future date.

Expiration Date – According to this option trading guide, the expiration date marks the point at which an options contract ceases to exist. Once they expire, equity options lose all their time value.

If the purchaser of an option doesn’t exercise the contract before its expiration, they lose the premium paid for it. The purchaser has no rights, and the option has no value.

Hedge – To hedge, as outlined in this option trading guide, means taking an offsetting position that limits the price risk of an existing investment.

A hedge usually involves an opposite trade in a related asset or derivative to reduce exposure to market swings. For example, an owner of common stock may buy a put option to hedge against a potential decline in the stock price.

Position – The combined total of an investor’s open option contracts (Calls and/or puts) and long or short stock.

Premium – 1. Total price of an option: intrinsic value plus time value. As described in this option trading guide, a premium is the price paid by the buyer or received by the seller of an options contract. Although some mistakenly equate it solely with time value, it actually includes both intrinsic and time components.

It’s determined by several factors, including the time remaining until the contract expires and expectations for future volatility in the underlying asset’s price. The premium is a nonrefundable payment in full from the purchaser to the seller in exchange for the rights conveyed by the option.

Strike Price – This option trading guide defines an options contract as a derivative that grants the holder the right, but not the obligation, to buy or sell an underlying security at a set price in the future. That price, known as the strike or exercise price, determines potential profit or loss.

The strike price (exercise price) is the price per share at which the underlying security may be purchased (in the case of a call) or sold (in the case of a put) by the option holder upon exercise of the contract.

Time Value – Time value is the portion of the option premium that is attributable to the amount of time remaining until the expiration of the option contract. Time value is the value an option has beyond its intrinsic value.

Frequently Asked Questions

Below, this part of our option trading guide answers common questions about this type of trading.

1. What should I know about broker trading options, and how does it affect investors?

These options refer to the process by which brokers execute or recommend trades in complex investment products. These products may include equity options and index options.

Can these instruments be legitimate investment tools? Yes, sometimes. However, improper or overly aggressive options activity can expose investors to significant losses.

2. What is unauthorized options trading, and what can investors do about it?

This type of trading occurs when a broker executes options trades, such as puts, calls, index options, or equity options, without obtaining the investor’s consent or written authorization beforehand.

As you can imagine, this kind of trading violates FINRA regulations. It also violates the broker’s fiduciary duty to act in their clients’ best interests.

3. How can investors recognize and respond to options trading fraud?

This form of fraud involves deceptive or manipulative practices related to recommending or selling options contracts. One example is misrepresenting the risks of complex products. Other examples include concealing commissions or churning accounts by excessively trading index and equity options for profit.

Due to the leveraged nature of these options covered in this part of our option trading guide, victims can suffer significant portfolio losses in just a few days.

Last modified: February 3, 2026