Securities Investigation: Morgan Stanley ARK Innovation ETF Auto Callable Notes

The White Law Group is investigating potential securities claims involving broker dealers who may have improperly recommended Morgan Stanley Contingent Income Buffered Auto-Callable Securities (due July 11, 2024, Based on the Worst Performing of the S&P 500® Index and the ARK Innovation ETF) to investors.

According to the prospectus, Morgan Stanley ARK Innovation ETF Auto Callable Notes are complex and a high-risk investment. They do not provide for the regular payment of interest and provide a minimum payment at maturity of only 15% of the stated principal amount. Investors in the securities must be willing to accept the risk of losing up to 85% of their initial investment and the risk of not receiving any contingent monthly coupons throughout the 2.75-year term of the securities.

Because all payments on the securities are based on the worst performing of the underlyings, a decline of either of the underlyings by an amount greater than the buffer amount as of the final observation date will result in a loss of your investment, even if the other underlying has appreciated or has not declined as much.

Contingent Income Buffered Auto Callable Notes linked to ARK Innovation ETF

If structured notes are labeled as “Contingent Income Buffered Auto-Callable,” it signifies that the notes have certain features and conditions that determine their payout and potential early redemption. Let’s break down the components:

- Contingent Income: Contingent income refers to the possibility of receiving additional coupon or interest payments based on specific conditions being met. These conditions are typically related to the performance of the underlying asset or index. The contingent income feature allows investors to potentially earn higher income beyond the regular coupon payments if certain criteria are satisfied.

- Buffered: The term “buffered” indicates that the notes offer downside protection within a predefined range. This means that the investor is shielded from a certain percentage of potential losses in the value of the underlying asset. For example, if the buffer is set at 10%, the investor is protected against the first 10% decline in the underlying asset’s value.

- Auto Callable: The auto callable feature means that the notes can be redeemed or called by the issuer before their scheduled maturity date if specific conditions are met. These conditions are typically tied to the performance of the underlying asset or index. If the conditions are satisfied, the notes will be automatically redeemed, and the investor will receive the predetermined payout.

Combining these elements, Contingent Income Buffered Auto-Callable notes provide investors with the potential for additional income if certain conditions are met, while also offering downside protection within a predefined buffer range. However, there is a possibility of early redemption if the auto-call conditions are triggered.

As structured notes are complex investments, they may not be suitable for you based on your individual investment goals and risk tolerance.

As structured notes are complex investments, they may not be suitable for you based on your individual investment goals and risk tolerance.

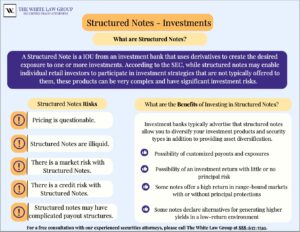

Understanding the Risks of Structured Notes

There is a long list of risks associated with investing in Morgan Stanley ARK Innovation ETF Auto Callable Notes, including the following:

- Market Risk: The value of Contingent Income Buffered Auto-Callable notes is influenced by the performance of the underlying asset or index. If the underlying asset experiences significant fluctuations or declines in value, it can result in a reduction in the value of the notes.

- Credit Risk: The notes are typically issued by financial institutions. Therefore, investors face the credit risk of the issuer. If the issuer defaults or experiences financial instability, it can lead to a loss of principal and interest payments.

- Early Redemption Risk: The auto-call feature in these notes introduces the risk of early redemption by the issuer. If the auto-call conditions are met, the notes may be redeemed before their scheduled maturity date, which means investors may not receive the full term of the investment or potential future returns.

- Contingent Income Risk: The additional coupon or interest payments, contingent upon specific conditions being met, may not materialize if the predetermined criteria are not satisfied. Investors should carefully assess the likelihood of achieving the contingent income and understand the potential impact on their overall returns.

- Limited Upside Potential: While Contingent Income Buffered Auto-Callable notes offer potential additional income and downside protection within a buffer range, they may have limited participation in the positive returns of the underlying asset. Investors may not fully capture the appreciation beyond the buffer, potentially limiting their overall returns.

- Complexity Risk: These notes can be complex financial instruments, involving various features, terms, and conditions. Understanding the contingencies, buffer range, auto-call triggers, and potential payouts can be challenging for investors. It is crucial to carefully review the offering documents and seek professional advice to fully comprehend the risks associated with these notes.

- Liquidity Risk: The notes may have limited liquidity in the secondary market. Selling the notes before maturity may be challenging, especially if there is low demand or restrictions on resale, which can impact an investor’s ability to exit the investment.

Investigating Potential FINRA Claims

The White Law Group is investigating the liability that brokerage firms may have for recommending complex, often extremely high-risk, structured notes such as Morgan Stanley ARK Innovation ETF Auto Callable Notes

With the market in turmoil, many investors who purchased such investments believing they provided downside protection or were akin to bonds because of the dividend component are instead finding that these products can indeed suffer enormous losses.

Brokers often pitch structured products, as providing “downside protection” against losses to a related index while allowing modest upside gain potential. Of course, this is only true if the value of the index doesn’t fall below a predetermined price. If the price falls below that point, the losses in structured notes can still be huge.

These products typically pay a high fee to the financial advisors that sell them.

Brokerage firms have two main duties in recommending structured callable notes linked to equity investments or indexes. First, brokerage firms are required to perform adequate due diligence on any product they recommend. Second, brokerage firms are required to ensure that all recommendations made are suitable for their client in light of the client’s age, investment experience, net worth, income, and investment objectives. If a brokerage firm fails to do either of these things, the firm can be held responsible in a FINRA arbitration claim.

Hiring a FINRA Attorney – The White Law Group

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm dedicated to helping investors in claims in all 50 states against their financial professional or brokerage firm. Since the firm launched in 2010, it has handled over 700 FINRA arbitration cases.

Our firm represents investors in all types of securities related claims, including claims involving stock fraud, broker misrepresentation, churning, unsuitable investments, selling away, and unauthorized trading, among many others.

With over 30 years of securities law experience, The White Law Group has the expertise to help investors defrauded in securities, investment and financial business transactions attempt to recover their investment losses. The firm reviews securities fraud cases throughout the country.

If you have suffered losses investing in Morgan Stanley ARK Innovation ETF Auto Callable Notes , the securities attorneys of The White Law Group may be able to help. For a free consultation, call the firm’s office at 888-637-5510.

For more information on The White Law Group, please visit our website at https://whitesecuritieslaw.com.

Tags: auto callable notes, Morgan Stanley ARK Innovation ETF Auto Callable Notes, structured products Last modified: July 14, 2023