Elements of Securities Fraud – What you need to know

Securities fraud is a serious crime that involves the manipulation of financial markets for personal gain. Securities fraud is classified as a deceptive practice in the stock or commodities markets that induces investors to make purchase or sale decisions on the basis of false information. It can take many forms, but all instances of securities fraud share several common elements that are important to understand.

Learning these elements could help you if you’re thinking about investing, red flags to look for, and what to do if you feel as though you’ve been defrauded. The Federal Bureau of Investigation is the entity responsible for cracking down on illegal activity related to fraudulent schemes and fraudulent activities. There are a wide range of securities fraud claims that involve a variety of financial transactions.

What are the Primary Elements of Securities Fraud?

There are several elements to look for and understand when learning about securities fraud. The Federal Bureau of Investigation (FBI) describes securities fraud as criminal activity that can include high-yield investment fraud, Ponzi schemes, pyramid schemes, advanced fee schemes, foreign currency fraud, broker embezzlement, hedge-fund-related fraud, and late-day trading. In many cases, fraudsters seek to dupe investors through misrepresentation and to manipulate financial markets in some way. The government maintains concerns about the deception of investors in both public and non-public companies and transactions. Sophisticated investors and market participants can be the victims of misrepresentations as much as retail investors can be. Here are the primary pillars of securities fraud elements:

Misrepresentation:

This occurs when an individual or company makes false statements or omissions about a security or investment. Allegations of securities fraud are usually based on the defendant misrepresenting or failing to provide necessary financial information to the plaintiff who is seeking to buy or sell a security.

This critical information may include the issuer’s profits, future prospects, contractual obligations, or the nature of the product the issuer of the security was selling. The misrepresentation or omission must be considered material, meaning that a reasonable buyer or seller of the securities would deem that information important. A material omission can satisfy this element. Under the umbrella of misrepresentation includes examples such as hidden dealer markups in offering prices, false statements of “guaranteed” returns, and inaccurate reporting of positions in futures.

Insider Trading:

This occurs when an individual or group of individuals attempt to artificially inflate or deflate the price of a security or investment. This can be done through a variety of methods, and it can ultimately cause significant harm to investors and undermine the integrity of the financial markets.

This occurs when an individual or group of individuals attempt to artificially inflate or deflate the price of a security or investment. This can be done through a variety of methods, and it can ultimately cause significant harm to investors and undermine the integrity of the financial markets.

Continually, insider trading is typically committed by individuals with access to confidential or material nonpublic information about the company. Taking advantage of this privileged access is considered a breach of the individual’s fiduciary duty. Directors, executives, or anyone else who has information or who holds more than 10% of any class of a company’s securities are considered insiders by the SEC. If an insider makes a transaction, they must file Form 4, Statement of Changes in Beneficial Ownership, within two business days of making the transaction.

According to the Financial Regulatory Authority (FINRA), in November of 2018 financial Advisor Raymond J. Pirrello Jr. of Garden State Securities in Hackensack, NJ was suspended after he allegedly exchanged business related text messages, using his personal cell phone, and business related emails, using an unauthorized personal email address, to engage in firm related business with a customer at his member firm, in alleged violation of firm rules. Due to these acts of misconduct, including failure to follow the customer’s instructions, the customer reportedly suffered approximately $300,000 in damages.

Manipulation:

This is another element of securities fraud, and it occurs when an individual attempts to tamper with the price of a security. This can be done through spreading false information, engaging in high-frequency trading, or using other tactics to manipulate the true state of the market.

The U.S Code 42 U.S. Code § 17301 Prohibits any form of market manipulation. The primary goal of market manipulation is to create false impressions of the value of a security or market, which can then lead to investors making investment decisions based on information that is inaccurate and false. All of these tactics are illegal and can have serious consequences for those who choose to engage in them.

Complex Investment Products:

Securities fraud often utilizes complex investment products or investment strategies that are difficult for investors to understand. Some types of complex investments include Structured Products, Private Placement Investments, and Non-traded Real Estate Investment Trusts (REITs). See: Are Non-Traded REITs a Safe Bet?

This type of fraud is particularly troublesome for investors because it preys on those who may not have the knowledge or experience to understand the risks. The GWG L Bonds for example, were complex investments that went wrong. According to filings with the SEC on January 18, 2022, GWG Holdings did not make the January 15, 2022 interest payments of approximately $10.35 million and principal payments of approximately $3.25 million to its L Bond investors. After failing to timely file its 2020 annual report, GWG suspended its offering of L Bonds.

Further, several members of the Board of Directors reportedly resigned in the second quarter of 2021. Complex investments typically invest in nontraditional assets or engage in one or more complex strategies which is why it is important to conduct extensive research prior to investing in one. Use resources available to you like BrokerCheck by FINRA, as you can investigate your financial advisor or broker in a few simple steps. Also, confide in a trusted family member prior to investing as they may be able to help you identify red flags and avoid fraudulent investments.

Examples of Securities Fraud

Now that we have a basic understanding of the elements of securities fraud, it’s important to explore examples of securities fraud to identify dangerous investments for yourself, and to be better prepared prior to investing. Here are some examples:

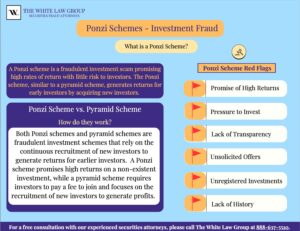

Ponzi Schemes:

Ponzi Schemes are a type of investment fraud in which returns are paid to earlier investors using capital of newer investors. This scheme relies on a constant influx of new investors to keep the returns flowing. These schemes often crumble when there is a lack of investors to pay the returns. Companies that engage in a Ponzi scheme aim to focus their energy into attracting new clients to make investments, otherwise their scheme will become illiquid.

Ponzi Schemes are a type of investment fraud in which returns are paid to earlier investors using capital of newer investors. This scheme relies on a constant influx of new investors to keep the returns flowing. These schemes often crumble when there is a lack of investors to pay the returns. Companies that engage in a Ponzi scheme aim to focus their energy into attracting new clients to make investments, otherwise their scheme will become illiquid.

The SEC has issued guidance on what to look for in potential Ponzi schemes including guarantee of returns or unregistered investment vehicles with the SEC. In August of 2021, The Securities and Exchange Commission stated that John J. Woods of Livingston Group Asset Management Company d/b/a Southport Capital, and Horizon Private Equity, III, LLC was allegedly running an extensive ponzi scheme. This scheme was purportedly an ongoing operation for more than 10 years, and the investors of this scheme were allegedly telling clients that they would receive returns of 6-7% interest, guaranteed for two to three years, for non-specific investments in a fund called “Horizon Private Equity.” In total, investors in the Ponzi scheme were owed over $110,000,000 in principal.

Accounting Fraud:

This involves manipulating financial records to make a company appear more profitable than it actually is. This could involve inflating revenue, hiding losses, or engaging in other deceptive accounting practices. For accounting fraud to take place, a firm must deliberately falsify financial records. Consider a firm that makes an estimate that must be revised later. No accounting fraud has taken place because the errors were not deliberate.

The most extensive case of accounting fraud took place in the early 2000’s and involved the energy company Enron Corporation. This scandal was the result of a complex accounting fraud that involved hiding debt and inflating profits to make the company appear more affluent than it really was. When this corporation and its foundation of fraudulent activity was discovered, Enron collapsed. This was the largest scandal in accounting fraud history because it led to increased scrutiny of corporate accounting practices.

However, the Sarbanes Oxley Act was founded and established new requirements for public companies to improve financial reporting and accountability. In September of 2019, Vereit Inc., a publicly traded REIT formerly known as American Realty Capital Properties (ARCP) founded by Nicholas Schorsch and his partners at AR Global (formerly AR Capital), agreed to pay a total of $738.5 million to settle a class action lawsuit. After the accounting misdeed was revealed, ARCP’s market value dropped by more than $3 billion and Schorsch eventually resigned as executive chairman.

The initial suit and allegations against Schorsch stated, “This abuse, together with the foreseeable impact of financial fraud they perpetrated at an affiliated entity, was so severe that after less than three years RCAP declared bankruptcy, having lost nearly $1 billion in investors’ money.” Schorsch blocked attempts by the independent directors to negotiate superior deals with third parties to avoid bankruptcy, according to the lawsuit. Accounting fraud is a dangerous game because it can lead to financial losses for investors, while also undermining the integrity of the financial system.

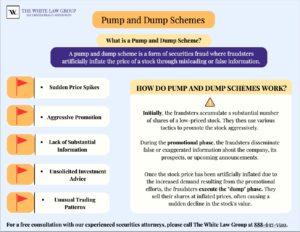

Pump and Dump Schemes:

In a pump and dump scheme fraudsters artificially inflate the price of stock by spreading false rumors or engaging in other manipulative tactics. Once the price of stock has inflated, these fraudsters sell their shares, causing the price of the stock to continually plummet and leave investors with significant losses.

In a pump and dump scheme fraudsters artificially inflate the price of stock by spreading false rumors or engaging in other manipulative tactics. Once the price of stock has inflated, these fraudsters sell their shares, causing the price of the stock to continually plummet and leave investors with significant losses.

In May of 2016, A penny-stock promoter pleaded guilty to conspiring to manipulate stocks and laundering more than $250 million in profits, in what prosecutors have described as one of the largest-ever “pump and dump” schemes. Mulholland reportedly manipulated more than 40 publicly traded companies, including Cynk Technology Corp., whose stock’s climb and subsequent collapse in 2014 briefly gave the social-network operator a $4 billion valuation even though it reported no assets, no revenue and just one employee.

Pump-and-Dump Schemes are fraudulent procedures that create the impression of high demand and essentially drive up prices. These schemes are illegal and can have significant consequences for those that engage in this fraudulent behavior.

High Yield Investment Programs:

These programs are a fraudulent investment scheme that promises high returns, often in excess of 100%. Most HYIPs are affiliated with Ponzi schemes where the organizers take money from new investors to pay returns to established investors. High Yield Investments promise high returns with little to no risk, but they are often fraudulent. They also may use false or misleading advertising to lure investors, and they may promise returns that are too good to be true.

These investments are often riskier than more conventional investments and can include stocks, mutual funds, and other types of securities. Some common HYIPs include junk bonds, which are bonds issued by companies with lower credit ratings, and stocks in emerging markets, which can offer higher returns, while also carrying higher risks. High Yield Investments work by offering a higher rate of return, and are typically offered to investors in exchange for accepting a higher level of risk.

For example, a company that issues junk bonds may offer a higher rate of return to investors in exchange for the higher risk associated with investing in bonds issued by a company with a lower credit rating.

In one recent HYIP, the company offered memberships that purported to provide investors with up to a 60 percent profit in 100 days. In less than a year, the company took in more than $10 million from investors. The company relied on Biblical themes and the promise of high profits to lure unsuspecting investors. All investors’ proceeds were lost.

Watch Out For These Elements of Securities Fraud

By remaining vigilant and staying aware of these elements of securities fraud, you could save yourself or a loved one from serious financial losses. Scammers are always looking for ways to take advantage of unsuspecting investors and use high pressure sales tactics or false promises to get people to invest in their schemes. If you believe that you may be a victim of securities fraud, you should meet with a securities fraud lawyer as soon as possible to learn about your legal options. As a victim of fraud, your claim will likely proceed in arbitration, though it could be filed in federal district court under certain circumstances. Regardless, you should gather all documentation relevant to your potential fraud claim and reach out to a securities fraud law firm. Remember to conduct your own research, be wary of unsolicited investment offers, and seek advice from a trusted financial advisor. If an investment seems too good to be true…it probably is.

Help for Victims of Securities Fraud

If you believe you are a victim of securities fraud please call the offices of The White Law Group for a free consultation at 888-637-5510.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm with offices in Chicago, Illinois and Seattle Washington. The White Law Group has the expertise to help investors defrauded in securities, investment and financial business transactions. For more information on The White Law Group, please visit our website at https://whitesecuritieslaw.com.

Last modified: August 10, 2023