Investors often find UITs appealing. They’re simple. A UIT is also transparent while offering portfolio diversification. Unlike ETFs or mutual funds, UITs offer a fixed portfolio with a set and precise termination date.

However, a UIT isn’t always all positive. There are risks associated with investing in unit investment trusts. Unfortunately, some brokers don’t disclose these complex risks to investors. Excessive fees, unsuitable recommendations, and inappropriate sales practices associated with UITs have resulted in substantial losses.

In this post, you’ll learn what a unit investment trust is, what makes it risky, and we’ll also answer commonly asked questions about UITs.

What is a Unit Investment Trust?

UITs are exchange-traded mutual funds that offer a fixed (unmanaged) portfolio of securities with a definite life. Investors should be aware of the risks associated with investing in UITs.

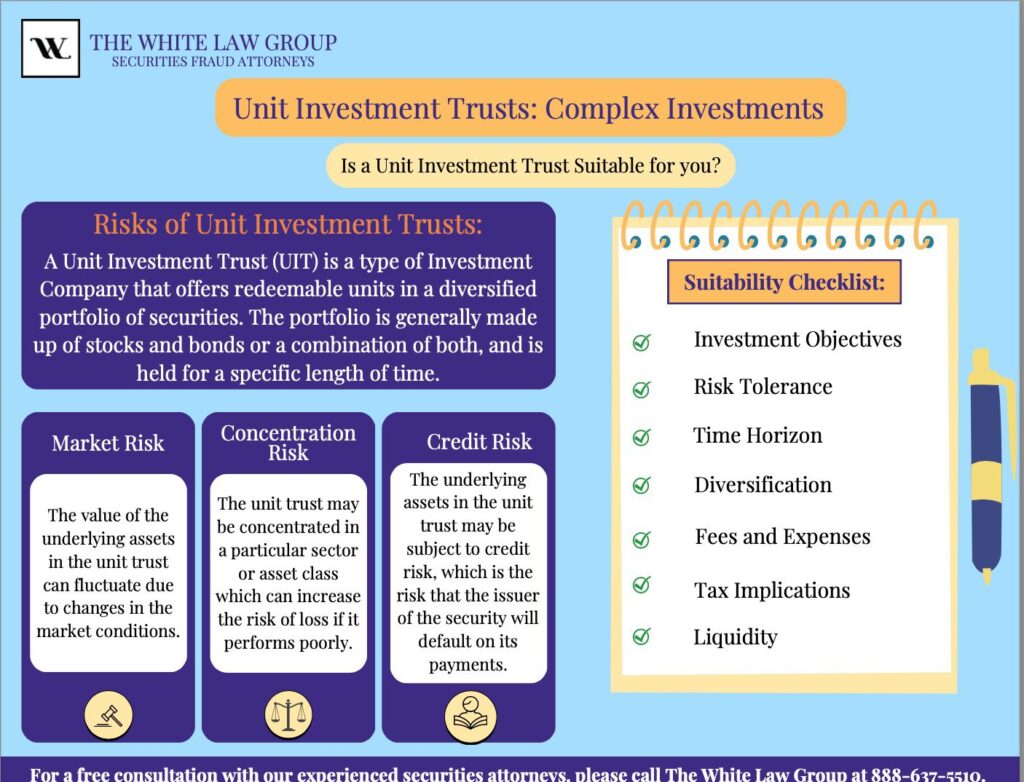

What Are the Risks of Investing in Unit Investment Trusts?

You now know what a unit investment trust is. It’s now time to learn what makes UITs risky.

Many UIT sponsors will maintain a secondary market, which allows owners of UIT units to sell them back to the sponsors and allows other investors to buy UIT units from the sponsors. Often, if units are repurchased from the sponsor, it’s at a discounted rate, which means a loss for the investor. This can be problematic when the units are invested in volatile or risky sectors.

Unit investment trusts don’t actively trade their investment portfolio. That is, a UIT buys a relatively fixed portfolio of securities (for example, five, ten, or twenty specific stocks or bonds) and holds them with little or no change for the life of the UIT. Because the investment portfolio of a UIT is fixed, investors know basically what they are investing in for the duration of their investment. Unfortunately, if one of the securities is underperforming, no adjustments can be made. There’s a significant risk associated with investing in UITs. This is especially important in the volatile energy sector.

UITs have a termination date that is established when the UIT is created. When a UIT terminates, any remaining investment portfolio securities are sold, and the proceeds are paid to the investors. Many brokers are promoting “short-term strategy” trusts that dissolve after one to two years, possibly due to the high transaction fees charged at both the purchase and dissolution stages. UITs can be very attractive to brokers due to the high upfront commissions, usually around 4%.

On behalf of investors, The White Law Group is investigating claims that some brokers violated securities law and FINRA regulations when selling certain UITs. It’s possible that the broker-dealers failed to perform adequate due diligence on the unit investment trusts before offering them for sale to their clients, and that the brokerage firms failed to determine whether the investments were appropriate in light of their clients’ age, investment experience, net worth, and risk tolerance. If a broker overlooks suitability requirements, investors may have an actionable claim to recover their losses in a product through FINRA dispute resolution.

Examples of Unsuitable Unit Investment Trusts:

On March 1, 2023, financial advisor Gary Bowman allegedly failed to file an answer to the CFP Board’s Complaint within the required timeframe. The CFP Board’s Complaint was in connection with allegations by FINRA, in which Bowman was suspended from association with any FINRA member in any capacity for three months.

Bowman was issued a $10,000 fine for violating FINRA Rules 2111 and 2010. According to FINRA, Bowman was accused of engaging in unsuitable patterns of short-term trading of UITs in customer accounts. Additionally, Bowman was purportedly making recommendations that caused his customers to incur avoidable sales charges. FINRA also alleges that the frequency and cost of these transactions were unsuitable for the investor.

On October 20, 2015, the Financial Industry Regulatory Authority (FINRA) announced that it had ordered 12 firms to pay restitution totaling more than $4 million and fines totaling more than $2.6 million for failing to apply available sales charge discounts to customers’ purchases of UITs and related supervisory failures. A UIT, composed of redeemable units of a fixed portfolio of securities, is risky due to its fluctuations based on the market.

Sponsors generally offer sales charge discounts to investors, known as “breakpoint discounts” and “rollover and exchange discounts.” In March 2004, FINRA issued a Regulatory Notice to firms titled, Unit Investment Trust Sales, to remind broker-dealers that they should develop and implement procedures to ensure customers receive appropriate sales charge discounts for UITs.

Suitability Checklist for Unit Investment Trusts

Your financial advisor should only recommend investments that are suitable for you. Liquidity needs, time horizon, and income are just a few categories that an advisor should consider before recommending any investment. Once that is completed, the brokerage firm must ensure it completes due diligence.

Besides “What is a unit investment trust?”, there are many other questions you may have about this subject. Here’s what to ask when thinking of investing in UITs:

- Investment Objectives: Does the UIT align with your investment objectives?

- Risk Tolerance: Do you have the risk tolerance to invest in a UIT?

- Time Horizon: Do you have a long enough time horizon to hold the UIT until maturity?

- Diversification: Does the UIT provide enough variety?

- Fees and Expenses: Are the fees and expenses associated with the UIT reasonable?

- Tax Implications: Are the tax implications of investing in the UIT appropriate for your tax situation?

- Liquidity: Do you have the liquidity needed to hold the UIT until maturity?

Investors may have grounds to file an actionable claim through FINRA dispute resolution to recover their losses in a product if a broker fails to comply with suitability requirements.

What is FINRA Arbitration and How Does it Work?

FINRA oversees brokers and brokerage firms. It is overseen by the Securities and Exchange Commission (SEC). It is authorized by Congress to protect U.S. investors from investment fraud by making sure the broker-dealer industry operates fairly and honestly.

If you feel you have been defrauded, you may be able to seek restitution through FINRA arbitration. Don’t wait long. Once you’ve retained a securities fraud attorney, the process of filing a claim through FINRA could take place. This claim should include a description of the fraud, the amount of money lost, and any supporting documentation. Details matter here.

Once the claim is filed, FINRA will appoint an arbitrator to hear the case. The arbitrator is responsible for reviewing the evidence and determining whether the investor is entitled to restitution. It’s a formal process.

If the arbitrator rules in favor of the investor, they will issue an award for damages, and this can be used to seek restitution from the person or company that defrauded the investor.

Frequently Asked Questions

How do UITs compare to mutual funds?

Unit investment trusts vs. mutual funds is a standard comparison for investors exploring portfolio options. While both offer pooled investments and diversification, mutual funds are actively managed and can change holdings at the discretion of the fund manager. In contrast, UITs have a fixed portfolio and a set maturity date. They’re predictable but less flexible.

Which is better: a unit investment trust vs. an ETF?

Inherently, a UIT isn’t “better” than an ETF, or vice versa. The best option depends on your investing background and goals. A UIT offers a fixed, transparent, and professionally selected portfolio with a set maturity, but lacks flexibility. An ETF is open-ended, actively managed, and offers liquidity and intraday trading capabilities.

What should I know about unit investment trust fees?

Some brokers may promote UITs due to their high commissions, which typically hover around 4%, and don’t always align with your best interests as an investor. The fees associated with a UIT vary based on a range of factors, including:

- Annual operating expenses

- Termination cost

- Upfront sales charges

Are UTIs tax-efficient investments?

A UIT can offer some tax advantages. However, they’re rarely the most tax-efficient investment options. Because a UIT isn’t actively traded, there tend to be fewer distributions of capital gains than if you invested in the average actively managed fund. Additionally, interest income or dividends from UIT holdings could be subject to taxation.

Can I sell a UIT before its maturity date?

In most cases, yes. However, selling your stake in a unit investment trust can come at a cost. While some sponsors offer a secondary market designed for investors to liquidate their units, they’re often repurchased at a discount. That’s great for a buyer. However, it can result in a significant capital loss for you.

Contact FINRA Arbitration Attorneys

If you have questions about what a unit investment trust is and your investment in a UIT and would like to speak to a securities attorney about your potential to recover losses through FINRA arbitration, please call The White Law Group at 1-888-637-5510 for a free consultation.

The White Law Group, LLC, is a national securities fraud, securities arbitration, investor protection, and securities regulation and compliance law firm with offices in Chicago, Illinois, and Seattle, Washington. For more information on our firm, please visit our website: https://whitesecuritieslaw.com/

Tags: Unit Investment Trusts Last modified: June 30, 2025