Understanding Conflicts of Interest

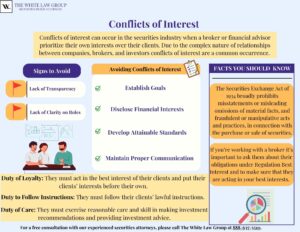

Conflicts of interest can occur in the securities industry when a broker or financial advisor prioritize their own interests over their clients. Due to the complex nature of relationships between companies, brokers, and investors conflicts of interest are a common occurrence. Brokers are often incentivized to sell certain securities or investment products, which can lead to conflicts of interest when those particular products are not in the best interest of the investor.

Conflicts of interest can occur in the securities industry when a broker or financial advisor prioritize their own interests over their clients. Due to the complex nature of relationships between companies, brokers, and investors conflicts of interest are a common occurrence. Brokers are often incentivized to sell certain securities or investment products, which can lead to conflicts of interest when those particular products are not in the best interest of the investor.

Conflicts of interest can also occur due to the lack of transparency that exists within the industry. Investors may not always have access to all of the information they need to make informed decisions, which can make it difficult for them to identify potential conflicts of interest. Further, some brokers may not be fully honest or transparent about the incentives they receive for selling certain products which can make it difficult for investors to know if their broker is acting in their best interest.

Brokers and investment advisors owe their clients a number of duties, which are collectively known as Fiduciary Duties:

Duty of Loyalty: They must act in the best interest of their clients and put their clients’ interests before their own.

Duty of Care: They must exercise reasonable care and skill in making investment recommendations and providing investment advice.

Duty to Follow Instructions: They must follow their clients’ lawful instructions.

Duty to Disclose Material Information: They must disclose all material information related to the investments they recommend or advise on, including any conflicts of interest.

Duty to Manage Risk: They must manage risk appropriately and not expose their clients to undue risk.

Duty to Avoid Unauthorized Transactions: They must not make any unauthorized trades in a client’s account.

Duty to Maintain Confidentiality: They must maintain confidentiality with respect to their clients’ personal and financial information.

Brokers are expected to follow these duties because it helps ensure that they are acting in their clients best interests. By following fiduciary duties, advisors build stronger and more trustworthy relationships with their clients which establish long-term financial relationships.

Fiduciary Duty

Fiduciary duty is a legal obligation that requires a person or entity to act in the best interest of another party. In the securities industry, this duty is often owed by brokers to their clients. Brokers who owe fiduciary duty to their clients are required to act in the clients best interest and to avoid conflicts of interest.

This means that a broker must put their clients interests ahead of their own and must disclose any potential conflicts of interest that could impact their ability to act in the client’s best interest. Following through on fiduciary duties is an important concept to understand in the securities industry because it helps to ensure that investors are protected from potential conflicts of interest. Breaching fiduciary duties is a serious offense and can lead to severe punishments.

For example, in March of 2022, the SEC reportedly filed a civil complaint in 2020 alleging that from at least Aug.15, 2014, through December 2018, registered investment advisor, Ambassador Advisors, along with part owners, executives and investment advisor representatives of the firm unlawfully placed their clients into mutual fund share classes charging 12b-1 fees when the customers were eligible for lower-cost share classes. This is a breach of fiduciary duty due to the nature of the case details and through failure to make proper disclosure about their conflicts of interest regarding their selection of the share classes, according to the SEC.

FINRA and Conflicts of Interest

FINRA published a thorough report on conflicts of interest that demonstrates recurring challenges that are consistently contributing to compliance and supervisory breakdowns. The Report on Conflicts of Interest was published in October 2013, and FINRA continuously works to monitor the efforts employed by firms to identify, mitigate and manage conflicts of interest.

According to FINRA there are several rules that govern the ethical obligations of firms and brokers, and they are as follows:

-

The Securities Exchange Act of 1934 broadly prohibits misstatements or misleading omissions of material facts, and fraudulent or manipulative acts and practices, in connection with the purchase or sale of securities.

-

Section 15(c) of the Act prohibits a broker from effecting any transaction in or inducing or attempting to induce the purchase or sale of any security by means of any manipulative, deceptive, or other fraudulent device or contrivance.

-

FINRA Rule 2010 (Standards of Commercial Honor and Principles of Trade) states that a firm “in the conduct of its business, shall observe high standards of commercial honor and just and equitable principles of trade.”

-

FINRA Rule 2020 (Use of Manipulative, Deceptive or Other Fraudulent Devices) provides that no firm “shall effect any transaction in, or induce the purchase or sale of, any security by means of any manipulative, deceptive or other fraudulent device or contrivance.”

-

FINRA Rule 2241 (Research Analysts and Research Reports), addresses conflicts of interest relating to the publication and distribution of equity research reports.

-

FINRA Rule 2242 (Debt Research Analysts and Debt Research Reports), which became effective on February 22, 2016, addresses conflicts of interest relating to the publication and distribution of debt research reports.

Regulation Best Interest (Reg Bi)

The Regulation Best Interest Act was created to establish a “best interest” standard of conduct for broker-dealers and associated persons when they make a recommendation to a retail customer of any securities transaction or investment strategy involving securities, including recommendations of types of accounts.

Essentially, it requires brokers to act in their clients’ best interests, and make fiscally responsible investments. Investors are consistently being defrauded by investors, and Reg BI is meant to help this issue and protect investors from fraud. The rule requires that brokers disclose any conflicts of interest they may have and prioritize their clients interests over their own. Under this new rule brokers must consider the costs and risks of investments and recommend certain investments based on the financial status of the client.

Further, the rule also suggests that brokers are to provide clients with clear and concise information about the investments they are recommending. Regulation Best Interest (Reg BI) is an important step forward in protecting investors. By requiring brokers to act in their clients’ best interests, the rule helps ensure that investors are getting the best advice possible. If you’re working with a broker it’s important to ask them about their obligations under Regulation Best Interest and to make sure that they are acting in your best interests.

Examples of Regulation Best Interest

On Sept. 6, 2022, Perceptive Advisors LLC was charged with allegedly failing to disclose conflicts of interest related to its personnel’s alleged ownership of sponsors of special purpose acquisition companies. Perceptive reportedly agreed to the entry of the SEC’s findings and without admitting or denying the findings, Perceptive agreed to a cease-and-desist order, a censure, and a $1.5 million penalty to settle the charges.

According to a press release on March 2, 2022, the Securities and Exchange Commission charged Cambridge Investment Research Advisors, Inc. with breaching its fiduciary duty by failing to disclose material conflicts of interest related to its selection of mutual funds and wrap accounts for clients. Since at least 2014, the firm allegedly failed to disclose material conflicts of interest to its clients, according to the SEC’s complaint. The SEC seeks retribution in the forms of permanent injunction, disgorgement including prejudgment interest, and civil penalties.

According to the SEC on March 17, the regulator has censured and fined HSBC Securities $725,000 over alleged failures in disclosure of conflicts of interest in its wrap program. Between November 2015 and August 2017, HSBC allegedly misled its current and prospective advisory clients and didn’t disclose conflicts of interest related to how it compensated its dually registered investment advisor representatives in the firm’s retail banking and wealth management unit, according to the SEC.According to the SEC, HSBC also allegedly failed to implement written policies and procedures designed to prevent violations of the Investment Advisers Act of 1940’s provisions on representatives’ compensation.

FINRA and Regulation Best Interest

In July of 2019, FINRA reported on The Securities and Exchange Commission and the adoption of a new rule under the Securities Exchange Act of 1934 (‘‘Exchange Act’’), establishing a standard of conduct for broker-dealers and natural persons who are associated persons of a broker-dealer (unless otherwise indicated, together referred to as ‘‘broker-dealer’’) when they make a recommendation to a retail customer of any securities transaction or investment strategy involving securities (‘‘Regulation Best Interest’’).

FINRA is responsible for monitoring the brokerage industry and enforcing rules and regulations related to the trading of securities. Seeking restitution through FINRA arbitration can be a legal option if you feel as though you are a victim of fraud. After retaining a securities fraud attorney, the process begins of filing a claim through FINRA. The claim typically entails a description of the fraudulent behavior you’ve experienced, the amount of money lost or stolen, and any supporting documentation that may assist your case. Once the claim is filed, FINRA will appoint an arbitrator to hear the case. Arbitrators review the evidence and come to a decision about whether the investor is entitled to restitution. If the arbitrator rules in favor of the investor, they will issue an award for damages, and this can be used to seek restitution from the person or company that defrauded the investor. FINRA is managed by the Securities and Exchange Commission (SEC) and is authorized by Congress to protect U.S. investors from investment fraud by making sure the broker-dealer industry operates fairly and honestly.

Hiring a FINRA Attorney

FINRA arbitration is a process in which an impartial arbitrator or panel of arbitrators is appointed to hear the dispute and render a decision. The White Law Group helps clients navigate the arbitration process and represent their interests throughout the proceedings. This can include preparing and filing the initial claim, conducting discovery, presenting evidence and arguments at the hearing, and appealing the decision if necessary.

If you have an investment related dispute, the securities attorneys at the White Law Group may be able to help you. The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm dedicated to helping investors in claims in all 50 states against their financial professional or brokerage firm. Since the firm launched in 2010, it has handled over 700 FINRA arbitration cases. The firm has offices in Seattle, Washington and Chicago, Illinois and reviews securities cases across the country.