Introduced to improve transparency and investor protection, FINRA Rule 4512 plays a crucial role in regulating customers’ account information. Broker-dealers must collect and maintain key details about their clients to make informed and ethical investment recommendations.

This rule ensures that firms are accountable for accurate documentation and better equipped to recognize financial red flags. That’s why FINRA 4512 and preventing elder fraud go hand in hand.

What is FINRA Rule 4512?

FINRA Rule 4512 is a regulatory requirement that requires broker-dealers to make and keep records of the “essential facts” about each customer’s account. The rule is designed to ensure that broker-dealers have accurate and up-to-date information about their customers and their investment objectives, enabling them to provide appropriate recommendations and advice.

Under FINRA Rule 4512, broker-dealers must obtain and maintain the customer’s:

- Name

- Address

- Telephone number

- Date of birth

- Employment status

- Occupation

- And the name and address of any employer or other financial institution with which the customer has an account.

Trusted Contact System

Brokerage firms are also required to know the customer’s investment objectives and any other information the broker-dealer considers necessary to make suitable recommendations.

The rule also requires broker-dealers to make and maintain a record of any information they obtain about a customer’s investment experience, financial situation, and risk tolerance. Amendments to FINRA Rule 4512 also require brokerage firms to make reasonable efforts to implement a “trusted contact” system into their customer accounts.

This rule requires members to update the trusted contact information for accounts subject to the requirements in Exchange Act Rule 17a-3. Specifically, FINRA Rule 4512(c) provides that a member is required to make reasonable efforts to obtain and/or to update, where appropriate, the name of and contact information for a trusted contact consistent with the requirements in Exchange Act Rule 17a-3(a)(17).

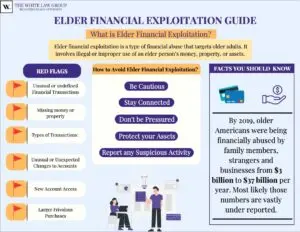

FINRA 4512 and Elder Fraud

FINRA Rule 4512 is an essential tool for protecting seniors from financial exploitation. These individuals are often targeted by fraudsters and scammers who attempt to exploit their economic vulnerability. FINRA 4512 can help ensure that broker-dealers have accurate and up-to-date information about their clients, enabling them to detect and prevent elder fraud and other serious issues.

FINRA Rule 4512 is an essential tool for protecting seniors from financial exploitation. These individuals are often targeted by fraudsters and scammers who attempt to exploit their economic vulnerability. FINRA 4512 can help ensure that broker-dealers have accurate and up-to-date information about their clients, enabling them to detect and prevent elder fraud and other serious issues.

The rule requires broker-dealers to obtain and maintain essential facts about each customer’s account, including the customer’s age and investment objectives. For senior customers, broker-dealers must also consider their specific needs and concerns, including any health or financial issues that may impact their investment decisions.

Broker-dealers are also required to establish and maintain procedures to detect and report financial exploitation of senior customers. These procedures may include:

- Placing holds on disbursements or transactions

- Contacting a trusted contact person designated by the customer

- Reporting suspicious activity to the relevant authorities

Additionally, FINRA has issued specific guidance to broker-dealers regarding the protection of senior investors. This includes the requirement for training staff to identify and report suspected financial exploitation of seniors. These measures help ensure that seniors are protected and investment professionals are fulfilling their responsibilities to their clients.

FINRA Rule 2165 Financial Exploitation of Adults and “Trusted Contact”

FINRA proposed some changes to the rule in 2017 due to concerns about senior exploitation. FINRA Rule 2165 (Financial Exploitation of Specified Adults) and amendments to FINRA Rule 4512 (Customer Account Information) became effective in February 2018. These two rules work together to ensure firms pay closer attention to seniors and other specified adults who may be potential victims of fraud and abuse.

A trusted contact is a person designated by the customer whom the broker-dealer can speak with if the customer becomes incapacitated or is suspected of financial exploitation. This person’s role is to provide information about the customer’s health status or financial situation. This may help the broker-dealer make decisions that are in the best interest of the customer.

Protecting Vulnerable Seniors

FINRA Rule 4512 and FINRA Rule 2165 are both designed to help protect vulnerable investors, including seniors, from financial exploitation. However, they differ in their specific requirements and application.

FINRA Rule 2165 permits broker-dealers to place temporary holds on disbursements or transactions from the accounts of specific customers if there is a reasonable belief of financial exploitation. The rule allows broker-dealers to put a temporary hold on disbursements or transactions if they suspect that a customer is being exploited, and to notify a trusted contact person designated by the customer.

The key difference between the two rules is that FINRA Rule 4512 is a record-keeping requirement. At the same time, FINRA Rule 2165 provides a mechanism for broker-dealers to take action in response to suspected financial exploitation. Rule 4512 requires broker-dealers to obtain and maintain essential information about their customers, while Rule 2165 allows broker-dealers to take action if they suspect that a customer is being exploited.

FINRA Rule 4512 Violations

Examples of brokers or firms who have been disciplined by FINRA for violations of FINRA Rule 4512 in the past include:

- A broker-dealer that failed to establish and maintain adequate procedures to detect and report potential financial exploitation of senior customers.

- A registered representative who failed to update customer account information, including the customer’s address and employment status, for several years.

- A broker who made unsuitable investment recommendations to a customer despite having inaccurate or incomplete information about the customer’s investment objectives and financial situation.

- A firm that failed to obtain the required documentation to verify the identity of new customers.

These are just a few examples of potential violations of FINRA Rule 4512. FINRA takes breaches of its rules very seriously and imposes disciplinary actions against individuals and firms who don’t comply with its requirements. Broker-dealers need to understand and comply with all applicable laws and regulations, including Rule 4512, to protect investors and maintain the integrity of the securities industry.

Frequently Asked Questions

What are the record-keeping requirements under FINRA Rule 4512?

Under FINRA Rule 4512, broker-dealers must maintain “essential facts” about their customers. That information can include their name, date of birth, employment status, contact information, and investment goals. These aren’t just formalities—they provide a pivotal foundation for brokers to make suitable investing-related recommendations to those they serve. Proper documentation ensures that a broker or firm can answer record-keeping questions from regulators during FINRA arbitration proceedings.

How does the trusted contact system help prevent customer exploitation?

This system is a response to the understandable concern about financial abuse involving elderly individuals. Under Rule 4512, broker-dealers must make a reasonable effort to obtain contact details of a trusted person who can be reached when concerns arise about an investor’s health and/or decision-making abilities.

The trusted contact won’t have access to an investor’s account. Instead, their role is to serve as a vital communication link between broker-dealers and their clients when things are uncertain.

Why is customer identification a significant focus in enforcing FINRA Rule 4512?

This type of identification is a cornerstone of Rule 4512 compliance. Before opening an account, broker-dealers must verify the information they receive from customers. Not only does this help eliminate fraudulent account-related actions, but it also enables firms to tailor their recommendations better.

Get Your Free Consultation

When disputes arise between investors and securities firms or brokers, they may be required to resolve their differences through FINRA arbitration. FINRA arbitration is a process in which an impartial arbitrator or panel of arbitrators is appointed to hear the dispute and render a decision.

The White Law Group assists clients in navigating the arbitration process and represents their interests throughout the proceedings. This can include preparing and filing the initial claim, conducting discovery, presenting evidence and arguments at the hearing, and appealing the decision if necessary.

In addition to their knowledge of FINRA rules and procedures, the FINRA attorneys at the White Law Group also have experience in securities law and litigation. They can provide valuable guidance to clients on the strengths and weaknesses of their case, the likelihood of success, and the potential risks and rewards of pursuing arbitration.

If you have an investment-related dispute, the securities attorneys at the White Law Group may be able to help you. The White Law Group, LLC, is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm dedicated to helping investors in claims against their financial professional or brokerage firm in all 50 states. Since the firm launched in 2010, it has handled over 800 FINRA arbitration cases.