Are Private Placement Investments Suitable for you?

Did your financial advisor recommend investing in private placements in Regulation D (Reg D)? If you are not an accredited investor, this type of investment may not suit you. If you suffered investment losses in a Reg D private placement, the securities fraud attorneys at The White Law Group may be able to help you. If you have ever asked, “How do private investments work?” continue reading to learn more and for some examples of private placement investments.

Table of Contents

ToggleWhat is a Reg D Private Placement Investment?

Reg D is a set of rules established by the U.S. Securities and Exchange Commission (SEC) under the Securities Act of 1933. It provides exemptions from the registration requirements for specific private securities offerings. Reg D aims to raise capital for small businesses and startups by allowing them to raise funds from accredited investors without going through the rigorous and costly process of a complete public offering. Regulation D provides three main exemptions from registration requirements:

- Rule 504: This exemption allows companies to offer and sell up to $5 million of private placement investment securities within a 12-month period. Small businesses and startups often use it to raise funds locally or in a single state.

- Rule 505: This exemption allows companies to offer and sell up to $5 million of securities within a 12-month period, but it imposes certain restrictions on the type of investors who can participate. Companies can sell securities to an unlimited number of accredited investors (wealthy individuals or institutions meeting specific criteria) and up to 35 non-accredited investors who meet particular sophistication requirements.

- Rule 506: This exemption is the most common and offers two options for private placement investments:

- Rule 506(b): A company can raise unlimited funds without general advertising or solicitation under this option. It can sell securities to unlimited accredited investors and up to 35 non-accredited investors who specify sophistication requirements.

- Rule 506(c): This option allows companies to engage in general advertising or solicitation to attract investors but only restricts the offering to accredited investors. Companies must take reasonable steps to verify the accredited status of the investors.

While Regulation D provides exemptions from registration, this doesn’t mean that private placement investments are exempt from all securities laws. Companies must still comply with anti-fraud provisions and provide investors with accurate and complete information.

How Do Private Placement Investments Work?

Companies choose Reg D exemptions that align with their needs and investor criteria. They prepare legal documentation, including private placement memoranda outlining investment opportunities and risks.

Depending on the exemption chosen, companies may verify the accredited investor status of potential investors and, if permitted, market the private placement investment opportunity through general solicitation. Interested investors review the PPM, commit funds through a subscription agreement, and, upon reaching a target, the company closes the offering. The raised funds are used for stated business purposes, and ongoing communication with investors is maintained.

Examples of Private Placements:

- Limited Liability Companies (LLC)

- Non-Traded Real Estate Investment Trust (REIT)

- Hedge Funds

- Equipment Leasing Agreements

- Tenants-in-Common

- 1031 DST (Delaware Statutory Trust)

- Oil and Gas Limited Partnerships

- Non-traded Business Development Company (BDC)

The Risks Private Placement Investments under Regulation D

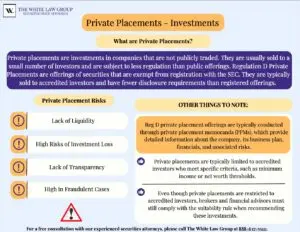

Reg D private placement offerings are typically conducted through private placement memoranda (PPMs), which provide detailed information about the company, its business plan, financials, and associated risks.

While they can offer potentially high returns, there are several examples of risks associated with investing in Reg D private placements, including:

- Limited liquidity: Reg D private placement investments are not publicly traded, so investors have limited liquidity. This can make selling your investment challenging if you need to access your funds quickly.

- Lack of transparency: Private companies are not required to disclose the same information as publicly traded companies, so investors may not have access to all the information they need to make informed decisions.

- High risk: Private placement investments are generally considered high-risk investments because startups or companies often offer them with a limited operating history. These companies may have a higher risk of failure and be more susceptible to market fluctuations.

Limited regulatory oversight: Reg D private placements are exempt from many publicly traded securities regulations, so investors may have limited legal recourse if something goes wrong. - Potential for fraud: Because private placement investments are not subject to the same level of regulatory oversight as publicly traded securities, there is a greater risk of fraud or misrepresentation.

Suitability Rule and Regulation D Private Placements

The suitability rule is commonly referred to as FINRA Rule 2111 or the Suitability Rule. FINRA stands for the Financial Industry Regulatory Authority, a self-regulatory organization that oversees brokerage firms and brokers in the United States. FINRA Rule 2111 sets forth the obligations and standards your broker must follow when recommending private placement investments.

Private placements are typically limited to accredited investors who meet specific criteria, such as minimum income or net worth thresholds. The suitability rule acknowledges that accredited investors may have a certain level of financial sophistication and risk tolerance that may make private placements suitable for them.

Even though private placements are restricted to accredited investors, brokers and financial advisors must still comply with the suitability rule when recommending Regulation D private placement investments. They must assess whether a private placement suits the individual accredited investor based on their specific financial circumstances and investment objectives.

Complex, High-Risk Investments

Reg D Private placements can be inherently risky due to their illiquid nature, limited transparency, and concentrated exposure. Brokers and financial advisors are responsible for evaluating the risks involved with private placements and determining whether the investment aligns with the client’s risk tolerance. They must also ensure investors understand the risks and can withstand potential losses.

Private placement investments often require extensive disclosure documents, such as private placement memoranda (PPMs), offering circulars, or prospectuses. Brokers and financial advisors must review these documents and ensure the investor receives all necessary information to make an informed investment decision. They should also disclose key facts about the investment, such as the issuer’s business, financial condition, risk factors, and any conflicts of interest.

The White Law Group has represented numerous investors in Regulation D private placement investment claims.

Reg D Private Placement Investors may have Claims

When brokers violate securities laws, such as making unsuitable private placements, the brokerage firm they work with may be liable for investment losses through FINRA Arbitration.

FINRA Dispute Resolution is an arbitration venue for investors with claims against their brokerage firm or financial professional. It allows investors to attempt to recoup their private placement investment losses and is an alternative to filing such claims in court. For more information, please visit FINRA Arbitration Attorney.

Free Consultation

If you invested in a Regulation D private placement and have suffered significant losses, please contact the securities attorneys of The White Law Group at 888-637-5510 for a free consultation.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm with offices in Chicago, Illinois, and Seattle, Washington.

Our firm has handled over 700 FINRA arbitration claims involving unauthorized trading, unsuitable private placement investments, fraud, negligence, churning/excessive trading, and improper use of margin.

For more information on The White Law Group, visit https://whitesecuritieslaw.com.

Frequently Asked Questions

Suppose your broker encouraged you to invest in a high-risk investment vehicle despite knowing you lacked the experience as an investor to understand its risk. In that case, you should collect relevant documentation, including account statements and communications with your broker. Once you have done so, contact the broker-deal and share your concerns. They may have an existing dispute resolution process between brokers and their clients. If they do not or refuse to cooperate with you, contact a securities attorney. They can assess the strength and inform you of its likelihood of success.

If you have suffered significant losses after making an unsuitable investment, several potential options are available. This includes:

- Filing a FINRA arbitration claim

- Seeking damages for fraud, misrepresentation, or negligence in a civil court

A securities attorney can evaluate your case and determine whether FINRA arbitration or a traditional court will yield a successful outcome for your case.