Investment Losses from Broker Churning? The Broker Churning Attorneys at The White Law Group can Help.

The investment-churning attorneys at The White Law Group continue to file claims on behalf of investors whose brokers or financial advisors defrauded them.

Table of Contents

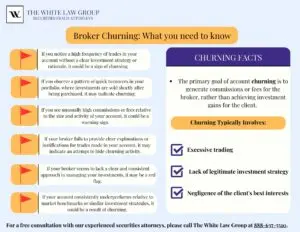

ToggleChurning refers to a deceptive practice where a broker or financial advisor primarily buys and sells securities within a client’s account to generate commissions for themselves rather than serving the client’s best interests. It involves unnecessary and excessive trading activity not justified by the client’s investment objectives or financial situation. If you have suffered investment losses from broker churning, you may need an experienced churning attorney. Investment churning primarily aims to generate commissions or fees for the broker rather than achieving investment gains for the client.

Broker churning typically involves the following:

- Excessive trading: The broker trades too much within a client’s account, often without a legitimate investment purpose. The frequency and turnover of transactions are far beyond what is necessary for the client’s investment goals and may result in investment losses from broker churning.

- Lack of legitimate investment strategy: The trades conducted by the broker are not based on the client’s investment objectives or financial needs. Instead, they are primarily driven by the desire to generate commissions or fees for the broker.

- Negligence of the client’s best interests: The broker fails to act in the client’s best interests, disregarding their investment goals, risk tolerance, and financial circumstances. Excessive trading activity is not aligned with the client’s long-term investment strategy and can sometimes lead to investment losses from broker churning.

Broker churning is considered securities fraud because it violates various securities laws and regulations, including those established by regulatory agencies such as the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC). It breaches the broker’s fiduciary duty to act in the best interests of their clients and involves deceptive practices to generate financial gain for themselves.

Investors who fall victim to broker churning may suffer from significant investment losses due to the excessive transaction costs, fees, and potential adverse effects on their investment performance.

Examples of Investment Churning

Here are a few examples of how a broker may churn a customer’s account:

- Excessive Trading: This form of broker churning occurs when a broker consistently buys and sells securities within a client’s account, regardless of the client’s investment goals or financial situation. They may execute numerous trades quickly, resulting in high transaction costs for the client and, ultimately, investment losses from broker churning.

- Unauthorized Trading: A broker places trades without obtaining proper authorization from the client. They may excessively trade in the client’s account without their knowledge or consent, aiming to generate commissions or fees.

- Frequent Switching: A broker frequently switches the client’s investments between different securities or products without a legitimate reason. This activity may occur even if the new investments are not suitable for the client’s financial objectives and can result in investment losses from broker churning.

- Inappropriate Investment Recommendations: A type of investment churning in which a broker recommends unsuitable investments to the client, encouraging them to buy or sell securities that do not align with their investment goals or risk tolerance. This can lead to unnecessary trading within the account.

- Ignoring Investment Objectives: A broker disregards the client’s stated investment objectives and instead focuses on generating commissions. They may engage in excessive trading to maximize compensation without considering the client’s long-term interests. Ignoring a client’s long-term goals can lead to investment losses from churning.

- Failure to Diversify: A broker fails to diversify the client’s portfolio adequately and instead concentrates their investments in a few securities. Excessive concentration in a limited number of assets increases the risk exposure of the customer’s portfolio.

If you suspect broker churning, you should seek counsel from the experienced churning attorneys at The White Law Group. If you have suffered investment losses from broker churning, you can recover your losses by filing a FINRA arbitration claim against your brokerage firm.

Regulators Sanction Merrill Lynch for Investment Churning

In 2020, Charles Kenahan, a former financial advisor with Merrill Lynch, faced accusations of churning, excessive commissions, and unauthorized trades. The New Hampshire Bureau of Securities Regulation reached a $26 million settlement with Merrill Lynch over its alleged failure to supervise Kenahan’s activities. As part of the settlement, Merrill Lynch was fined $1.75 million, and an additional $250,000 was imposed for its supervision failure. Some of Merrill Lynch’s clients suffered investment losses due to Kenahan’s broker churning.

Kenahan was reportedly barred from participating in the state securities business. The majority of the settlement, $24.25 million, goes to a high-net-worth Merrill Lynch client in New Hampshire, marking the state’s most significant monetary sanction. Merrill Lynch had settled for $40 million in 2019 with another investor over similar allegations against Kenahan. According to FINRA BrokerCheck, Kenahan was registered with Merrill Lynch from 2007 until 2019, when he faced allegations from clients of broker churning in the form of unauthorized and excessive trading and unsuitable investment recommendations, resulting in investment losses.

How do I know if my Broker is Churning my Account?

Red Flags of Broker Churning

If you notice a high frequency of trades in your account without a clear investment strategy or rationale, this could be a sign of churning.

- Observing a pattern of quick turnovers in your portfolio, where investments are sold shortly after purchase, may indicate investment churning.

- If you see unusually high commissions or fees relative to the size and activity of your account, it could be a warning sign, regardless of whether you suffer from investment losses because of the broker churning.

- Have you observed any unusual activity in your account, such as large transfers or withdrawals, that do not align with your investment strategy or rationale? This could indicate churning.

- Did your broker fail to provide clear explanations or justifications for trades made in your account? It may indicate an attempt to hide churning activity.

- This is a red flag if your broker does not clearly and consistently manage your investments.

- Is your account consistently underperforming relative to market benchmarks or similar investment strategies? This could be due to churning.

- Did you find trades in your account that you did not authorize or were unaware of? This serious red flag of broker churning warrants immediate attention and investigation, even if you do not immediately experience investment losses from these trades.

These signs alone may not prove broker churning, as some brokers may engage in legitimate active trading strategies. However, if you observe several of these red flags and have concerns about your broker’s activities, you should consider consulting with an experienced churning attorney. You may be able to recover your investment churning losses through FINRA Arbitration.

FINRA Arbitration may be the Answer

FINRA (Financial Industry Regulatory Authority) arbitration allows investors to seek resolution and potential compensation for claims related to securities fraud, including investment losses from broker churning. FINRA is a self-regulatory organization that oversees brokerage firms and their registered representatives in the United States. The churning attorneys at The White Law Group help investors recover money from broker misconduct and securities fraud through the FINRA arbitration process.

FINRA Rules for Churning Claims: How does it work?

When you open an account with a brokerage firm, you typically sign an agreement with a mandatory arbitration clause. This means that any disputes between you and the brokerage firm must be resolved through arbitration rather than court, including those related to investment losses from broker churning.

To initiate the process, our experienced investment churning attorneys will help you file a Statement of Claim with FINRA, outlining the details of your case, including the alleged broker churning and the losses you have suffered. The claim will specify the amount of compensation you are seeking. FINRA will appoint a panel of arbitrators to hear your case. The panel typically consists of three arbitrators, including both public (non-industry) and industry arbitrators with experience and expertise in securities matters, including those involving clients who suffered investment losses from broker churning.

The arbitration hearing is similar to a trial but with less formal procedures. Both parties present their evidence, including documents, testimonies from witnesses, and expert opinions. The arbitrators review the evidence and decide based on the facts and laws. The decision is known as an award. The award may include a monetary award that compensates you for your investment losses from broker churning, including any associated costs, fees, and interest. The decision of the arbitration panel is binding and enforceable.

FINRA arbitration provides an accessible and efficient forum for resolving disputes related to securities fraud, including investment churning. It offers a streamlined process that often leads to faster resolutions than traditional court litigation. However, it’s essential to consult with an experienced churning attorney to guide you through the process and ensure that your rights are protected and that you are justly compensated for your investment losses from broker churning.

How Attorneys Can Prove a Broker Churning Claim

According to FINRA rules for churning claims, three essential elements must be proven by churning attorneys to win. Those elements are (1) control, (2) excessive trading, and (3) scienter (see, e.g., In re Al Rizek, Securities Exchange Act Release No. 41725, In re Joseph J. Barbato, Securities Exchange Act Release No. 41034), Craighead v. E.F. Hutton & Co., 899 F.2d 485, 489 (6th Cir. 1990).

(1) Control

In a FINRA arbitration case, if a broker is to be found liable for causing their client investment losses from churning or excessively trading an account, the arbitration panel must first find that the broker had either express or implied control over the account. For example, if the advisor and not the client directed the excessive trading. This issue is at the heart of all investment churning claims.

The easiest way to prove control is when the client gives the stockbroker or financial advisor discretionary authority to trade the account by signing a discretionary trading agreement. When such an agreement exists, proving a client’s investment losses stemmed from broker churning is simpler.

More typically, control is established by demonstrating that the broker had “de facto” control of the account through testimony, evidence, or course of conduct evidence. For example, suppose it can be demonstrated that the client followed the broker’s recommendations in most transactions. In that case, this is considered sufficient evidence to establish that the broker had “control” over the account, thus increasing the likelihood of the panel ruling that a client’s investment losses were from broker churning. See, e.g., District Business Conduct Committee v. Daniel Wright Sisson, NASD Decision, Complaint No. C01960020 (De facto control of an account may be established where the client habitually followed the broker’s advice).

Another factor in determining control in investment-churning cases is the client’s ability to understand and evaluate whether the financial advisor’s recommendations are appropriate. Factors that panels generally look at in determining whether the client had this ability, which would make them ineligible to be compensated for their investment losses from broker churning, include sophistication, formal education, and occupation, prior or contemporaneous securities investment experience, the customer’s reading habits, the wealth of a customer relative to the size of the account and the client’s reliance/dependence on the broker’s advice. See, e.g., Carras v. Burns, 516 F.2d 251, 258 (4th Cir. 1975) (“[A] customer retains control of his account if he has sufficient financial acumen to determine his own best interests and he acquiesces in the broker’s management”).

An investor’s level of sophistication is key to whether they will eventually be able to recover investment losses from broker churning. Suppose it can be demonstrated that the investor lacked the sophistication to trade their account and relied entirely on the financial advisor’s advice. This is generally sufficient to establish that the financial advisor had “de facto” control over the account.

(2) Excessive Trading

The second element of an investment churning claim is demonstrating that the account was excessively traded (or churned). Determining whether there is excessive trading in an account, and thus whether an investor is eligible to recover their investment losses from broker churning, depends entirely on the type of account, the investor involved, and the account’s investment objectives. For example, the trading volume necessary to prove that an aggressive day trader’s account was churned (versus a retired investor living on a monthly budget) is considerably higher. Case law generally establishes that excessive trading may only be gauged considering the nature of the account, the dominant element of which is the client’s investment objective. Clients with more aggressive portfolios may have difficulty proving their investment losses were from broker churning. For example, FINRA Rule 2111 regarding suitability states that churning may be evident if trading occurred that was not consistent with the client’s financial goals, risk tolerance, and knowledge of investment strategies.

Once the risk tolerance and general nature of the account are determined, a quantitative analysis of the trading in the account is conducted to decide whether or not it was excessively traded.

Turnover Ratio – Level of Investment Churning

To determine whether the trading in a particular account rises to the level of broker churning and, ultimately, whether an investor can recover their investment losses from it, an analysis often used is the calculation of a “turnover ratio.” A turnover ratio is the total number of purchases the account makes divided by the average monthly equity. That ratio is then annualized (dividing the result by the number of months involved to get a per-month ratio, then multiplying that result by 12). Courts have often recognized that a turnover ratio of more than 6 in a regular retail account can be considered excessive trading and, thus, potentially grounds clients to recover their investment losses from broker churning. See, e.g., Arceneaux, 767 F.2d at 1502 (“The courts which have addressed this issue have indicated that an annual turnover rate over six reflects excessive trading.”).

Courts have also found that in retail securities accounts, for a conservative investor, an annualized turnover rate of two is suggestive, of four is presumptive, and of six or more is conclusive of excessive trading, making it more likely that a client will be able to convince the panel their investment losses were from broker churning. See, e.g., 68 N.C.L. Rev. 327, 339-40 (1990), noting the “six” rule and the “2-4-6? Rule.

An alternative method used in investment churning cases is the C/E Ratio or commission-to-equity ratio. The C/E Ratio is calculated by dividing the total commissions in the account by the average equity and then annualizing the result.

Both methods are intended to establish the same basic principle – that the trading in the account was designed to benefit the broker through the creation of commissions, and the trading strategy may cause the client investment losses from churning on the part of their broker.

(3) Scienter (Specific Intent to Defraud)

Finally, you must establish a scienter or intent to win an account churning claim. Your churning attorneys must also demonstrate that the financial advisor excessively traded the account with the specific intent to defraud, or at least with reckless disregard for the interests of the client. Churning involves a conflict of interest in which a broker or dealer seeks to maximize their commissions by disregarding the customer’s interests–particularly if clients suffer investment losses from this broker churning.

If the level of trading is egregious, that may be enough to satisfy the scienter element. Scienter separates investment churning from excessive trading. See, e.g. In re Donald A. Roche, Securities Exchange Act Release No. 38742. See, also, Franks v. Cavanaugh, 711 F. Supp. 1186 (S.D.N.Y. 1989) (the mere fact that the account was churned is typically sufficient to a scheme or artifice to defraud within the meaning of 10b-5). When the intent to defraud is determined, clients will likely recover their investment losses from broker churning.

Establishing a scienter with excessive trading rather than account churning can be more challenging. However, arbitration panels can often recognize when an unscrupulous financial advisor is trading to maximize commissions. This is usually established by discussing the financial advisor’s industry track record (FINRA BrokerReport, or CRD). For example, suppose a financial advisor has previously been sued for churning or excessive trading. In that case, it is not difficult for an arbitration panel to determine that the broker was again acting with the scienter in excessively trading the account now at issue, thus increasing the likelihood of a client receiving compensation for their investment losses from broker churning.

FINRA Rules for Investment Churning Claims

The primary FINRA Rule used at arbitration hearings when discussing broker churning is FINRA Rule 2111 regarding suitability.

FINRA Rule 2111 requires that a broker-dealer or associated person “have a reasonable basis to believe that a recommended transaction or investment strategy involving a security or securities is suitable for the customer, based on the information obtained through the reasonable diligence of the [firm] or associated person to ascertain the customer’s investment profile.” The customer’s investment profile is critical in determining whether they will receive damages from their investment losses due to broker churning. In general, a customer’s investment profile would include the customer’s age, other investments, financial situation and needs, tax status, investment objectives, investment experience, investment time horizon, liquidity needs, and risk tolerance.

For excessive trading cases, FINRA Rule 2111 also has a quantitative suitability standard that applies. Quantitative suitability requires a broker who has actual or de facto control over a customer account to have a reasonable basis for believing that, considering the customer’s investment profile, a series of recommended transactions, even if suitable when viewed in isolation, are not excessive and unsuitable for the customer seeking to recover investment losses from broker churning. Factors such as turnover rate, cost-to-equity ratio, and use of in-and-out trading in a customer’s account may provide a basis for finding excessive activity at issue.

Investment churning is a relatively blatant violation of Rule 2111 because, if proven, account churning can never be suitable.

What Kind of Damages can I expect to Recover?

Typically, the damages in a broker churning case are any excessive commissions or expenses the client paid and any actual investment losses to the client’s portfolio from broker churning. See, e.g., Securities Regulation & Law Report, Volume 35, Number 10, ISSN 1522-8797. In an upward-moving market, an investor may also be entitled to the market gain that should have been experienced had the account been appropriately invested.

Because of the number of trades involved in a typical investment churning case, damages are usually best proven by churning attorneys through expert reports that analyze the gains, losses, and commissions of every trade and break the results in a format that is easy for the FINRA arbitration panel to understand and thus reward a client compensation for the investment losses from broker churning they experienced. These reports vary in cost depending on the expert and the number of trades involved, but churning cases are virtually impossible to prove without them.

Common Brokerage Firm Churning Defenses – Who controlled the Account?

Although the parties are likely to agree on the approximate amount of damages and the respective turnover ratio or P/E ratio, brokerage firms usually defend investment churning cases by fighting the “control” element of the claim.

For example, firms often attempt to argue that the investor directed the account and the firm followed the client’s instructions, thus making the client ineligible to recover investment losses from broker churning. Once again, the client’s background is essential here because it is more difficult for a FINRA arbitrator to believe that an 80-year-old retiree was day trading their account than a 40-year-old high-income executive.

Brokerage firms will often attempt to paint the client as highly sophisticated and capable of understanding the trading involved and exercising control over the account, rendering their claim of suffering investment losses from broker churning invalid. See, e.g., Follansbee v. Davis, Skaggs & Co., 681 F.2d 673, 677-78 (9th Cir. 1982) (no control by a broker where the customer had a degree in economics, read and understood corporate financial reports, and regularly read investment literature), and Newburger, Loeb & Co., Inc. v. Gross, 563 F.2d 1057, 1070 (2d Cir. 1977), cert—denied, 434 U.S. 1035 (1978) (no control by broker where customer had post-graduate degree, years of experience in the market, and subscribed to investment services).

The Second Typical Defense in Investment Churning Cases

Suppose a brokerage firm cannot establish that the client who claims to have suffered investment losses from broker churning had control of the account. In that case, the second typical defense seen in these cases is the affirmative defenses of ratification, waiver, and estoppel. These legal theories state that a customer cannot wait to see whether an investment proves to be profitable or unprofitable before he complains that the transaction was unauthorized or that the trading was excessive.

A customer who is seeking to receive damages for investment losses from broker churning and who receives trade confirmation slips, monthly account statements, or other information reflecting that transactions have occurred and the nature and frequency of those transactions, and who fails to complain in a timely fashion, may have his claims barred under the doctrines of ratification, waiver, and estoppels. See, e.g., Brophy v. Redivo, 725 F.2d 1218 (9th Cir. 1984) (If the customer receives confirming documents and does not object, by his silence, he has ratified the trades or waived his claim).

At the hearing, brokerage firms will typically examine the investor who claimed to suffer investment losses from broker churning by going through the confirmation slips that were provided and asking why the investor did not immediately complain if they knew that the trading strategy implemented was not what they wanted and thus a form of investment churning. The counter to this argument is the ruling of the Court in Hecht v. Harris Upham, which stated: “that while confirmation slips were sufficient to inform plaintiff of the specific transactions made, they were not sufficient to put her on notice that the trading of her account was excessive.” Hecht v. Harris Upham & Co., N.D. Cal. 1968.

Investment losses from broker churning cannot be disproven based on the receipt of these slips alone. The mere fact that confirmation slips were provided to the client is not determinative. A ratification or waiver defense can fail if the customer proves he did not have all the material facts relating to the trade. See, e.g., Davis v. Merrill Lynch, Pierce, Fenner & Smith, Inc., 906 F.2d 1206, 1213 (8th Cir. 1990). However, the longer the investor allows the investment churning of an account, the more difficult it is to counter the ratification argument and recover investment losses from broker churning or to demonstrate that the broker hid the true nature of the trading strategy.

Brokerage firms will also attempt to argue against controlling the account if the confirmation slips are marked as “unsolicited,” meaning that the customer allegedly ordered many of the transactions without ever having had the securities called to their attention by the stockbroker. Whether the confirmation slips were the customer’s idea is often a credibility battle, as the client seeking damages for their investment losses from broker churning will likely testify that the trades were the broker’s idea. The broker will claim that the trades were the client’s idea.

Documents Needed to Prove Investment Churning Claims

For broker churning claims, the following documents are needed in addition to typical FINRA Arbitration claim documents:

- All commission runs relating to the customer’s account(s) at issue or, in the alternative, a consolidated commission report relating to the customer’s account(s) that allegedly experienced investment losses from broker churning.

- All documents reflecting compensation of any kind, including commissions, from all sources generated by the Associated Person(s) assigned to the customer’s account(s) for the two months preceding through the two months following the transaction(s) at issue, or up to 12 months, whichever is longer.

- Documents sufficient to describe or set forth the basis upon which the Associated Person(s) was compensated during the years in which the transaction(s) or occurrence(s) in question occurred. This shows whether the investment losses from broker churning were connected to an incentive for the broker and include a) any bonus or incentive program and b) all compensation and commission schedules showing compensation received or to be received based upon volume, type of product sold, nature of trade (e.g., agency v. principal), etc.

- All confirmations for the customer’s transaction(s) at issue in the investment churning claim.

- All agreements with the customer, including, but not limited to, account opening documents, cash, margin, and option agreements, trading authorizations, powers of attorney, or discretionary authorization agreements, and new account forms.

- All account statements for the customer’s account(s) that experienced investment losses from alleged broker churning during the period and/or relating to the transaction(s) at issue.

Additional Case Law / Authority for Broker Churning Claims

In re Daniel L Zessinger, Initial Decision Release No. 94 (Aug. 2, 1996) – For conservative investors, a turnover rate of two [annually] suggests excessive trading; four is presumptively excessive trading, and six is conclusive of excessive trading.

In re Application of Rafael Pinchas, Review of Disciplinary Action Taken by the NASD, Securities and Exchange Act Release No. 41816 (Sept. 1, 1999) – In and out trading is a practice challenging for a broker to justify and can, by itself, provide a basis for finding excessive trading.

In re Wayne Miller, Securities Exchange Act Release No. 25520 – A broker has de facto control over a customer’s account if the customer cannot evaluate the broker’s recommendation and exercise independent judgment.

In re Joseph J. Barbato, Securities Exchange Act Release No. 41034 – Investment Churning occurs when a broker enters into transactions and manages a client’s account to generate commissions rather than further his client’s interests.

In re David Wong’s application, Securities Exchange Act Release No. 45426, the scienter element of broker churning may be inferred from the commissions the registered representative charges.

Carras v. Burns, 516 F.2d 251, 258, 259 (4th Cir. 1975) – In the absence of an express agreement, control may be inferred from the broker-customer relationship when the customer cannot manage the account and must take the broker’s word for what is happening

Hecht v. Harris Upham & Co., N.D. Cal. 1968—The requisite degree of control is met when the client follows the broker’s recommendations.

Hotmar v. Lowell H. Listrom & Co., 808 F.2d 1384 (10th Cir. 1987) (no control by the broker where evidence showed customer owned several businesses and rental property, spoke with broker almost daily, knew how to use broker’s computer, and occasionally rejected broker’s recommendations).

National Investment Churning Attorneys

Broker churning claims can be complex and sometimes challenging to prove and recover investment losses from them. Brokerage firms almost always hire experienced securities defense firms to defend them in these claims.

If you believe that you are the victim of account churning by your brokerage firm or financial advisor, please contact the experienced churning attorneys at The White Law Group at 888-637-5510.

The White Law Group, LLC is a nationally recognized law firm specializing in securities fraud, securities arbitration, investor protection, and securities regulation/compliance. Our primary commitment is to assist investors across all 50 states in pursuing claims against their financial professionals or brokerage firms, including those suffering investment losses from broker churning. Since our establishment in 2010, we have successfully filed over 700 FINRA arbitration claims.

Our firm is dedicated to representing investors in various securities-related claims. These include cases involving stock fraud, broker misrepresentation, investment churning, unsuitable investments, selling away, unauthorized trading, and various other securities issues.

With a wealth of experience exceeding 30 years in securities law, The White Law Group possesses the knowledge and skills to help you recover your investment losses. To learn more about our services and how we can assist you, please visit our official website at whitesecuritieslaw.com.

Frequently Asked Questions

Consider the following factors if you are evaluating whether your broker engaged in account churning or excessive trading:

- Frequency of trades: A high volume of transactions in a short period could indicate churning.

- Turnover Rate: If your account’s investments are frequently replaced, this could signify excessive trading.

- Broker Justification: The broker should be able to connect investment decisions with your broader objectives. If there is a misalignment between the two, excessive trading could result.