FINRA Rule 3210 Protects Investors from Conflicts of Interest

The Financial Industry Regulatory Authority (FINRA) helps to keep investors and their investments safe by enacting rules and publishing guidance for brokerage firms and financial advisors. In 2016, a new rule FINRA 3210, Accounts At Other Broker-Dealers and Financial Institutions, was introduced and approved by the U.S. Securities and Exchange Commission. Rule 407 is now superseded by Rule 3210 in the United States Securities market.

Rule 407, under NYSE, was a law that required a letter for FINRA registered representatives allowing the employee to hold investments in equities or bonds in personal accounts. Rule 407 required the reps to disclose personal bank account information about the account in which they are holding the security. The rule was designed to avoid conflict of interest and protect retail investors.

What is FINRA Rule 3210?

The purpose of FINRA Rule 3210 (and formerly rule 407) is to ensure that registered brokerage firms, brokers and financial advisors are able to avoid any conflicts of interests by maintaining high ethical standards.

The rule also applies to associated persons including people who are related to the employee such as spouses, children, and other family members.

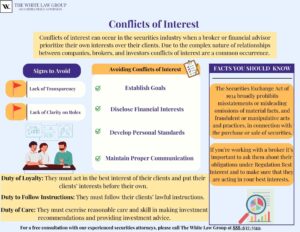

Conflicts of interest refer to situations where a financial professional’s personal interests or obligations may compromise their ability to act in the best interests of their clients. In the context of Rule 3210, conflicts of interest typically involve scenarios where a registered representative or associated person of a member firm participates in private securities transactions or outside business activities.

Examples of Conflicts of Interest

Outside Business Activities: Registered representatives may have outside business activities that could conflict with their obligations to their firm or clients. For example, if a representative has a side business that competes with their firm or provides financial services to clients without proper disclosure, it could create conflicts of interest.

Undisclosed Compensation: Conflicts of interest may arise if a registered representative receives undisclosed compensation, such as referral fees or commissions, for recommending certain investments or products to clients. This can influence the representative’s recommendations and may not be in the client’s best interest.

Personal Investments: Registered representatives may have personal investments or financial interests that conflict with their duties to clients or their firm. For example, if a representative invests in a security they recommend to clients without disclosing their personal stake, it could create conflicts of interest.

Requirements under FINRA Rule 3210

FINRA Rule 3210, Accounts At Other Broker-Dealers and Financial Institutions, states that:

(a) No person associated with a (FINRA) member shall, without the prior written consent of the member, open or otherwise establish at a member other than the employer member, or at any other financial institution, any account in which securities transactions can be effected and in which the associated person has a beneficial interest.

(b) Any associated person, prior to opening or otherwise establishing an account subject to this Rule, shall notify in writing the executing member, or other financial institution, of his or her association with the employer member.

(c) An executing member shall, upon written request by an employer member, transmit duplicate copies of confirmations and statements, or the transactional data contained therein, with respect to an account subject to this Rule.

Stated simply, to avoid conflicts of interest, representatives are required to obtain written permission when opening accounts at other financial institutions where securities transactions take place, including banks or brokerage firms. While a member firm is able to monitor the rep’s activities at own organization, it may not be able to do so at another institution.

FINRA Rule 3210 Letter

In the past, Rule 407 was often referred to as Rule 407 Letter, because the declarations are required in writing. The same can be said for FINRA Rule 3210.

FINRA Rule 3210 requires brokers and financial advisors to declare any outside accounts and notify their member firm in writing when they plan to open any new account where securities transactions take place. The representatives are also required to have consent in writing from their member firms for any outside accounts.

Free Consultation with Securities Attorneys

If you have questions about conflicts of interest or need representation from a FINRA attorney, the securities attorneys of The White Law Group may be able to help. For a free consultation, call the firm’s office at 888-637-5510.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm dedicated to helping investors and financial professionals in claims in all 50 states. Since the firm launched in 2010, it has handled over 700 FINRA arbitration cases.

Our firm represents investors in all types of securities related claims, including claims involving stock fraud, broker misrepresentation, churning, unsuitable investments, selling away, and unauthorized trading, among many others. We also represent financial advisors with employement disputes.

With over 30 years of securities law experience, The White Law Group has the expertise to help you. With offices in Chicago, Illinois and Seattle, Washington, the firm reviews securities fraud cases throughout the country.

Tags: conflicts of interest, FINRA rule 3210, Rule 407 letter, securities fraud attorney Last modified: May 24, 2024