Trading on Margin

Margin trading involves borrowing money from your broker-dealer to buy stocks, with the purchased stocks serving as collateral. When you establish a margin account, you deposit a certain amount of money, known as the “margin,” into the account. Trading “on margin” allows you to increase your buying power and potential profits, but it also raises your risk and potential losses from a margin call. One of the risks of trading on margin is the possibility of losing more money than you initially invested.

To open a margin account, your broker-dealer must obtain your signature and provide you with an agreement that outlines the terms and conditions of the account.

Prior to engaging in margin trading, FINRA (Financial Industry Regulatory Authority) mandates a minimum deposit (margin requirement) equal to the purchase price, although some broker-dealers may require a higher amount. This deposit is referred to as the “margin minimum.” The amount you can borrow, known as the “initial margin,” cannot exceed 50% of the stock’s purchase price.

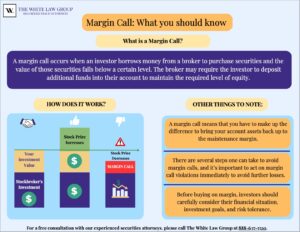

What is a Margin Call?

A margin call occurs when you borrow money from your brokerage firm to purchase securities and the value of those securities fall below a certain level. The broker may require you to deposit additional funds into their account to maintain the required level of equity.

If you are unable to meet the margin call, the broker may sell some or all of the securities in the account to cover the outstanding debt. Margin calls can be costly and can result in significant losses for the investor. It’s important to carefully monitor margin accounts and to have a plan in place for meeting margin calls if they occur.

There are a few reasons why you could receive a margin call.

-You trade for more than the buying power in your account.

-The value of your margin account decreases.

-Your broker raises the house maintenance margin requirements.

If you receive a margin call, it’s important to take action quickly to avoid further losses or penalties. The first step is to review your account and determine the cause of the margin call. You should also review your investment strategy and consider whether it’s appropriate for your financial situation and risk tolerance.

What if I am unable to meet the Margin Call?

If you are unable to meet the margin call with cash or securities, you may need to sell some of your holdings to raise the necessary funds. It’s important to carefully consider which securities to sell and to understand the potential tax implications of selling investments.

If you are unable to meet the margin call and your broker sells securities in your account to cover the debt, you may be subject to additional fees or penalties. It’s important to understand the terms of your margin agreement and to work with your broker to avoid margin calls in the future.

Understanding Margin Call: Examples

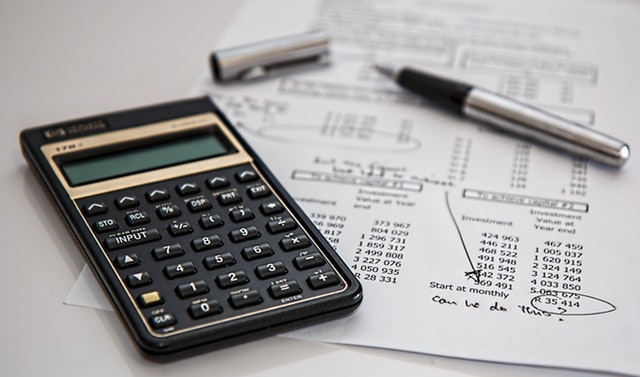

We learned that margin calls are triggered when the value of an account drops below the maintenance level. For example, say you hold five futures contracts that have an initial margin of $12,000 and a maintenance margin of $9,000. When the value of your account falls to $3,500 a margin call will require you to put $5,500 more in your account to return the account to the initial margin level. The margin call is eliminated if you close or sell your futures contract.

Additionally, a change in the value of a margin account decreases an investor’s equity to a level where a broker must issue a margin call. For example, click on the chart below:

How to Avoid Margin Calls

There are several steps one can take to avoid margin calls, and it’s important to act on margin call violations immediately to avoid further losses. Before opening a margin account, investors should carefully consider whether they really need one.

Most long-term investors don’t need to buy on margin to earn solid returns. Plus, the loans are not free of charge. Brokerages charge interest on them. However, if you wish to invest with margin, here are a few things you can do to manage your account and avoid a margin call.

- Monitor your account regularly: Keep a close eye on your account and monitor the value of your securities and the amount of margin you are using. If the value of your securities falls below the required level. You may be at risk of a margin call.

- Set stop-loss orders: Consider setting stop-loss orders on your securities to automatically sell them if their value falls below a certain level. This can help limit your losses and reduce the risk of a margin call.

- Diversify your portfolio: Investing in a diversified portfolio of securities can help reduce your overall risk and limit the impact of any one security on your portfolio.

- Be conservative with your margin: Only borrow what you need and avoid using margin to make speculative investments or to chase high-risk opportunities.

- Keep cash reserved: Maintain a cash reserve in your account to help cover any unexpected margin calls or losses.

Buying on margin can be a useful tool for investors looking to increase purchasing power and potentially boost their returns. However, it’s important to understand the risks involved, including the potential for significant losses and the risk of margin calls.

Before buying on margin, investors should carefully consider their financial situation, investment goals, and risk tolerance. By taking these precautions and organizing your research, you can help reduce your risk of margin call and protect your investments. It is highly recommended to always consult a trusted financial advisor before investing.

Unsuitable Margin Trading

If your broker recommends or engages in margin trading that is not appropriate for your financial situation, investment goals, risk tolerance, or overall investment strategy, that would be considered unsuitable margin trading.

Here are key aspects of unsuitable margin trading:

Risk Tolerance: Brokers are obligated to assess a client’s risk tolerance before recommending margin trading. If the client has a low risk tolerance or cannot afford the potential losses associated with margin trading, it may be unsuitable.

Investment Objectives: Margin trading should align with the client’s investment objectives. If the client’s goals involve long-term growth with minimal risk, engaging in speculative and leveraged margin trading might be unsuitable.

Financial Situation: Brokers need to consider a client’s financial situation, including income, net worth, and liquidity. If the client lacks the financial capacity to cover potential losses, margin trading may be unsuitable.

Investment Knowledge and Experience: If a client is not familiar with margin trading or lacks experience in handling leveraged positions, engaging in such activities may be unsuitable.

Communication and Disclosure: Brokers should communicate the risks associated with margin trading clearly and transparently. If a broker fails to disclose the risks adequately or misrepresents the nature of margin trading, it could be deemed unsuitable.

Excessive Trading (Churning): Excessive trading in a client’s margin account, known as churning, can be considered unsuitable. It may lead to unnecessary fees and risks, primarily serving the broker’s interest in generating commissions.

Client’s Consent: Even if a client has agreed to margin trading, the broker should ensure that the client fully understands the risks involved. If the client’s consent is obtained without adequate disclosure or understanding, it may be considered unsuitable.

Regulatory bodies, such as the Financial Industry Regulatory Authority (FINRA) in the United States, have rules and guidelines in place to prevent unsuitable trading practices.

Do I Need a Securities Fraud Attorney?

Brokers have a duty to recommend investments that are suitable for their clients based on the clients’ individual circumstances. If a broker engages in unsuitable margin trading, it could lead to regulatory sanctions, fines, and potential legal action by the affected clients. Clients who believe they have been subjected to unsuitable margin trading can file complaints with the relevant regulatory authorities and seek legal advice.

The White Law Group’s FINRA arbitration attorneys have handled over 700 FINRA arbitration claims involving unauthorized trading, unsuitable investments, fraud, negligence, churning/excessive trading, and improper use of margin.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm with offices in Chicago, Illinois and Seattle, Washington.

If you are concerned about unsuitable margin trading or a possible losses due to a margin call, the White Law Group may be able to help. For a free consultation with a securities attorney, please call the firm’s office at 312-238-9650.

For information on The White Law Group and its representation of investors in securities claims, visit https://whitesecuritieslaw.com.

Tags: margin trading, what if i get a margin call? Last modified: January 31, 2024