Unauthorized Trading in your Brokerage Account

Have you suffered losses due to broker misconduct or broker negligence? The unauthorized trading attorneys at The White Law Group may be able to help by filing a FINRA Dispute Resolution Claim against your brokerage firm. FINRA is the self-regulator that oversees brokers and brokerage firms.

Table of Contents

ToggleIs your Broker Trading without your Consent?

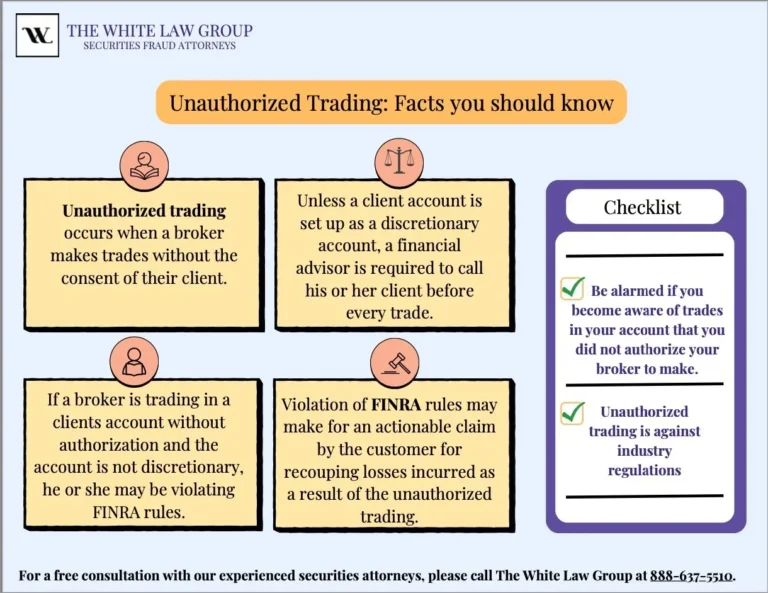

This type of trading in brokerage accounts occurs when a broker buys or sells securities without your prior consent or authorization. Unauthorized trading can happen in various ways, such as when a broker makes trades in your account without your knowledge or approval or when a broker exceeds the trading authority you have granted them.

This form of trading can seriously violate the broker’s duty to act in your best interests. It can also result in financial losses, as the trades made without your knowledge or approval may not align with your investment objectives or risk tolerance.

In addition, unauthorized trading can violate securities industry regulations and rules. Broker-dealers must obtain prior written authorization from their clients before making trades in their accounts and promptly notify them of any trades made in their accounts.

If you suspect misconduct or negligence on the part of your broker, you may have legal recourse to recover any losses incurred as a result. You may recover unauthorized trading losses by filing a FINRA arbitration claim. FINRA can investigate the matter and take disciplinary action against the broker or broker-dealer if necessary. You may want to consider speaking to our experienced unauthorized trading attorneys at The White Law Group, who can guide you through the process.

Discretionary vs Non-Discretionary Accounts

Discretionary and nondiscretionary accounts are two types of brokerage accounts with different levels of control and decision-making authority. Before contacting a securities attorney regarding an unauthorized trading claim, it’s essential to understand your investment account.

A discretionary account is an account in which the broker or investment advisor has the authority to make trades and investment decisions on behalf of the account holder without seeking prior approval for each transaction. In other words, the account owner gives the broker the authority to make investment decisions without consulting the account owner first. It is thus more challenging to prove unauthorized trading, broker misconduct, or negligence since the broker has some authority to act on their client’s behalf. Based on the client’s investment objectives and risk tolerance, the broker can buy or sell securities or other investments in the account as they see fit.

A non-discretionary account is an account in which the account owner retains complete control over investment decisions. The broker can offer investment advice and make recommendations, but the client must authorize each transaction before it can be executed. Failing to do so can constitute unauthorized trading. An attorney can evaluate your case to determine if misconduct has occurred.

The key difference between the two types of accounts is the level of decision-making authority. In a discretionary account, the broker can make trades and investment decisions on behalf of the client without prior authorization. The broker can only offer advice and recommendations in a nondiscretionary account, and the client must authorize each transaction. If the broker does not secure the client’s approval before executing a transaction, it could be a form of unauthorized trading.

Discretionary accounts often require greater trust between the client and broker, as the broker has greater control over investment decisions. They also usually come with higher fees, as the broker assumes greater responsibility for managing the account.

FINRA Rules Regarding Broker Misconduct and Negligence

FINRA (Financial Industry Regulatory Authority) is a self-regulatory organization that oversees broker-dealers’ activities and their associated persons in the United States. One of FINRA’s primary roles is enforcing rules and regulations to protect investors from misconduct, such as unauthorized trading, while maintaining market integrity.

FINRA Rule 3260 requires broker-dealers to obtain written authorization from their clients before executing any transactions in their accounts. The rule also requires broker-dealers to notify clients promptly of any trade executed in their accounts.

If you have been the victim of unauthorized trading, you may be able to recover your losses through FINRA’s arbitration process with the help of an attorney. This process allows investors to seek compensation for damages resulting from broker misconduct, including unauthorized trading.

Broker Misconduct Involving Unauthorized Trading

If a broker engages in this misconduct, FINRA may take disciplinary action against the broker and the broker-dealer. This could include fines, suspensions, or revocation of the broker’s license to practice in the securities industry.

In March 2023, FINRA reportedly suspended a former Laidlaw and Company rep after allegations that he exercised discretionary authority in customer accounts. The findings stated that the customers did not provide prior written authorization for Grant to exercise discretion in their accounts, thus constituting unauthorized trading. In addition, the rep’s member firm did not accept any of the customer accounts as discretionary accounts. FINRA ordered a fine of $5,000 and a one-month suspension.

Former Raymond James rep James “Eddie” Lyons, who the firm reportedly fired, has been the subject of numerous customer complaints, alleging that he made trades without his client’s authorization. The most recent broker misconduct allegations are from a claim filed this month by an attorney alleging unauthorized trading in customer accounts concerning high-risk oil and gas investments. FINRA reportedly barred Lyons in 2018 after he failed to provide information in its investigation.

In July 2022, FINRA reportedly barred broker William “Ed” Torriente for allegedly placing transactions in client accounts that the clients were unaware of. The findings reportedly stated that the firm later filed a Form U5 Amendment for Torriente, disclosing two different customer complaints alleging, among other things, that he had taken part in unauthorized trading.

According to the rep’s FINRA broker report, two customer complaints sought $500,000 damages for allegations of “unauthorized discretion. “

In March 2022, FINRA sanctioned a Cadaret, Grant & Co. broker for allegations that he executed trades without investor authorization — for the second time. In both cases, the representative entered an Acceptance, Waiver, and Consent (AWC) with FINRA to settle the allegations.

As we reported in January 2021, FINRA reportedly suspended JP Morgan advisor Trevor Rahn for 18 months after allegations from his clients and their attorneys surfaced that he implemented an unauthorized and unsuitable trading strategy for customer orders. He was also fined $10,000. Rahn purportedly engaged in a pattern of breaking customer orders for execution from January 2014 to September 2018, according to FINRA.

Rahn allegedly took part in a form of broker misconduct in which he recommended an average pricing investment strategy to his customers in which he executed orders by breaking them into multiple small trades, each generating a separate commission, yet had no reasonable basis to believe this strategy was suitable for his customers. He also purportedly exercised time and price discretion on over 7,500 trades without the required authorization, according to FINRA.

Unauthorized Trading Attorneys – Free Consultation

If your broker was making trades in your account without your knowledge or permission, the unauthorized trading attorneys at the White Law Group may be able to help you. With a phone call to our offices, the firm can review the details of your situation and evaluate whether you have a viable legal case against your brokerage firm. We can assess the strength of your evidence and help you determine your legal options.

If you have a strong unauthorized trading case, we can file a FINRA complaint on your behalf. If your case cannot be resolved through a complaint, our firm can represent you in arbitration or litigation. We can argue your case before a panel of arbitrators or in court, advocating for your rights and seeking compensation for any losses you may have suffered due to unauthorized trading.

In some cases, it may be possible to negotiate a misconduct settlement with the broker or brokerage firm without going to arbitration or litigation. The securities fraud attorneys at the White Law Group can help you negotiate a fair settlement that compensates you for your losses.

If you are concerned about investment losses in your account, the unauthorized trading attorneys at the White Law Group may be able to help you. To speak with a securities attorney, please call the offices of the White Law Group at (888) 637-5510.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm dedicated to helping investors in claims in all 50 states against their financial professional or brokerage firm.

Since its launch in 2010, the firm has handled over 800 FINRA arbitration cases. It has offices in Seattle, Washington, and Chicago, Illinois, and reviews securities cases nationwide.

Frequently Asked Questions

FINRA regulates several entities, including broker-dealers, capital acquisition brokers, and funding portals. Broker-dealers are businesses that buy and sell securities on behalf of their clients. Capital acquisition brokers have several functions, such as advising companies and private equity firms on raising capital and corporate restructuring and acting as agents for institutional investors looking to purchase unregistered securities. Finally, funding portals serve as middlemen for crowdfunding efforts. FINRA lawyers can aid individuals impacted by misconduct or negligence on the part of any financial institution.

Securities include stocks, representing an individual’s partial ownership of a company; bonds, loans from an investor to a borrower; and options, a type of financial derivative that grants investors the right to buy or sell an asset within a specified period. Securities law concerns three broad areas:

- Laws regarding disclosure requirements for publicly-traded companies

- Laws intended to prevent those with valuable information from using it to game the market through methods such as insider trading.

- Laws regulating what brokers can and cannot do for investors.

Securities attorneys are employed by the government, financial institutions, and individual investors to navigate the complexities of relevant securities laws.

The U.S. Securities and Exchange Commission (SEC) regulates all financial markets in the United States, while FINRA is focused on overseeing the securities industry–particularly stockbrokers.