Selling Away Lawyers

Did you know that your brokerage firm can be held responsible for investment losses if your financial advisor is involved in selling away from the firm (unapproved securities transactions)?

Table of Contents

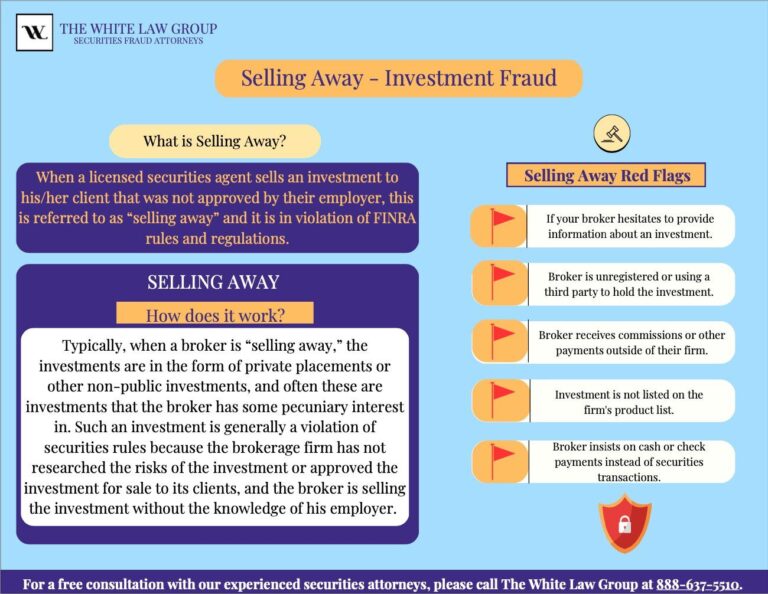

ToggleWhen a licensed securities agent sells an investment to their client that their employer is unaware of, referred to as “selling away,” it violates FINRA Rules and Regulations and other laws governing the behavior of finance professionals.

But what is selling away in practice? Typically, when lawyers from The White Law Group and other firms oversee this type of case, a broker is “selling away” investments in the form of private placements or other non-public investments, and often these are investments that the broker has some pecuniary interest in. Such an investment is generally a violation of securities rules because the brokerage firm has not researched the risks of the investment or approved the investment for sale to its clients, and the broker is selling the investment without the knowledge of his employer.

Even if the representative didn’t receive a typical finder’s fee or commission, the individual may receive indirect compensation when an investment is sold away. It is essential to consult with a lawyer with experience in selling away cases if you suspect your broker made an investment recommendation that benefits them at your expense.

Still, a broker-dealer can be held liable for a financial advisor’s “selling away” because it failed to supervise its employees and protect its clients adequately.

FINRA and Selling Away

The Financial Industry Regulatory Authority (FINRA), overseen by the SEC, provides regulatory services to the financial industry by licensing and regulating broker-dealers. FINRA also operates the largest dispute resolution forum in the securities industry.

FINRA Dispute Resolution is the forum for almost all disputes between investors, brokerage firms, and brokers. For selling away claims, clients and their lawyers present their case to a panel, who weigh the evidence and rules in favor of either the investor or broker. FINRA’s mission is “to safeguard the investing public against fraud and bad practices.”

The following are rules put in place by FINRA to protect investors from selling away.

FINRA Rule 3280 Private Securities Transactions of an Associated Person

During FINRA arbitration hearings involving allegations of selling away, lawyers often dispute whether the broker violated Rule 3280. According to this rule, with certain exceptions, financial advisors may not engage in private securities transactions (“selling away”). In some circumstances, these transactions are allowed if the professional provides written notice to the firm and discloses whether or not they will receive compensation for the proposed transaction.

FINRA Rule 3270 Outside Business Activities of a Registered Person

A second rule lawyers typically cite in selling away cases is FINRA Rule 3270. Under this rule, financial advisors registered with FINRA may not engage in any outside business activity and private securities transactions unless they first provide written notice to the firm. The rule also governs the duty of brokerage firms to supervise disclosed outside business activities. See: FINRA Rule 3270 Outside Business Activities

A registered representative must evaluate the proposed activity to determine whether it is appropriately characterized as an outside business activity or should be treated as an outside securities activity subject to the requirements of Rule 3280. Lawyers of investors selling away cases typically attempt to prove the activity was improperly categorized. FINRA requires broker-dealers to supervise members’ activities and approve disclosed outside business activities. Further, FINRA brokerage firms are generally obligated to manage their agents’ activities regardless of whether they are disclosed.

SEC Rule 206(4)-7(a)

The Securities and Exchange Commission’s rule governing “selling away” is the SEC Rule 206(4)-7(a), and it is a rule studied closely by securities lawyers. It says that a registered investment advisory (RIA) firm is under an obligation to have policies and procedures to prevent violation of the Act or SEC rules adopted under the Act.

This duty applies to outside business activities that could present opportunities to engage in fraud or violate fiduciary duty. The rule requires RIAs to supervise any activity that could cause a violation, including selling investments, regardless of whether they are approved or disclosed.

What are the Consequences for Selling Away?

When lawyers preside over selling-away claims in FINRA arbitration, they usually seek damages for their clients and penalties against the broker to discourage future misconduct. Sanctions for financial professionals caught selling away from their member firm may include dismissal, suspension, or a bar from the securities industry. Monetary fines are also possible depending on the offense’s severity and the harm it causes to investors.

Firms can also be sanctioned if they receive notice of the sale but fail to provide written approval, disapproval, or acknowledgment of the notice. Suppose you believe your broker has been selling away. In that case, a securities lawyer can advise you on the damages you may eventually collect and any sanctions the broker, broker, and firm may face.

FINRA Sanctions and Selling Away Examples

On June 25, 2021, FINRA reportedly barred financial advisor George McCaffrey III of NTB Financial. He purportedly provided FINRA with allegedly false information concerning FINRA’s investigation. The case received significant attention among lawyers specializing in selling away claims because of its scale; McCaffrey purportedly participated in 22 undisclosed private securities transactions in which nine investors, including one firm customer, purchased $1,775,000 in debt and equity securities. The findings stated that McCaffrey introduced the nine individuals to representatives of a greenhouse building and leasing company so they could invest in the company.

Those investors allegedly purchased $1,775,000 in promissory notes from the greenhouse building and leasing company and preferred stock in one of the company’s affiliates. Lawyers were able to prove McAffrey engaged in selling away because the transactions were not reportedly executed through the firm. McCaffrey allegedly did not notify his member firm that he would participate in them, nor did he report this on the firm’s annual compliance questionnaire.

On December 20, 2022, FINRA reportedly barred former PFS Investments advisor Desiderio Torrez (CRD#: 4759218). He allegedly failed to provide information in FINRA’s investigation about a customer complaint relating to Torrez’s alleged recommendation that the customer invest in a company.

FINRA reportedly reached a settlement agreement with financial advisor Daniel T. Minich (CRD #6465746) in August 2022. He allegedly participated in three private securities transactions totaling approximately $200,000 without providing prior written notice to his member firm, Ameriprise Financial.

Securities Attorneys and FINRA Arbitration

FINRA operates the largest securities dispute resolution forum in the United States. It has extensive experience providing a fair, efficient, and effective venue to handle securities-related disputes, including selling-away claims involving investors and their lawyers. Investors can file an arbitration claim or request mediation through FINRA when they have a dispute involving the business activities of a brokerage firm or one of its brokers. To be considered, the alleged act resulting in a claim must have occurred within the past six years.

Don’t wait to take action if you are concerned that your financial advisor may be selling away. Please call the selling away lawyers at White Law Group at 888-637-5510 for a free consultation.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm. We are dedicated to representing investors in FINRA arbitration claims against brokerage firms throughout the United States.

The White Law Group has handled over 800 FINRA arbitration claims. Our lawyers have taken on claims involving selling away, unauthorized trading, unsuitable investments, fraud, negligence, churning/excessive trading, and improper use of margin. Our attorneys have recovered millions of dollars from many brokerage firms. The firm works on a contingency fee basis to help you in your time of need.

For information on The White Law Group and its representation of investors in claims against brokerage firms, visit https://whitesecuritieslaw.com.

Frequently Asked Questions

According to FINRA Rule 3270, outside business activity can take on several forms, including:

- Consulting services for businesses or individuals outside of the broker’s primary employer.

- Freelance work such as copywriting or graphic design.

- Buying, selling, or renting fundamental real estate properties.

- Leading seminars or workshops

It is not necessarily improper for brokers to engage in outside activities. However, they need to disclose this work and avoid conflicts of interest.

When brokers ” sell away,” from their firm, they recommend that their clients invest in securities their brokerage does not hold. Unscrupulous brokers typically engage in this behavior when they stand to benefit from their client’s investments.

As mentioned above, there are two FINRA rules related to selling away: Rules 3280 and 3270. Rule 3280 bars brokers from executing private securities transactions, with some exceptions. Similarly, Rule 3270 states that brokers may not participate in outside business activities without first providing written notice.