Did your broker recommend investing in an Oil and Gas Limited Partnership (LP)?

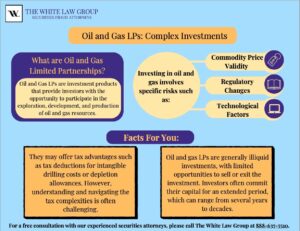

Investing in oil and gas limited partnerships (oil and gas LPs) can be risky, and if your broker failed to explain the risks to you before investing, you may be able to file a FINRA claim to recover investment losses.

Private placement investments are securities offerings exempt from registration with the SEC. Under the federal securities laws, a company may not offer or sell securities unless the offering has been registered with the SEC or an exemption from registration is available.

These offerings are typically not subject to some of the laws and regulations that are designed to protect investors, such as the comprehensive disclosure requirements that apply to registered offerings. Private and public companies engage in private placements to raise funds from investors.

Oil and gas limited partnerships are a type of private placement investment that uses a portion of investors’ money to drill and operate oil and gas wells. These oil and gas drilling programs (also known as Direct Participation Programs (DPPs) are sponsored and managed either by investment companies or oil and gas exploration companies. The structure of these investments typically includes very high fees and commissions.

What is Regulation D?

When reviewing private placement documents, you may see a reference to Regulation D. Regulation D includes three SEC rules—Rules 504, 505 and 506— to sell securities in unregistered offerings. The entity selling the securities is commonly referred to as the issuer or sponsor. Each rule has specific requirements that the issuer must meet.

If you have reason to believe that an unregistered offering claiming to rely on one of these rules does not satisfy the applicable requirements, consider this a red flag about the investment.

SEC Rule 504

Generally, securities issued under Rule 504 will be restricted securities unless the offering meets certain additional requirements, this rule permits certain issuers to offer and sell up to $1 million of securities in any 12-month period. These securities may be sold to any number and type of investor, and the issuer is not subject to specific disclosure requirements. As a prospective investor, you should confirm with the issuer or sponsor whether the securities being offered under this rule will be restricted.

SEC Rule 505

Rule 505 allows issuers to offer and sell up to $5 million of their securities in any 12-month period but there are limits on the types of investors who may purchase them. The issuer may sell to an unlimited number of accredited investors, but to no more than 35 non-accredited investors. If the issuer sells its securities to non-accredited investors, the issuer must disclose certain information about itself, including its financial statements. If sales are made only to accredited investors, the issuer has discretion as to what to disclose to investors. Any information provided to accredited investors must be provided to non-accredited investors.

SEC Rule 506

An unlimited amount of money may be raised under Rule 506. An issuer relying on Rule 506(b) may sell to an unlimited number of accredited investors, but to no more than 35 non-accredited investors and the non-accredited investors in the offering must be financially sophisticated or, in other words, have sufficient knowledge and experience in financial and business matters to evaluate the investment. To satisfy the sophistication requirement the investor may have a purchaser representative. An investor engaging a purchaser representative should pay particular attention to any conflicts of interest the representative may have.

As with a Rule 505 offering, if non-accredited investors are involved, the issuer must disclose certain information about itself, including its financial statements. If selling only to accredited investors, the issuer has discretion as to what to disclose to investors. Again, any information provided to accredited investors must be provided to non-accredited investors.

Before you Invest in Oil and Gas LPs

Oil and gas limited partnerships may be pitched as a unique opportunity that is only being offered to a handful of investors, but don’t be fooled by this high-pressure sales tactic. Even if the deal is “unique,” it may not be a good investment.

These offerings tend to be illiquid and they often are associated with high fees and sales commissions. They are typically sold as unregistered securities which lack the same regulatory oversight as more traditional investment products like stocks or bonds. An additional risk inherent to oil and gas private placements is the general risk that comes with the energy market. The energy market has seen enormous ups and downs over the past few years. These investments may seem wise at first, until the dramatic drop in distributions.

It is important for you to obtain all the information that you need to make an informed investment decision.

Issuers and sponsors relying on Rule 505 and 506(b) exemptions from registration must provide non-accredited investors an opportunity to ask questions and receive answers regarding the investment.

Are Oil and Gas LPs Suitable for you?

The Financial Industry Regulatory Authority (FINRA) has established suitability rules that broker-dealers must follow when recommending investments to their clients, including oil and gas limited partnerships (private placements).

FINRA Rule 2111 (Suitability) requires broker-dealers and their associated persons to have a reasonable basis to believe that a recommended investment, including oil and gas private placements, is suitable for the customer based on their investment objectives, risk tolerance, financial situation, and other relevant factors. The rule emphasizes the importance of conducting a thorough analysis of the client’s individual circumstances before making any recommendations.

Oil and gas private placements are generally considered to be high-risk investments. Broker-dealers must carefully assess and disclose the risks associated with these investments to their clients. They should consider factors such as the speculative nature of the oil and gas industry, commodity price volatility, limited liquidity, potential for loss of principal, and the potential for lack of diversification.

Broker-dealers are required to disclose all fees, expenses, and commissions associated with the purchase of oil and gas private placements. This includes any upfront fees, ongoing management fees, and potential performance-based fees. Investors should have a clear understanding of the costs involved in the investment.

Your broker also has an obligation to conduct thorough due diligence on the oil and gas private placement offerings they recommend. This involves analyzing the issuer’s financial statements, operational history, management team, drilling plans, and any associated risks. The due diligence process should be documented to demonstrate that the broker-dealer has made reasonable efforts to understand the investment and its potential risks.

It’s important to note that while FINRA sets these suitability rules, the ultimate responsibility for ensuring the suitability of an investment rests with the broker-dealer and their associated persons. Investors should carefully review any recommendations, ask questions, and consider seeking independent financial advice before investing in oil and gas private placements or any other investment product.

Investigating Potential FINRA Claims involving Oil and Gas LPs

The White Law Group has represented numerous investors in claims against their brokerage firms for improperly recommending oil and gas limited partnerships.

In those claims, the firm has alleged, among other things, that the investments were (1) high-risk and unsuitable for our clients given their financial situation, needs and investment objectives, (2) that the risks of the investment were not fully disclosed to them, and (3) that the brokerage firms that sold the investments failed to conduct the proper due diligence with respect to the investments (as the firms are required to do by FINRA Rules).

The firm continues to investigate potential securities claims involving the following oil and gas lps drilling program sponsors, among others:

Resource Royalty

Waveland Drilling

Atlas Energy Group

MDS Energy

Mewbourne Oil Co.

US Energy Development Corp.

Catalyst Energy

APX Energy

Hiring a FINRA Attorney – The White Law Group

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm dedicated to helping investors in claims in all 50 states against their financial professional or brokerage firm. Since the firm launched in 2010, it has handled over 700 FINRA arbitration cases.

Our firm represents investors in all types of securities related claims, including claims involving stock fraud, broker misrepresentation, churning, unsuitable investments, selling away, and unauthorized trading, among many others.

With over 30 years of securities law experience, The White Law Group has the expertise to help investors attempt to recover their investment losses. The firm reviews securities fraud cases throughout the country.

If you have suffered losses investing in oil and gas limited partnerships, the White Law Group may be able to help you by filing a FINRA Dispute Resolution claim. For a free consultation please call us at 888-637-5510.

Tags: Oil and gas, Reg D private placements Last modified: March 6, 2024