What you need to know before Investing “on Margin”

Margin trading is borrowing money from your broker-dealer to purchase stock. It’s like a loan, and the stock you buy is collateral. When you open a margin account, the “margin” is the money you deposit into the account. Margin trading increases your purchasing power and potential profits, as well as your risk and downside. When investing on margin, you risk losing more money than you invested.

Table of Contents

ToggleTo open a margin account, your broker-dealer must obtain your signature and provide you with an agreement explaining the terms and conditions of the account. Before you begin trading on margin, FINRA requires a minimum deposit of the purchase price on covered agency transactions, though some broker-dealers may need more. Your deposit is known as the “margin minimum.” The amount you borrow, called the “initial margin,” cannot exceed 50% of the purchase price of the stock.

Maintenance Margin Requirements

When investing in margins, your account is restricted by a “maintenance margin,” which requires you to keep a minimum amount of equity. Most broker-dealers require maintenance margins between 30% and 40%.

If your margin account falls below the maintenance margin requirements, your broker-dealer will issue a “margin call” and ask you to deposit more cash or stocks into your account. If you do not meet the call by investing additional money or stocks on margin for covered agency transactions, your broker-dealer has the right to sell your stock. You can increase your account equity until you reach the required maintenance margin.

Although most broker-dealers will attempt to notify you, they are not required to make a margin call and can sell your stocks without consulting you first. Further, firms can increase maintenance margin requirements anytime and without prior notice.

You must be familiar with your brokerage firm’s policies for investing on margin. Even if you are notified and given a specific date to meet a margin call, your firm still has the right to sell your stocks immediately. This often occurs when the market value of your stocks continues to fall. Furthermore, you have no control over which stocks your broker-dealer chooses to sell, so there can be collateral damage, such as tax implications when investing on margin.

What is FINRA Rule 4210?

Rule 4210 is a regulation that sets margin requirements for covered agency transactions. It applies to broker-dealers and requires them to maintain a minimum margin in customer accounts when engaging in certain transactions.

The Financial Industry Regulatory Authority (FINRA) is the self-regulatory organization responsible for overseeing and regulating the securities industry in the United States. FINRA created Rule 4210 in response to the financial crisis of 2008. The rule was designed to address concerns about excessive leverage and potential systemic risk in the securities lending market, including the practice of investing on margin.

The rule was enacted in 2016 after receiving the approval of the Securities and Exchange Commission (SEC).

FINRA Rule 4210 applies to covered agency transactions in securities, options, and futures contracts and requires broker-dealers to collect and maintain margin by specific requirements. The margin required is based on the risk of the transaction, with higher-risk transactions requiring higher levels of margin.

In addition to setting margin requirements for firms that allow investing on margin, Rule 4210 includes provisions for calculating and maintaining margin and requirements for using collateral and treating cash and securities in margin accounts.

The rule aims to promote responsible risk management among broker-dealers and help ensure the stability and integrity of the financial markets. By requiring margin for certain transactions, the rule helps mitigate the risk of losses and reduce the potential for economic instability previously associated with investing on margin.

Changes to FINRA Rule 4210

While the rule was created by FINRA staff and approved by the FINRA Board of Governors, it was developed with input from various stakeholders, including member firms, industry groups, and regulators. The rule has since been updated several times in response to securities market changes and industry participant feedback.

FINRA filed a proposed rule change with the SEC on February 24, 2023, regarding investing in margins for covered agency transactions. This change will again delay the effective date of changes to Rule 4210, which was previously implemented on December 15, 2016.

The new date for the proposed rule change will be October 25, 2023, for amendments to Rule 4210 (Margin Requirements) for Covered Agency Transactions.

FINRA initially filed the rule proposal in 2015 to amend FINRA Rule 4210 to establish margin requirements for “Covered Agency Transactions” involving investing on margin.

The SEC approved the proposal on June 15, 2016. However, the industry sought clarification regarding implementation due to the potential impact on smaller and mid-sized firms. The industry asked FINRA to extend the implementation date.

Since then, FINRA has filed numerous extensions. Since the covered agency transactions continue to change, additional extensions, amendments, and industry comments may be filed.

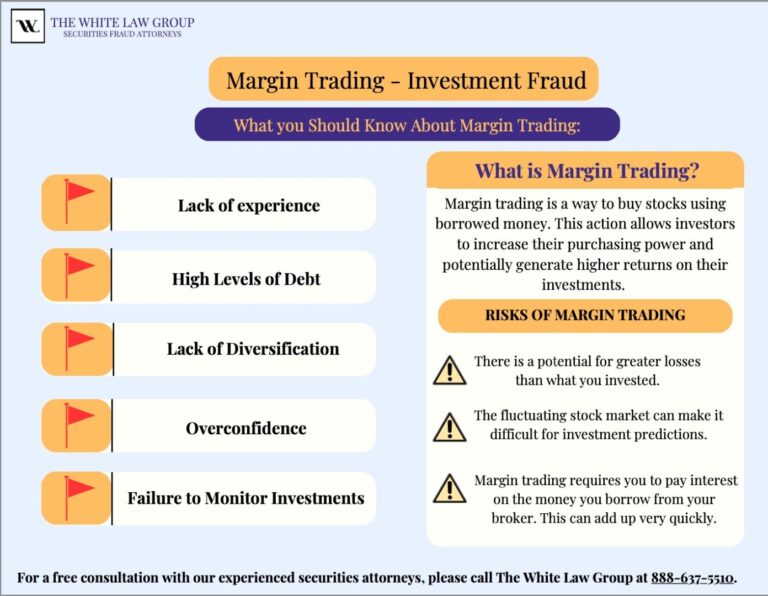

Risks of Investing on Margin include:

- Losses can be magnified. This is because you borrow money to invest when you buy securities on margin. If the value of the investment falls, you may be required to put up additional funds to maintain the required margin, and if you are unable to do so, their securities may be sold at a loss.

- Margin calls can occur when the value of the securities in the margin account falls below a certain level, and you must put up additional funds to maintain the required margin. If you cannot meet the call while investing on margin, your securities may be sold at a loss.

- When you borrow money to invest on margin for a covered agency transaction, you typically incur interest costs. If the investment does not perform as expected, the interest costs can add up and increase the overall losses.

- Margin trading can be hazardous in volatile markets, as the value of the securities in the margin account can fluctuate rapidly. This can increase the likelihood of margin calls and magnified losses.

If you cannot meet a margin call while investing on margin, your securities may be sold at a loss. This can be particularly problematic if the securities are part of a long-term investment strategy, as forced liquidation can result in significant losses and disrupt your overall investment plan.

FINRA Attorneys for Securities Disputes

When disputes arise between investors and securities firms or brokers, they may be required to resolve their differences through FINRA arbitration. This includes cases where a broker violated FINRA Rule 4210 while working with a client investing on margin for covered agency transactions. FINRA arbitration is a process in which an impartial arbitrator or panel of arbitrators is appointed to hear the dispute and render a decision.

The White Law Group helps clients navigate the arbitration process and represent their interests throughout the proceedings. This can include preparing and filing the initial claim, conducting discovery, presenting evidence and arguments at the hearing, and appealing the decision if necessary.

In addition to their knowledge of FINRA rules and procedures, the FINRA attorneys at the White Law Group have experience in securities law and litigation, including cases involving investing on margin. They can provide valuable guidance to clients on the strengths and weaknesses of their case, the likelihood of success, and the potential risks and rewards of pursuing arbitration.

Free Consultation

If you have a securities-related dispute, the FINRA attorneys at the White Law Group may be able to help you. The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm dedicated to helping investors in claims in all 50 states against their financial professional or brokerage firm, including violations of FINRA Rule 4210’s requirements for investing on margin. Since the firm launched in 2010, it has handled over 700 FINRA arbitration cases.

For a free consultation with a securities attorney, please call the offices at 888-637-5510 for a free consultation.

The White Law Group is a national securities fraud, securities arbitration, and investor protection law firm with offices in Chicago, Illinois, and Seattle, Washington.

For more information on The White Law Group and its representation of investors, please visit White Law Group

Frequently Asked Questions

A FAQ The White Law Group often receives about Rule 4210, which concerns how margin requirements differ between day traders and less active investors. According to FINRA, a day trader is an investor who executes four or more trades within a five-day business week. If, however, only 6 percent of an investor’s trades within a five-day week are day trades, they are not considered pattern day traders. FINRA requires pattern day traders to have at least $25,000 in equity if they hope to trade on margin.

Since the original publication of this article, the changes to Rule 4210 have been finalized. According to FINRA, the rules governing covered agency transactions went into effect on May 22, 2024.

Rule 4210 establishes the amount of money investors must deposit if they hope to trade on margin. It applies to various covered agency transactions, such as buying stocks and derivatives. It is intended to reduce risk and protect investors, brokerage firms, and the financial industry.