Concerned about your investment in a Cove Capital 1031 DST?

Cove Capital Investments creates 1031 exchange DST investments for accredited investors, according to its website. The company reportedly sponsors DST properties in the multifamily, net lease, industrial and office sectors.

The White Law Group is investigating the liability that FINRA registered brokerage firms may have for improperly recommending 1031 exchange DST investments to investors.

According to SEC filings, the Cove Capital filed a Form D to raise capital from investors for the following 1031 DST Delaware Statutory Trust investments:

Cove Essential Net Lease 30 DST

Cove Net Lease Income Fund 18, LLCCove San Antonio Multifamily 33 DSTCove Airport Medical DST

Cove Debt Free Charlotte Pharmacy DSTCove Debt Free Maplewood Industrial DSTCove Debt Free Maryland Medical DST

Cove Debt Free Tacoma Data Center DST

Cove Debt Free Washington Pharmacy DST

Cove Debt Free Winston-Salem Distribution DST

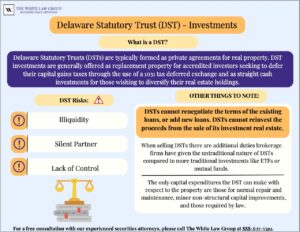

The Risks of Investing in 1031 DST Investments

While there may be tax advantages to investing in a 1031 DST investment, there are several downside risks.

While there may be tax advantages to investing in a 1031 DST investment, there are several downside risks.Like other real estate, a DST 1031 is considered an illiquid asset. Though you may be receiving cash flow, you won’t have access to any proceeds until the asset is sold, and the program concludes, which could involve a span of 7-10 years or more. 1031 DSTs cannot raise new capital once the investment is made, leaving investors holding the bag if expensive repairs are needed or other issues arise – like a drop in occupancy or rental income.

Further, investors in a DST often have no rights or say so in regard to property operations, and more importantly generally no control over when the property will be sold.

The White Law Group has represented dozens of investors over the last few years in DSTs. Unfortunately, unscrupulous financial advisors will push these products to maximize their own commissions. The firm is investigating the liability that FINRA registered brokerage firms may have for improperly recommending high-risk DSTs to investors.

Broker Due Diligence and Regulation Best Interest

The SEC’s Regulation Best Interest (Reg BI) is a rule under the Securities Exchange Act of 1934. It sets a higher standard of conduct called the “best interest” standard for broker-dealers and their representatives. This standard applies when they suggest any securities transaction or investment strategy involving securities, including recommending different types of accounts, to retail customers. Essentially, it requires these professionals to prioritize the customer’s best interests when making such recommendations.

Under the “best interest” standard, broker-dealers are obligated to perform comprehensive due diligence when evaluating any investment. This comprehensive evaluation aims to empower investors to make well-informed decisions aligned with their best interests.

If your financial advisor fails to perform due diligence on an investment before recommending it to you, they could be held liable for investment losses. If your advisor unsuitably recommended a 1031 DST offering and you lost money, the securities attorneys at The White Law Group may be able to help you. You may be able to recover losses by filing a FINRA Arbitration claim against the brokerage firm that sold you the investment.

If you have suffered losses investing in Cove Capital 1031 DST offerings, please contact the offices of The White Law Group at 1-888-637-5510.

The White Law Group is a national securities fraud, securities arbitration, and investor protection law firm with offices in Chicago, Illinois and Seattle, Washington.

FINRA provides an arbitration forum for investors to resolve disputes. The White Law Group represents investors in FINRA arbitration claims throughout the country. Visit the firm’s homepage to learn more about the firm’s representation of investors.