Are you a Victim of Variable Annuity Switching?

Overselling variable annuities or variable annuity switching can be a problem and is not in the best interest of the investor. If you have suffered losses due to variable annuity switching, the securities attorneys at The White Law Group may be able to assist you in the recovery of your investment losses.

An annuity is a long-term investment that is issued by an insurance company, with a series of payments made at equal intervals. Through annuitization, your purchase payments (or contributions) are converted into periodic payments possibly lasting a lifetime.

People typically buy these as a way to diversify their portfolios and as part of a retirement strategy. To explain the way an annuity works, think about social security — you put money into it, and once you reach a certain age or disability, you begin getting money back. The difference is, it is not the government that guarantees the annuity, but the insurance company. Some of the popular annuity companies are MetLife, American Equity Insurance Life, Prudential Annuities, Lincoln Financial Group, Allianz Life of North America, among others.

Basic Features of Variable Annuities

Annuities, or insurance products, have four basic types:

- Immediate – initiate payments to the annuitant on the onset

- Deferred – postpone payment until a later date, such as a set age

- Fixed – guarantee payout

- Variable – fluctuate based on the performance of the stock market

Each type of annuities can be tailored to meet the suitability of the investor, which is the broker’s responsibility. Depending on the type of product selected, an annuity allows you to convert a single lump-sum of money, which is referred to as a premium, into a lifetime of guaranteed income payments (fixed). You are able to recover your money if the need arises at any time. You will, however, receive less than you initially invested due to surrender charges. Another route that can be taken is receiving a payment which is determined by the performance of your annuity’s underlying investments (variable). Immediate and deferred are self-explanatory.

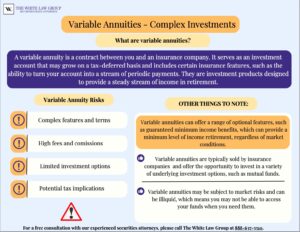

Another feature of an annuity is the tax deferment. The money you contribute to your annuity is not taxed and grows tax-deferred, however, your earnings are taxed at your regular income rate. This is a huge advantage, allowing you to put money away and allowing it to grow, pre-taxed. Unlike IRAs or 401(k)s there is no annual contribution limit for annuities. Your monthly income will be determined by your total premium, how much time you have had it in the annuity and what plan your annuity is (deferred annuity accumulates money while the immediate annuity pays out.)

The Risks and Problems Associated with Variable Annuities

Variable annuities are complex investment products and their many different rules and terms might be perplexing for the average person. This becomes an issue, particularly when salespeople promote these products without taking into account the distinct financial requirements of individual investors.

Variable annuities are complex investment products and their many different rules and terms might be perplexing for the average person. This becomes an issue, particularly when salespeople promote these products without taking into account the distinct financial requirements of individual investors.

High Commissions

Every time a broker sells a variable annuity, they receive a larger than average commission for the sale, which is anywhere from 3-7%. Many brokers primarily work for commissions, and may not always have their client’s best interest in mind. The Insurer of the annuity makes their money on annuity fees and management services.

Surrender Charges

For a client to truly benefit from investing in variable annuities, it is the long term that pays off. Sometimes a broker may entice his client to sell a variable annuity to roll into another annuity for the sole purpose of collecting commissions. Not only does the client lose the income that they were receiving from the annuity that was sold, but they will have to pay a surrender charge as well as commissions on whatever product they are switching to.

A surrender charge is a fee paid by the owner of the variable annuity to withdraw all of or some of their principal before the annuity’s surrender period has expired. Let’s say hypothetically you invested $250,000 in a 10-year annuity with a 5-year surrender period and a 10% surrender charge. Depending on what annuity you purchased you are either receiving payments now or will receive payments at a later date.

Now, let’s say you have an emergency and need $100,000 3 years into your annuity. You have not yet completed the surrender period of 5-years. You will be charged 10% on $100,000 which is $10,000 to receive your money. If you want or need to pull your principle after the surrender period has lapsed there will not be a fee. In some cases, surrender fees drop from year to year. For example; to retrieve funds within the first year the fee is 10%, within the second year the fee is 8%, the next year 6%, the next year 4%, until the surrender period is complete. Once you add in the state and local taxes, front-end fees, and surrender fees, this may offset much or all of the annuity’s tax advantages. Ensure you read all the disclosure materials and ask plenty of questions to your broker or advisor.

Examples of Overselling Variable Annuities or Variable Annuity Switching

Overselling variable annuities or variable annuity switching can be a problem and is not in the best interest of the investor.

November 2017: FINRA censured and fined Ameritas Investment Corp. $180,000 for lapses in the supervision of variable annuity sales. Between September 2013 and July 2015, Ameritas “failed to establish, maintain and enforce an adequate supervisory system and written supervisory procedures related to the sale of multi-share class variable annuities.” Ameritas sold 4,075 individual Variable Annuity contracts, from which the firm earned over $58 million in revenue. The firm sold 697 L-share contracts, which totaled 17% of its overall VA sales, or about $11 million. L-share contracts typically provide a shorter surrender period, of three to four years, than B-share contracts, which typically have a surrender period of seven years and are the most sold share class in the industry. To learn more, see: Ameritas Censured & Fined $180,000 – Variable Annuity Sales

April 2022: Florida broker Francis Velten Jr. (CRD#: 2291911) was barred by FINRA after allegations that that he churned and flipped his elderly customers’ accounts at his member firm, allegedly encouraging them to surrender their annuities and sell mutual fund holdings away from the firm and use the proceeds to purchase “bonus” annuities. He has 9 customer complaints filed against him, according to his FINRA broker report. Allegations include unsuitable recommendations, unsuitable annuity sales, variable annuity switching, among others.

May 2022: The SEC fined RiverSource Distributors Inc., a subsidiary of Ameriprise Financial Services LLC, $5 million for allegedly improperly switching Ameriprise customers’ variable annuities to generate commissions. RiverSource employees allegedly developed and implemented targeted sales practices between 2016 and 2018 to induce Ameriprise Financial Services (AFS) reps to zero in on variable annuities customers for contract switches, according to the SEC. As a result, variable annuity exchanges increased from $671 million in 2015 to $768 million in 2016, $1,006,000 in 2017 and $1,049,000 in 2018. The firm reportedly agreed to a cease-and-desist order, a censure and to pay a civil money penalty of $5 million to settle the SEC charges.

FINRA Rules: Quantitative Suitability

The Financial Industry Regulatory Authority (FINRA) is the regulatory entity that governs the rules and guidelines brokers/advisors, and brokerage firms follow. Suitability obligations are critical to ensuring investor protection and promoting fair dealings with customers and ethical sales practices. If the investment is not suitable, the broker failed in his or her duties, and the brokerage firm failed in their supervisory obligation. FINRA Rule 2111 lists the three suitability obligations for firms and associated persons.

One of the three is quantitative suitability which states, “a broker with actual or de facto (in fact) control over a customer’s account to have a reasonable basis for believing that a series of recommended transaction, even if suitable when viewed in isolation, is not excessive and unsuitable for the customer when taken together in light of the customer’s investment profile.”

This means your broker, who has control over the account, must be able to articulate and justify trading transactions to limit wrongdoings like annuity switching. If a variable annuity is switched for the sole purpose of generating commissions and there is no legitimate investment reason for doing so, this likely violates FINRA’s quantitative suitability rule.

FINRA Rule 2330

Due in part to the complexity of these products, FINRA’s Rule 2330 requires that firms provide more comprehensive and targeted protection to investors who purchase or exchange variable annuities.

FINRA Rule 2330 is all about customers and their accounts. Specifically, it’s about how financial professionals, like brokers or financial advisors, should handle things when they recommend buying or selling securities (like stocks or bonds) to their customers. The rule is designed to make sure that customers are getting suitable investment recommendations based on their individual needs and circumstances.

Here are a few key points from FINRA Rule 2330:

- Know Your Customer: Financial professionals need to take the time to understand their customers’ financial situations, investment goals, risk tolerance, and any other relevant factors. This helps them suggest investments that make sense for that particular customer.

- Suitability: This is the big focus. Financial professionals should only recommend investments that are suitable for the customer based on the information they’ve gathered. It’s like recommending a shirt that’s the right size and style – but in this case, it’s investments that match the customer’s goals and comfort with risk.

- Reasonable Basis: Before suggesting an investment, financial professionals should do their homework. They need to make sure the investment is a good choice in general, and that it’s suitable for at least some customers. It’s like the salesperson checking that the clothes they’re recommending are good quality and in fashion.

- Record-Keeping: Financial professionals need to keep records of the information they’ve gathered from customers and the recommendations they’ve made. This helps ensure that they’re following the rules and acting in the best interests of their customers.

- Communication: It’s important for financial professionals to explain to their customers why they’re making a particular recommendation. Just like the salesperson might explain why a certain outfit is a great choice based on your preferences and the occasion.

Overall, FINRA Rule 2330 is like a set of guidelines to help financial professionals do their best to recommend investments that fit each customer. It’s there to make sure that the advice given isn’t just a one-size-fits-all approach but tailored to what’s best for each individual.

FINRA Arbitration Attorneys

This information is all publicly available and provided to you by The White Law Group.

Broker dealers are required to perform adequate due diligence on any investment they recommend and to ensure that all recommendations are suitable for the investor. Brokerage firms that fail to do so may be held responsible for any losses in a FINRA arbitration claim.

Experienced securities attorneys can help you through the FINRA arbitration process. The intricacies of FINRA arbitration can be challenging to navigate, and a skilled attorney with expertise in securities law can significantly enhance your prospects of a successful outcome.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm with offices in Chicago, Illinois and Seattle, Washington. We represent investors across the country in claims against their brokerage firms. For more information on the firm and its representation of investors, visit https://whitesecuritieslaw.com.

If you think you have been a victim of variable annuity switching with your broker or financial advisor, please call our offices at (888) 637-5510 for a free consultation with a securities attorney.

Tags: variable annuity Last modified: August 30, 2024