Protecting Yourself from Investment Fraud – Pump and Dump Schemes

Pump and dump schemes continue to be a significant concern for investors, particularly those navigating the stock market. These schemes involve fraudulent practices that manipulate stock prices, leaving unsuspecting investors with substantial losses. To help you safeguard your investments, we’ve compiled some frequently asked questions about pump and dump schemes.

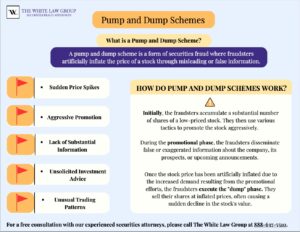

What is a Pump and Dump Scheme?

A pump and dump scheme is a form of securities fraud where fraudsters artificially inflate the price of a stock through misleading or false information. Their aim is to attract investors and create a sense of hype around the stock. Once the price reaches its peak, the fraudsters sell their shares, causing the stock’s value to plummet. This leaves other investors holding depreciated shares and often results in significant financial losses.

How Do Pump and Dump Schemes Work?

Pump and dump schemes typically involve several stages. Initially, the fraudsters accumulate a substantial number of shares of a low-priced stock. They then use various tactics to promote the stock aggressively. This can include sending mass emails, using online forums and social media platforms, or even engaging in cold calling campaigns.

During the promotional phase, the fraudsters disseminate false or exaggerated information about the company, its prospects, or upcoming announcements. They may make claims of extraordinary profits, undisclosed partnerships, or other enticing details that lure in potential investors.

Once the stock price has been artificially inflated due to the increased demand resulting from the promotional efforts, the fraudsters execute the “dump” phase. They sell their shares at inflated prices, often causing a sudden decline in the stock’s value. This leaves other investors with substantial losses, as they bought the stock at artificially inflated prices that are unsustainable without the fraudulent hype.

Examples of Pump and Dump Schemes

Pump and dump schemes have been prevalent in the financial markets, with numerous high-profile cases serving as cautionary tales. Here are a few examples:

- Wolf of Wall Street: The notorious case of Jordan Belfort, popularized by the movie “The Wolf of Wall Street,” involved a pump and dump scheme where Belfort and his associates allegedly manipulated the prices of various stocks, defrauding investors out of millions of dollars.

- Cynk Technology: In 2014, the Securities and Exchange Commission (SEC) exposed a pump and dump scheme involving Cynk Technology. The stock’s price soared from a few cents to over $21 per share, even though the company had no revenue or assets. The SEC later suspended trading and charged individuals involved in the scheme.

- Biotech Pump and Dumps: Pump and dump schemes are common in the biotech sector, where fraudsters often exploit the excitement surrounding new medical breakthroughs or drug approvals. They artificially inflate the prices of small biotech stocks and then sell their shares, leaving other investors with substantial losses.

How Can I Identify a Pump and Dump Scheme?

Recognizing the warning signs of a pump and dump scheme is crucial in protecting yourself from investment fraud. Here are some key indicators to watch for:

- Sudden Price Spikes: Keep an eye out for significant and rapid price increases in low-volume stocks. Such abnormal price movements can be an indication of pump and dump schemes.

- Aggressive Promotion: Be wary of aggressive marketing campaigns that make unrealistic claims or promises of guaranteed returns. Fraudsters often use high-pressure tactics to create a sense of urgency and encourage investors to act quickly.

- Lack of Substantial Information: If a company lacks comprehensive and reliable information about its fundamentals, financials, or business model, it’s wise to exercise caution. Pump and dump schemes often involve obscure companies with limited public disclosures.

- Unsolicited Investment Advice: Be cautious of unsolicited investment advice received via email, social media, or phone calls from unknown sources. Fraudsters may try to convince you to invest in a particular stock without proper justification or transparency.

- Unusual Trading Patterns: Pay attention to irregular trading patterns, especially when coupled with sudden price increases. If you notice abnormal trading volumes or suspicious activities surrounding a stock, it could be a sign of manipulation.

What Steps Can I Take to Protect Myself?

To protect yourself from pump and dump schemes, it’s important to be proactive and diligent. Consider the following measures:

- Conduct Thorough Research: Before investing in any stock, conduct comprehensive research to understand the company’s financial health, industry position, and overall legitimacy. Verify the information independently and seek advice from reputable sources.

- Exercise Skepticism: Be skeptical of investment opportunities that promise guaranteed returns or unusually high profits with low risk. Remember that if an investment seems too good to be true, it likely is.

- Consult with a Trusted Financial Advisor: Seek guidance from a qualified financial advisor who can provide objective advice and help you navigate potential investment risks. They can assist in evaluating investment opportunities and identifying red flags. See: FINRA BrokerCheck – Easy way to Check your Broker

- Stay Informed: Keep yourself updated on the latest news, market trends, and regulatory actions. By staying informed, you can better protect yourself from fraudulent schemes and make informed investment decisions.

What Should I Do If I Suspect I’ve Been a Victim?

If you suspect that you have fallen victim to a pump and dump scheme, take the following steps:

-Document Relevant Information: Gather and document all relevant information, including communications, transactions, and any suspicious activities related to the investment.

-Report to Regulatory Authorities: File a complaint with the appropriate regulatory body such as the Securities and Exchange Commission (SEC) or your country’s equivalent agency. Provide them with all the evidence and details to aid in their investigation.

-Seek Legal Advice: Consult with a securities fraud attorney who specializes in investor protection. They can assess your situation, advise you on potential legal remedies, and guide you through the process of seeking restitution if applicable.

Hiring an Investment Fraud Attorney

Pump and dump schemes pose a significant risk to investors, but by understanding how they operate and staying vigilant, you can protect yourself from falling victim to investment fraud. Remember to conduct thorough research, remain skeptical of unrealistic promises, and consult with professionals when needed. By taking proactive measures, you can navigate the market confidently and safeguard your financial well-being.

The White Law Group, LLC is a well-established law firm specializing in national securities fraud, securities arbitration, investor protection, and securities regulation/compliance. Our primary focus is assisting investors from all 50 states in their claims against financial professionals or brokerage firms. Since our inception in 2010, we have successfully handled over 700 FINRA arbitration cases.

Our dedicated attorneys are committed to representing investors in a wide range of securities-related claims. These include cases involving stock fraud, broker misrepresentation, churning, unsuitable investments, selling away, unauthorized trading, pump and dump schemes and more.

With a collective experience of over 30 years in securities law, The White Law Group possesses the necessary expertise to assist defrauded investors in their pursuit of recovering their investment losses. To learn more about our services, please visit our website at whitesecuritieslaw.com.

If you believe you’ve been a victim of a pump and dump scheme, contact the securities fraud attorneys at The White Law Group for a free consultation. Call us at 888-637-5510 or visit our website at whitesecuritieslaw.com for more information and expert legal assistance.

Last modified: June 22, 2023