Securities Fraud Investigation Involving Indexed Annuities

The White Law Group is investigating the sales practices of brokerage firms and insurance companies that market and sell equity indexed annuities to retired or elderly investors.

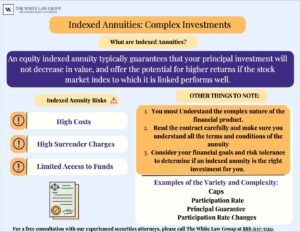

Indexed Annuities are annuities that are typically tied to a particular stock market index such as the S&P 500 or the Dow Jones Industrial Average. An equity indexed annuity typically guarantees that your principal investment will not go down in value, and offers the potential for higher returns if the stock market index to which it is linked performs well.

The way the annuity is marketed is typically to assure investors that if the index to which the annuity is tied goes down, the annuity owner has a safety net – the equity indexed annuity’s value at the beginning of the year (plus, in some cases, a guaranteed minimum rate of return). There are, however, downsides to indexed annuities and these investments are not appropriate for all investors.

The Downsides of Indexed Annuities:

Indexed annuities are complex, and the manner in which they work varies widely among the insurance carriers that issue them. An individual carrier may also offer differing products, and revise its products from time to time. The biggest problem with indexed annuities (and the reason that annuities are so closely monitored by regulators) is the costs associated with purchasing and owning annuities. In addition to their complexity, indexed annuities often include high surrender charges in the early years, which tend to lock in the investor for several years. These surrender charges can make indexed annuities unsuitable for elderly or retired investors because it significantly limits the investors’ ability to access their funds if an unforeseen expense (like a medical expense) arises.

Indexed annuities are complex, and the manner in which they work varies widely among the insurance carriers that issue them. An individual carrier may also offer differing products, and revise its products from time to time. The biggest problem with indexed annuities (and the reason that annuities are so closely monitored by regulators) is the costs associated with purchasing and owning annuities. In addition to their complexity, indexed annuities often include high surrender charges in the early years, which tend to lock in the investor for several years. These surrender charges can make indexed annuities unsuitable for elderly or retired investors because it significantly limits the investors’ ability to access their funds if an unforeseen expense (like a medical expense) arises.

Examples of the Variety and Complexity:

-

Principal Guarantee: Many equity indexed annuities provide that you’ll receive at least 100% of your invested funds; others guarantee only 90%.

-

Participation Rate: This is the percentage of the stock market index’s gain that is credited to the annuity. One equity indexed annuity might offer a return equal to 85% of the gain; another might offer 45%.

-

Participation Rate Changes: Insurers often reserve the right to change the participation rate from year to year. If the insurer lowers the rate, this could reduce your return.

-

Caps: Caps create limits on the gain regardless of the performance of the index. Even though an equity indexed annuity might provide a 100% participation rate, a cap would limit any gain to a certain figure (like 7% a year).

-

Spread / Margin / Asset Fee: Some equity indexed annuities subtract this type of fee each year from equity indexed annuities’ gain.

-

Returning Customers: Some carriers offer lower returns to returning customers than they do to new customers.

-

Guaranteed Minimum Rate: Some equity indexed annuities offer a guaranteed minimum rate of return. A guaranteed minimum is sometimes adjustable in the future, and in some cases only applies to funds withdrawn in a certain manner. For example, an equity indexed annuity might guarantee a minimum 3% return over a certain number of years, but only if you withdraw funds in the form of lifetime monthly income.

-

Method of Calculating Index Changes: Equity indexed annuities employ differing methods for calculating yearly changes in a stock market index. Differing methods (e.g., monthly averages and annual point-to-point calculations) can produce wide disparities in calculating equity indexed annuities returns.

Are Indexed Annuities a Suitable Investment For You?

Your financial advisor should only recommend investments that are suitable for their clients. Financial advisors should conduct a suitability analysis on a holistic level. Liquidity needs, time horizon, risk tolerance, age, income, are just a few categories an advisor should take into account prior to recommending any investment. Once that is completed the brokerage firm must ensure that due diligence was completed at every level of each investment.

-

Understand the complex nature of the financial product.

-

Read the contract carefully and make sure you understand all the terms and conditions of the annuity

-

Consider your financial goals and risk tolerance to determine if an indexed annuity is the right investment for you.

-

Understand the surrender period and penalties for withdrawing your money early.

-

Have a thorough understanding of the rate caps and participation rates that determine how much of the index’s gains you’ll receive.

-

Understand the indexing method used by the annuity and how it works.

What is FINRA Arbitration and How Does it Work?

Financial Industry Regulatory Authority (FINRA), is responsible for overseeing the activities of brokerage firms, and for enforcing rules and regulations related to the trading of securities. If you have suffered losses due to an unsuitable investment recommendation you may be able to recover your losses through FINRA arbitration. FINRA arbitration can be a helpful process if you have been defrauded. Once you’ve retained a Securities Fraud Attorney, the process of filing a claim through FINRA could take place. This claim should include a description of the fraud, the amount of money lost, and any supporting documentation.

Once the claim is filed, FINRA will appoint an arbitrator to hear the case. The arbitrator is responsible for reviewing the evidence and making a decision about whether the investor is entitled to restitution. If the arbitrator rules in favor of the investor, they will issue an award for damages, and this can be used to seek restitution from the person or company that defrauded the investor. FINRA is overseen by the Securities and Exchange Commission (SEC) and is authorized by Congress to protect U.S. investors from investment fraud by making sure the broker-dealer industry operates fairly and honestly.

The White Law Group Can Help You

We are currently investigating the indexed annuity sales practices of FINRA-registered brokerage firms and insurance companies.

If you have any information that may assist The White Law Group in its investigation into the sales practices of firms marketing and selling equity indexed annuities, please contact our Chicago, Illinois office at 888-637-5510.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm with offices in Chicago, Illinois and Seattle Washington. The White Law Group has the expertise to help investors defrauded in securities by filing a FINRA Arbitration claim. For more information on The White Law Group, please visit our website at https://whitesecuritieslaw.com.

Tags: complex investment products, indexed annuities Last modified: July 27, 2023

Read this BEFORE you buy from Midland National Life

Don’t Trust Midland National Life or Midland Annuity. They have been sued all over the country for their sales practices that amount to ripping off senior citizens.

If you want to know more, just Google MIDLAND NATIONAL LIFE REVIEW or MIDLAND NATIONAL LIFE COMPLAINT or visit http://www.midland-national-life-review.com

Ask your life insurance agent for alternatives to Midland National. If they are unwilling to suggest any you may want to consider another insurance agent.

You just have to wonder whether Midland has managed to trash whatever good name they used to have.

Midland National is part of the Sammons Financial Group and is affiliated with the North American Company for Life and Health and Midland Annuity.