Do You Have Concerns about a Limited Partnership Investment?

Investors can face the dangerous game of fraud from limited partnership investments due to promoters misrepresenting the risks involved, and unexpected returns. Some limited partnerships also fail to disclose the material information that would be important for investors to know before making an extensive investment decision. Do you think you’ve been defrauded as a result of investing in a limited partnership investment? The White Law Group may be able to help you navigate your legal options.

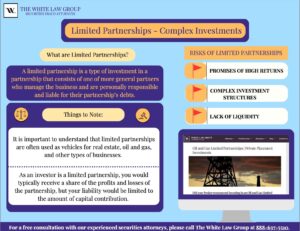

What are Limited Partnership Investments?

A limited partnership investment is a type of expenditure in a type of partnership that consists of one or more general partners who manage the business and are personally responsible and liable for their partnership’s debts. Limited partnerships are also classified as one or more persons who contribute capital and share in the profits but do not participate in the management of the business and are not personally liable for the partnership’s debts beyond the amount of their capital contribution. It is important to note that limited partnerships are often used as vehicles for real estate, oil and gas, and other types of businesses. As an investor in a limited partnership, you would typically receive a share of the profits and losses of the partnership, but your liability would be limited to the amount of capital contribution.

A limited partnership investment is a type of expenditure in a type of partnership that consists of one or more general partners who manage the business and are personally responsible and liable for their partnership’s debts. Limited partnerships are also classified as one or more persons who contribute capital and share in the profits but do not participate in the management of the business and are not personally liable for the partnership’s debts beyond the amount of their capital contribution. It is important to note that limited partnerships are often used as vehicles for real estate, oil and gas, and other types of businesses. As an investor in a limited partnership, you would typically receive a share of the profits and losses of the partnership, but your liability would be limited to the amount of capital contribution.

Red Flags of Limited Partnership Investments

Like any form of investment, each have their own red flags to look for to avoid fraud and financial losses. If you encounter any of these red flags when investigating a limited partnership investment opportunity, continue with your research and due diligence before investing. The following are some red flags that you should be aware of:

- Promises of High Returns with little or no risk is a common red flag of investment fraud in general, and limited partnerships are no exception. While it is possible to earn high returns on investments, it is typically associated with higher risk as well. Any investment that promises high returns with little or no risk should be viewed with skepticism, as it is likely too good to be true. In the case of limited partnerships, some promoters may misrepresent the nature of the investment, or the expected returns to attract investors. Investors should overall exercise caution and be wary when hearing promises of high returns, as they could be at risk for devastating financial losses.

- Complex or Confusing Investment Structures or strategies is another red flag to consider when investing with limited partnerships. Some limited partnerships may be structured in a way that is difficult for investors to understand or evaluate, which can make it easier for promoters to misrepresent the investment and hide information from investors. This could also be a tell-tale sign that the investment is not transparent or may be designed to obscure the risks involved. Investors should be cautious of investments that use unfamiliar strategies or techniques since they could be more difficult to evaluate or monitor. It is important to carefully review all of the disclosure documents provided by the promoter and ask questions if they do not understand any aspect of the investment.

- Lack of Liquidity or the ability to sell the investment is another red flag of investing in limited partnerships. Unlike the publicly traded securities, limited partnership interests are not freely transferable and may be difficult for investors to exit the investment if they need to raise cash or if they become dissatisfied with the investment. Investors should also research and be wary of the liquidity risks associated with limited partnerships and should carefully consider their investment time horizon and liquidity needs prior to investing. Additionally, investors should remain cautious if the investment is requiring a long-term commitment or lock-up period, as it may be very difficult to withdraw from the investment if it does not perform as expected. As always, review the governing documents before investing, and seek advice from a qualified and trusted professional if you have questions or concerns regarding your investment.

Investing in limited partnerships can be a complex and risky endeavor, and investors should be aware of the red flags associated with these investments. Promises of high returns, complex investment strategies, lack of transparency, and other issues like conflicts of interest are potential warning signs to be wary of. Investors should conduct continuous research and practice due diligence prior to investing. Seeking the advice of a trusted advisor is extremely important when investing. By being aware and taking a cautious approach to investing, investors may be able to minimize the risks and increase their chances of success in their challenging yet rewarding asset class.

Examples of Limited Partnership Investments

Some examples of limited partnerships include real estate partnerships, oil and gas partnerships, private equity funds, and hedge funds. These partnerships are typically structured as limited partnerships to take advantage of the tax benefits and liability protection offered by this form of business organization. While limited partnerships can offer attractive returns for investors, they can carry risks and are not suitable for all investors.

For example, Oil and Gas partnerships are a type of limited partnership that invests in the exploration, production, and distribution of oil and gas. These partnerships are typically formed to raise capital for oil and gas projects, which can be expensive and risky. Investors in oil and gas partnerships typically receive a share of the profits generated by the project which can be significant if the project is successful. However, they can also bear a share of the risks involving and associated with the project including the risk of dry wells, environmental liabilities and regulatory changes. Investors in oil and gas partnerships should carefully review the partnership agreement and other offering documents before investing and should seek the advice of a qualified professional.

Recovery of Investment Losses

Investors who have been financially harmed by a limited partnership investments may have legal options available to them, but it can be difficult to navigate the complex legal landscape. Securities fraud attorneys can help with investors by providing legal advice and representation to help investors recover their losses though litigation or arbitration. Securities fraud attorneys can also guide investors in understanding their rights and legal options, while also looking intensely into relevant documents to determine the best course of action. The final important note is that securities fraud attorneys can assist with recovering financial losses. This includes compensation for lost investment opportunities, lost profits, and other damages resulting from broker malpractice.

Do you need a Securities Fraud Attorney?

The White Law Group’s FINRA arbitration attorneys have handled over 700 FINRA arbitration claims involving unauthorized trading, unsuitable investments, fraud, negligence, churning/excessive trading, and improper use of margin. The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm with offices in Chicago, Illinois and Seattle, Washington.

If you are concerned about an investment in a limited partnership, the securities attorneys at The White Law Group may be able to help. Please call the firm’s office at 312-238-9650. For information on The White Law Group and its representation of investors in broker negligence claims, visit https://whitesecuritieslaw.com.