Have you suffered losses investing in D&L Energy, LP? If so, The White Law Group may be able to help.

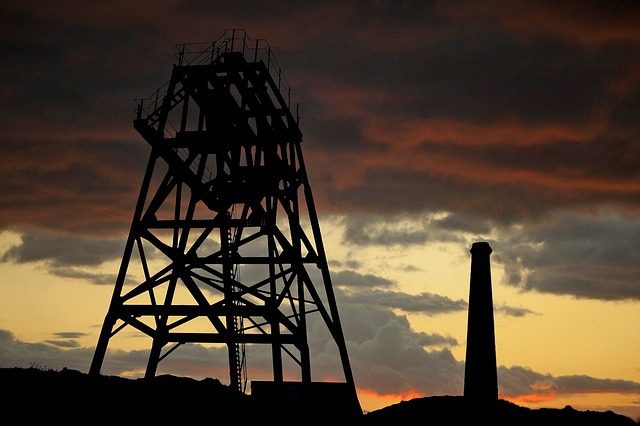

D&L Energy, Inc. was founded in 1986 in Youngstown, Ohio to explore, produce, and market the business of oil and natural gas in Ohio and Pennsylvania. D&L Energy also provided surveying, well servicing and maintenance, excavation and well site preparation, drilling, road boring, pipelining, well site cleanup and reclamation, fracturing, and completion services. On April 16, 2013, D&L Energy, Inc., along with its affiliate, filed a voluntary petition for reorganization under Chapter 11 in the U.S. Bankruptcy Court for the Northern District of Ohio.

D&L first gained media attention when its wastewater disposal wells were tied to a series of earthquakes in 2011 and 2012. The bankruptcy occurred after the Ohio Department of Natural Resources (ODNR) revoked all of the company’s operating permits following revelations that the company had illegally disposed of wastewater into a Mahoning River tributary.

According to reports, in November of 2013 the U.S. Bankruptcy Court of the Northern District of Ohio Tuesday approved the sale of the assets of D&L Energy Inc. to a Denver company, Resource Land Holdings LLC for $20.7 million.

The trouble with alternative investment products, like D&L Energy, LP, is that they involve a high degree of risk and are typically sold as unregistered securities which lack the same regulatory oversight as more traditional investment products like stocks or bonds.

The White Law Group is investigating the liability that brokerage firms may have for improperly selling private placements like D&L Energy, LP.

Broker dealers that sell alternative investments are required to perform adequate due diligence on all investment recommendations to ensure that each investment recommendation that is made is suitable for the investor in light of the investor’s age, risk tolerance, net worth, financial needs, and investment experience.

However, another problem with Reg D private placements is that the high sales commissions and due diligence fees the brokers earn for selling such products sometimes can provide brokers with an enormous incentive to push the product to unsuspecting investors who do not fully understand the risks of these types of investments or to outright misrepresent the basic features of the products – usually focusing on the income potential and tax benefits while downplaying the risks.

Fortunately, FINRA does provide for an arbitration forum for investors to resolve such disputes and if a broker or brokerage firm makes an unsuitable investment recommendation or fails to adequately disclose the risks associated with an investment they may be found liable for investment losses in a FINRA arbitration claim.

You may be able to recover investment losses incurred as a result of your purchase of D&L Energy, LP. Please contact The White Law Group at 1-888-637-5510 for a free consultation.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm with offices in Chicago, Illinois and Franklin, Tennessee. The firm represents investors throughout the country in claims against their brokerage firm.

For more information on the firm and its representation of investors, visit www.WhiteSecuritiesLaw.com.