Securities Attorneys for Financial Advisors with Employment Disputes

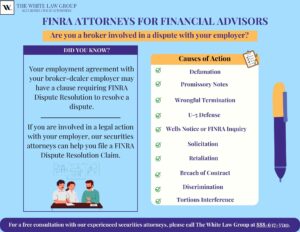

Are you a financial advisor with an employment dispute with your former employer? If so, The White Law Group may be able to help you. Licensed financial professionals, registered with FINRA, can face a variety of legal actions that can affect their ability to change jobs or even continue in their profession.

- Discrimination: Discrimination can include age discrimination, gender discrimination, and racial discrimination. Federal Statutes prohibit discrimination based on age, gender, or race, making it actionable. In many cases, a separate charge is filed with the Equal Employment Opportunity Commission (EEOC) before bringing a FINRA arbitration claim.

- Retaliation/Whistleblower Claims: If a broker-dealer terminates an employee for reporting a compliance violation or preventing the employee from doing so, it can be grounds for a retaliation or whistleblower claim against the firm.

- Solicitation/Raiding Claims: Solicitation/raiding claims often involve the recruitment of brokers from one firm to another. In such cases, the firm losing the advisors may sue the acquiring firm. Advisors caught in the middle may require separate representation to ensure their interests are protected.

- Promissory Note Litigation: Many brokerage firms use Promissory Notes as a recruiting tool. However, if an advisor leaves before fulfilling the terms of the Note, brokerage firms often sue the advisor to collect the outstanding balance owed.

- Tortious Interference with a Business Relationship: If a former employer interferes with your ability to make a living or work with a particular client, you may have a claim for tortious (intentional) interference with a business relationship.

- Defamation: Defamation refers to any intentional false communication, written or spoken, that harms a person’s reputation. In the securities arbitration context, defamation can include an inaccurate mark on an advisor’s U-4/U-5.

- Wrongful Termination: While most financial advisors are at-will employees who can be terminated for any or no reason, if the stated reason for termination provided by the brokerage firm is inaccurate, it may raise a claim for wrongful termination.

Please note that each case is unique, and the applicability of these claims may vary depending on the specific circumstances. Consulting with an attorney experienced in securities law can provide personalized guidance for your situation.

FINRA Arbitration Attorneys

Securities employment disputes are governed by the FINRA Code of Arbitration for Industry Disputes. FINRA Rule 13200 states that except as otherwise provided in the Code, a dispute must be arbitrated under the Code if the dispute arises out of the business activities of a member or an associated person and is between or among: Members (i.e. broker-dealers); Members and Associated Persons (i.e. financial advisors); or Associated Persons.

If you are a financial advisor with an employment dispute involving your former employer, it is likely that the case will need to be arbitrated through FINRA’s Dispute Resolution.

One exception is if the matter involves discrimination claims, including sexual harassment. FINRA Rule 13201 states that a claim alleging employment discrimination, including sexual harassment, in violation of a statute, is not required to be arbitrated under the Code. Such a claim may be arbitrated only if the parties have agreed to arbitrate it, either before or after the dispute arose.

FINRA arbitrations usually take between 12-15 months from the date of filing and depositions are strongly discouraged, making the process generally faster and less expensive than litigation filed in Court.

Since securities employment disputes are usually handled through FINRA arbitration, it is important to hire an experienced FINRA securities employment attorney who is familiar with the nuances of FINRA arbitration (versus Court litigation).

Free Consultation with FINRA Lawyers

The White Law Group is a national securities arbitration, securities regulation, and securities compliance law firm with offices in Chicago, Illinois and Seattle, Washington. The firm’s lawyers have extensive experience in securities employment disputes, including previous experience representing some of the world’s largest broker-dealers.

If you are a financial advisor and have questions about a securities employment matter, please contact the lawyers with The White Law Group at 888-637-5510.

For more information on The White Law Group, please visit the firm’s website at https://whitesecuritieslaw.com.

Tags: securities employment disputes Last modified: September 29, 2023