Concerned about your investment in a Carter Exchange 1031 DST investment?

Carter Exchange reportedly forms and operates investment and real estate investment companies in the multifamily, office, industrial, retail, healthcare, and specialty sectors. The company reportedly sponsors 1031 DST properties.

CX Texas Industrial, DST CX Partners Fund 2 Ltd CX Evergreens at Mahan, DST CX Mode at Hyattsville, DST CX Heritage, DST CX Station at Savannah Quarters, DST CX Owings Mills Multifamily, DST CX Station at Clift Farm, DST CX Palo Verde Holdings Ltd. CX Retreat at the Park, DST CX Lullwater at Blair Stone, DST CX Multifamily Portfolio, DST CX EOS Orlando, DST CX Foundry Yards, DST CX Residences at Congressional Village, DST CX Station at Clift Farm, DST CX Lively Indigo Run, DST CX Midwest Industrial Logistics, DST CX Station at Poplar Tent, DST CX Station at Savannah Quarters, DST CX Alexandria, DST CX Courts of Avalon, DST CX Highland, DST CX Riverstone, DST CX Liberty Mill, DST CX Evergreens at Mahan, DST CX Residences at Congressional Village, DST CX Mode at Hyattsville, DST CX Highland, DST CX Reagan Crossing, DST

CX Cypress McKinney Falls, DST

The Risks of Investing in 1031 DST Investments

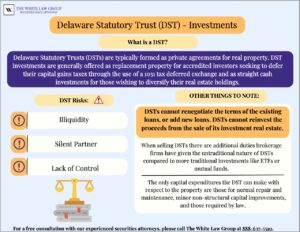

While there may be tax advantages to investing in a 1031 DST, there are several downside risks.

Like other real estate, a DST 1031 is considered an illiquid asset. Selling your investment in a DST might not be easy or quick, unlike stocks that trade publicly. When you invest in a DST, you won’t have control over the property’s management or decisions. Someone else, like a trustee or sponsor, makes these choices.

It’s essential to thoroughly research and understand these risks before investing in a 1031 DST. Consulting with financial advisors or experts who specialize in real estate investments can help in making informed decisions.

Broker Due Diligence and Regulation Best Interest

The SEC’s Regulation Best Interest (Reg BI) is a rule under the Securities Exchange Act of 1934. It sets a higher standard of conduct called the “best interest” standard for broker-dealers and their representatives. This standard applies when they suggest any securities transaction or investment strategy involving securities, including recommending different types of accounts, to retail customers. Essentially, it requires these professionals to prioritize the customer’s best interests when making such recommendations.

Under the “best interest” standard, broker-dealers are obligated to perform comprehensive due diligence when evaluating any investment. This comprehensive evaluation aims to empower investors to make well-informed decisions aligned with their best interests.

If your financial advisor fails to perform due diligence on an investment before recommending it to you, they could be held liable for investment losses. If your advisor unsuitably recommended a 1031 DST offering and you lost money, the securities attorneys at The White Law Group may be able to help you. You may be able to recover losses by filing a FINRA Arbitration claim against the brokerage firm that sold you the investment.

If you have suffered losses investing in Carter Exchange 1031 DST offerings, please contact the offices of The White Law Group at 1-888-637-5510.

The White Law Group is a national securities fraud, securities arbitration, and investor protection law firm with offices in Chicago, Illinois and Seattle, Washington.

FINRA provides an arbitration forum for investors to resolve disputes. The White Law Group represents investors in FINRA arbitration claims throughout the country. Visit the firm’s homepage to learn more about the firm’s representation of investors.