Before trusting someone with your money, understanding their background isn’t only smart, it’s crucial. That’s where the Financial Industry Regulatory Authority (FINRA) comes in. This authority lets investors independently review records, professional histories, licensing details, and other information about brokers or financial advisors.

Whether you’re new to investing or have decades of experience, spending a few minutes to review someone’s FINRA BrokerCheck profile can help you avoid a costly mistake while avoiding anyone with a negligent or fraudulent financial background. It’s an extremely valuable tool.

Investors have access to more information and databases than ever before. Using BrokerCheck is a proactive and competent step you can take to protect yourself and your finances.

What is FINRA BrokerCheck?

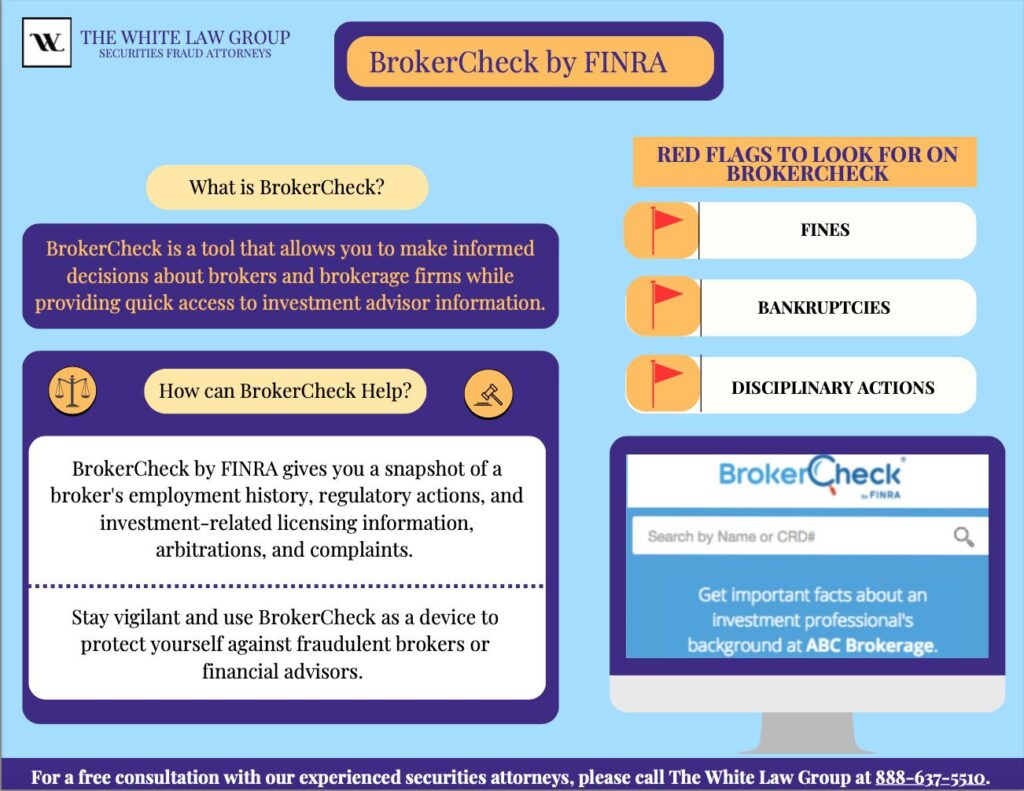

FINRA offers its BrokerCheck tool to help you research the professional backgrounds of brokers and brokerage firms, as well as investment advisor firms and advisors. The information provided by FINRA’s BrokerCheck tool can include:

- Professional backgrounds

- Qualifications

- Disciplinary records (if they exist)

What is FINRA?

The Financial Industry Regulatory Authority (FINRA) is an independent, non-governmental regulator for all securities firms doing business with the public in the United States. Congress authorizes FINRA to protect America’s investors by making sure the securities industry operates freely and honestly.

It operates the largest securities dispute resolution forum in the United States, providing a fair, efficient, and effective venue for handling securities-related disputes. The resolution of problems and disputes is accomplished through two non-judicial proceedings– arbitration and mediation.

FINRA BrokerCheck can also assist you with the following:

- Making informed choices about brokers and firms while providing easy access to investment adviser information.

- Letting you know a firm’s or individual’s registration status and if they can sell securities (stocks, bonds, mutual funds, etc.), offer investment advice, or both.

- Gives you a snapshot of a broker’s employment history, licensing information, regulatory actions, arbitrations, and customer complaints.

How to Use FINRA’s BrokerCheck Tool

Start by visiting FINRA’s website. From this website’s homepage, you can search by a broker’s name, their Central Registration Depository (CRD) number, or a firm’s name. This user-friendly tool is suitable for both new and seasoned investors.

Here’s an in-depth look at how to use this tool and understand the information it provides.

Provide a Name or CRD Number

You can enter the firm’s name or the representative’s first and last name. However, common names can produce several results. You will be shown a list of legal names based on the name you input into the FINRA BrokerCheck system. In this case, it helps to know the person’s legal name. A better solution is to ask the representative for their CRD (Central Registry Depository) number and enter it.

Check the Summary

This FINRA BrokerCheck page contains information about the exams someone has passed, the firms that have held their licenses, and whether the individual has any disclosures on their record. Your primary interest should be disclosure events. Do these events exist in someone’s record? Are they open or closed? How were they resolved?

Is the Broker Registered?

If a brokerage firm no longer licenses the advisor, the system will display “Not FINRA registered since month/year.” This indicates that the representative has allowed their securities licenses to lapse, which means they should not be providing investment advice for compensation as a Registered Investment Advisor or Investment Advisor Representative.

What Are the Broker’s Qualifications?

Describes the representative’s licensing at the national and state levels. Ensure the representative is licensed to conduct business in your state. View the licensing examinations that this representative has completed.

Registration and Employment History

Review the representative’s current and past employers. Is there a history of job-hopping? Any significant gaps in their employment?

An employment gap isn’t always a cause for concern. Some are explainable. However, a series of short-term positions may suggest red flags. If you notice a history of frequent job changes, it’s worth digging deeper.

Does the Representative Have Any Disclosure Events?

This is the most crucial section of the FINRA BrokerCheck service. An investor, the representative’s company, or a regulatory agency can initiate an event that requires a disclosure describing the complaint and its resolution. Disclosures may be serious, non-events, or frivolous. The most serious disclosures describe events with the following outcomes:

- The representative participated in restitution to the investor

- The representative was suspended from the industry

- The representative was terminated by their employer

A non-event disclosure occurs when the complaint is withdrawn. Frivolous complaints result in a ruling against the person or organization that initiated the complaint.

Be cautious of advisors who have multiple disclosures on their records. You should be careful, even if some of the complaints are frivolous. You may be surprised that repeat offenders can retain their licenses and continue to sell investment products to the public. That’s why it is always important to check the advisor’s FINRA record.

Even a single disclosure event is worth asking additional questions. Does it reflect behavior that could put your investments at risk? BrokerCheck makes it easier to make this call before it’s too late.

Frequently Asked Questions

1. What is FINRA BrokerCheck used for?

This authority oversees and regulates all broker-dealers and their registered representatives nationwide. It exists to protect investors by doing whatever is possible to ensure that the securities industry operates honestly and fairly. Through tools like FINRA BrokerCheck, this organization provides investors with easy access to background information about financial professionals, including any open disclosure events on their records.

2. Can someone check if they are listed on BrokerCheck?

No. BrokerCheck searches are anonymous and confidential. In other words, no one can see if you looked them up using FINRA’s BrokerCheck tool. Because of that, you can research one or multiple brokers without concern that your searches will be made public. Such anonymity allows investors to explore a professional’s history and identify potential red flags, such as job-hopping or regulatory issues.

3. What disqualifies you from a FINRA background check?

Several factors can disqualify a professional from becoming or remaining a FINRA-registered representative. These can include:

- Serious criminal convictions

- Regulatory sanctions

- Failure to disclose critical information

- A history of customer complaints

Typically, a single issue, like a lone, frivolous complaint, isn’t likely to disqualify someone from being searchable through a FINRA background check.

The White Law Group – Securities Fraud Attorneys

This information is provided by The White Law Group, a national securities fraud, securities arbitration, and investor protection law firm with offices in Chicago, Illinois, and Seattle, Washington.

The White Law Group, LLC, is dedicated to helping investors in claims against their financial professional or brokerage firm in all 50 states. Since the firm launched in 2010, it has handled over 800 FINRA arbitration cases.

Our firm represents investors across the country in all types of securities-related claims, including claims involving:

- Stock fraud

- Broker misrepresentation

- Churning

- Unsuitable investments

- Selling away

- Unauthorized trading

Free Consultation with a FINRA Attorney

If you invested with a suspicious broker and would like to speak to a securities attorney to determine if your brokerage firm may be liable for your investment losses, please call the securities attorneys of The White Law Group at 888.637.5510 for a free consultation. We can also help you understand more about FINRA BrokerCheck.

For more information on The White Law Group, visit https://whitesecuritieslaw.com.

Tags: Broker disclosures, Chicago broker fraud attorney, Chicago churning attorney, Chicago FINRA attorney, Chicago investment fraud attorney, Chicago securities attorney, Chicago securities lawyer, FINRA brokercheck, How to use BrokerCheck, Securities fraud attorney Chicago, What is BrokerCheck Last modified: June 30, 2025