Did your financial advisor recommend investing in non-traded REITs?

Non-traded Real Estate Investment Trusts (REITs) dropped significantly last year, dropping by two-thirds through November 2023 compared to the same period in the previous year.

Table of Contents

ToggleFactors such as higher interest rates and declines in commercial property prices contributed to reduced investor interest. Share redemptions increased, leading to a 12% decline in non-traded REIT net asset values over the year. In 2023, those investing in non-traded REITs raised $9.8 billion, down from $30 billion in the previous year.

This trend resulted in decreased property sales transactions, marking a shift from being net buyers in 2022 to net sellers in 2023. Blackstone Real Estate Income Trust and Starwood Real Estate Income Trust, two major REITs, experienced a decline in investments.

The Impact of Higher Interest Rates on Valuations

Blackstone REIT’s assets decreased by $7.8 billion to $109.7 billion. At the same time, investing in Starwood non-traded REIT’s real estate declined by $2.7 billion to $23 billion. The industry’s challenges are attributed to the impact of higher interest rates on valuations across asset classes, including real estate. Despite a few new non-traded REITs entering the market, fundraising remained sluggish.

In contrast, alternative investments, including non-traded business development companies and interval funds, outpaced non-traded REITs, raising over $35 billion in 2023. The report also highlighted increased redemption activity, where, rather than investing in non-traded REITS, investors pulled money out of real estate investments.

REITs posted $4.6 billion in redemptions for Q3, with Stanger & Co. estimating elevated redemptions of about $4.5 billion in Q4. Overall, the total reported net asset value for all REITs contracted to $96 billion in November 2023, reflecting a 12% decline from the peak in January 2023.

Non-traded REITs may be Overvalued by 30%

Investment News reported in May 2023 that non-traded REITs may be overvalued by as much as 30%, mainly investing in non-traded REITs in the form of commercial real estate.

With many American businesses still operating with some of their workforce at home post-pandemic and rising interest rates, commercial real estate is taking a hit. According to Investment News, the Dow Jones U.S. Real Estate Index was down almost 15.7% over the past year, indicating that investing in non-traded REITs and other commercial real estate has significantly declined. Meanwhile, the S&P 500 index increased a little more than a percentage point over the same period. Further, this month’s real estate data firm CoStar Group Inc. report indicated that the U.S. office vacancy rate hit a new high of 12.9% in the first quarter. This number reportedly exceeds the peak during the 2008 financial crisis.

This could be bad news for those contemplating investing in non-traded REITs, considering these products’ exceedingly limited share redemption programs. See: Non-traded REITs “Liquidity Issue”

Non-Traded Real Estate Investment Trusts (REITs) Overview

Investing in Non-Traded REITs vs. Exchange Traded REITs

There are two types of REITs: exchange-traded REITs and non-traded REITs. Both are subject to the exact IRS requirements, including distributing at least 90 percent of taxable income to shareholders. Like exchange-traded REITs, non-traded REITs are registered with the Securities and Exchange Commission. They must make regular SEC disclosures, including filing a prospectus and quarterly (10-Q) and annual reports (10-K), all publicly available through the SEC’s EDGAR database. While there are similarities between investing in non-traded REITs and exchange-traded REITs, they have exchange-traded differences, as illustrated in the chart below provided by The Financial Industry Regulatory Authority (FINRA).

Non-Traded REITs | Exchange-Traded REITs | |

Listing Status | Shares are not listed on a national security list. | Shares trade on a national securities exchange. |

Secondary Market | Very limited. While a portion of the total shares outstanding may be redeemable each year, redemption offers may be priced below the purchase or current price, subject to limitations. | Exchange-traded. It is generally easy for investors to buy and sell. |

Front-End Fees | Front-end fees can be as much as 15% of the per-share price. Those fees include selling compensation and expenses, which cannot exceed 10%, as well as additional offering and organizational costs. | Front-end underwriting fees, in the form of a discount, may take 7% or more of the offer proceeds. Investors who buy shares in the open market pay a brokerage commission. |

Anticipated Source of Return | Investors typically seek income from distributions over the years. Depending on the value of assets, the return on capital upon liquidation may be more or less than the original investment. | Investors typically seek capital appreciation based on prices at which REITs’ shares trade on an exchange. REITs also may pay distributions to shareholders. |

Private REITs

According to FINRA, investors exploring investing in non-traded REITs should consider another type—a private REIT or private-placement REIT—which does not trade on an exchange. Private REITs carry significant risks to investors. They are unlisted, making them hard to value and trade, and they are generally exempt from Securities Act registration.

Private REITs are not subject to the exact disclosure requirements as public non-traded REITs. The lack of disclosure documents makes it extremely difficult for investors to make an informed decision about the investment, even for those with years of experience investing in non-traded REITs. Private REITs can generally be sold only to accredited investors, such as those with a net worth of more than $1 million.

Risks of Investing in REITs

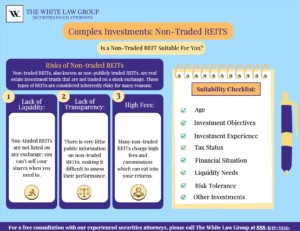

Although the selling points of non-traded REITs can be enticing, investors should weigh these selling points against the numerous complexities and risks associated with these investments.

Distributions are not guaranteed and may exceed operating cash flow. Those exploring investing in non-traded REITs should know that a REIT’s Board of Directors, in exercising its fiduciary duties, decides whether to pay distributions and the amount of any distribution. This can be a red flag if a REIT issuer is behind or incomplete in its SEC filings.

Distributions for all REITS from current or accumulated earnings and profits are taxed as ordinary income, as opposed to the tax rate on qualified dividends, which generally carries a tax rate of 15 percent. However, that rate can be 20 percent for people investing in non-traded REITs in the highest tax bracket or 0 percent for those in the lowest two tax brackets. If a portion of your distribution constitutes a return of capital, that portion is not taxed until your investment is sold or liquidated, at which time you will be taxed at capital gains rates.

Non-traded REITs are illiquid. As their name implies, non-traded REITs have no public trading market. Those exploring investing in non-traded REITs should, however, note that most non-traded REITs are structured as a “finite life investment,” meaning that at the end of a given timeframe, the REIT is required either to list on a national securities exchange or liquidate. Even if a liquidity event occurs, there is no guarantee that the value of your investment will have gone up—and it may go down or lose all its value. Suppose the value of the REIT’s portfolio has changed materially during the offering period. In that case, people investing in the non-traded REIT for the first time may be paying a per-share price above or below the per-share net value of the underlying real estate.

Early redemption is often tricky and may be expensive. Most public non-traded REIT offerings limit the number of shares that can be redeemed before liquidation. Investors must consider their short-term capital needs before investing in long-term, illiquid security. They should carefully review the section explaining the terms and limitations of the REIT’s share redemption plan.

Individuals considering investing in non-traded REITs should also note that, due to the illiquid nature of the investment, they may receive solicitations to sell their non-traded REIT investment outside of the sponsor’s redemption program through a mini-tender offer. These offers are often for less than 5 percent of a company’s stock, and they typically carry far fewer protections to investors than traditional tender offers. According to the Financial Industry Regulatory Authority, investors can receive a price well below the sponsor’s estimated per-share value or, if available, the early redemption program price.

Front-End Fees and Commissions

Anyone exploring investing in non-traded REITs should know they can be expensive, and the fees add up quickly. Front-end fees generally consist of two parts: selling compensation and expenses, which cannot exceed 10 percent of the investment amount, and additional offering and organizational costs, sometimes referred to as “issuer costs,” which are also paid from the offering proceeds.

For example, if you plan on investing $10,000 in non-traded REITs, you can expect a 15 percent front-end fee. That means that $8,500 will work for you at the time of investment. By comparison, the underwriting compensation associated with exchange-traded REITS usually is seven percent of the offering proceeds.

According to state regulatory guidelines, the total for both types of fees cannot exceed 15 percent. FINRA guidelines also limit the total for both types of fees to 15 percent in offerings that an affiliated broker-dealer sells.

Financial Advisor Fraud Related to Investing in Non-traded REITs

Unfortunately, high commissions could motivate unscrupulous financial advisors to sell a non-traded REIT regardless of whether the investment aligns with the client’s objectives and profile. Moreover, the total commissions and expenses make it difficult for the REIT to perform in line with the market.

Unsuitability

Brokers must consider a customer’s age, financial situation, investment objective, and investment experience before recommending that they invest in non-traded REITs. An investment in a non-traded REIT may be unsuitable for a given customer, or the transaction amount or frequency may be excessive.

Misrepresentation involving Non-traded REITs

Sometimes, a customer complains that the broker said something was a very safe investment, but the customer later discovers that it was, in fact, very risky. Customers rely upon the recommendations of financial advisors when investing in products like non-traded REITs, and failure to disclose the risk adequately is a misrepresentation or material omission.

Unfortunately, many investors do not discover the truth in such cases until they have incurred substantial losses and realize that the investment was not so safe in the first place. However, this should be distinguished from an experienced, wealthy investor interested in speculating with a portion of his portfolio by investing in non-traded REITs. This investor would understand the risk, be willing to take it and be able to afford it.

Securities Fraud Investigation of Non-traded REITs

The White Law Group has represented numerous investors in securities fraud claims against their brokerage firm for improper recommendations of Non-traded REITs. The firm is currently investigating the following non-traded REIT, among others:

- Peakstone Realty Trust/Griffin Realty Trust

- Sila Realty Trust

- Healthcare Trust Inc.

Non-traded REITs are rarely, if ever, suitable for those investing in securities to achieve short-term goals. Even long-term investors must be willing to bear illiquidity risks. Consider the front-end cost relative to the sales costs you would incur to buy and sell other securities during the same holding period as the life of the REIT. Consider how much share price appreciation and distributions you will need to receive to overcome these front-end charges.

As you weigh investing in non-traded REITs, be wary of pitches or sales literature offering simplistic reasons to buy a REIT investment. Sales pitches might play up high yields and stability while glossing over the product’s lack of liquidity, fees, and other risks. Ask your advisor to explain why the non-traded REIT is right for you and how it will help you achieve your specific investment goals.

Before investing in non-traded REITs, always ask to review the initial prospectus and any prospectus supplements. These documents will contain a more extensive and balanced discussion of the risks involved than any sales material or pitches you receive.

Remember only to invest if you are confident that the product can help you meet your investment objectives and are comfortable with the associated risks.

National Securities Attorneys – the White Law Group

If you have concerns after investing in non-traded REITs and want to speak with a securities attorney, please call The White Law Group at 888-637-5510.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm dedicated to helping investors file claims against their financial professional or brokerage firm in all 50 states. Since its launch in 2010, the firm has handled over 700 FINRA arbitration cases.

Our firm represents investors in securities-related claims, including claims involving stock fraud, broker misrepresentation, churning, unsuitable investments, selling away, and unauthorized trading.

With over 30 years of securities law experience, the White Law Group has the expertise to help investors defrauded in securities, investment, and financial business transactions attempt to recover their investment losses.

Frequently Asked Questions

Before investing in REITs, you should consider the following:

- Your financial goals: If you hope to achieve a short-term financial goal, such as making a down payment on a home or a car in the next year, REITs are a poor investment because of their illiquidity.

- Your risk tolerance: REITs are a risky investment. If you are approaching retirement and cannot afford sudden and severe losses, REITs are not your optimal investment vehicle.

- The REIT’s redemption terms: Attempting to redeem your investment early on can be expensive. Consider other investment products if you cannot afford to have money inaccessible for an extended period.

You can spot fraud or misrepresentation regarding REITs in several ways before it occurs. This includes:

- Investigate the financial health of the REIT, including its redemption terms and past performance.

- Ask your financial advisor about any fees associated with investing in the REIT.

- Prepare for conversations with your advisor by creating a list of questions you have about the REIT.

- Consult with a third party who will not benefit from your decision to invest in the REIT.

REITs generate returns through several channels, including:

- Income from residential and commercial tenants

- Capital appreciation due to favorable market conditions, upgrades to the property, and portfolio acquisitions.

Typically, investors receive income when the REIT sells properties within its portfolio or when a liquidity event occurs, such as a merger or the REIT’s listing on a public exchange.

[…] The trouble with non-traded REITs, like The Parking REIT, is that they are complex and inherently risky products. […]

[…] CNL Healthcare Properties Decrease in Net Asset Value Recovery of CNL REIT Losses Did your Financial Advisor Recommend a Non-Traded REIT? […]