Healthcare Trust Inc.: Lawsuits and Liquidation

The White Law Group continues to investigate FINRA arbitration claims involving Healthcare Trust Inc. (ARC Healthcare Trust II) and the liability broker dealers may have improperly recommending it to investors.

Healthcare Trust Inc. has reportedly completed its internalization of management as the company considers a public listing on a national stock exchange. Alongside this, the company has rebranded as National Healthcare Properties Inc. to better reflect its focus on healthcare real estate.

Healthcare Trust: Reverse Stock Split

Additionally, the company executed a 4-for-1 reverse stock split after it reported a net loss of $139 million for the first half of 2024, primarily due to $98.2 million in termination fees from the internalization process. The board also updated the company’s per-share net asset value (NAV) to $13, down from $14 in 2022.

Healthcare Trust Inc. – Risks and Liquidity Problems

Unfortunately for investors it appears that many financial advisors/brokerage firms that sold non-traded REITs such as Healthcare Trust Inc. may have understated or misrepresented the risks and liquidity problems.

HTI specializes in healthcare-related real estate, including medical office buildings and senior housing. The REIT’s portfolio includes 207 healthcare-related properties across 32 states with a gross asset value of $2.6 billion.

The REIT, sponsored by American Realty Capital (now known as AR Global), was part of a commercial real estate empire built by investor Nicholas Schorsch that was involved in an accounting scandal several years ago. Unfortunately, American Realty Capital REITs have had less than stellar results for investors. See: Hospitality Investors Trust Inc. (HIT REIT) Files Chapter 11 Bankruptcy

Disappointing Net Asset Value (NAV) per share

According to filings with the SEC on March 31, 2023, the REIT has declared a new Net Asset Value of $14.00 per share. Previous NAVs per share were $14.50 as of December 31, 2020, $15.75 per share as of December 31, 2019, and $17.50 per share as of December 31, 2018. Shares were originally priced at $25.00 each.

Secondary Sales Price Indicates Losses for Investors

According to Central Trade and Transfer, a secondary market for non-traded REITs, shares of Healthcare Trust Inc. have recently been sold for as low as $2.15/per share. Unfortunately for many investors, it appears that the secondary market price would represent significant losses on their initial capital investment.

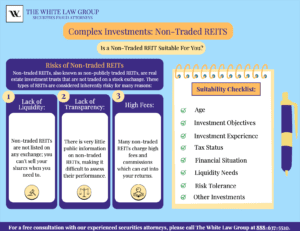

Are Non-Traded REITs Suitable for you?

Non-traded REITs are high risk, complex investments and are not suitable every investor. Prior to making recommendations to an individual investor, brokerage firms are required by the Financial Industry Regulatory Authority (FINRA) to disclose all the risks of an investment. Recommendations should only be made if the investment is suitable for an individual investor given their age, investment objections, investment experience and risk tolerance.

Non-traded REITs are high risk, complex investments and are not suitable every investor. Prior to making recommendations to an individual investor, brokerage firms are required by the Financial Industry Regulatory Authority (FINRA) to disclose all the risks of an investment. Recommendations should only be made if the investment is suitable for an individual investor given their age, investment objections, investment experience and risk tolerance.

Brokerage firms that do not perform adequate due diligence on an investment and/or make unsuitable recommendations can be held accountable for investment losses through FINRA arbitration.

High commissions could be a motivating factor for unscrupulous financial advisors to sell the REIT regardless of whether the investment is in line with the client’s investment objectives and profile. Moreover, the total commissions and expenses make it difficult for non-traded REITs to perform in line with the market.

Class Action vs. Individual FINRA Arbitration Lawsuit

People often wonder whether a large class action lawsuit is a better litigation option for them than an individual FINRA arbitration case. The answer depends on many factors, but typically if the loss sustained is large (say larger than $100,000), an individual arbitration claim is likely a better option. Class actions as a recovery option are more appropriate for grouping large numbers of individuals who have small claims – too small to generally pursue individually.

Investigating Potential Lawsuits involving Healthcare Trust Inc.

If you invested in a Healthcare Trust Inc. (ARC Healthcare Trust II) and would like to discuss your litigation options, please call the securities attorneys of The White Law Group at 888-637-5510 for a free consultation.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm dedicated to helping investors in claims in all 50 states against their financial professional or brokerage firm. Since the firm launched in 2010, it has handled over 700 FINRA arbitration cases.

Our firm represents investors in all types of securities related claims, including claims involving stock fraud, broker misrepresentation, churning, unsuitable investments, selling away, and unauthorized trading, among many others.

With over 30 years of securities law experience, The White Law Group has the expertise to help investors defrauded in securities, investment and financial business transactions attempt to recover their investment losses.

Tags: AR Global, AR Global Healthcare Trust Inc., non-traded REITs Last modified: October 22, 2024