Peakstone Realty Trust NYSE Listing: 2024 Update

The White Law Group continues to investigate potential securities claims involving Peakstone Realty Trust Inc. (fka Griffin Realty Trust) to investors. Our firm continues to file claims on behalf of investors who have suffered investment losses in Peakstone. Here are some key takeaways of the current situation, according to analysts.

- Volatility: Peakstone Realty Trust’s average weekly movement is 7.3%, ranking it among the 10% most volatile stocks in the US market.

- Earnings: The company reported a loss per share (EPS) of -$15.38.

- Outstanding Shares: As of the latest available data, Peakstone Realty Trust has 36,346,622 shares outstanding.

- Price Movement: After its last earnings report, the stock price decreased by -2.182%.

- Sentiment: The company’s news sentiment score is 1.02, indicating a generally positive tone in recent articles about the company. However, short interest has increased by 46.22%, indicating bearish sentiment among investors.

- Fair Value: Estimated return represents the projected annual return after purchasing shares, based on the EPS growth rate projected over 5 years.

Peakstone Realty Trust’s journey from Griffin Realty Trust to a publicly listed entity on the New York Stock Exchange had its ups and downs, with investors eagerly anticipating liquidity following Griffin’s suspension of redemptions. However, the trading price of Peakstone (PKST) upon its debut disappointed many. After a 1 for 9 reverse stock split, the company estimated its Net Asset Value (NAV) at $66.87, significantly higher than its trading price.

Shares opened at $8 per share and closed at $11.65 on the first day of trading in April 2023. While it reached a high of $39.65 in June, it closed at $13.75 per share yesterday. This fluctuation reflects the volatility in the capital markets and the challenges specific to the office property market, which have changed negatively since the last NAV update.

Decrease in Revenue – Peakstone Realty Trust

As of March 31, 2024, Peakstone reported: revenue of $59.2 million, an 11.64% decrease from last year’s $67 million. The company notes that the change in revenue is due to the “execution of strategic dispositions.”

PKST reported net income of approximately $5.5 million (net income attributable to common shareholders of approximately $5 million, or $0.14 per basic and diluted share); and same store cash net operating income of approximately $44.8 million, a 0.7% increase compared to the same quarter in 2023.

In other news, last December, Peakstone reportedly announced the termination of a former executive vice president, without cause. No details regarding the termination were provided.

Office REITs Take a Hit – PKST

Peakstone Realty Trust (NYSE: PKST) is a industrial and office REIT. Unfortunately for investors, Office REITs in particular have taken a hit due to the changing landscape of remote work. With more people working from home, the demand for office space has shifted.

Companies are adopting flexible work arrangements, which might mean they need less office space or could opt to downsize their current office footprint. Reduced demand for office space can lead to higher vacancy rates in office properties, potentially impacting the rental income generated by office REITs. If these REITs have a significant investment in office properties, they could experience declining rental income and property values.

Peakstone Reverse Stock Split – What does it mean for Shareholders?

A reverse stock split occurs when a company decreases the number of shares in order to increase the dollar value of the individual shares. In one example, if the company has $100,000 worth of outstanding shares, with 10,000 shares at $10 per share, they may elect to create 2,500 shares at $40 per share.

Because the share price increases, it may look more attractive to new investors, resulting in more money invested into the company, creating the perception that a company’s stock has increased in value. Or a company may do a reverse stock split so that its share price will appear like its competitors.

Unfortunately, companies whose stock price has been decreasing for a while may execute reverse stock split in an attempt to hide it. It potentially could be a sign that the company is in poor financial health.

Griffin Realty Trust – NAV Declines

The company reported an updated Net Asset Value (NAV) per share of $7.37 as of June 30, 2022, a decrease from 2021 of NAV of $9.10 per share – a decline of 18%. According to a filing with the SEC, the company reported that the lowered NAV is due to the decrease in the value of office properties, which was partially offset by an increase in the value of its industrial properties.

The company noted that “office properties continue to be negatively impacted by pandemic-related work-from-home trends.”

Tender Offer Suggests Losses for Shareholders

In January 2023, the board of Griffin Realty Trust Inc. reportedly sent a letter to their shareholders announcing their neutrality regarding an unsolicited tender offer from CMG Partners LLC and its affiliates. CMG’s offer included the purchase of up to 500,000 shares of Class A and Class AA common stock for just $3.40 per share.

In a letter to stockholders, Griffin’s board of directors stated that CMG Partners’ offer is approximately 54% less than the most recently published NAV of $7.37 as of June 30, 2022.

Potential Lawsuits to Recover REIT Investment Losses

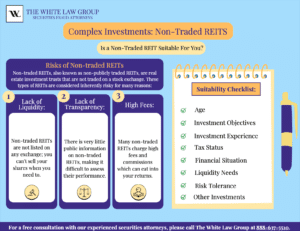

The trouble with non-traded REITs is that they are complex and inherently risky products.

The trouble with non-traded REITs is that they are complex and inherently risky products.

Lack of liquidity is often problematic for many investors. Investors looking to sell often have difficulty finding a buyer and can suffer significant losses on the sale.

Broker dealers are required to inform clients of the risks associated with investment recommendations. They must ensure that those recommendations are suitable for the investor considering the investor’s age, risk tolerance, net worth, and investment experience. Firms that fail to do so may be held responsible for any losses.

The Financial Industry Regulatory Authority (FINRA) provides regulatory services to the financial industry by licensing and regulating brokerage firms. FINRA also operates the largest dispute resolution forum in the securities industry. FINRA Dispute Resolution is the forum for almost all disputes between investors, brokerage firms and brokers.

Class Action vs. Individual FINRA Arbitration Lawsuit

Free Consulation

If you have suffered losses investing in Peakstone Realty Trust, Inc. (Griffin Realty Trust), you may be able to recover your losses by filing a FINRA Dispute Resolution Claim. Please contact The White Law Group at 888-637-5510 for a free consultation.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm with offices in Chicago, Illinois and Seattle, Washington.

Tags: Griffin Capital Essential Asset REIT lawsuit, Griffin realty trust NAV, Griffin Realty Trust lawsuit, IndustrialCo, non-traded REITs, Peakstone Realty Trust Last modified: July 16, 2024