Understanding Derivatives

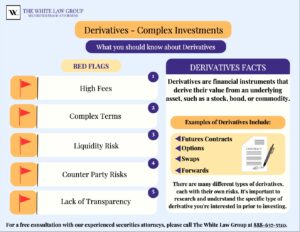

Derivatives are financial instruments that derive their value from an underlying asset, such as stocks, bonds, or commodities. They can be quite complex and are often used by investors to manage risk or speculate on future price movements. These investments can be highly leveraged, meaning that a small change in the underlying asset’s value can result in a significant gain or loss in the derivative’s value. However, they also offer opportunities for diversification and other investment strategies. Understanding the foundational aspects of derivatives is important, and they are as follows:

Derivatives are financial instruments that derive their value from an underlying asset, such as stocks, bonds, or commodities. They can be quite complex and are often used by investors to manage risk or speculate on future price movements. These investments can be highly leveraged, meaning that a small change in the underlying asset’s value can result in a significant gain or loss in the derivative’s value. However, they also offer opportunities for diversification and other investment strategies. Understanding the foundational aspects of derivatives is important, and they are as follows:

-

Familiarize yourself with the different types of derivatives

-

Explore how they are used in investment decisions

-

Utilize educational resources to refresh your knowledge

-

Stay consistent with financial news and market trends

-

Understanding and learning about derivatives is an ongoing process

Different Types of Derivatives

There are several unique types of derivatives. One form of a derivative is a futures contract, which allows investors to buy or sell an asset at a predetermined price and date in the future. This can be very useful for hedging against price fluctuations or for speculating on the future direction of the asset’s price.

Another type is an options contract, which gives the holder the right, but not the obligation to buy or sell an asset at a specified price within a certain time frame. Options can be used to protect against downside risk or to take advantage of potential upside opportunities. An options contract generally costs a fraction of what the underlying shares would. Using options is a form of leverage, allowing an investor to make a bet on a stock without having to purchase or sell the shares outright.

Swaps are another kind of derivative, where two parties agree to exchange cash flows based on predetermined terms. For example, a currency swap allows two parties to exchange interest payments and principal amounts denominated in different currencies. This can be useful for managing currency risk or for taking advantage or interest rate differentials between countries.

Commodity futures are another type of derivative contact that allows investors to buy or sell a specific quantity of a commodity, such as oil, gold, or wheat at a predetermined price and date in the future. These contracts are traded on commodity exchanges and serve as a way for market participants to manage their exposure to price fluctuations in commodities. These derivatives offer a way for producers and consumers of commodities to hedge against price volatility. Although commodity futures maintain a variety of positive attributes, they also hold their share of cons. They can be highly volatile and subject to price fluctuations, which can result in significant financial losses. Along with that they also require a solid understanding of the market and its factors, making them complex and potentially risky investments.

Commodity Futures in the News

Recently, the Commodity Futures Trading Commission issued orders simultaneously filing and settling charges against swap dealer and futures commission merchant (FCM), who are affiliated with four financial institutions. These offenses reportedly consist of failing to maintain, preserve, or produce records that were required to be kept under CFTC recordkeeping requirements, and failing to diligently supervise matters related to their businesses as CFTC registrants. According to the CTFC, as a result of each registrant’s alleged failure to ensure that its employees including supervisors and senior-level employees complied with communications policies and procedures, each registrant failed to maintain hundreds if not thousands of business-related communications.

Further, in July of 2019, Financial Advisor IQ reported on multiple plaintiff lawyers filing at least three class action lawsuits after federal prosecutors secured a June 25 deal with Merrill Lynch Commodities. The firm was reportedly ordered to pay $25 million to resolve their investigation into alleged deceptive trading practices. The Commodity Futures Trading Commission announced on the same day a separate settlement with the Merrill Lynch Commodities unit of Bank of America, requiring it to “pay an $11.5 million civil fine, cooperate with any related investigations, and remediate practices,” according to the article.

Something important to note is how manipulating the market by creating the false impression of increased supply or demand, in order to induce other market participants to buy and to sell futures contracts, is known as “spoofing.” The penalties of committing this offense can be severe depending on the nature of the case details.

Advantages and Disadvantages of Derivatives

Derivatives offer several advantages to investors. Firstly, they provide opportunities for hedging and risk management. By using derivatives, investors can protect themselves against potential losses caused and adverse price movements in the underlying assets. This can be particularly useful for businesses that rely on commodities or currencies, as derivatives allow them to mitigate the impact of price fluctuations. Another advantage that derivatives offer is their enhanced liquidity and flexibility. Investors can enter and exit derivative positions with ease, as the market for derivatives is typically more liquid than the underlying assets.

Although derivatives are useful for investors, there are also disadvantages to consider when educating yourself on these types of complex investments. There is the potential for high leverage. Derivatives often allow investors to control a large position with a relatively small upfront investment. While this can amplify potential gains, it also magnifies the losses. High leverage can lead to substantial financial risks, particularly if the market moves against the investors position.

Do I Need a Securities Fraud Attorney?

If you suspect you have been a victim of securities fraud, it may be wise to consult with a securities fraud attorney. They specialize in handling cases related to investment fraud and can provide valuable advice and representation. Understanding your rights as an investor is something that is imperative when dealing with investment fraud. Securities attorneys have the expertise to analyze investment strategies, evaluate actions of brokers or financial advisors, and determine if any misconduct or violations have occurred. By partnering with a securities fraud attorney who understands the intricacies of FINRA, you can increase your chance of recovering losses resulting from investment fraud and holding the responsible parties accountable for their actions.

FINRA Arbitration

The Financial Regulatory Authority is a non governmental organization that regulates brokerage firms and exchange markets in the United States. FINRA oversees and enforces the primary rules and regulations that protect investors and ensure fair and transparent financial markets. They work to set standards for professional conduct, licensing, and education for individuals and firms in the securities industry. FINRA arbitration is a process in which an impartial arbitrator or panel of arbitrators is appointed to hear the dispute and render a decision. The White Law Group helps clients navigate the arbitration process and represent their interests throughout the proceedings. This can include preparing and filing the initial claim, conducting discovery, presenting evidence and arguments at the hearing, and appealing the decision if necessary.