USEDC 2016 Drilling Fund LP – Securities Investigation

Are you concerned about your investment in USEDC 2016 Drilling Fund LP? If so, The White Law Group may be able to help you recover your losses by filing a FINRA Dispute Resolution against the brokerage firm that sold you the investment.

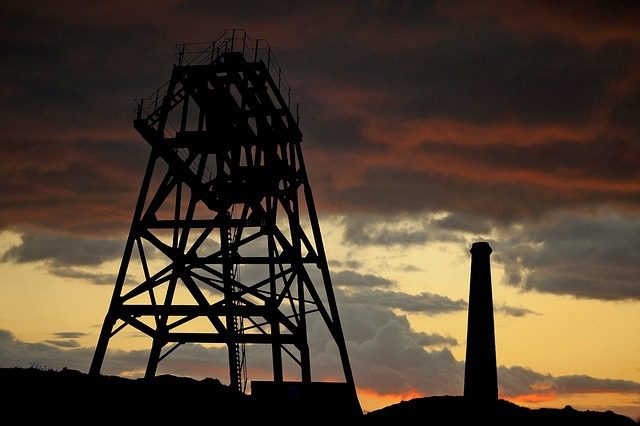

According to Bloomberg, U.S. Energy Development Corporation explores, drills, and operates oil and natural gas wells in the United States and Canada. The company focuses on drilling, acquisition, and joint venture opportunities. It reportedly undertakes projects in Oklahoma, Texas, North Dakota, Marcellus, and other states in the United States, as well as Canada.

U.S. Energy raises money from investors through Reg D private placement offerings like the company did for USEDC 2016 Drilling Fund LP. These Reg D private placements are typically sold by brokerage firms in exchange for a large up front commission, usually between 7-10%, as well as additional “due diligence fees” that can range from 1-3%.

In the case of USEDC 2016 Drilling Fund, the fees were as follows, “Dealer-Manager Fee – 2%; Sales Commission – 7%; Due Diligence Fee – 0.5%; Marketing Fee – 0.5%.”

The trouble with oil & gas limited partnerships, like USEDC 2016 Drilling Fund LP, is that they involve a high degree of risk and are typically sold as unregistered securities which lack the same regulatory oversight as more traditional investment products like stocks or bonds.

An additional risk inherent to U.S. Development Corporation offerings is also the general risk that comes with the energy market – a market that has seen enormous losses over the last few years due to the declining cost of oil and other energy commodities.

Investigating Potential Lawsuits

The White Law Group is investigating the liability that brokerage firms may have for improperly recommending oil and gas LPs such as USEDC 2016 Drilling Fund LP to investors.

Broker dealers are required to perform adequate due diligence on all investment recommendations. They must ensure that each investment is suitable for the investor in light of the investor’s age, risk tolerance, net worth, financial needs, and investment experience.

Fortunately for investors, FINRA provides an arbitration forum for investors to resolve such disputes. If a broker or brokerage firm makes an unsuitable investment recommendation or fails to adequately disclose the risks associated with an investment they may be liable for investment losses in a FINRA arbitration claim.

If you are concerned about your purchase of USEDC 2016 Drilling Fund LP please contact The White Law Group at 1-888-637-5510 for a free consultation with an experienced securities attorney.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm with offices in Chicago, Illinois and Franklin, Tennessee. The firm represents investors throughout the country in claims against their brokerage firm.

For more information on the firm and its representation of investors, visit www.WhiteSecuritiesLaw.com.

Tags: oil and gas losses, private placement investments, securities fraud attorney, U.S. Energy Development Corporation class action, U.S. Energy Development Corporation investigation, U.S. Energy Development Corporation lawsuit, U.S. Energy Development Corporation losses, USEDC 2016 Drilling Fund LP class action, USEDC 2016 Drilling Fund LP complaints, USEDC 2016 Drilling Fund LP damages, USEDC 2016 Drilling Fund LP investigation, USEDC 2016 Drilling Fund LP Investment Losses, USEDC 2016 Drilling Fund LP investor relations, USEDC 2016 Drilling Fund LP lawsuit, USEDC 2016 Drilling Fund LP litigation, USEDC 2016 Drilling Fund LP losses, USEDC 2016 Drilling Fund LP recovery options, USEDC 2016 Drilling Fund LP reviews, USEDC 2016 Drilling Fund LP value Last modified: March 6, 2019