Securities Investigation: UBS AG Buffer Auto callable Contingent Yield Notes linked to ARK Innovation ETF

Are you concerned about your investment in UBS Auto Callable Notes? The White Law Group is investigating the UBS Auto Callable Notes Linked to the least performing of the Russell 2000® Index and the shares of the ARK Innovation ETF due August 17, 2026.

Complex Investment Product – UBS Auto Callable Notes Linked to ARK Innovation ETF

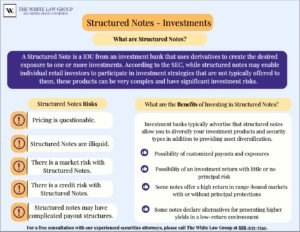

According to the prospectus, the UBS Auto Callable Notes Linked to ARK Innovation ETF is a complex investment product. The shares aren’t listed on any exchange and do not guarantee the repayment of principal and do not provide for the regular payment of interest. With the opportunity for higher yields, comes greater risks including the risk of losing your entire initial investment, according to the prospectus.

When you invest in a structured note, you essentially purchase an investment like a bond, which is linked to an underlying asset or index, such as the ARK Innovation ETF. The note has a maturity date, indicating when you will receive your initial investment back. In the case of this note, the underlying asset is the ARK Innovation ETF and Russell 2000® Index.

Auto Callable Notes vs Callable Notes

The difference between Callable notes and auto callable structured notes is the terms of when the issuer has the option to redeem the notes.

Callable notes give the issuer the right to redeem (or “call”) the notes before their maturity date. This means that if the issuer decides to exercise the call option, they can repay the investors and retire the notes earlier than originally planned. The issuer typically calls the notes when interest rates decrease, allowing them to refinance the debt at a lower cost. As a result, investors in callable notes face the risk of having their investment redeemed before the expected maturity, potentially missing out on future interest payments or potential gains.

Auto callable notes, on the other hand, also have a call feature, but with an additional condition. These notes contain a predetermined level tied to an underlying asset or index. If the underlying asset or index reaches or exceeds this specified level at any point before the maturity date, the notes are automatically redeemed (or “auto-called“). In this case, the investor receives a predetermined payout, typically higher than the interest they would have earned if the notes were held until maturity. Auto callable notes provide an opportunity for investors to capture potential gains if the underlying asset performs well. However, if the auto-call condition is met, investors lose the opportunity to benefit from any further potential appreciation in the underlying asset.

Auto callable notes introduce the potential for early redemption based on specific predetermined criteria.

Additional Risks – UBS Auto Callable Notes Linked to ARK Innovation ETF

There are additional risks associated with investing in UBS Auto Callable Notes Linked to ARK Innovation ETF:

There are additional risks associated with investing in UBS Auto Callable Notes Linked to ARK Innovation ETF:

-

Early Redemption Risk: Auto callable notes have an “auto-call” feature, which means they can be redeemed by the issuer if the underlying asset or index reaches or exceeds a specified level before the maturity date. If the auto-call condition is met, the notes are redeemed early, and investors may miss out on potential future gains if the underlying asset continues to appreciate.

-

Market Risk: The value of auto callable notes is closely tied to the performance of the underlying asset or index. If the market experiences significant fluctuations or declines, the value of the notes may decrease, potentially resulting in a loss of principal for investors.

-

Credit Risk: Auto callable notes are typically issued by financial institutions, which means investors are exposed to the credit risk of the issuer. If the issuer defaults or faces financial instability, investors may face a loss of their principal investment.

-

Limited Participation: Auto callable notes often cap the potential returns investors can earn. Although they offer the possibility of higher payouts if the auto-call condition is met, the maximum return achievable may be limited compared to investing directly in the underlying asset or index.

-

Complexity Risk: Auto callable notes can be complex financial instruments that may be challenging for investors to fully understand. The terms and conditions, including the auto-call triggers, payout structures, and potential barriers, can vary between different notes. Investors should carefully review the terms and ensure they comprehend the associated risks before investing.

-

Liquidity Risk: Auto callable notes may have limited liquidity in the secondary market, meaning they can be challenging to sell before maturity, especially if there is low demand or restrictions on resale. Investors should consider the potential difficulty of selling these notes if the need arises.

-

Capital Loss Risk: If the underlying asset or index performs poorly, auto callable notes may not be auto-called and will continue to maturity. In such cases, investors may face a decline in the market value of the notes, potentially resulting in a capital loss if they decide to sell before maturity.

Investigation – Investment Loss Recovery

The White Law Group is investigating the liability that brokerage firms may have for recommending complex, often extremely high-risk, structured notes such as UBS Auto Callable Notes Linked to ARK Innovation ETF

With the market in turmoil, many investors who purchased such investments believing they provided downside protection or were akin to bonds because of the dividend component are instead finding that these products can indeed suffer enormous losses.

Brokers often pitch structured products, as providing “downside protection” against losses to a related index while allowing modest upside gain potential. Of course, this is only true if the value of the index doesn’t fall below a predetermined price. If the price falls below that point, the losses in structured notes can still be huge.

These products typically pay a high fee to the financial advisors that sell them.

Brokerage firms have two main duties in recommending structured callable notes linked to equity investments or indexes. First, brokerage firms are required to perform adequate due diligence on any product they recommend. Second, brokerage firms are required to ensure that all recommendations made are suitable for their client in light of the client’s age, investment experience, net worth, income, and investment objectives.

If a brokerage firm fails to do either of these things, the firm can be held responsible in a FINRA arbitration claim.

Hiring a Securities Attorney

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm dedicated to helping investors in claims in all 50 states against their financial professional or brokerage firm. Since the firm launched in 2010, it has handled over 700 FINRA arbitration cases.

Our firm represents investors in all types of securities related claims, including claims involving stock fraud, broker misrepresentation, churning, unsuitable investments, selling away, and unauthorized trading, among many others.

With over 30 years of securities law experience, The White Law Group has the expertise to help investors defrauded in securities, investment and financial business transactions attempt to recover their investment losses. The firm reviews securities fraud cases throughout the country.

If you have suffered losses investing in UBS Auto Callable Notes Linked to ARK Innovation ETF , the securities attorneys of The White Law Group may be able to help. For a free consultation, call the firm’s office at 888-637-5510.

For more information on The White Law Group, please visit our website at https://whitesecuritieslaw.com.