Ponzi Schemes on the Rise

According to reports, the number of Ponzi schemes increased dramatically in 2023 and 2024, compared to the previous years.

Table of Contents

ToggleWhat is a Ponzi Scheme, and why is it on the rise?

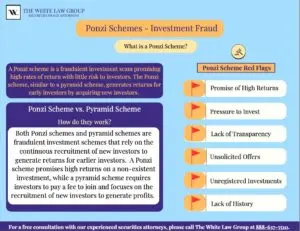

A Ponzi scheme is a fraudulent investing scam that promises high rates of return with little risk to investors. Like a pyramid scheme, it generates returns for early investors by acquiring new investors.

Three of the most prominent examples of Ponzi schemes were uncovered during the 2008 financial crisis: Bernie Madoff, who swindled $65 billion from unsuspecting investors; Thomas Petters, who swindled $3.7 billion; and Allen Stanford, who swindled $8 billion.

Despite the high-profile prosecutions of Madoff, Petters, and Stanford, Ponzi schemes appear to be once again on the rise. Authorities reportedly discovered 59 alleged Ponzi schemes in 2022, and 66 alleged Ponzi schemes in 2023, with close to $5.3 billion and $2 billion respectively, in investor losses.

Ponzi scheme vs. Pyramid scheme

Both Ponzi and pyramid schemes are fraudulent investment schemes often operated by financial advisors. They rely on continuously recruiting new investors to generate returns for earlier investors. However, there are some key differences between the two.

A Ponzi scheme is named after Charles Ponzi, who became notorious for using this method in the early 20th century. In a Ponzi scheme, the fraudster promises investors high returns on their investments and pays those returns utilizing the money invested by subsequent investors. After seeing Ponzi’s ill-gotten gains, others attempted schemes of their own, leading to the rise of Ponzi schemes in the first half of the 20th century.

With this scheme, there is no actual investment or business generating returns, and the scheme relies solely on continuously recruiting new investors to keep it going. Eventually, when there are no more new investors to recruit, the scheme collapses, and investors lose their money.

On the other hand, a pyramid scheme is a similar fraudulent investment scheme typically operated by financial advisors with a slightly different structure. In recent years, legal businesses using this alternative to the Ponzi Scheme have increased. In a pyramid scheme, investors pay a fee to join, and they are promised the opportunity to earn money by recruiting new investors. The more people they recruit, the more money they can make.

However, pyramid schemes often do not offer any actual product or service to sell; their primary focus is recruiting new investors. As with a Ponzi scheme, when there are no more new investors to recruit, the scheme collapses, and most investors lose their money. Due to their simplicity, pyramid schemes, like Ponzi schemes, are rising in the United States.

While both Ponzi and pyramid schemes rely on fraudulent financial advisors recruiting new investors to generate returns for earlier investors, a Ponzi scheme promises high returns on a non-existent investment. In contrast, a pyramid scheme requires investors to pay a fee to join and focuses on recruiting new investors to generate profits.

Examples of Ponzi Schemes

With Ponzi schemes on the rise in recent years, The White Law Group has represented numerous investors whose brokers have been defrauded through various Ponzi schemes. The following are a few examples of schemes the firm has investigated.Marat Likhtenstein’s $1.24 Million Ponzi Scheme

Horizon Private Equity III Ponzi Scheme

Shawn Goode’s $4.8 Million Ponzi Scheme

Another example of a Ponzi scheme came to a head in April 2022. On April 18, 2022, the SEC filed an emergency action and charged financial advisor Shawn Goode with defrauding clients and misappropriating millions of dollars of investor funds. With Ponzi schemes on the rise in recent years, the SEC has begun to take aggressive action against those who orchestrate them.

Good, of Wilmington, NC, allegedly raised at least $4.8 million from five clients at Morgan Stanley to make supposedly low-risk investments in tax-free bonds and land-development projects. The clients included retirees and a single mother of young children. Single mothers are often victims of the types of Ponzi schemes on the rise today.

However, rather than invest the money, the SEC alleges that Good used the funds to repay other victims and pay for his expenses, including luxury cars, international travel, and approximately $800,000 in credit card bills.

Brenda Smith’s $100 Million Ponzi Scheme

A final example of a prominent Ponzi scheme involved former investment fund manager Brenda Smith, 61, of Philadelphia. She was reportedly sentenced on May 4, 2022, to 109 months in prison for allegedly orchestrating a $100 million Ponzi scheme. Ponzi schemes orchestrated by women have been on the rise in recent decades as more women move into the financial industry.

Smith reportedly managed and controlled Broad Reach Capital LP, a pooled investment fund/hedge fund established in February 2016 and open to accredited investors.

As reported, from February 2016 through August 2019, Smith reportedly promised investors a 30% yearly return through sophisticated trading strategies involving highly liquid securities. Promises of high annual returns are a common characteristic of the structure of Ponzi schemes that are currently on the rise.

Smith purportedly used the money to buy her investments and pay back other investors instead of investing the funds as promised. In July, she allegedly distributed a false document through Broad River, valuing its assets at $180 million.

To learn more, see:

Cryptocurrency Ponzi Schemes

Ponzi schemes involving cryptocurrency have been on the rise in recent years. Regulators focus on cryptocurrency and digital assets, which have come under significant pressure as the total cryptocurrency market cap has reportedly dived from over $2 trillion in January 2022 to roughly $800 billion in November.

According to Ponzitracker, several fraudulent schemes allegedly caught in 2022 involved cryptocurrency assets. The growing popularity of cryptocurrency partly explains why Ponzi schemes are on the rise in the 2020s. At least five different alleged schemes were related to or based on cryptocurrency assets, including actions involving allegedly fraudulent exchanges, mining platforms, trading, and investment funds.

In May 2022, the Department of Justice charged the leader of a purported cryptocurrency and forex trading platform, EminiFX, with commodities fraud and wire fraud offenses. The CEO purportedly solicited more than $59 million in investments from hundreds of individual investors after making false representations about the EminiFX trading platform.

One type of cryptocurrency Ponzi scheme on the rise is one in which brokers promise fixed returns on their investments. In March 2022, the U.S. Attorney’s office in Brooklyn charged the owners and operators of the web-based virtual currency companies EmpowerCoin, ECoinPlus, and Jet-Coin with conspiracy to commit wire fraud and money laundering in connection with a sophisticated scheme to steal assets from investors. EmpowerCoin, ECoinPlus, and Jet-Coin received more than $40 million from investors.

As alleged, the websites for EmpowerCoin, ECoinPlus, and Jet-Coin fraudulently promised investors and potential investors guaranteed fixed returns on virtual currency investments. A common characteristic of the cryptocurrency Ponzi scheme on the rise today is the explanation that traders are taking advantage of arbitrage opportunities. The owners of EmpowerCoin, ECoinPlus, and Jet-Coin allegedly falsely promised investors and potential investors that these returns were made possible through overseas virtual currency trading operations. Investors and potential investors were encouraged to invest in companies using either cash or Bitcoin. According to the complaint, the assets were used to repay other investors or simply stolen, including by the three owners. The companies collapsed shortly after receiving the investors’ holdings without engaging in trading activity.

Protecting Yourself Against the Forms of Ponzi Schemes on the Rise Today – Common Red Flags

- Promise of High Returns: Ponzi schemes often promise very high returns, significantly higher than market rates. These returns are usually guaranteed, and the scheme promoters may claim that the returns are generated through innovative trading strategies or unique investment opportunities.

- Lack of Clarity about Investment Strategy: The promoters of a Ponzi scheme may be vague about how they plan to generate the promised returns. They may use technical jargon or claim that their investment strategy is proprietary, making it difficult for investors to understand how their money is used. The volume of information available on the internet about how individuals conducted Ponzi schemes of the past is partly why new ones are on the rise today.

- Pressure to Invest: Ponzi operators often use high-pressure tactics to persuade investors to invest in the scheme. They may create a sense of urgency by claiming the investment opportunity is only available for a limited time or that there is a waiting list of investors.

- Lack of Transparency: Ponzi schemes lack transparency. Promoters may provide investors with little or no information about the company’s financial condition, assets, liabilities, or performance. They may also refuse to provide financial statements or other documents, enabling investors to make an informed decision.

- Unsolicited Offers: Modern communications technology partly explains why Ponzi schemes are on the rise. Ponzi scheme operators may contact potential investors directly, often through unsolicited phone calls or emails. They may offer incentives, such as a high commission or referral fee, to persuade individuals to recruit other investors.

- Unregistered Investments: Ponzi schemes are often unregistered, meaning no government agency regulates them. Promoters may claim that the investment is exempt from registration or operates under a foreign jurisdiction that does not require registration.

- Lack of History: A defining feature of Ponzi schemes on the rise today is that individuals or companies often operate them with no track record or history of successful investments. Investors should always conduct thorough due diligence and research the promoters’ backgrounds and investment histories.

It’s important to note that just because one or more of these red flags is present doesn’t necessarily mean the investment opportunity is a Ponzi scheme. However, investors should be cautious and research before investing their money.

Hiring a Securities Attorney

With Ponzi schemes on the rise, it is always wise to seek assistance if you suspect fraud. When brokers violate securities laws, such as making unsuitable investments, their brokerage firm may be liable for investment losses through FINRA Arbitration.

If your broker has defrauded you, you may be able to file a claim with FINRA to seek resolution through arbitration. FINRA arbitration can be complex and technical, and having an experienced attorney knowledgeable about securities law can significantly increase your chances of success.

A securities attorney, such as those at the White Law Group, can help you with many aspects of the arbitration process, including evaluating the merits of your claim and determining whether you have a strong case for arbitration.

Your attorney can assist you in drafting a statement of claim that accurately reflects the allegations of fraud and the damages you seek. They will also represent you at the arbitration hearing, present evidence, and argue.

They can also negotiate a settlement on your behalf, which may be an option to consider before arbitration.

Working with a securities attorney ensures that your interests are protected throughout the FINRA arbitration process, and you have the best possible chance of achieving a favorable outcome.

Remember that FINRA arbitration is generally a faster and less expensive alternative to a traditional court proceeding.

Free Consultation

If you suspect you have been a victim of a Ponzi scheme and would like to speak with a securities attorney about your options, schedule a free consultation or call The White Law Group at 888-637-5510.

The White Law Group is a national securities fraud, securities arbitration, and investor protection law firm with offices in Chicago, Illinois, and Seattle, Washington.

Frequently Asked Questions

Employment in finance services gives the organizer of Pyramid and Ponzi schemes an air of credibility. They may have lists of other clients to reference when claiming a new victim. While you should not reflexively distrust financial advisors, you should be wary of promises on returns that sound too good to be true or if communication between you and the financial planner is poor.

Pyramid schemes are named pyramid schemes because money is made by recruiting others to invest in them rather than generating an actual return. The person who started the scheme benefits most from the arrangement, while each layer below receives less.