How to Avoid Online Trading Scams & Social Media Fraudsters

Online scams are becoming more common these days, as the internet flourishes and is an everyday tool for people. Online trading scams are fraudulent schemes that scam artists use to con people out of their hard earned money. These scams utilize fake websites, social media, and other online platforms to trick people into investing in these companies or buying worthless stocks. By educating yourself, you may be able to identify and avoid these scams for yourself or a loved one.

Online Trading Scam Stories

Online trading scams are more prominent than we think, and when people share their stories of fraud, they’re ultimately helping others in avoiding these financial traps.

Bill – “Cutting Edge Crypto”

Bill was contacted over the phone by an online trader who “Specialized in binary options, cryptocurrency and forex trading.” The person conveyed over the phone that their company was on the cutting edge and used the latest technology and could offer guaranteed returns. The victim invested a few thousand dollars and used the scammers online platform, which seemed to work very well. Bill could see his trades were resulting in good profits. At that point, he invested more money at their persistence and was promised that he would earn even larger funds, the more that he invested.

When Bill wanted to withdraw the money, he was told he would need to pay taxes on his profits before he could access it. He was never warned about this, but the fraudsters insisted he needed to pay taxes before he could get his money back. After he asked for his money, his trades started to fail and the accumulated profits were starting to decrease. They pressured him to invest more so that he could reverse the situation by increasing his ‘trades volume’. They threatened he would lose everything unless he invested more money as an emergency.

The victim in this situation feels very embarrassed by this scam, as they were very convincing and professional. The con artists stated he would be ‘kicked off the market’ because his trades were failing and he was reduced to a mere 3% of his initial investment, but by that point he knew it was all fake. He lost over $50,000 as a result of this fake online trading scam.

Diana – “Make Money from Home”

In November of 2018, Diana worked full-time and was looking to make some extra money on the side. She clicked an ad on a Yahoo! news article and watched slick videos about how she could ‘make easy money from home’. Diana decided to give this company a chance, so she called and made an initial payment of US$300. The call center was based in Scotland, so Diana felt confident her money was safe. Her ‘broker’ said he would call every two days to help her trade.

After a few weeks, she was pressured to invest $5,000 to get ‘bonus payments’. Diana went ahead with this second investment, but later stated she felt uneasy about this investment and requested to pull out of the trade. This is when things went down hill for Diana. The broker became very passive-aggressive, telling Diana she couldn’t have her deposit back because she hadn’t reached the required volume of trades and bonuses.

She asked the broker not to contact her again, but he kept calling – usually very late at night. Eventually, Diana threatened to call the police and blocked the broker’s number. Since then, Diana has received cold calls from other similar companies. She has not had any money returned to her.

Signs of Online Trading Scams

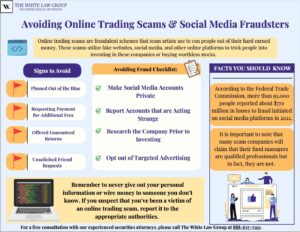

Signs of Online Trading Scams

-

Phoned Out of the Blue: If you are called randomly by a stranger offering unsolicited advice on investments, then you should avoid this number and block their future calls. This is a tell tale sign of an online scam.

-

Paying Additional Fees: If you’re forcefully directed or requested to pay additional fees or taxes on your investment, especially if this was not mentioned in the terms and conditions, then that is a significant sign of an online trading scam. In the two stories above, the first individual was asked to pay taxes on his profits, and Diana was asked to pay additional fees to receive ‘bonus payments’.

-

Offered ‘Guaranteed Returns’: Although all investments come with risks, it is important to pay attention to details and exercise caution if your broker says anything relating to guaranteed returns, as this is a common sign of fraud, especially if you’re conducting online trading.

-

Unsolicited Friend Requests: If you receive a friend request or someone starts following you and is sending messages regarding quick cash, easy money, or something of that nature, you should be wary and block the account. Or you have the option to report the account to the social media platform and flag for fraudulent behavior.

It is important to note that many scam companies will claim that their fund managers are qualified professionals but in fact, they are not. Scammers often claim massive historical returns and will show numbers that way exceed market norms to lure investors in. Be sure to check these claims and not simply invest blindly.

Social Media’s Involvement with Online Scams

Popular social media platforms such as Facebook, Instagram, and Twitter are a fraudsters playground when it comes to luring people into these scams. Commonly, fake profiles and groups are created to promote illegitimate companies and investment opportunities. They may also use different social media platforms to contact people directly to persuade individuals to invest in their fake companies. It’s important to be cautious when receiving investment opportunities on social media, and do thorough research prior to giving away personal information or investing any money.

According to the Federal Trade Commission, more than 95,000 people reported about $770 million in losses to fraud initiated on social media platforms in 2021. Those losses account for about 25% of all reported losses to fraud in 2021 and represent a stunning eighteen fold increase over 2017 reported losses. Reports are up for every age group, but people in ages ranging from 18 to 39 were more than twice as likely as older adults to report losing money to these scams in 2021.

There are some ways you can avoid social media scams, and online trading scams.

-

It’s important to limit who can see your posts and information on social media. All platforms collect information about you from your activities on social media, but visit your privacy settings to set some restrictions. If your account is on “Private”, then you’re in a good position to avoid these scams, as people cannot reach out to you unless you approve of their request to follow you.

-

Check if you can opt out of targeted advertising. Some platforms let you do that.

-

If you get a message from a friend about an opportunity or an urgent need for money, call them. Their account may have been hacked – especially if they ask you to pay by cryptocurrency, gift card, or wire transfer. That’s typically how scammers ask you to pay.

-

Before you buy, check out the company. Search online for its name plus “scam” or “complaint.” Conducting preliminary a a small step that could save you financially,

Reporting Online Trading Scams to Authorities

Online Trading Scams can be difficult to detect, however there are tools you can utilize to avoid falling for these scams. Always do your research before investing any money, and be cautious of any investment opportunities that sound too good to be true. Remember to never give out your personal information or wire money to someone you don’t know. If you suspect that you’ve been a victim of an online trading scam, report it to the appropriate authorities.

According to the Financial Regulatory Authority (FINRA), investors should look for the typical mistakes, such as poor grammar, misspellings, odd or awkward phrasings, or misuse of investor terminology. In addition to these, investors should be on the lookout for websites using the registered representative’s name as the domain name for the website (e.g., firstnamemiddlenamelastnamedotcom). These sites are primarily reported as fraudulent and dangerous.

FINRA is a non governmental organization that regulates the securities industry in the United States. It is responsible for overseeing the activities of brokerage firms, and for enforcing rules and regulations related to the trading of securities. Seeking restitution through FINRA arbitration can be a helpful process if you feel as though you’ve been defrauded. Once you’ve retained a securities fraud attorney, the process of filing a claim through FINRA could take place. This claim should include a description of the fraud, the amount of money lost, and any supporting documentation. Once the claim is filed, FINRA will appoint an arbitrator to hear the case. The arbitrator is responsible for reviewing the evidence and making a decision about whether the investor is entitled to restitution. If the arbitrator rules in favor of the investor, they will issue an award for damages, and this can be used to seek restitution from the person or company that defrauded the investor. FINRA is overseen by the Securities and Exchange Commission (SEC) and is authorized by Congress to protect U.S. investors from investment fraud by making sure the broker-dealer industry operates fairly and honestly.

Hiring a Securities Fraud Attorney

This information is all publicly available and provided to you by The White Law Group. For a free consultation with our securities fraud attorneys, please call the White Law Group at 888-637-5510.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm with offices in Chicago, Illinois and Seattle Washington. The White Law Group has the expertise to help investors defrauded in securities, investment and financial business transactions. For more information on The White Law Group, please visit our website at https://whitesecuritieslaw.com.

Last modified: February 24, 2026