What is Mutual Fund Switching?

Mutual fund reallocation, or switching, involves the strategic transfer of assets from one fund to another within the same investment portfolio.

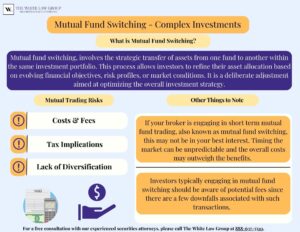

In some cases, brokers or financial advisors may suggest mutual fund switching primarily for their gain in commissions or fees. When they facilitate a switch, especially if it involves a transaction, they might earn commissions from the new investment. This could incentivize them to recommend changes that might not always align perfectly with the investor’s best interests.

This potential conflict of interest has been a concern in the financial industry. The switch might not always be in the investor’s best interest but rather driven by the advisor’s financial incentives. It’s important for investors to be aware of these potential conflicts and ask questions about any proposed changes to understand if they genuinely benefit their financial goals or if they primarily benefit the advisor.

See also: Variable Annuity Switching

How Does Mutual Fund Switching Work?

Within the Same Fund Family: Mutual fund switching usually involves transferring assets from one mutual fund to another within the same fund family or investment company. This is because different funds within the same family often share certain administrative processes, making the switch more seamless.

No Sale or Purchase Involved: Unlike selling one fund and buying another, which could trigger taxable events, mutual fund switching involves exchanging shares directly. This means that, in most cases, there are no tax consequences for the investor, however keep in mind that this is not always the case.

Why Would You Consider Mutual Fund Switching?

The primary advantage of switching is that you can exit from an underperforming fund and move to a better one to increase your portfolio returns. By performing this action, you can reduce your investment cost by switching from a regular to a direct plan. Here are some examples of why one might partake in mutual fund switching:

- Change in Investment Goals: If an investor’s financial goals or risk tolerance changes, they might want to switch to a fund that better aligns with their new objectives.

- Market Conditions: Investors may switch funds in response to changing market conditions. For example, during a bull market, they might prefer equity funds, while in a bear market, they might opt for more conservative options.

- Performance Concerns: If an investor is dissatisfied with the performance of their current fund, they might choose to switch to another fund with better prospects.

What could go Wrong?

Navigating the terrain of mutual fund switches demands a strategic approach to mitigate potential pitfalls. Attempting to time the market is considered to be a challenging endeavor with unpredictable outcomes. One must exercise caution considering there are a few obstacles that can impact overall financial performance. Here are some of the common issues that can arise with mutual fund switching:

- Costs and Fees: Some mutual funds charge fees or loads for switching between funds. Investors should be aware of any associated costs and consider them when deciding to make a switch.

- Considerations: Investors should carefully evaluate the reasons for switching and the potential benefits of the new fund. It’s essential to conduct thorough research on the new fund’s investment strategy, performance history, fees, and other relevant factors.

- Tax Implications: It’s important to remember the tax implications that go along with mutual fund switching. Mutual fund transactions incur short-term or long-term capital gains tax. Switching funds or schemes is redemption. Suppose you go from regular to direct. The tax is levied since switching constitutes redemption. The table below displays long-term and short-term fund tax rates:

Excessive trading and performing frequent shifts in decision-making, can lead to heightened transaction costs and undermine long-term investment objectives. As always, when assessing a new fund, investors should do a comprehensive review before committing to a significant decision. Some investors find themselves in an emotion-driven decision which pose inherent risks; therefore, maintaining a disciplined, long-term perspective is key.

Achieving coherence with one’s financial plan is important, ensuring that fund switches align seamlessly with long-term goals. Seeking counsel from financial professionals can provide valuable insights for sound decision-making.

Mutual Fund Switching Gone Wrong

In August of 2022, FINRA Censured and fined Kovack Securities in connection with Short-term Mutual Fund Trading. According to a Letter of Acceptance Waiver and Consent, Kovack Securities was ordered to pay a total of $210,000 for supervisory failures.

Between March 2015 and May 2017, the company purportedly neglected to implement, sustain, and uphold a supervisory system, inclusive of documented procedures, that was adequately designed to ensure adherence to FINRA’s suitability rule concerning the short-term trading of mutual fund class A shares. Notably, these shares are intended to serve as long-term investments.

Kovack Securities allegedly failed to allocate appropriate resources for reviewing these transactions, neglected to establish a process effectively designed to identify short-term trading activities involving class A share mutual funds, and did not adequately respond to warning signs of inappropriate mutual fund trading by a former representative.

Overall, the representative purportedly advised Kovack customers to make A share mutual fund purchases totaling more than $2.1 million, despite having recommended sales to the same customers in the preceding year. This resulted in unnecessary sales charges for the customers. In response to the investigation, the firm voluntarily provided restitution to the affected customers. See also: Kovack Securities Inc. Overview.

Do you Need a Securities Fraud Attorney?

Brokerage firms have a responsibility to adequately disclose all risks before selling any investment and must consider suitability factors such as age, financial needs, and risk tolerance to name a few. Firms that do not perform adequate due diligence on an investment or demonstrate a breach of fiduciary duty can be held accountable for losses incurred through FINRA arbitration.

If you are seeking guidance on filing a FINRA complaint or have concerns about mutual fund switching, please don’t hesitate to reach out to The White Law Group at 888-637-5510.

The White Law Group, LLC, is a nationwide law firm specializing in securities fraud, securities arbitration, investor protection, and securities regulation/compliance, with offices in Chicago, Illinois, and Seattle, Washington.

With over 30 years of experience in securities law, The White Law Group possesses the proficiency needed to assist investors who have suffered losses in securities, and investments. For further details about The White Law Group, visit our website at https://whitesecuritieslaw.com.

Tags: mutual fund switching, short term mutual fund trading Last modified: December 11, 2023