How can you tell if your financial advisor has a fraud record? FINRA BrokerCheck

According to reports, more than half of all households use a financial advisor. Unfortunately broker misconduct and financial advisor fraud is prevalent.

Close to 7 percent of financial advisors have been disciplined for a fraud dispute or some form of misconduct, according to a 2016 academic study, “The Market for Financial Adviser Misconduct” from the University of Minnesota and the University of Chicago.

A fraud record is not necessarily the end of the line, though. Of the registered advisors who engaged in misconduct at least once, 38 percent are repeat offenders.While roughly half of advisors lose their jobs after an offense, 44 percent are back in the industry within a year.

That’s especially troubling, as “prior offenders are five times as likely to engage in new misconduct as the average financial advisor,” according to the study.

It’s likely that the actual rate of fraud and misconduct is much higher. The authors pored through disclosure information in FINRA BrokerCheck, a database run by the industry’s self-regulatory organization, the Financial Industry Regulatory Authority (FINRA). The database gathers data from regulatory filings and from information that firms and investment professionals must file with FINRA.

How to Check your Financial Advisor’s Record

The Central Registration Depository (CRD) is a computerized database that contains information about most brokers and their representatives. You can check for proper licensing in your state and if they have had disciplinary problems or received serious complaints from investors. You can also find information about the brokers’ employment history and whether or not they have ever filed for bankruptcy.

The Financial Industry Regulatory Authority (FINRA) provides you with information from the CRD on it’s BrokerCheck website. Anyone can use the FINRA BrokerCheck tool. It is the easiest way to tell if your financial advisor has a record of fraudulent behavior.

Financial Advisor Fraud Statistics

Many investors are unaware of the underlying dynamics of the Financial Industry Regulatory Authority (FINRA), an independent, non-governmental agency responsible for licensing and regulating stockbrokers and brokerage firms in the U.S. What may come as a surprise is that FINRA’s budget is predominantly funded by the very brokerage firms it regulates, giving rise to an apparent conflict of interest.

While FINRA mandates brokers and brokerage firms to report customer complaints, disputes, and regulatory sanctions, it is reasonable to question whether the organization is effectively addressing the issue of “rogue brokers” and eradicating misconduct from the industry.

According to a study, it is the clients who are most vulnerable to misconduct that often require the most assistance. The study revealed that misconduct tends to be concentrated in firms that cater to retail investors, individuals who engage in personal account buying and selling. Notably, the study found that the most common victims of misconduct were elderly individuals, those with high incomes, and individuals with low levels of education.

Among the firms evaluated in the study, Oppenheimer & Co. emerged as the worst performer, with 19.6 percent of its 2,275 advisors having faced disciplinary action for misconduct. On the other end of the spectrum, Morgan Stanley, with 3,807 advisors, had the lowest rate of disciplinary action at 0.79 percent.

States such as Arizona, California, and Florida exhibited some of the highest rates of misconduct. In 2015, FINRA took action by barring 500 individuals and 25 firms from the industry, demonstrating its commitment to addressing regulatory violations.

Common Types of Financial Advisor Fraud

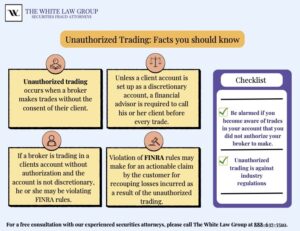

Unauthorized Transactions or Trading

“Selling Away”

Selling away refers to the practice of a broker or financial advisor soliciting you to purchase securities that are not held or offered by their brokerage firm. In most cases, these activities violate securities regulations. Typically, when a broker engages in “selling away,” they are promoting investments such as private placements or other non-public investments in which they have a personal financial interest. These investments are generally considered violations of securities rules because the brokerage firm has not conducted research on the investment’s risks or approved it for sale to clients, and the broker is selling the investment without the knowledge of their employer. Nevertheless, a broker-dealer can be held liable for a financial advisor’s “selling away” if they fail to adequately supervise their employees and protect their clients.

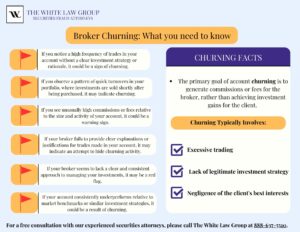

Churning/Excessive Trading

Misrepresentation or Omissions

In certain cases, customers may find themselves in a situation where a broker assured them that an investment was safe, only to later discover that it carried significant risks. When customers rely on the recommendations of financial advisors, it is crucial for the advisor to provide accurate and complete information. Failure to do so constitutes a misrepresentation or omission of material facts. Unfortunately, many investors only uncover the truth about an investment after experiencing substantial losses, realizing that the initial representation of safety was inaccurate. It’s important to note that this differs from situations where experienced and wealthy investors deliberately choose to speculate with a portion of their portfolio, fully understanding and accepting the associated risks.

Unsuitability

Brokers must align their investment recommendations with a customer’s age, financial situation, investment objectives, and experience. Investing in a particular type of security may be unsuitable, or the amount and frequency of transactions may be excessive and unsuitable for a specific customer.

FINRA Arbitration Attorneys

If you are a victim of financial advisor fraud, you may be able to file a FINRA claim against your brokerage firm. FINRA arbitration can be a complex and technical process, and having an experienced securities attorney who is knowledgeable about securities law can greatly increase your chances of success. Brokerage firms are required to adequately supervise their agents. They can be held responsible for any losses in a FINRA arbitration claim if it is determined that they failed to properly supervise their agent.

If you have suffered investment losses due to financial advisor fraud, the attorneys at The White Law Group may be able to help. For a free consultation, please call (888) 637-5510.

The White Law Group, LLC is a reputable national law firm specializing in securities fraud, securities arbitration, investor protection, and securities regulation/compliance. We are dedicated to assisting investors across all 50 states in pursuing claims against their financial professionals or brokerage firms. Since its establishment in 2010, the firm has successfully handled over 700 FINRA arbitration cases.

The firm represents investors in various types of securities-related claims, including those involving stock fraud, misrepresentation by brokers, churning, unsuitable investments, selling away, unauthorized trading, and more.

With more than 30 years of experience in securities law, The White Law Group has the knowledge and expertise to help defrauded investors seek to recover their investment losses. For further details, please visit our website at whitesecuritieslaw.com.

Tags: financial advisor fraud record, Financial advisor frequent trades, FINRA Last modified: October 27, 2023