What are Callable Certificates of Deposits?

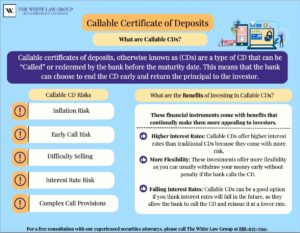

Callable certificates of deposits, otherwise known as (CDs) are a type of CD that can be “Called” or redeemed by the bank before the maturity date. This means that the bank can choose to end the CD early and return the principal to the investor. These types of investments can be good for investors who are looking for a higher yield than traditional CDs, but are willing to accept the risks that come along with them as well. Along with the risks, there are also certain benefits that can fit the needs of investors who have a short-term investment horizon and are looking for a relatively safe way to earn a higher yield than traditional investment routes.

What Are the Risks of Callable Certificates of Deposits?

-

Early Call Risk: The bank may call the CD early, which can result in the investor losing out on potential interest payments.

-

Difficulty Selling: Callable CDs may be difficult to sell if the investor needs to cash out before maturity.

-

Complex Call Provisions: Callable CDs may have complex call provisions that can be difficult for investors to understand.

-

Interest Rate Risk: Callable CDs may be subject to an interest rate risk, which is the risk that interest rates will rise after the CD is purchased.

-

Inflation Risk: These investments may not keep pace with inflation, which can erode the value of the investment over time.

-

Credit Risk: They are also subject to the credit risk of issuing banks, meaning that if the bank goes bankrupt, the investor may lose their investment.

-

Liquidity Risk: Callable CDs may be less liquid than other types of investments, which can make it difficult to access funds when they are needed.

-

Opportunity Cost: If interest rates rise after the investor purchases a callable CD, they may miss out on potential higher yields from other investments.

What Are the Benefits of Callable Certificates of Deposits?

Callable certificates of deposit can be an attractive investment option for those looking to earn higher interest rates on their savings. These financial instruments come with benefits that continually make them more appealing to investors. Here are some examples of the benefits:

Higher Interest Rates: Callable CDs offer higher interest rates than traditional CDs because they come with more risk. The bank can call the CD at any time, which means you could miss out on future interest payments if rates fall.

More Flexibility: These investments offer more flexibility as you can usually withdraw your money early without penalty if the bank calls the CD. This can be helpful if you need access to your money before the CD matures.

Falling Interest Rates: Callable CDs can be a good option if you think interest rates will fall in the future, as they allow the bank to call the CD and reissue it at a lower rate. This means you can take advantage of higher rates now while still having the option to reinvest at a lower rate in the future.

Understanding the Risks of Callable CDs

In Vancouver, Washington, an elderly couple went to their bank to “roll-over” an existing CD. The couple had existing medical conditions making their foreseeable future under the care of assisted living. The couple told the salesperson they wanted instant access to their funds because of their entry into assisted living. The salesperson insisted that they purchase a 10-year callable CD worth $90,000. They understood the salesperson and were under the impression that they could “call the CD” when they needed cash. When the couple moved into assisted living, they tried to call the CD and found that only the bank could call the CD. They complained to the Department of Financial Institutions (DFI) Securities Division. An investigation took place and after negotiation with the bank, the couple received their funds in full.

According to the Washington State Department of Financial Institutions, state regulators urge investors to educate themselves and learn the maturity date of a CD prior to investing. You should also have a firm understanding of where the money will be deposited, the penalties for early withdrawal and the costs associated with selling before maturity. Also, it’s important to know whether the interest rate is fixed or variable. State and federal securities regulators can provide answers to questions about stockbrokers, brokerage firms or specific securities products such as “callable” CDs.

It is important to conduct your research prior to investing in a Callable Certificate of Deposit. Understanding the risks, and the investment as a whole could save you from financial losses.

Can a Securities Fraud Attorney Help?

A securities fraud attorney can help investors who have been the victim of fraud or other forms of misconduct. They can assist with investigating the investment, which would entail determining whether fraud or misconduct has occurred. They can also assist in guiding you through the legal options you have, and they can also represent you in a FINRA Arbitration claim.

If you have suffered investment losses in a callable certificate of deposit, the securities attorneys at The White Law Group may be able to help you. Please call 888-637-5510 for a free consultation.

The White Law Group, LLC is a national securities fraud, securities arbitration, investor protection, and securities regulation/compliance law firm with offices in Chicago, Illinois and Seattle Washington. The White Law Group has the expertise to help investors defrauded in securities, investment and financial business transactions. For more information on The White Law Group, please visit our website at https://whitesecuritieslaw.com.

Tags: Callable Certificates of Deposits Last modified: July 27, 2023