What is AI?

AI is a new and rapidly developing technology that stands for artificial intelligence. It is a branch of computer science that focuses on creating machines that can perform tasks that typically require human-like intelligence such as visual perception, speech recognition, decision making, and language translation. AI uses certain algorithms and statistical models to analyze data and make predictions. For example, you could ask AI to draw up an analysis of how many people were defrauded in the last 10 years, and why? In seconds, you would be holding a statistical data set displaying the fraudulent activity of the past 10 years. This technique and realm of technology is becoming increasingly popular in various industries, including finance, healthcare, and transportation. Although this is a very intriguing form of technology, it is still very untraveled and there are several concerns regarding its accuracy. Only time will tell how much it will change our world, and affect our use of technology.

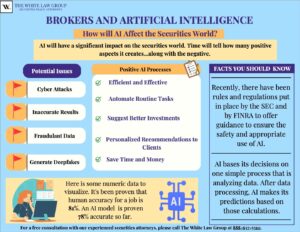

Brokers and AI

Brokers and AI can work together to create a more efficient and effective trading environment. Stockbrokers have the ability to make decisions based on a variety of factors, unlike AI that bases its decisions on one simple process that is analyzing data. After data processing, AI makes its predictions based on those calculations. There are positives and negatives when intertwining both forces since this new technology is unexplored and new territory to our securities world.

The Growing Concerns of AI

The Growing Concerns of AI

Recently, on August 3rd, 2023, The Massachusetts Secretary of the Commonwealth sent several detailed letters to firms including JPMorgan and Morgan Stanley to learn how they are using AI with investors. This investigation was launched to examine the use of Artificial Intelligence and its role in the securities industry. There is a certain urgency and growing concern with artificial intelligence due to the unchecked facts, which could then lead to reputational damage and financial losses for clients and investors.

The secretary, William Galvin expressed his concern with Artificial Intelligence and stated, “If deployed without the guardrails necessary to ensure proper disclosure and consideration of conflicts, I am concerned that this technology could result in harm to investors,” This statement is deemed valid due to the fact that the new technology remains untested and unproven, especially when dealing with securities.

It has been suggested by many that there must be guidelines and a set of rules the securities industry should follow to handle cases appropriately and responsibly. Further, the founder of the Digital Assets Council of Financial Professionals, Ric Edelman expressed in an email, “Done correctly, generative AI can and will be a tremendous productivity tool that improves client service. But without necessary guardrails, investor safety is at risk.”

Sal Cucchiara, chief information officer for wealth management and investment management at Morgan Stanley stated, “We recognize the transformative potential of AI in finance and are committed to ensuring its responsible use in alignment with our core values, and we will continue to conduct regular audits to ensure that our AI systems are transparent, explainable and auditable to facilitate accountability,”

Rules and Regulations for Artificial Intelligence (AI)

The U.S Securities and Exchange Commission (SEC) adopted new rules requiring publicly traded companies to disclose hacking incidents. Reportedly, these measurements were helping those investing with the increasing cyber attacks within the markets.

The AI proposal that was recently issued would require broker-dealers to “eliminate or neutralize” any conflict of interest that occurs if a trading platform’s predictive data analytics puts the broker’s financial interest ahead of that of the firm’s clients.

If adopted, the rule would require that investment advisers produce investment advice through an organic and functioning, interactive website, among other changes. This preventative strategy could be placed preventing them from using the two-decade-old exemption inappropriately.

How can Brokers Leverage AI?

Although there is concern regarding the guidelines and accuracy of AI, there are ways that brokers can leverage AI to improve their services. AI can be used to analyze large amounts of data to identify trends, patterns, and these strategies can be used by brokers to make better investment decisions for their clients.

Further, AI can also be used to automate routine tasks such as account opening and trade execution. This could increase efficiency and save valuable time. It’s also important to think about how it could be used to protect and monitor client portfolios. Alerting brokers when changes need to be made, such as rebalancing or selling off underperforming assets is something that would be an extremely helpful tool in the securities industry.

There is also the benefit of providing personalized investment advice and opportunities for clients. These assessments would be based on raw numeric data, which is most helpful since it cuts down on portfolio reviewing time.

FINRA’s Involvement with Artificial Intelligence

In 2020, the Financial Industry Regulatory Authority (FINRA) issued the report “Artificial Intelligence (AI) in the Securities Industry” in which it examined the key applications of AI by broker-dealers and their firms, pin pointing on the areas of communications with customers, investment procedures, and operational functions that take place.

The report identified that broker-dealers were employing tools such as virtual assistants to help address basic client inquiries and AI apps to automatically categorize and redirect customer emails to the appropriate recipient. It was also shown that these AI tools were helping create more comprehensive client profiles by aggregating data regarding clients’ assets, spending patterns, debt balances, electronic communications, etc.

Further, FINRA released a report stating how over the past few years, there have been numerous incidents reported about AI applications that may have been fraudulent, nefarious, discriminatory, or unfair, highlighting the issue of ethics in AI applications. FINRA suggested that “Broker-dealers should conduct their own assessments of the implications of AI tools, based on their business models and related use cases.”

The White Law Group is a national securities fraud, securities arbitration, and investor protection law firm with offices in Chicago, Illinois and Seattle, Washington. We represent investors in all 50 states. Our attorneys have recovered millions of dollars from many brokerage firms in the past. For a free consultation with one of our securities attorneys, please call the offices at 888-637-5510.

For more information on The White Law Group, and its representation of investors, please visit: https://whitesecuritieslaw.com/

Tags: AI Last modified: August 7, 2023